Startup Stories

How Peak XV-Backed Neo Is Looking To Disrupt The Wealth Advisory, AMC & Family Office Space

[ad_1]

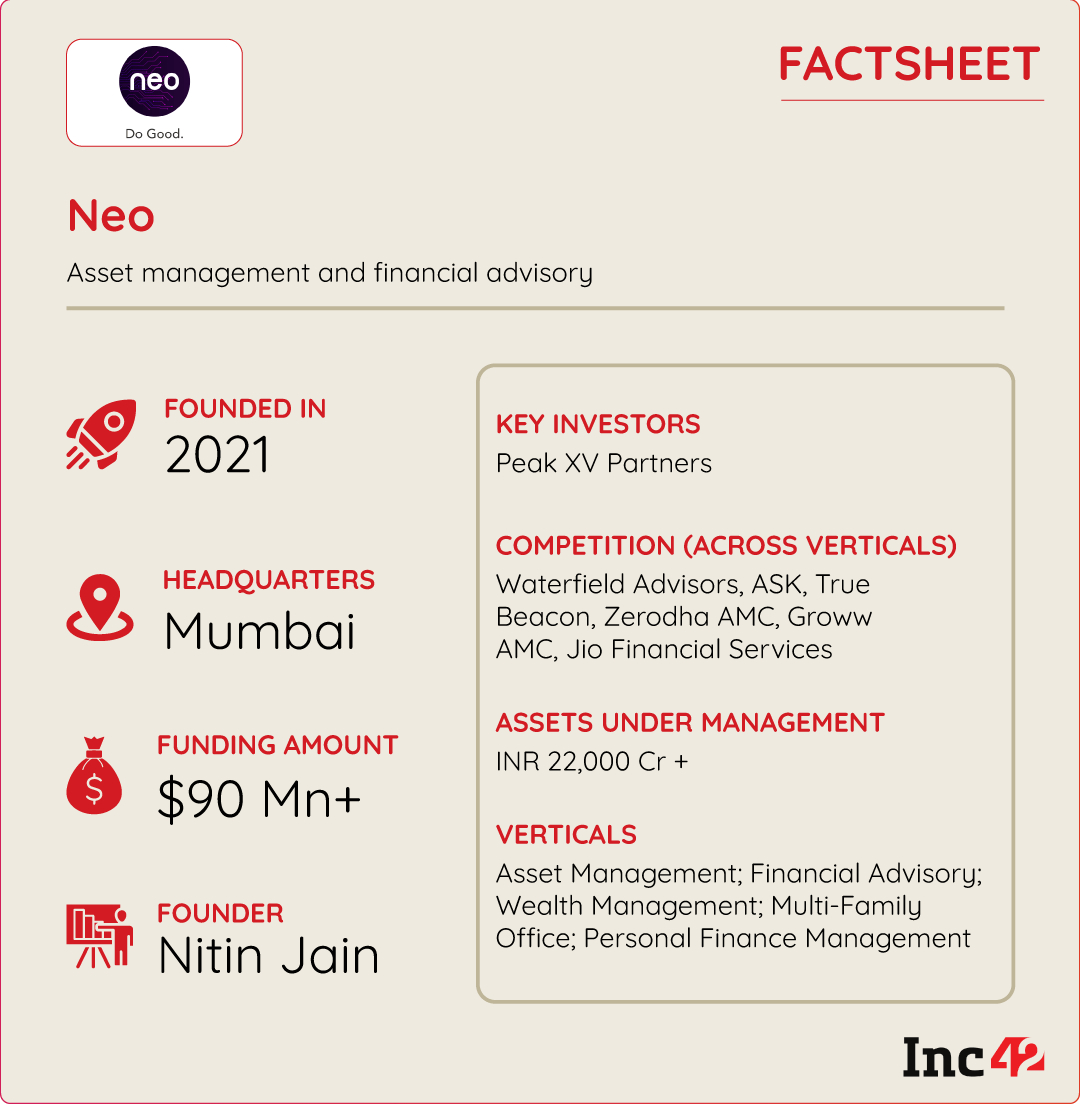

Having started off with a $40 Mn seed fund from some external investors and the founding team, Neo has raised $35 Mn (INR 300 Cr) in a growth round led by Peak XV Partners

Neo was founded in May 2022 by Nitin Jain, the former wealth management CEO at PAG-Edelweiss Financial Services and a bevy of experienced professionals from the wealth management space

Founder and chairman Jain believes that Neo’s focus on yield-based income solutions set it apart from the competition in the AMC space, which now includes the likes of Jio Financial Services, Zerodha and others

What’s the biggest gap in the financial advisory and asset management space in India? For Neo, a Mumbai-based startup that was founded in November 2021, the answer is two-fold — unbiased advice from trusted experts and transparency.

“You see bias in a lot of players because of the conflict of interest in terms of the way the organisations are structured,” says Nitin Jain, founder, chairman and managing director of Neo Wealth and Asset Management.

Neo’s approach to the financial advisory space can be broken down into four central verticals — wealth advisory, asset management, multi-family offices and a wealth management platform for independent advisors. This makes Neo a lot more diverse and transparent than many players in the market, the founder claimed.

Jain brings a wealth of expertise to the financial advisory space. Before starting up with Neo, he was the wealth management CEO at PAG-Edelweiss Financial Services and as he recalled, the market opportunity was massive after the liquidity boom of 2021.

The founder told us he got together with ‘some friends’ to tap this opportunity and he saw there was room enough for an advisory that was focussed on yield-based investing as long the right people are leading the charge (more on Neo’s leadership team later).

Having started off with a $40 Mn seed fund from some external investors and the founding team, Neo has today announced a $35 Mn (INR 300 Cr) round led by Peak XV Partners.

The founder said that the fresh round will help catalyse growth initiatives at Neo, develop and expand the wealth management business, deepen the asset management franchise model, and help attract top talent, which he believes will be a key competitive advantage to tap the massive wealth and asset management opportunity in India.

Neo: From Wealth Advisory To Multi-Family Office

Neo’s businesses include a wealth advisory where it is purely advising clients and an asset management arm that will create products in the space of alternatives with a sharp focus on yield-based income solutions. Jain believes that a lot of fund managers in India focus on growth, which is why it’s an opportunity to target yield, which is a better proposition for younger investors.

“The typical AMC promise is that if the money stays with them for five years or 10 years, then the investor will get an X or Y amount in return. But with Neo, we create a good yield and cash flows for you over a period of time. So actually the money starts to work for you and you’re getting some cash and it can be a good second income for a lot of professionals.”

Currently, Neo has solved for three yield buckets for 10%-12%, 16%-18% and 18%-20% returns in its asset management vertical. Yield in this case refers to the earnings generated and realised by investors on any investment over an annual, quarterly or monthly basis.

Under the asset management business, Neo’s focus is on delivering inflation-beating returns without the volatility of equity markets, which has been particularly of note in the past two years.

Besides asset management and wealth advisory, Neo has also forayed into the wealth management side through a multi-family office setup as well as a CIO-like approach for families that are in the HNI or UHNI category.

The multi-family office model targets those families that have more than $400 Mn-$500 Mn of investible surplus. As more and more Indian HNI families realise the need to diversify their portfolio, multi-family offices have become more and more commonplace. The primary advantage here for advisors is that they can operate at a greater cost efficiency by managing several families through a central infrastructure.

“We actually represent the family offices in conversations with businesses and funds. In this case, we actually buy products for the client. But we have also created a platform called Neo Wealth Partners where we provide the infrastructure, the brand, the capital and other capabilities and bring on registered wealth managers to grow their client base with us,” the founder and CMD added.

He further explained that Neo Wealth Partners are not paid by the company, but by their clients directly, with Neo keeping a small share as a platform fee. This makes them completely independent. “We do not have a say in what their advice is or which products they should be selling. There’s complete transparency so clients can choose which independent wealth managers they want to work with.”

Around 300 relationship managers in the wealth space practically control around 65%-75% of the total AUM in India, Jain added. His initial fear with Neo was that investors might be hesitant to move away from these dominant players who have 10-12 years of experience and have major organisations backing them.

“We actually do not pay RMs any meaningful fixed compensation but I’ve been very positively surprised by the response. In six months, we have been able to bring on 25 RMs and we will have close to 40 by the end of the year.”

From a technology point of view, RMs get a dashboard to access the track record of a client, their investment history as well as data related to industry reports, performance of particular asset classes and more. This enables RMs to make the right decisions for each client independently.

At the moment, Neo is largely using technology as an enabler for its expertise-driven advisory. However, the company is planning to leverage emerging technology in a big way for products in the year to come. Jain did not elaborate on the new products expected from Neo in the future.

Wealth Management’s New Faces

The growing opportunity in the wealth management and asset management space has seen heavyweights such as Reliance throw their hats into the ring. Jio Financial Services, which signed a joint venture with BlackRock for an AMC, is set to bring its financial muscle and vast resources to the arena.

Besides JFS, new entrants in the AMC space include the likes of startups such as Zerodha and Groww, along with Bajaj Finserv Asset Management, NJ Mutual Fund and WhiteOak Capital Mutual Fund, as well as Edelweiss Asset Management, Jain’s former company.

Overall, more than 40 companies are operating in the asset management space and incumbents believe that the advantage they have is on pricing and products.

Incumbents argue that the new entrants will definitely disrupt distribution and bring more investors to the space, but they will not be able to challenge existing players in terms of pricing or product innovation.

The total assets under management of the Indian mutual fund industry was about INR 46 Lakh Cr as of September 2023, which is just 15% of India’s gross domestic product (GDP).

This is several leagues behind developed nations. In the US, for example, the MF-to-GDP ratio is at 80%. This is the real opportunity for AMCs in India as the economy, GDP and per capita income grow in the next five to ten years.

Of course, macroeconomic swings such as the one in the past 20 months come and go, but given the fact that the MF-to-GDP ratio has grown from around 10% in March 2020 to 15% today shows just how rapidly the market is maturing.

Jain reiterated that Neo’s competitive edge in AMC comes from its sharp focus on yield-based income solutions. This, he believes, is a more common need in the market than wealth appreciation which is how other asset managers approach this space.

“I can’t think of more than two or three names in that category today. We think there is a very unique opportunity to build private credit and invest in real assets. Our clients would be buying out of solar plants, buying out of road projects. We convert them eventually into InvITs (Infrastructure Investment Trust) and give our clients a stream of cash flows rather than one big cheque at the end of five or seven years and locking in their money.”

Neo Taps Family Office Boom

When it comes to the multi-family office vertical, Neo has taken a diversification-first approach but it’s also looking at new-age asset classes such as startup investments, which may have a longer investment horizon.

According to an Inc42 report, there are 300-plus family offices in India, and this number is expected to increase significantly. Our estimates show that the number of family offices actively taking part on an annual basis in startup investments will likely increase 5x to 735 by 2030 from 123 in 2023.

Several experts pointed to a sea change in the way family offices manage their wealth today versus a decade ago. The focus is higher on startups and new-age businesses as opposed to real estate or gold or public markets.

Jain and Neo will be faced with competition such as Waterfield Advisors, Cervin Advisors and other emerging players that are formally targeting HNI families. The Neo founder believes that the distinct advantages for Neo are the company’s ability to negotiate with funds and ensure better governance standards on the startup side.

He claims that Neo works closely with some exceptional fund managers in the startup ecosystem that the leadership team has known for decades. “When we advise families to go into direct investing, we have the capability to evaluate deals independently. Or we will take family offices to the pedigreed firms and get the most preferred terms and co-investment solutions for them.”

Banking On A Wealth Of Experience

The other major advantage for Nitin Jain is the leadership team at Neo. Besides Jain, Neo’s founding team includes Varun Bajpai, former country head, Macquarie Group; Hemant Daga, former CEO, Edelweiss Asset Management ; Puneet Jain, former executive director at Goldman Sachs and Kotak Institutional Equities; and A Srikanth, BridgeMonte Advisors founder and former CEO of Motilal Oswal Wealth.

Varun Bajpai, CEO Neo Wealth Management (left to right)

Each of the founding members of Neo plays a critical role in these various verticals.

Bajpai is the CEO of Neo Wealth Management and also heads Neo World, the investment education and personal finance platform which is currently under development. This platform will take users through a goal-oriented journey of savings and investments through gamification and emerging technologies.

Daga is the CEO of Neo Asset Management, while Puneet Jain is the MD and CIO of Neo Asset Management. Finally, Srikanth leads the Neo Multi Family Office as a CEO to advise ultra-high net worth families on strategic investments, estate planning, offshoring and asset acquisitions.

Together these individuals brought over 100 years of wealth and investment advisory experience to Neo and close to INR 3 Lakh Cr of assets under advice. “When you go to a doctor, you look to check their pedigree as a caregiver and how they have performed over the years. So not only do we have a very unique positioning, vis-a-vis the competition, but also some of the most competent and most experienced people in that space.”

[ad_2]

Source link