Startup Stories

Pune-Based Startup Quintrans Wants To Bring Hyperloop To India

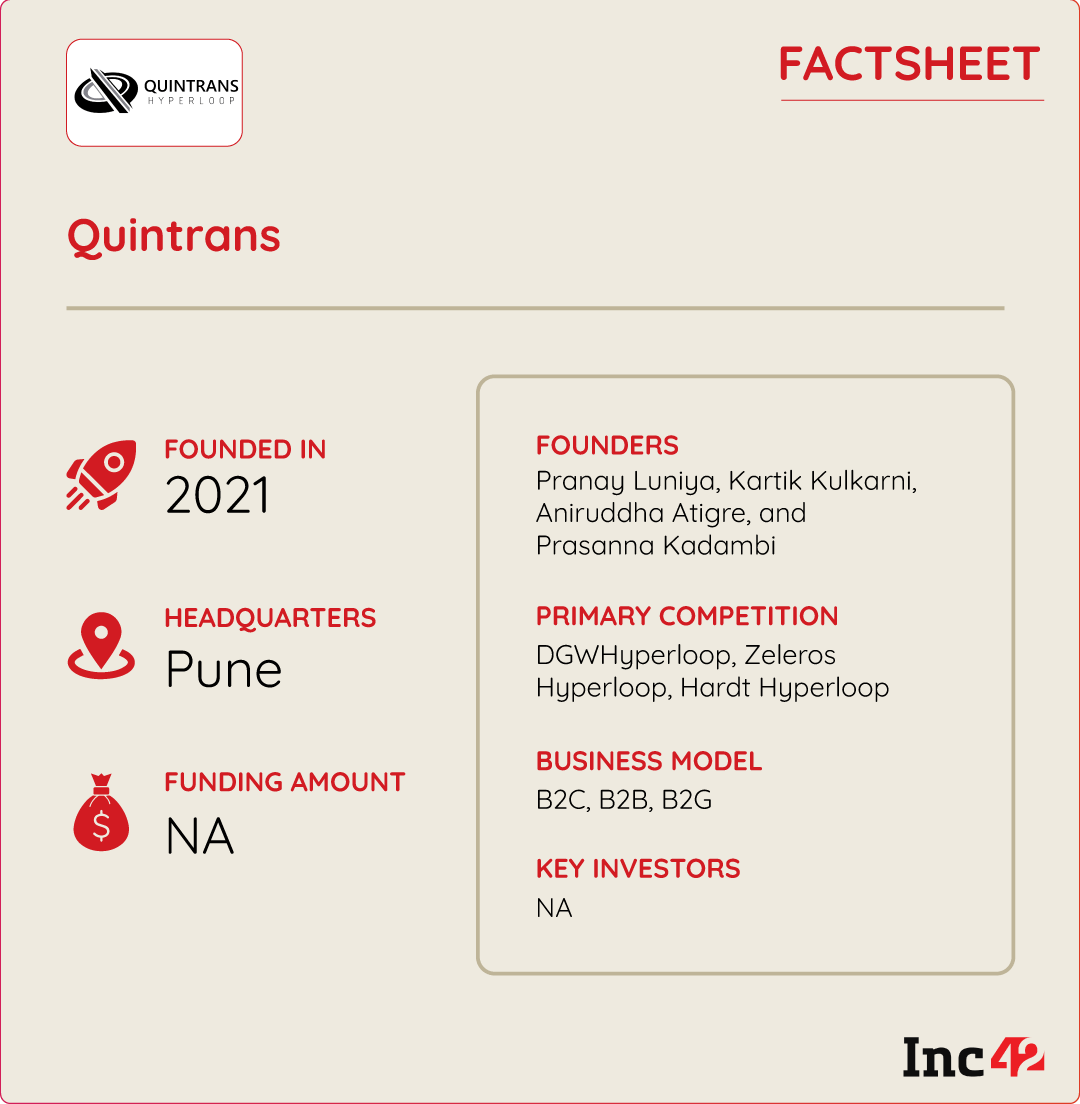

Founded in 2021 by Pranay Luniya, Kartik Kulkarni, Aniruddha Atigre, and Prasanna Kadambi, Quintrans is developing the country’s very own hyperloop technology, aiming to connect the Pune-Mumbai route

The startup has so far received around INR 80 Lakh-INR 85 Lakh as grant money while the agreement for another INR 60 Lakh-INR 80 Lakh government grant is under process

As per a research report, the global Hyperloop train market size is projected to achieve a market size of $57.5 Bn by 2032

From bullet trains to state-of-the-art maglev (magnetic levitation) systems, countries across the globe have long been obsessed with making their locomotives run at break-neck speeds, all while maintaining safety.

However, this fascination reached new heights in 2013 when Tesla CEO Elon Musk, in one of his research papers, introduced the concept of hyperloop.

This innovative technology envisions trains hurtling through low-pressure tubes at more than 1,200 km/h, paving the way for a new era of rapid transit. For context, the fastest train in the world is the Shanghai Transrapid Maglev Train in China, which is capable of reaching speeds of over 400 km/h.

Despite intriguing the interest of many nations across the globe, the technology, which today is being envisioned as the fifth mode of transportation, continues to be a distant dream even a decade later.

Meanwhile, something quite interesting is happening back home. Well, several entities, including state governments and private players, have been mulling the development and deployment of hyperloop technology in the country for a few years now. And at the forefront of this paradigm shift is a Pune-based startup, Quintrans.

Founded in 2021 by Pranay Luniya, Kartik Kulkarni, Aniruddha Atigre, and Prasanna Kadambi, Quintrans is developing the country’s very own hyperloop technology, aiming to connect the Pune-Mumbai route.

Notably, the startup is already in discussion with the Maharashtra government to deploy its tech on the route. The project, if sees the light of day, has the potential to reduce the 3-hour journey to just 30 minutes.

Amid this, the most interesting part of the Quintrans story is that it is working in a space that is yet to become fully tangible. Nevertheless, with several projects and research across the globe, the hyperloop technology is expected to soon cater to an increasing need for a faster and cheaper transportation system.

As per a research report, the global Hyperloop train market size is projected to achieve a market size of $57.5 Bn by 2032.

Quintrans: The Genesis

Before becoming a fully functional business, a startup if you will, Quintrans was initially a research unit, which the then engineering students of MIT Pune (now the cofounders of Quintrans) started in 2018.

Speaking with Inc42, the CEO of Quintrans, Luniya, said that the research unit got a startup makeover after the team realised the commercial viability of the project were working on.

Taking clues from Musk’s research, the cofounders developed their Hyperloop technology, which they showcased at several global competitions, including the SpaceX Hyperloop pod competition and European Hyperloop Week.

These competitions gave them a major push and they were able to attract the attention of companies like IBM India, Festo India, and Aeron Systems, which gave them financial backing.

Currently, Quintrans has reached a stage where it is developing a 30-metre full-scale pilot setup of its Hyperloop in Pune to showcase the technology and its potential to different authorities, including the Railway Ministry, NITI Aayog, the Maharashtra government, and others. The startup aims to develop the prototype by the end of 2024.

Quintrans has so far received around INR 80 Lakh-INR 85 Lakh as grant money. Luniya said that currently, an agreement for another INR 60 Lakh-INR 80 Lakh government grant is under process, which is expected to happen by December this year or January 2024.

Unlocking New Avenues In Cargo Movement

As per Luniya, the proposition for passenger hyperloops is going to take at least another decade. Hence, Quintrans is not limiting itself to only speeding up the Pune-Mumbai route railway movement with its technology.

The startup has already started exploring alternate ways of generating revenue from industries that require guided movement of vehicles for cargo, particularly in the logistics space.

The company is already in talks with a few port authorities in India where Quintrans’ technology can power the movement of shipping containers from ports to cargo hubs.

Besides, the startup is also in talks with some industrial corridors to help them fast-track the transportation of goods from one corridor to the other, built 30-40 km apart.

Quintrans has held discussions with the Maharashtra Industrial Development Corporation (MIDC) and the National Industrial Corridor Development Corporation (NICDC) for the same. It is also looking to collaborate with Bengaluru International Airport to help the authority in exploring ways to connect the airport with the centre of the city.

While most of these entities are interested in deploying the technology, they require a better understanding of Hyperloop, Luniyas said, adding that the startup’s 30-metre pilot track is a step in that direction.

Forging Ahead In The Hyperloop Frontier

While Quintrans aims to keep itself open to various other channels for generating revenue, its research to further develop the 30-metre track will continue. Also, the company is in talks with a few VCs to raise funds.

Establishing Hyperloops is cost-intensive, which has also been one of the barriers to deploying it at scale anywhere in the world.

Today, the 30-metre pilot set up by Quintrans in India costs around $1 Mn. “Going ahead, the per km cost of the hyperloop would be somewhere around INR 150 Cr,” Luniya said.

While regulatory challenges in the implementation and execution of Hyperloops, particularly due to safety concerns, also remain a major roadblock, Luniya believes that more tests carried out by tech players like Quintrans would help prove the merits of the technology.

In India, the startup competes with DGWHyperloop and research units like Avishkar Hyperloop. In the global market, some of the startups working on this tech include Europe’s Zeleros Hyperloop and Hardt Hyperloop.

While many, including Richard Branson’s Hyperloop One (Virgin Hyperloop), have failed to make the technology a reality even after millions of dollars of investment, it will be interesting to see how Quintrans pulls it off.

[Edited by Shishir Parasher]

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories12 months ago

Startup Stories12 months agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency8 months ago

Crptocurrency8 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016