[ad_1]

The Current State of the Altcoin Season Index

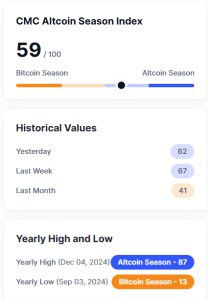

On December 18, 2024, the Altcoin Season Index registered a score of 59, down three points from the previous day. Tracked by CoinMarketCap (CMC), this index measures the market’s shift between Bitcoin and altcoins based on their relative performance over 90 days. With a score above 50, the market remains in Altcoin Season, a period when altcoins outperform Bitcoin in price gains.

This shift indicates a growing preference among investors for altcoins, which can offer higher volatility and potentially greater returns. But what does this drop in the index mean for traders and the broader crypto market?

Understanding the Altcoin Season Index

1. How the Index Works

The Altcoin Season Index evaluates the performance of the top 100 cryptocurrencies, excluding stablecoins and wrapped tokens, compared to Bitcoin over the past 90 days. The scoring system is simple:

- Above 75: Strong Altcoin Season, with most coins outperforming Bitcoin.

- Below 25: Bitcoin Season, with Bitcoin dominating altcoin performance.

The index serves as a barometer for market sentiment, guiding traders on whether to focus on Bitcoin or diversify into altcoins.

2. Altcoin vs. Bitcoin Performance

For the market to be in Altcoin Season, 75% or more of altcoins need to outperform Bitcoin. At 59, the index indicates a balanced but altcoin-leaning market, reflecting a competitive environment where altcoins are holding their ground.

What a Drop to 59 Signals

The three-point drop in the index suggests subtle shifts in market dynamics. While the score remains in Altcoin Season territory, the reduced margin hints at Bitcoin regaining some relative strength. Here’s what this means:

1. Increased Bitcoin Activity

The drop may signify rising interest in Bitcoin, possibly due to macroeconomic factors or significant news, such as regulatory developments or institutional adoption.

2. Consolidation Among Altcoins

Altcoin performance may be consolidating as traders take profits from recent rallies. This can lead to decreased momentum and reduced index scores.

3. Investor Sentiment

A slight decline in the index could reflect shifting sentiment, with investors cautiously returning to Bitcoin or waiting for clear market trends before making significant moves.

Why Altcoin Season Remains Strong

Despite the minor drop, the crypto market remains firmly in Altcoin Season. Here’s why altcoins continue to shine:

1. Diversification and Innovation

Altcoins often provide exposure to emerging blockchain technologies, from DeFi platforms to NFT ecosystems. This diversification attracts investors looking for the next big opportunity.

2. Higher Volatility

Altcoins tend to exhibit greater price swings, which can lead to substantial short-term gains. Traders capitalizing on these movements contribute to altcoin dominance.

3. Bitcoin Saturation

As Bitcoin matures, its price gains become less dramatic compared to smaller-cap altcoins. This dynamic encourages investors to explore altcoin projects with higher growth potential.

Top Performing Altcoins Driving the Index

While Bitcoin remains the market leader, several altcoins have outperformed it recently, contributing to the Altcoin Season Index score:

- Ethereum (ETH): With its strong presence in decentralized finance (DeFi) and upcoming updates, ETH continues to attract significant investment.

- Solana (SOL): Known for its scalability and low transaction costs, Solana has seen substantial adoption.

- Polygon (MATIC): Benefiting from Layer 2 scaling solutions, Polygon has gained traction among developers and users alike.

- Pepe (PEPE): A meme coin gaining popularity due to community-driven hype and speculation.

Risks and Opportunities During Altcoin Season

Opportunities

- High Returns: Altcoins often deliver exponential returns during this phase.

- Emerging Projects: It’s a great time to identify and invest in innovative blockchain projects.

Risks

- Volatility: While altcoins can generate massive gains, they are also prone to steep corrections.

- Market Sentiment Swings: A sudden shift toward Bitcoin or external factors like regulatory crackdowns can impact altcoin performance.

What to Watch for Moving Forward

1. Bitcoin’s Influence

A significant rally or increased dominance by Bitcoin could push the Altcoin Season Index lower. Watch for Bitcoin breaking key resistance levels or news of institutional inflows.

2. Regulatory Developments

Government policies toward cryptocurrencies, especially altcoins, could shape the market’s direction. Favorable regulations might strengthen Altcoin Season, while crackdowns could boost Bitcoin’s relative appeal.

3. Altcoin-Specific Innovations

Keep an eye on advancements within the altcoin ecosystem, such as new protocol upgrades, partnerships, or use cases that could drive further outperformance.

Conclusion: The Implications of a 59 Altcoin Season Index

The Altcoin Season Index’s drop to 59 reflects a nuanced market where altcoins still outperform Bitcoin but with reduced dominance. This balance provides opportunities for traders who diversify their portfolios, leveraging both Bitcoin’s stability and altcoins’ growth potential.

As the crypto market evolves, staying informed about trends like the Altcoin Season Index can help investors make smarter decisions. Whether you’re holding Bitcoin, trading altcoins, or exploring new blockchain projects, understanding these dynamics is crucial for navigating the ever-changing world of cryptocurrency.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

[ad_2]

Source link