Startup Stories

How Peak XV-Backed Neo Is Looking To Disrupt The Wealth Advisory, AMC & Family Office Space

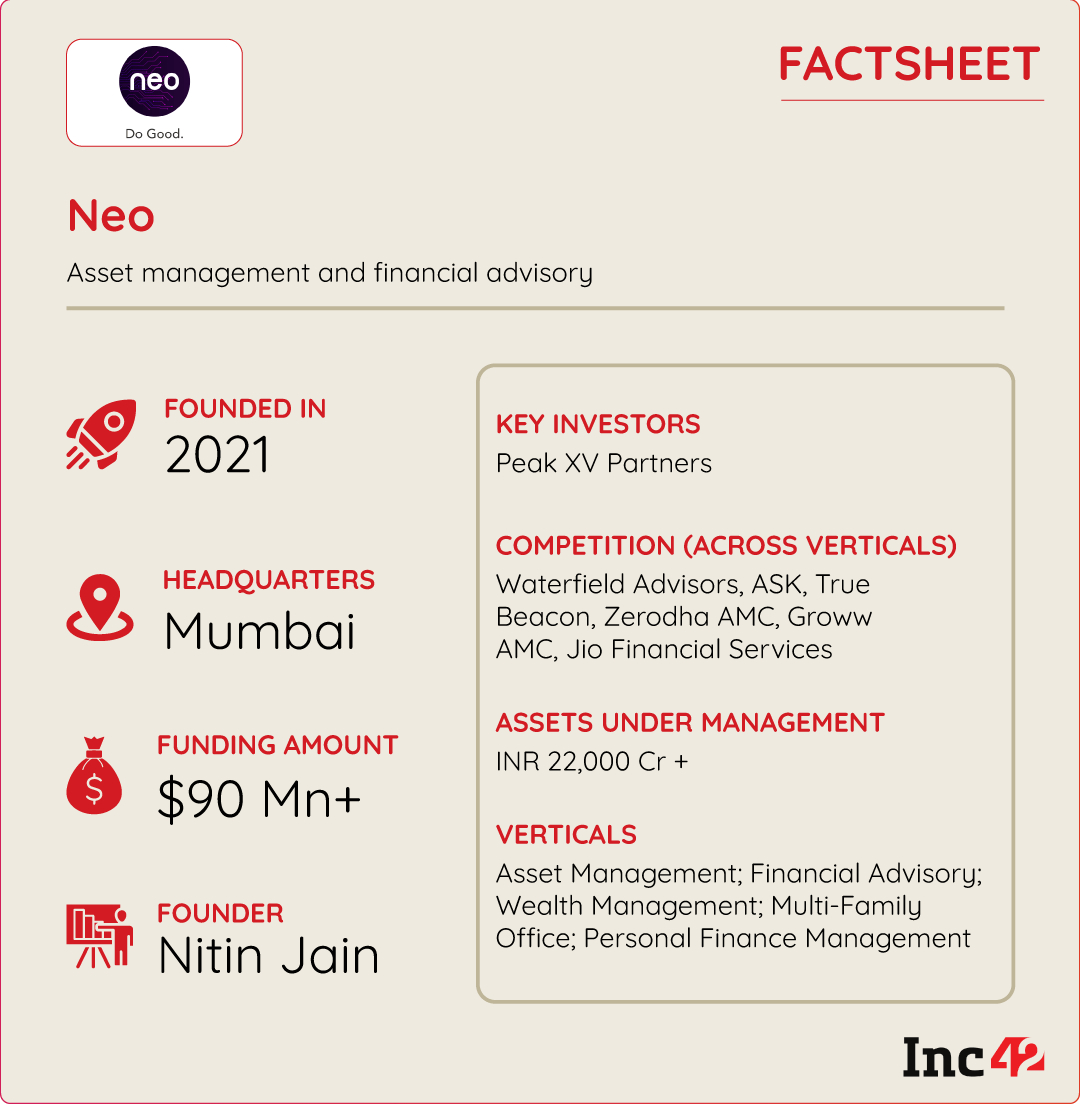

Having started off with a $40 Mn seed fund from some external investors and the founding team, Neo has raised $35 Mn (INR 300 Cr) in a growth round led by Peak XV Partners

Neo was founded in May 2022 by Nitin Jain, the former wealth management CEO at PAG-Edelweiss Financial Services and a bevy of experienced professionals from the wealth management space

Founder and chairman Jain believes that Neo’s focus on yield-based income solutions set it apart from the competition in the AMC space, which now includes the likes of Jio Financial Services, Zerodha and others

What’s the biggest gap in the financial advisory and asset management space in India? For Neo, a Mumbai-based startup that was founded in November 2021, the answer is two-fold — unbiased advice from trusted experts and transparency.

“You see bias in a lot of players because of the conflict of interest in terms of the way the organisations are structured,” says Nitin Jain, founder, chairman and managing director of Neo Wealth and Asset Management.

Neo’s approach to the financial advisory space can be broken down into four central verticals — wealth advisory, asset management, multi-family offices and a wealth management platform for independent advisors. This makes Neo a lot more diverse and transparent than many players in the market, the founder claimed.

Jain brings a wealth of expertise to the financial advisory space. Before starting up with Neo, he was the wealth management CEO at PAG-Edelweiss Financial Services and as he recalled, the market opportunity was massive after the liquidity boom of 2021.

The founder told us he got together with ‘some friends’ to tap this opportunity and he saw there was room enough for an advisory that was focussed on yield-based investing as long the right people are leading the charge (more on Neo’s leadership team later).

Having started off with a $40 Mn seed fund from some external investors and the founding team, Neo has today announced a $35 Mn (INR 300 Cr) round led by Peak XV Partners.

The founder said that the fresh round will help catalyse growth initiatives at Neo, develop and expand the wealth management business, deepen the asset management franchise model, and help attract top talent, which he believes will be a key competitive advantage to tap the massive wealth and asset management opportunity in India.

Neo: From Wealth Advisory To Multi-Family Office

Neo’s businesses include a wealth advisory where it is purely advising clients and an asset management arm that will create products in the space of alternatives with a sharp focus on yield-based income solutions. Jain believes that a lot of fund managers in India focus on growth, which is why it’s an opportunity to target yield, which is a better proposition for younger investors.

“The typical AMC promise is that if the money stays with them for five years or 10 years, then the investor will get an X or Y amount in return. But with Neo, we create a good yield and cash flows for you over a period of time. So actually the money starts to work for you and you’re getting some cash and it can be a good second income for a lot of professionals.”

Currently, Neo has solved for three yield buckets for 10%-12%, 16%-18% and 18%-20% returns in its asset management vertical. Yield in this case refers to the earnings generated and realised by investors on any investment over an annual, quarterly or monthly basis.

Under the asset management business, Neo’s focus is on delivering inflation-beating returns without the volatility of equity markets, which has been particularly of note in the past two years.

Besides asset management and wealth advisory, Neo has also forayed into the wealth management side through a multi-family office setup as well as a CIO-like approach for families that are in the HNI or UHNI category.

The multi-family office model targets those families that have more than $400 Mn-$500 Mn of investible surplus. As more and more Indian HNI families realise the need to diversify their portfolio, multi-family offices have become more and more commonplace. The primary advantage here for advisors is that they can operate at a greater cost efficiency by managing several families through a central infrastructure.

“We actually represent the family offices in conversations with businesses and funds. In this case, we actually buy products for the client. But we have also created a platform called Neo Wealth Partners where we provide the infrastructure, the brand, the capital and other capabilities and bring on registered wealth managers to grow their client base with us,” the founder and CMD added.

He further explained that Neo Wealth Partners are not paid by the company, but by their clients directly, with Neo keeping a small share as a platform fee. This makes them completely independent. “We do not have a say in what their advice is or which products they should be selling. There’s complete transparency so clients can choose which independent wealth managers they want to work with.”

Around 300 relationship managers in the wealth space practically control around 65%-75% of the total AUM in India, Jain added. His initial fear with Neo was that investors might be hesitant to move away from these dominant players who have 10-12 years of experience and have major organisations backing them.

“We actually do not pay RMs any meaningful fixed compensation but I’ve been very positively surprised by the response. In six months, we have been able to bring on 25 RMs and we will have close to 40 by the end of the year.”

From a technology point of view, RMs get a dashboard to access the track record of a client, their investment history as well as data related to industry reports, performance of particular asset classes and more. This enables RMs to make the right decisions for each client independently.

At the moment, Neo is largely using technology as an enabler for its expertise-driven advisory. However, the company is planning to leverage emerging technology in a big way for products in the year to come. Jain did not elaborate on the new products expected from Neo in the future.

Wealth Management’s New Faces

The growing opportunity in the wealth management and asset management space has seen heavyweights such as Reliance throw their hats into the ring. Jio Financial Services, which signed a joint venture with BlackRock for an AMC, is set to bring its financial muscle and vast resources to the arena.

Besides JFS, new entrants in the AMC space include the likes of startups such as Zerodha and Groww, along with Bajaj Finserv Asset Management, NJ Mutual Fund and WhiteOak Capital Mutual Fund, as well as Edelweiss Asset Management, Jain’s former company.

Overall, more than 40 companies are operating in the asset management space and incumbents believe that the advantage they have is on pricing and products.

Incumbents argue that the new entrants will definitely disrupt distribution and bring more investors to the space, but they will not be able to challenge existing players in terms of pricing or product innovation.

The total assets under management of the Indian mutual fund industry was about INR 46 Lakh Cr as of September 2023, which is just 15% of India’s gross domestic product (GDP).

This is several leagues behind developed nations. In the US, for example, the MF-to-GDP ratio is at 80%. This is the real opportunity for AMCs in India as the economy, GDP and per capita income grow in the next five to ten years.

Of course, macroeconomic swings such as the one in the past 20 months come and go, but given the fact that the MF-to-GDP ratio has grown from around 10% in March 2020 to 15% today shows just how rapidly the market is maturing.

Jain reiterated that Neo’s competitive edge in AMC comes from its sharp focus on yield-based income solutions. This, he believes, is a more common need in the market than wealth appreciation which is how other asset managers approach this space.

“I can’t think of more than two or three names in that category today. We think there is a very unique opportunity to build private credit and invest in real assets. Our clients would be buying out of solar plants, buying out of road projects. We convert them eventually into InvITs (Infrastructure Investment Trust) and give our clients a stream of cash flows rather than one big cheque at the end of five or seven years and locking in their money.”

Neo Taps Family Office Boom

When it comes to the multi-family office vertical, Neo has taken a diversification-first approach but it’s also looking at new-age asset classes such as startup investments, which may have a longer investment horizon.

According to an Inc42 report, there are 300-plus family offices in India, and this number is expected to increase significantly. Our estimates show that the number of family offices actively taking part on an annual basis in startup investments will likely increase 5x to 735 by 2030 from 123 in 2023.

Several experts pointed to a sea change in the way family offices manage their wealth today versus a decade ago. The focus is higher on startups and new-age businesses as opposed to real estate or gold or public markets.

Jain and Neo will be faced with competition such as Waterfield Advisors, Cervin Advisors and other emerging players that are formally targeting HNI families. The Neo founder believes that the distinct advantages for Neo are the company’s ability to negotiate with funds and ensure better governance standards on the startup side.

He claims that Neo works closely with some exceptional fund managers in the startup ecosystem that the leadership team has known for decades. “When we advise families to go into direct investing, we have the capability to evaluate deals independently. Or we will take family offices to the pedigreed firms and get the most preferred terms and co-investment solutions for them.”

Banking On A Wealth Of Experience

The other major advantage for Nitin Jain is the leadership team at Neo. Besides Jain, Neo’s founding team includes Varun Bajpai, former country head, Macquarie Group; Hemant Daga, former CEO, Edelweiss Asset Management ; Puneet Jain, former executive director at Goldman Sachs and Kotak Institutional Equities; and A Srikanth, BridgeMonte Advisors founder and former CEO of Motilal Oswal Wealth.

Varun Bajpai, CEO Neo Wealth Management (left to right)

Each of the founding members of Neo plays a critical role in these various verticals.

Bajpai is the CEO of Neo Wealth Management and also heads Neo World, the investment education and personal finance platform which is currently under development. This platform will take users through a goal-oriented journey of savings and investments through gamification and emerging technologies.

Daga is the CEO of Neo Asset Management, while Puneet Jain is the MD and CIO of Neo Asset Management. Finally, Srikanth leads the Neo Multi Family Office as a CEO to advise ultra-high net worth families on strategic investments, estate planning, offshoring and asset acquisitions.

Together these individuals brought over 100 years of wealth and investment advisory experience to Neo and close to INR 3 Lakh Cr of assets under advice. “When you go to a doctor, you look to check their pedigree as a caregiver and how they have performed over the years. So not only do we have a very unique positioning, vis-a-vis the competition, but also some of the most competent and most experienced people in that space.”

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency9 months ago

Crptocurrency9 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing