Startup Stories

How Bumtum Is Making Quality Baby Care Accessible in India’s Tier II and III Regions

There is hardly any middle-income family in India that may not be familiar with the challenges that parenthood brings with it, especially when it comes to burning holes in the not-so-deep pockets of an average Indian household.

Well, if you think that education is the biggest expense that every Indian parent has to bravely endure, then consider speaking with the ones with newborns, infants or even toddlers. Ranging from expensive vaccines and baby food to high-priced nifty infant clothing and diapers, there is hardly any relief for parents.

While the challenges are galore, baby care brand Bumtum aims to give a much-needed respite to the pockets of Indian parents by offering economical and quality baby diapers. However, this Rome, too, was not built in a day.

Post his return from the UK, Mayank Beria, a business student, closely observed the Indian baby care market, only to discover the opportunities waiting to be untapped.

With a family background in manufacturing, it was natural for him to stay away from third-party manufacturers, as he planned to foray into the baby care segment.

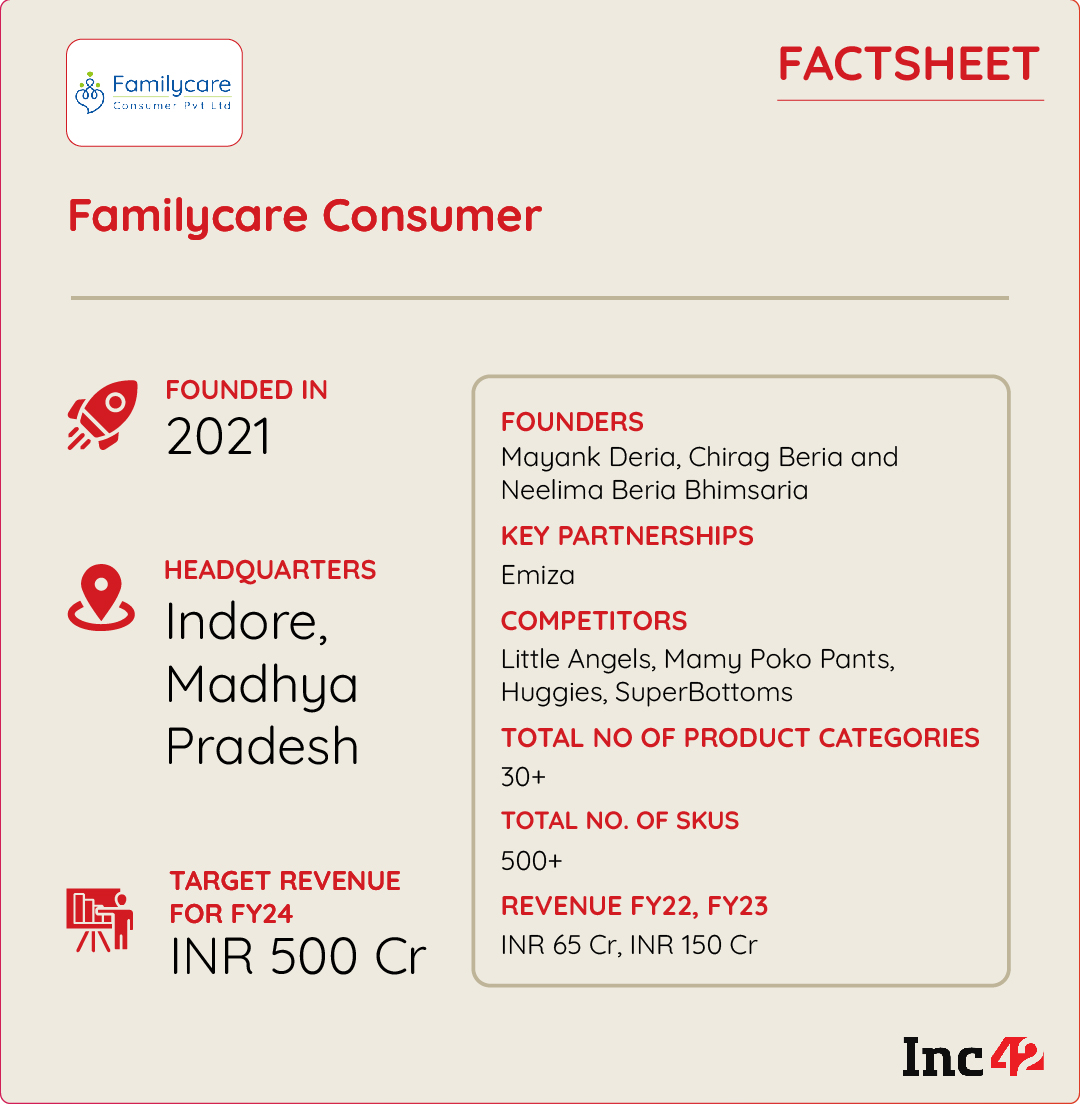

Finally, Beria joined forces with his siblings, Chirag Beria and Neelima Beria Bhimsaria to launch Bumtum. While Bumtum has been present in the market since 2017, it was officially launched in 2021.

However, later, the founders ventured into adult hygiene care with Elduro, feminine hygiene care with Freeme and preteen skin care with Amigo, all operating under their parent company, Familycare Consumer.

Initially, Bumtum products were manufactured and sold on the parent company’s website. However, to boost visibility, the founders later started selling the baby care products on Flipkart and Amazon.

Meanwhile, the baby care brand, Bumtum, strengthened its ties with retailers across Lucknow, Kanpur, Patna, Ranchi, Indore and Ahmedabad. The company claims to have sold its baby care products to 60K customers to date. Along with 500+ SKUs, Bumtum has baby products across 30 categories, including diapers, baby wipes, lotions, fleece coverings and more.

The founders claim that the parent company has generated a revenue of INR 150 Cr in FY23, up 150% YoY from INR 65 Cr in FY22. Beria has now set his eyes on garnering INR 500 Cr in revenue by the end of FY24, which would be a gigantic leap of 233% YoY.

To achieve the set target, Bumtum’s parent company, Familycare Consumer, partnered with 3PL player Emiza to deliver the Bumtum, Eduro, Freeme and Amigo range of products.

Standing Tall Against Established Brands

Bumtum emerged as a brand with the core purpose of simplifying the lives of parents, particularly in India, where the expense of baby care products is equal to spending on luxury. This is why Beria envisioned Bumtum primarily serving Tier II and III regions, where household incomes may not match those of Tier I counterparts.

However, a major challenge before its launch was that the market was dominated by bigger brands. Speaking with Inc42, Beria said that brands such as Mamy Poko Pants, Huggies and Pampers hold a market share of no less than 96%.

“To stand tall against these brands, we decided to launch Bumtum as a private label and started manufacturing and selling products under the brand name on marketplaces like Flipkart and Amazon. We took the brands offline, targetting smaller towns and positioning ourselves as ‘small town India’s favourite diaper brand’,” the founder said, looking back on his journey.

As the founders forged their journey, another challenge awaited. This time the founders were struck with the dilemma of creating with brand recall while competing with established players in smaller cities and towns.

After much deliberation, the founders decided to keep the communication simple. They even picked a cartoon character, Chota Bheem, to go on the packaging of baby diapers, solving the brand recall issue. Further, every marketing campaign they did was in Hinglish.

“For our Father’s Day campaign, we launched one of our digital ads in a Hinglish title, while the rest of the content was in Hindi. The campaign garnered 2 Mn views,” Beria said, adding that the brand recall strategies have worked wonders and the brand’s customer retention has grown by 50% since its launch.

Quality Meets Affordability

The founders of Bumtum were quick to identify that they could increase customer stickiness with just the right pricing strategy. According to Beria, the brand’s products are at least 25% cheaper than bigger brands. He, however, stressed that despite offering competitive pricing, they do not compromise on quality.

Interestingly, to ensure that all their products are of good quality, they have set up a manufacturing plant fully certified by International Organization Standardization, Sedex, Good Manufacturing Practice and Conformité Européenne (CE) in Pithampur, Indore. Moreover, the brand has a dedicated R&D team with its labs set up in the manufacturing unit.

Mayank revealed that the brand generates 65% of its revenue from marketplaces such as Amazon and Flipkart, while offline sales account for 35% of its total sales.

In terms of sharing revenue with ecommerce and logistics partners, it pays a commission to its partners. The cost for logistics partners is approximately 5-6% of their overall sales. Further, Mayank said that 90% of Bumtum’s revenue is generated from Tier II and III cities and towns, with the remaining 10% originating from Tier 1 users.

Banking Big On Third-Party Order Fulfilment

Bumtum understands the importance of adopting an omnichannel approach to cater to the essential needs of its customer base in Tier 2 and 3 regions. While it has a robust online presence, it acknowledges that offline presence is equally significant.

Bumtum recognises that this helps in building trust and confidence in the brand. It’s also worth noting that users in these regions may not be comfortable making online orders. By taking an omnichannel approach, Bumtum has ensured that it remains accessible to all its online and offline customers.

Meanwhile, to ensure that Bumtum has an efficient offline presence, it is focussed on strategic warehousing. For this, it partnered with Mumbai-based 3PL warehousing company Emiza, which provides tech-driven warehousing management with a network of over 22 fulfilment centres across Tier 2 regions such as Indore, Lucknow, Patna and more. These tech-enabled warehouses offer multi-tier shelving systems for easy order processing and a host of safety and security features.

Founded in 2015 by Ajay Rao and Jitendra Kumar, Emiza claimed that it works with 200 clients including Marico, Mamaearth, Clovia, The Souled Store and more.

The strategic partnership with Emiza helps the baby care product brand leverage the former’s

efficient SDD/NDD deliveries and cost-effective fulfilment specifically tailored for low-priced daily consumption items.

Emiza also serves Bumtum’s parent company Familycare Consumer and provides warehousing services for the brands Freeme, Amigo and Elduro.

When Familycare Consumer joined hands with Emiza in October 2022, it had a warehouse only in one location. Since then, the company has expanded its warehouses to 17 locations, with three more in the pipeline. Rao claimed that Emiza handles 80% of Familycare Consumer’s total volume.

Rao said that Familycare Consumer had three prerequisites for its fulfilment partner before onboarding them as a 3PL partner. Firstly, the partner needed to execute SDD/NDD deliveries, given the parent company focusses on selling daily consumption items like toiletries. Secondly, the fulfilment services provided by the 3PL partner had to be cost-effective, considering the relatively low average selling price of these products. Lastly, the selected partner should be experienced in delivering products across diverse categories. Rao said, “Emiza fit the bill,” indicating Emiza’s suitability for the role.

Emiza also manages fulfilment services for Familycare Consumer and ensures same and next-day deliveries. Ajay Rao, founder and CEO, Emiza said that until September 2022, Familycare Consumer’s delivery duration stretched to four to five days in remote areas. In the toiletries category, deliveries now reach customers within 24-48 hours.

What Does The Future Hold For Bumtum?

For decades now, people have been buying baby care products from legacy players like Huggies, Pampers and Mamy Poko Pants. This allowed white space for smaller brands like Super Bottoms and Bumtum to experiment with packaging and materials.

For instance, Super Bottoms uses organic cotton jersey fabric in its diapers, which is safer for toddlers, while Bumtum leverages a popular Indian cartoon character to establish its brand recall.

Not just this, Bumtum’s playbook to penetrate deeper into the nation with affordable yet quality products appears to be a great strategy to woo Indians in the long run. Given that the company saw a 150% YoY growth in its revenues, the founders’ projections to clock in INR 500 CR in revenues looks achievable. This is more because of the market in which they are operating.

According to a report, the baby care market is projected to reach $38.51 Bn by 2029, growing at a CAGR of 17.5%. This mirrors an immense opportunity for smaller baby care brands, which can leverage the white space created by bigger brands and continue experimenting with their products. Not to mention, technology will also play a key role in giving a much-needed boost to baby care product manufacturers going ahead. Given the tailwinds, brands like Bumtum seem poised to thrive and carve out a successful niche in the evolving market.

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency9 months ago

Crptocurrency9 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing