Crptocurrency

Bitcoin Surges 25% in 2 Weeks- Is This the Beginning of Bull Run?

[ad_1]

- Bitcoin surges to an 18-month high of $35,902, representing a 25% increase in just two weeks.

- The increase is attributable to the Federal Reserve’s decision to pause interest rate hikes, the prospective approval of a spot Bitcoin ETF, and the forthcoming 2024 Bitcoin halving event, all of which have created optimism about Bitcoin’s value.

- Bitcoin’s limited quantity, technology (blockchain), and growing trust make it appealing to both people and institutions seeking alternatives to traditional assets as a hedge against economic volatility.

Bitcoin Surges to $35,902, Is this the Start of a Bullish Trend?

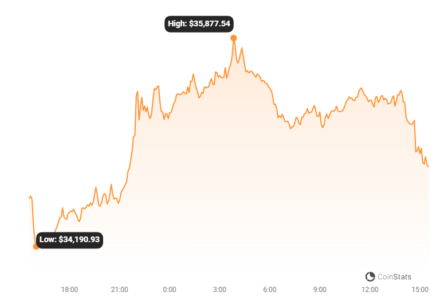

Bitcoin, the most well-known digital currency, just reached a crucial milestone. This has created quite a commotion in the bitcoin community. Bitcoin’s price skyrocketed to $35,902 on November 1, a high not reached in the previous 18 months. This amazing 25% spike in a fortnight has the crypto industry wondering if this is the start of the long-awaited Bull Run.

The market is buzzing with confidence, and investors are keeping a careful eye on Bitcoin’s moves for signs of a persistent rising trend. Many are debating whether this increase marks a key turning point in the cryptocurrency markets after a period of relative stability. As the value of Bitcoin fluctuates, all eyes are on whether it will retain its current momentum or undergo a correction.

Furthermore, the rise in Bitcoin’s price has sparked increased interest and debate regarding the future potential of alternative cryptocurrencies, with talks focusing on the broader ramifications for the entire digital asset market. This recent gain serves as a reminder of the volatility and unpredictability inherent in the cryptocurrency market, causing many to wonder whether this is a one-time surge or the start of a longer bullish phase.

Positive Momentum Strengthens Bullish Market Sentiment

Analysts are keeping a careful eye on Bitcoin’s bullish trends. Since early 2023, Bitcoin has been on an upward trend, with rising highs and lows—a technical indicator of buyer domination. However, as the currency reaches the critical $35K resistance level, there appears to be some hesitancy, implying a probable brief slump. Nonetheless, the general market momentum remains robust, as Bitcoin has reached major high points, indicating significant demand.

Read Also: Chinese Police Reveals $300 Million Cryptocurrency Scam! Scammers Used This Stablecoin!

What is Causing the Recent Surge in Cryptocurrency Markets?

Several major elements are currently contributing to the bitcoin market’s optimistic trajectory. One important element is the Federal Reserve’s recent decision to postpone interest rate hikes, which normally supports asset values, including cryptocurrencies like Bitcoin. The Fed’s intentional pause makes Bitcoin more appealing to investors seeking growth options outside of traditional interest-bearing assets.

Another important factor is the impending approval of a spot Bitcoin ETF. According to asset manager Bernstein, this clearance might boost Bitcoin’s value to an astonishing $150,000 by 2025. An ETF would put Bitcoin into mainstream financial portfolios, and it is possible that a considerable amount of its supply would be diverted to the ETF market.

Furthermore, the forthcoming Bitcoin halving event in 2024 is causing optimism. This occurrence has traditionally occurred before to a price increase because it decreases the rate of new Bitcoin creation, adding scarcity to the already limited quantity.

In Uncertain Times, a Digital Safe Haven

Bitcoin is stepping up as a new bastion for securing money in a world of economic uncertainty and worries about the dependability of old-school secure assets like US Treasury bonds. Its growing reputation as a trustworthy store of value is piqueing investors’ interest, giving Bitcoin an intriguing alternative to traditional assets.

Bitcoin is viewed as a hedge against inflation and economic instability because to its decentralized character and limited supply of 21 million coins. Blockchain technology, which provides transparency and security, lies at the heart of Bitcoin. This adds to its allure in a financial environment when trust is increasingly being questioned. This mix of scarcity, technological innovation, and rising recognition of Bitcoin’s durability is attracting both individual and institutional investors looking for alternative ways to preserve and build their capital.

A Look at What’s Next

Despite current market patterns indicating a positive market, it is critical to approach with care in the unpredictable crypto realm. Rapid price increases frequently precede market corrections, so investors must remain alert to market changes. However, the confluence of favorable macroeconomic conditions—the expected approval of a Bitcoin ETF, the impending halving, and Bitcoin’s image as a safe-haven asset—creates a potent mix that might spark a significant Bull Run for Bitcoin.

In the cryptocurrency industry, where optimism is cautiously balanced with a good dose of realism, these developments could herald the beginning of a new age for Bitcoin and the broader crypto market.

[ad_2]