Startup Stories

Why Millennials, GenZs Are Riding The Investment Tech Wave In India

[ad_1]

According to NSE, the number of active retail investors in stock markets rose 160% – from around 30 Lakh in January 2020 to 78 Lakh by March 2023

As per Zinnov, over 55% of users of investment tech apps are millennials, which suggests that this demographic has a greater risk appetite for trading

Inc42 spoke to Sidhavelayutham M, founder of discount brokerage platform Alice Blue to understand how investment techs are empowering novice retail investors

In 2023, the oldest millennials turn 40, while the oldest Gen Zers have already entered their mid-twenties. This dynamic demographic represents those who witnessed technology’s rise and those who practically grew up with it. And both have also adeptly leveraged emerging technology to improve their lives.

With an active presence in the Indian workforce, those in the 23-45 age group continuously seek ways to enhance their financial well-being.

Factors such as rising discretionary spending, increased financial literacy and the Covid-19 pandemic have encouraged younger Indians to overcome their aversion to risk and explore alternative income sources. Interestingly, NSE (National Stock Exchange) data shows that the number of active retail investors in stock markets rose from around 30 Lakh in January 2020 to 78 Lakh by March 2023 — clocking a 160% increase in two years.

However, it is not the growing risk appetite alone that has contributed to the rise of retail investors in capital markets. The transition from traditional broker models and agents to online platforms and smartphone apps has made trading simple, user-friendly, and accessible to a large user base.

“The trading culture is going through a fast-paced evolutionary process. The temptation to participate in the Indian growth story has not only made the investors trade in stocks but also trade in derivatives,” says Sidhavelayutham M, founder, & CEO of investment tech platform Alice Blue.

Sidhavelayutham M, who holds a degree in business administration, started discount broking platform Alice Blue in Tamil Nadu’s Erode 16 years ago and moved its headquarters to Bengaluru in 2017, at a time when investment tech was growing as a niche category within fintech.

Since 2006, the company has scaled its physical footprint across 20 Indian cities and has served more than 4 Lakh investors.

In 2017, the startup launched its trading app ANT(Analyse and Trade) to improve the user experience and simplify online trading across various segments, including equity, currency, and commodity. The app also enables users to trade in F&O (Futures and Options) and invest in initial public offerings (IPOs) and mutual funds.

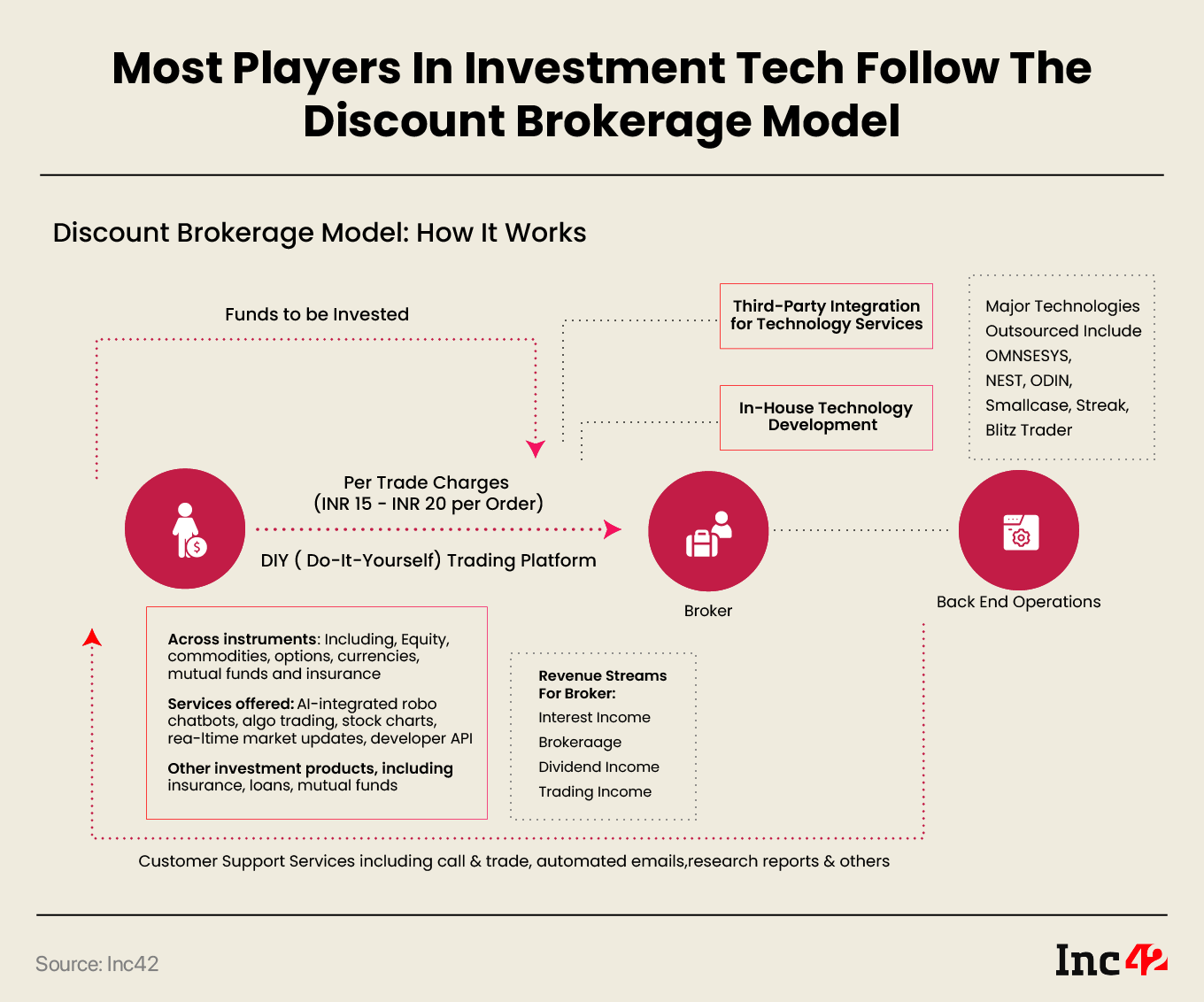

For context, a discount broker platform allows individuals to buy and sell various financial instruments including stocks, bonds, and exchange-traded funds (ETFs), at a reduced cost compared to traditional full-service brokerage firms. Such platforms offer online trading tools, including real-time market data, charts, and analysis tools to help users make informed investment decisions.

As opposed to the industry standard brokerage fee of INR 20, Alice Blue claims to charge INR 15 from its retail investors for intraday and F&O trading, besides offering free equity, IPO, and mutual funds investments.

Despite the macroeconomic headwinds and stock market crashes in the past year and a half, Alice Blue said that it witnessed an 18% YoY growth in trade volumes in 2022. This signals the retail investors’ confidence in the stock market and other investment assets.

Fostering Trust, Creating Awareness Around Retail Investment

Sidhavelayutham M entered the investment tech space even before the global financial crisis of 2007-08. Although that crisis was primarily caused by a downturn in the US housing market and a lack of regulatory oversight, its repercussions were felt in India as well.

The 2008 financial crisis demonstrated that reducing brokerage fees isn’t sufficient to earn the trust of investors, a lesson that India’s investment tech platforms have taken to heart. Beyond the allure of big bucks and exhilarating bull runs, there lies a harsh reality — without adequate knowledge and carefully calculated risks, no substantial returns can be achieved.

Even the past year has seen investors suffer big losses on their public market bets as the usually-reliable tech stocks crashed in a major way.

Recognising the importance of awareness and investor protection, investment techs have also added an educational component to their platforms. These aim to help individuals make well-informed investment decisions, something Alice Blue has also added in recent years.

For instance two of India’s prominent discount brokerage startups and Alice Blue’s notable rivals – Zerodha and Upstox — offer a wealth of resources including articles, videos, and glossaries focussed on stock markets, mutual funds, and more.

Commenting on Alice Blue’s educational mobile app ANTIQ, Sidhavelayutham M said, “We offer a wide range of webinars and seminars to ensure that young investors have the option of learning the nuances of the markets before investing. We always urge them to exercise caution and learn the ropes of the markets before plunging in.”

Educating investors is one thing, but converting potential leads into active retail investors is another.

According to Sidhavelayutham M, digital marketing has served the company well in reaching its target audience. Having physical offices across the country also helps build brand awareness and deepen the reach, he added.

However, nothing has worked as well as word-of-mouth marketing. Like its counterparts, Alice Blue has implemented a referral programme that allows users to receive a percentage of cashback on the brokerage fees they pay to the company.

By harnessing the power of referrals, investment tech platforms can not only acquire new users without overspending on marketing but also gain trust among them rapidly. Plus, the rewards programme is an incentive for existing users to stay loyal to the platform, since it reduces the fees even further.

This strategy works particularly well outside the metros that thrive on community networks and the trust inherent in one’s social circle.

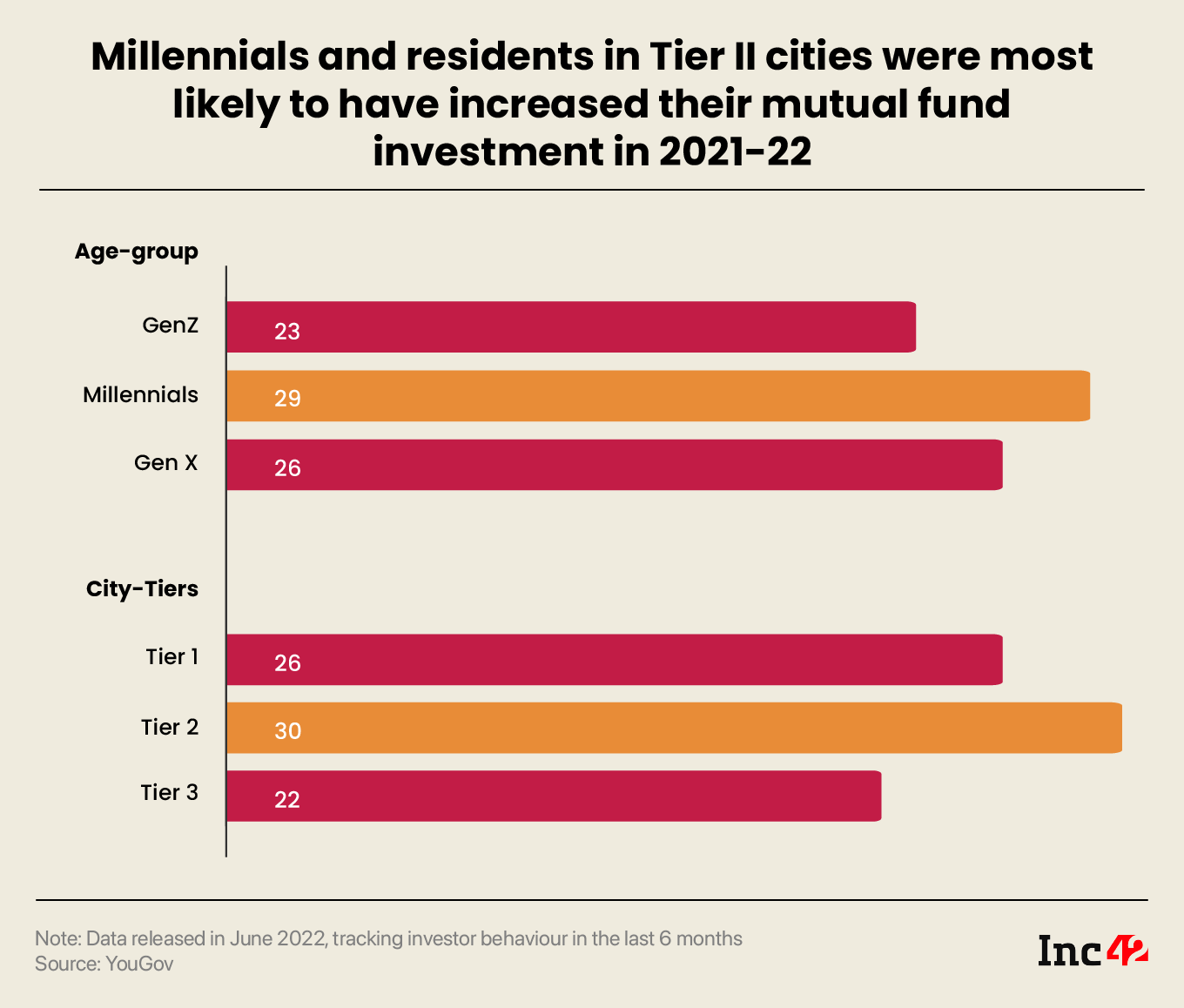

In fact, a report by international research firm YouGov showed that millennials and those residing in Tier 2 cities are most likely to increase their investment in mutual funds. According to its June 2022 report, 26% of millennials increased investing activity in mutual funds as compared to Gen Z (23%) and Gen X (23%).

Likewise, people from Tier 2 cities (30%) increased their mutual fund investments more than Tier 1 and 3 cities.

“We have been noticing a lot of people from smaller towns and even villages coming to our platform. The Covid lockdown was of course a big contributing factor towards growing the investor base from far and distant towns,” adds the founder.

Enhancing The Trading Experience

It’s no surprise that novice investors are attracted to digital investment platforms due to the convenience and affordability they offer, plus these platforms do a lot of the heavy lifting in terms of account creation and payouts of the returns in a timely manner.

Unlike full-service brokers, who usually impose a brokerage fee of 0.25%-0.75% on every transaction, discount brokers charge a minimal amount which is definitely more appealing for a first-time or novice investor.

However, in order to effectively compete with traditional counterparts, discount brokerages must consistently enhance their offerings to align with SEBI (Stock Exchange Board of India) regulations, while also maintaining a bug-free, seamless trading experience and a high level of user security.

Alice Blue has NSE (National Stock Exchange) and BSE (Bombay Stock Exchange) licenses.

Besides this, the company aims to constantly innovate and upgrade its tech stack, which is a key competitive moat in the investment tech space.

“We place paramount importance on hiring and retaining top-tier tech talent. Our team consists of industry leading professionals specialising in software development, data analysis, cybersecurity, and AI,” says Sidhavelayutham M, adding that customisable and conversational trading bots and AI-driven platforms are key to simplifying trading for beginners.

The platform also offers robust trading which enables traders (who manage large trade volumes on behalf of investors) to integrate third party applications that provide additional utilities. This helps them track multiple orders placed on a daily basis and enables seamless access to historic & real-time market data, trade execution and account management functionalities.

Platforms such as Alice Blue and its ilk also use secure servers, networks, and storage systems, while employing strong encryption protocols such as SSL (Secure Sockets Layer) and TLS (Transport Layer Security) to protect user data.

Besides, it has support for two-factor authentication as an additional layer of security, requiring users to provide a secondary verification factor (such as an OTP) along with their login credentials. In addition, Alice Blue also employs fingerprint login for enhanced security and is currently exploring blockchain technology to decentralize data, making it more secure and harder to tamper with.

What Are Millennials Looking For?

According to Inc42’s estimates, the investment tech industry is experiencing rapid growth, and its market size is expected to surge from $9.2 Bn in 2022 to $74 Bn by 2030, growing at a CAGR of 30%.

This growth can largely be attributed to millennials joining the retail investor pool. A report by management consulting firm Zinnov indicates that over 55% of investment app users belong to this demographic.

Given the dominance of millennials in the user base, it is unsurprising that investment tech platforms are targeting this segment. However, it is worth noting that a substantial portion of millennials exhibit a preference for low to medium-risk investments and more than 44% of all retail investors opt for systematic investment plans (SIPs), as per the report.

But Sidhavelayutham M believes this trend is changing. “A lot of our users have been steadily investing in the IPO bouquet. We are also seeing a lot of excitement around forthcoming IPOs from the likes of LIC & Anuras, Craftsman, EaseMyTrip & Suryoday,” he says.

Goldman Sachs analysis says new IPOs may add up to $400 Bn of market cap by 2024, making India the fifth largest market by capitalisation by 2024. The expected entry of new-age tech companies in the public markets is also exciting as these are the companies that young Indians have seen grow and flourish within their lifetimes.

Sidhavelayutham M adds that investment tech platforms have the potential to bring on-the-fence hesitant Indians to the retail investor fray as these platforms remove the entry barriers. Plus as fears of a volatile market and long-term recession act as headwinds, the education component is vital to retain new and experienced investors and create trust in the system.

Retail investor participation is often seen as an analog for the economic development of a country, and by enabling easy participation, platforms such as Alice Blue are accelerating India’s economy.

[ad_2]

Source link

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories7 months ago

Startup Stories7 months agoStartups That Caught Our Eyes In September 2023

-

Startup Stories7 months ago

Startup Stories7 months agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories6 months ago

Startup Stories6 months agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency2 months ago

Crptocurrency2 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

E-commerce7 months ago

E-commerce7 months agoTop Online Couponing Trends To Watch Out For In 2016

-

Startup Stories7 months ago

Startup Stories7 months agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories7 months ago

Startup Stories7 months agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing

-

Startup Stories7 months ago

Startup Stories7 months agoHow Shipyaari Has Given The Roar To Smaller D2C Brands With Its Logistics Tech Stack