Crptocurrency

Bitwise CIO Makes the Case for Adding Ether (ETH) To Investment Portfolios

Matt Hougan, CIO of Bitwise, a crypto-based index fund and ETF provider, has explained why he believes ether might be an interesting asset for an investment portfolio.

Three reasons to add ETH to your portfolio, and one important reason to stay BTC-only.

A thread.

— Matt Hougan (@Matt_Hougan) June 20, 2024

Hougan states three key reasons for investing in ether: diversification to “own the market,” different use cases than bitcoin, and historical analysis.

Bitwise CIO Presents Three Reasons to Invest in Ether

Matt Hougan, CIO of cryptocurrency index fund and exchange-traded fund (ETF) provider Bitwise, recently presented several reasons why institutional investors should add ether to their portfolios.

Hougan referred to three key fundamentals supporting ether as an investment in the crypto asset class. The first one has to do with diversification.

Hougan explains that as cryptocurrencies are part of a still insurgent asset class, it is difficult to pinpoint the specific crypto trait that will change the world. Consequently, the goal of each investor should be to “own the market.”

In this regard, Hougan considers a 3:1 bitcoin/ether allocation as the default starting place for most investors.

Ethereum also targets different use cases than Bitcoin and this might give ether an edge, given that programmability and decentralized finance constitute a different offer for the market.

This gives ether a different value compared to Bitcoin, which aims to be the “best form of money that ever has existed.” He assessed:

Adding some ETH to a majority BTC position gives you broader exposure to all the things public blockchains can do.

The third reason supporting this is history. Hougan stated that adding ether to an investment portfolio during a full market cycle has historically boosted the returns compared to a BTC-only investment proposal.

Nonetheless, he acknowledged that BTC outperformed ETH during the last year and that previous performance might not guarantee future returns.

Hougan concluded that while BTC is probably the dominant new form of money in crypto, “there are other potentially interesting applications of public blockchains, and ETH is currently the leader in those.”

This week, Bitwise disclosed a $2.5 million seed investment interest for its ether ETF product.

What do you think about Bitwise CIO’s take on Ethereum? Tell us in the comments section below.

Crptocurrency

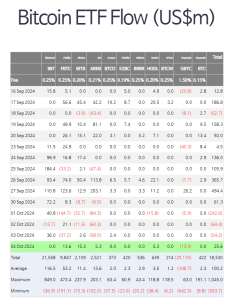

USA Spot Bitcoin ETFs Record Net Inflow of $25.6M on October 4, Led by Bitwise and Fidelity

USA Spot Bitcoin ETFs Record Net Inflow of $25.6M on October 4, Led by Bitwise and Fidelity

On October 4, U.S. spot Bitcoin ETFs witnessed a significant net inflow of $25.6 million, according to data from Farside Investors. The inflows were driven primarily by Bitwise’s BITB, which recorded the largest inflow of $15.3 million, followed by Fidelity’s FBTC with $13.6 million, Ark Invest’s ARKB and VanEck’s HODL, both registering $5.3 million.

In contrast, Grayscale’s GBTC saw a net outflow of $13.9 million, making it the only major ETF to experience a negative flow on the day. Other ETFs did not see any notable changes in net inflows or outflows.

Breakdown of ETF Movements

- Bitwise’s BITB led the market with $15.3 million in net inflows, reflecting growing confidence in its strategy for tracking spot Bitcoin prices.

- Fidelity’s FBTC followed closely with $13.6 million, demonstrating strong investor interest in Bitcoin ETFs offered by traditional financial institutions.

- Ark Invest’s ARKB and VanEck’s HODL both recorded $5.3 million in net inflows, further highlighting the broader investor demand for Bitcoin exposure.

- Grayscale’s GBTC, which has traditionally been a major player in the Bitcoin ETF space, faced $13.9 million in net outflows, signaling a potential shift in investor preferences as newer ETFs gain traction.

Investor Sentiment Shifting Toward Spot Bitcoin ETFs

The latest net inflows indicate a growing appetite for Bitcoin ETFs, as more institutional and retail investors seek to gain exposure to Bitcoin’s price movements without directly holding the cryptocurrency. The performance of Bitwise, Fidelity, and Ark Invest’s ETFs suggests a shift in market sentiment toward newer, more dynamic Bitcoin offerings, with spot ETFs becoming the preferred vehicle for gaining exposure.

Grayscale’s Outflow: A Sign of Shifting Preferences?

The $13.9 million outflow from Grayscale’s GBTC could reflect a growing preference for more liquid and straightforward Bitcoin ETFs, particularly those structured around spot prices. As newer ETFs with lower fees and better liquidity enter the market, GBTC’s traditional appeal may be waning, leading to increased outflows in favor of alternative products.

Conclusion

The net inflow of $25.6 million into U.S. spot Bitcoin ETFs on October 4 highlights the sustained demand for Bitcoin exposure via ETFs. With Bitwise and Fidelity leading the charge, investors are showing increasing confidence in the spot ETF market. However, Grayscale’s GBTC outflow serves as a reminder that competition in the space is intensifying, as newer ETFs gain favor among investors seeking better liquidity and transparency.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

USA September Payroll Report Boosts Likelihood of Quarter-Point Rate Cut in November

USA September Payroll Report Boosts Likelihood of Quarter-Point Rate Cut in November

The stronger-than-expected U.S. payroll report for September has increased the likelihood that the Federal Reserve will opt for a quarter-point rate cut during its November meeting, according to Nick Timiraos, the chief economics correspondent for The Wall Street Journal (WSJ). Timiraos suggested that this moderate approach aligns with the Fed’s recalibration strategy following a half-point cut in the previous month, which was prompted by signs of mild inflation and a cooling labor market.

September Payrolls Strengthen Fed’s Cautious Approach

The recent payroll data revealed stronger hiring trends than initially anticipated, especially in July, August, and September. The September report indicated a healthier labor market, leading the Fed to reassess its stance on further rate cuts. This aligns with Federal Reserve Chair Jerome Powell’s statement on September 30, in which he emphasized that the Fed is not in a hurry to implement additional rate cuts.

While some analysts had speculated about the possibility of another half-point rate cut, September’s robust employment figures have made it more likely that the Fed will take a measured approach and reduce rates by 0.25% instead.

The Fed’s Recalibration Strategy

Following last month’s half-point reduction, the Fed appears to be adopting a more gradual strategy as it responds to evolving economic conditions. The initial larger-than-usual rate cut was a response to emerging concerns about inflation and signs of weakness in the labor market. However, with recent revisions indicating stronger-than-expected hiring in July and August, the Fed may now opt for caution, avoiding overly aggressive moves that could risk overstimulating the economy.

Implications for the Economy

If the Federal Reserve proceeds with a quarter-point rate cut in November, it could signal the central bank’s commitment to balancing economic growth with inflation control. A moderate cut would provide support to businesses and consumers while ensuring that the economy doesn’t overheat. The Fed’s cautious approach reflects its need to maintain flexibility as it navigates the complexities of post-pandemic economic recovery.

Conclusion

With the September payroll report showing stronger-than-expected job growth, the Federal Reserve is likely to favor a quarter-point rate cut in November rather than a more aggressive reduction. This aligns with the Fed’s strategy of calibrating monetary policy in response to evolving economic conditions, ensuring stability while addressing inflation concerns.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

CryptoKeying——Real cloud mining platform, get higher returns

As the cryptocurrency market continues to grow, cloud mining has become a powerful alternative to traditional mining. Gone are the days of investing in expensive hardware, dealing with rising electricity costs, and grappling with complex mining algorithms. Instead, cloud mining allows users to rent computing power remotely and earn Bitcoin (BTC) without the need for a physical setup.

This article will explore how CryptoKeying positions itself as one of the best cloud mining platforms and how it can be the most convenient way for users to start earning BTC passively.

The charm of new energy cloud mining

With the development and popularization of the blockchain industry, digital cryptocurrencies such as Bitcoin have entered the vision of more people. At this time, the concept of “cloud computing power” has been mentioned again by miners. In theory, cloud computing power is a remote mining model. Users purchase cloud computing power contracts through the platform and obtain income regularly. The advantage is that users do not need to have an in-depth understanding of mining principles and various software and hardware, or purchase expensive mining machines, nor do they need to maintain them 24 hours a day. As long as they place an order to purchase a computing power contract, they can participate in one-click mining, which is similar to purchasing a product with income rights.

CryptoKeying: As easy as online shopping

In theory, the emergence of CryptoKeying has brought win-win results to the platform and investors. For investors, the process of participating in cloud computing power is as simple as shopping online. Investors only need to choose the corresponding cloud computing power contract and pay the fee to continuously obtain the corresponding digital cryptocurrency during the period when CryptoKeying cloud computing power is in effect.

Unexpected profit model

In the process of digital transformation, the emergence of cloud computing platforms with lower mining thresholds, more opportunities, and win-win operating models indicates that the “era of cloud mining for all” has arrived. CryptoKeying mining was born out of the opportunities of the times and is committed to building global consensus and allowing consensus to generate unlimited wealth. CryptoKeying provides the opportunity to earn $1,000 or more a day, allowing users to turn their dreams of getting rich online into reality.

Security and reliability

In the world of cryptocurrency, trust and security are of paramount importance. CryptoKeying understands this and puts user security first. CryptoKeying is committed to transparency and legitimacy, ensuring your investment is protected so you can focus on earning returns.

How to start your road to wealth

Starting your cloud mining journey with CryptoKeying is a simple process. Follow these simple steps to start earning passive income:

- Register: Create an account on the CryptoKeying platform.

- Choose a contract: Select a mining contract that matches your goals.

- CryptoKeying: Start mining now, powerful hardware at your service.

- Receive payments daily: Enjoy the convenience of daily payments, providing a steady stream of income.

Additional Rewards:

Signup Bonus: Get an instant $10.00 bonus when you sign up and start mining.

Invite Earnings: Increase your mining earnings by inviting friends. Get an ongoing 3% reward for mining activity.

VIP bonus: Get cumulative investment VIP bonus through long-term investment, up to 500,000 US dollars

Advertising bounty: CryptoKeying’s $50 million bounty is waiting for you. You can participate at any time as long as you have enough resources.

CryptoKeying Contract:

The contracts provided by CryptoKeying are not only simple but also diverse, providing you with a variety of options to meet your investment needs. They provide stable and risk-free fixed income.

CryptoKeying Custom Cloud Mining Contracts: Explore Tailor-Made Cloud Mining Options

Join the Laziest Way to Get Rich

As the cryptocurrency market continues to grow, CryptoKeying remains a pioneer in the field, offering an easy path to profitability. Whether you are an experienced cryptocurrency enthusiast or a complete newbie, CryptoKeying welcomes you to join the ranks of easy passive income.

All in all, CryptoKeying proves the power of simplicity in the world of cryptocurrency. Its emphasis on user-friendliness, security, and the potential to earn excess income every day, provides unique opportunities for beginners and experts alike. Join CryptoKeying today and embark on the easiest yet most rewarding journey to wealth online.

In order to facilitate new and old users, CryptoKeying has launched the latest APP installation package. For details, please visit the CryptoKeying official website: https://cryptokeying.com/

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

-

Startup Stories12 months ago

Startup Stories12 months agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories12 months ago

Startup Stories12 months agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories11 months ago

Startup Stories11 months agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency7 months ago

Crptocurrency7 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories12 months ago

Startup Stories12 months agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce12 months ago

E-commerce12 months agoTop Online Couponing Trends To Watch Out For In 2016

-

Startup Stories12 months ago

Startup Stories12 months agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing