Startup Stories

How The Uber Challenger Snap-E Cabs Is Disrupting Kolkata’s Ride-Hailing Market

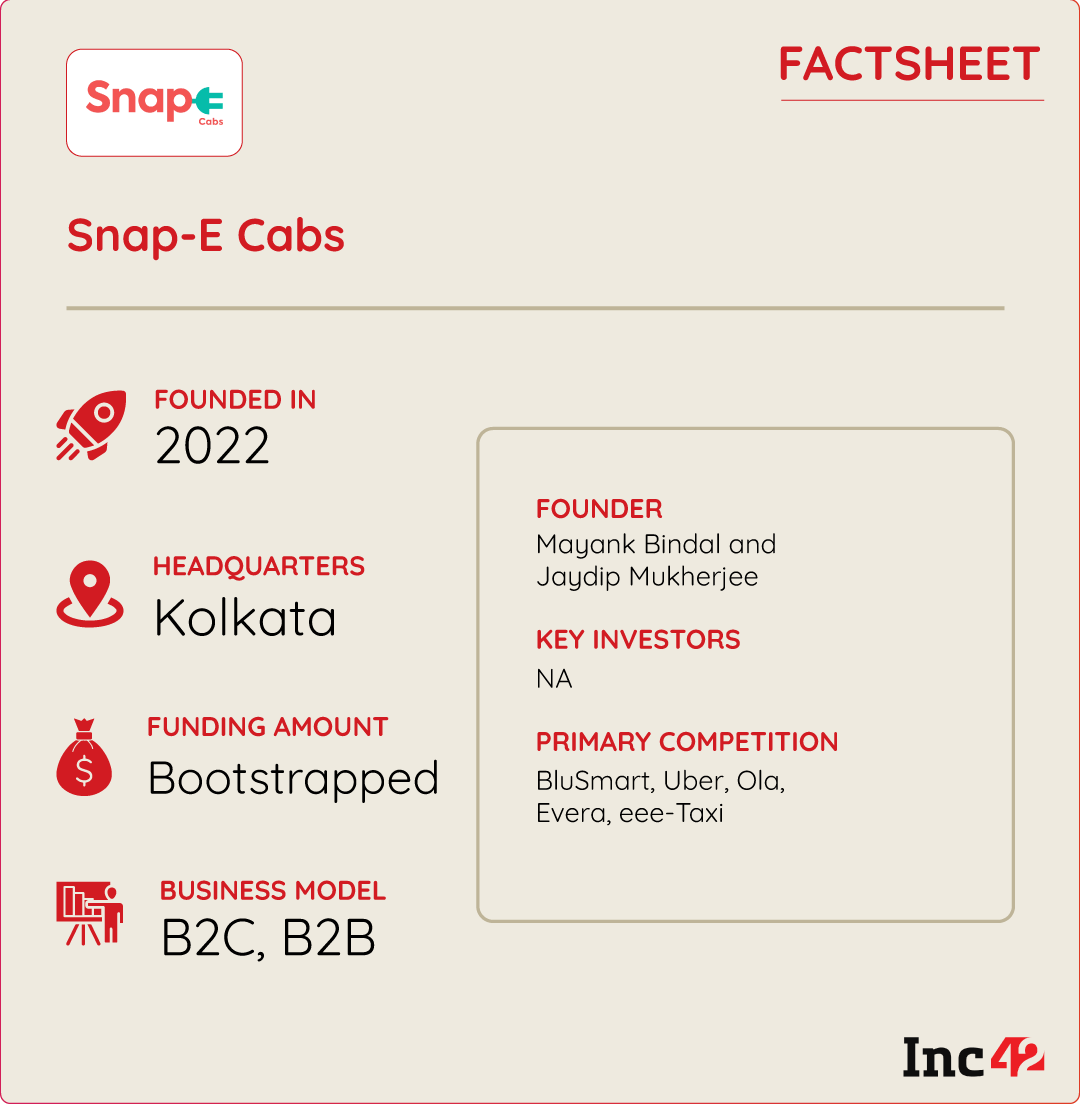

Incorporated in 2022, Snap-E offers several unique value propositions – from no-cancellation policies to no-surge fees – to passengers, who otherwise have to rely on the duopoly of Ola and Uber to move from point A to point B in the city.

Snap-E achieved a gross merchandise value (GMV) of INR 2.45 Cr in September alone. Over the past six months, the total GMV has amounted to INR 11 Cr.

The startup, which today has a fleet of 600 cars, is in talks with several VC firms and angel investors to raise funds

From horse wagons to iconic black and yellow Fiat Padmini cruising through the bustling streets of Indian metropolises, the evolution of taxis in India is rich and quite elaborate. It’s a journey that has also seen transformative changes, from the emergence of Ola and Uber to the current era of hassle-free electric vehicle cabs.

The history of taxis in India also tells us that the highly unorganised sector underwent a major transition 10 years ago when Uber entered the country in August 2013 and Android smartphones were baptising Indian telecom users at a break-neck speed.

Up until the entry of Uber in India, autorickshaws (three-wheelers), too, remained the dominating force for passenger intracity transit. However, by the time 2013 ended, a majority of Indians were seen ditching traditional taxis, only to shift to the new ones – Ola and Uber. This is because Indians could now book cabs with a single tap on their smartphone and get discounts and free rides while using these services.

On the other hand, a wave of new drivers entered this segment and joined Ola and Uber, lapping up handsome monthly earnings. Finally, the market was disrupted, dominated and captured by these new players, outpacing traditional taxis.

A decade later, history seems to be repeating itself, as a new race of taxi service providers has now started disrupting the ride-hailing market, freeing customers from inconveniences such as ride cancellations, surges, and subpar quality of services in many cases.

At the forefront of this seismic shift are Mayank Bindal and Jaydip Mukherjee, who want to address the existing pain points in urban transportation with their electric cab service, Snap-E Cabs.

Incorporated in 2022, the Kolkata-based startup offers several unique value propositions — from no-cancellation policies to no-surge fees — to passengers, who rely on the duopoly of Ola and Uber to move from point A to point B in the city.

Since its inception, the e-cabs provider has expanded its business significantly in Kolkata, with hardly any commitment to pipeline emissions.

With a push from the government to increase passenger and commercial EVs in the country, the sector is expected to witness unprecedented growth soon.

As per Vahan data, of the total 1.77 Lakh motor cabs registered till November 1 this year, more than 8K vehicles are electric. In 2022, the number stood at 1.14 Lakh versus 4.9K+ units.

Humble Beginnings Of The Bootstrapped Snap-E

When Snap-E initiated its operations in August 2022, the startup did not have an app and instead partnered with Uber to deploy its e-taxis on the streets of Kolkata.

Acquiring customers is one of the most challenging parts of app-based B2C businesses, cofounder and CEO Bindal told Inc42, reminiscing how the startup began its humble journey.

This very dilemma led Snap-E to opt for collaborating with Uber’s platform but with Snap-E’s branding on vehicles. This strategic decision helped the startup curtail the initial expenses associated with managing an app, customer relationships, and onboarding.

Much to everyone’s surprise, the startup witnessed a demand surge within two months of its operations. This also proved to be a huge learning curve for Bindal, who told Inc42 that they were able to disrupt the market and establish themselves just by streamlining the supply side of the sector.

“After seeing an unexpected demand surge, we realised that the real problem was in supply and not demand, following which we launched our app in October 2022, which received 30K downloads within weeks, giving us the window to emerge as a separate brand,” Bindal said.

The Snap-E app today has 4-5 Lakh downloads, and the startup receives close to 12K-15K ride requests daily in and around Kolkata.

“Unfortunately, with supply being a challenge, we are only able to do anywhere between 2,500-3,000 rides a day,” he added.

To resolve the demand side of the issue, the cofounder wants to take his current fleet of around 600 EVs to 1,000 by March next year.

An Uber challenger, Snap-E has procured about 160-170 cars from leasing firms like Mahindra and Muffin Green. For the remaining cars in its current fleet, the startup has taken bank loans.

According to Bindal, with about INR 20-22 Cr internal investment, Snap-E is bootstrapped so far.

Snap-E’s Always On Roads

In addition to its B2C taxi service model, Snap-E also operates a B2B business segment. The company has established partnerships with corporations such as TCS, Wipro, Cognizant, and several others to offer pick-and-drop services to their employees.

“Compared to cities like Delhi, Mumbai, and Bengaluru, Kolkata is still more of a day city and there is little traffic post 11 PM. That is predominantly the reason that we thought B2B was going to give us a steady stream of revenue with the maximum utilisation for our cars. And since the IT companies need cars for employee transportation, we decided to tie up with them,” Bindal said.

Snap-E effectively deploys all its vehicles during the day, with approximately 30-35% of them dedicated to providing employee pick-and-drop services during the nighttime hours.

Currently, around 75% of the company’s total revenue is derived from its B2C operations, while the remaining 25% originates from its B2B engagements.

In terms of its overall business performance, Snap-E achieved a gross merchandise value (GMV) of INR 2.45 Cr in September alone. Over the past six months, the total GMV has amounted to INR 11 Cr.

Snap-E follows a pricing structure that entails a flat fee of INR 150 for journeys up to 5 Km. Beyond this initial distance, the charge increases by INR 22.5 per km.

Building The Ecosystem

We cannot ignore the fact that building a robust charging infrastructure is the most important aspect when it comes to increasing the number of EVs and boosting the overall EV ecosystem.

Staying one step ahead in ensuring that its business runs seamlessly, Bindal said that Snap-E has established partnerships with various charge point operators (CPOs) such as Jio-bp, Tata Power, Chargezone, Evre, and others.

However, in the long run, the startup wants to do more than just depend on these CPOs. It wants to operate its own charging stations.

Snap-E has already signed an MoU with Kolkata Port Trust for building the charging stations, and the authority is ready to give them parcels of land on lease for 20-25 years.

Furthermore, the startup has commenced the process of entering into contracts with various potential parking aggregators to facilitate the operation of its vehicles in key locations, including airports and railway stations.

Meanwhile, Snap-E aims to deploy 2,000-3,000 more cars in Kolkata in the next 18-24 months. Moving forward, the startup aims to expand to other cities that have less access to ride-hailing platforms. Raipur in Chhattisgarh and Bhuvaneshwar in Odisha are the two Indian cities

Snap-E is currently planning to foray into, all while expanding its footprint in Kolkata.

Meanwhile, the startup is in talks with some VC firms and angel investors to raise funds. If the talks move through, Snap-E may announce the news in the next few months. The cofounder, however, has not disclosed the amount that he wishes to pick.

It’s worth noting Snap-E competes with players like BluSmart, Uber, Ola, and others, making significant strides in the EV ride-hailing space.

BluSmart, for instance, promotes customer-friendly features such as no surge fees and a no-cancellation policy, although its operations are currently limited to Bengaluru and Delhi-NCR.

Notable, Snap-E, too, is part of this rapidly evolving landscape and seems to be carving a niche for itself as one of the pioneering e-cab service providers.

However, going ahead, it will be fascinating to observe how the startup positions itself in the market in the years to come, especially when it comes to operating alongside established ride-hailing giants.

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency10 months ago

Crptocurrency10 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoWOW Skin Science’s Blueprint For Breaking Through In The $783 Bn BPC Segment

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016