Crptocurrency

Bitcoin Set to Reach New Highs as Dollar Weakens, Say Glassnode Co-Founders

[ad_1]

Bitcoin Set to Reach New Highs as Dollar Weakens, Say Glassnode Co-Founders

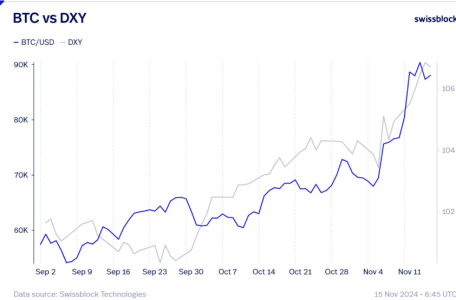

As the U.S. Dollar Index (DXY) shows signs of weakening, Bitcoin is positioned for a potential breakout to new all-time highs, according to Glassnode co-founders Jan Happel and Yann Allemann. In a recent post on their Negentropic X account, they highlighted Bitcoin’s increasing correlation with the DXY and suggested that ongoing easing policies and a softer dollar could pave the way for Bitcoin to reach unprecedented levels.

Bitcoin and the DXY: An Inverse Relationship

The DXY measures the strength of the U.S. dollar against a basket of major foreign currencies. Historically, Bitcoin has exhibited an inverse correlation with the DXY. When the dollar weakens, Bitcoin often benefits as investors seek alternative stores of value.

Recent Trends:

- DXY Performance: The DXY reached its yearly high shortly after the U.S. elections but has since begun to decline.

- Bitcoin’s Surge: Bitcoin’s price has climbed by 27% in November, nearing the psychologically significant $100,000 mark.

This inverse relationship underscores Bitcoin’s appeal as a hedge against dollar weakness and macroeconomic uncertainty.

Why a Weakening Dollar Benefits Bitcoin

Several factors contribute to Bitcoin’s bullish outlook amid a weakening dollar:

1. Inflation Hedge

As the dollar loses strength, inflationary pressures erode its purchasing power. Bitcoin’s fixed supply of 21 million coins makes it an attractive hedge against inflation, drawing increased interest from both retail and institutional investors.

2. Global Demand for Alternatives

A weaker dollar often prompts global investors to diversify into non-dollar assets. Bitcoin, with its global liquidity and decentralized nature, is a preferred alternative.

3. Easing Monetary Policies

The Federal Reserve’s shift toward easing policies—such as potential rate cuts—could further weaken the dollar while bolstering risk-on assets like Bitcoin.

Bitcoin’s Path to New All-Time Highs

With Bitcoin nearing $100,000, a breakthrough could mark the start of another major rally. Here are the key factors supporting this trajectory:

1. Institutional Interest

Spot Bitcoin ETFs have driven significant institutional inflows, signaling growing confidence in Bitcoin as an asset class. These inflows could accelerate further as regulatory clarity improves.

2. Supply Scarcity Post-Halving

The April 2024 Bitcoin halving has reduced the supply of new Bitcoin entering the market, creating upward pressure on prices as demand outpaces supply.

3. Market Sentiment

The Crypto Fear & Greed Index is firmly in the Extreme Greed zone, reflecting strong bullish sentiment and increased investor participation.

Historical Precedents: Bitcoin vs. DXY

Past periods of a weakening dollar have coincided with major Bitcoin rallies:

| Year | DXY Trend | Bitcoin Performance |

|---|---|---|

| 2017 | Declined ~10% | Bitcoin surged 1,300% |

| 2020 | Declined ~6% | Bitcoin gained 300% |

| 2024 (YTD) | Weakening since Q3 | Bitcoin up ~127% |

These trends highlight Bitcoin’s ability to capitalize on macroeconomic shifts, particularly during periods of dollar weakness.

Analysts’ Predictions for Bitcoin’s Next Move

Prominent crypto analysts echo Glassnode’s bullish outlook:

- James Check, a crypto market strategist, suggests Bitcoin could exceed $110,000 by year-end if the dollar continues its downward trend.

- Rekt Capital, a pseudonymous analyst, anticipates Bitcoin could surpass its previous all-time high of $69,000 and potentially target $125,000 in early 2025.

Both predictions hinge on the continuation of favorable macroeconomic conditions and sustained investor interest.

Risks to Watch

While Bitcoin’s outlook appears strong, investors should remain cautious of potential risks:

- Short-Term Volatility: Profit-taking or sudden macroeconomic shifts could lead to price corrections.

- Regulatory Challenges: Ongoing scrutiny of the cryptocurrency market may introduce uncertainty.

- DXY Reversal: A stronger-than-expected dollar recovery could temper Bitcoin’s upward momentum.

Strategies for Investors

For those looking to capitalize on Bitcoin’s bullish potential, consider the following strategies:

- Monitor Key Resistance Levels: Keep an eye on Bitcoin’s ability to break and sustain levels above $100,000.

- Diversify Portfolios: Balance Bitcoin exposure with other assets to mitigate risks associated with volatility.

- Stay Informed: Regularly track the DXY and macroeconomic indicators to anticipate market shifts.

Conclusion

As the DXY weakens, Bitcoin is poised to capitalize on favorable macroeconomic trends, with the potential to reach new all-time highs. Backed by institutional interest, strong market sentiment, and supply scarcity, Bitcoin’s bullish momentum appears sustainable in the near term.

For investors, understanding the interplay between the dollar and Bitcoin can provide valuable insights into market dynamics and help optimize investment strategies.

Stay updated with our article on how macroeconomic trends shape Bitcoin’s market performance.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

[ad_2]

Source link