Crptocurrency

CryptoQuant CEO: Trump’s Polymarket 61.3% Win Probability Likely Overstated

Trump’s Polymarket 61.3% Win Probability Likely Overstated

In a critical analysis of decentralized prediction markets, CryptoQuant CEO Ju Ki-young has expressed skepticism regarding Polymarket’s reported 61.3% probability of a Donald Trump victory in the upcoming U.S. presidential election. According to Ki-young, this figure may be overstated, highlighting the inherent limitations of prediction markets in accurately forecasting electoral outcomes.

Introduction to Polymarket’s Election Predictions

Overview of Polymarket

Polymarket is a decentralized prediction platform that allows users to bet on the outcomes of real-world events, including elections. Utilizing blockchain technology, Polymarket aggregates bets from participating users to generate probability metrics for various outcomes.

Polymarket’s Trump Win Probability

Polymarket recently reported a 61.3% probability of Donald Trump winning the presidential race. This figure has attracted significant attention, positioning Trump as the frontrunner in the eyes of the platform’s participants.

CryptoQuant CEO Ju Ki-young’s Critique

Overstated Probabilities

Ju Ki-young, CEO of CryptoQuant, has raised concerns that Polymarket’s 61.3% win probability for Trump may be overstated. He emphasizes that elections are ultimately decided by votes, not the size or volume of bets placed on prediction platforms.

Alternative Probability Metrics

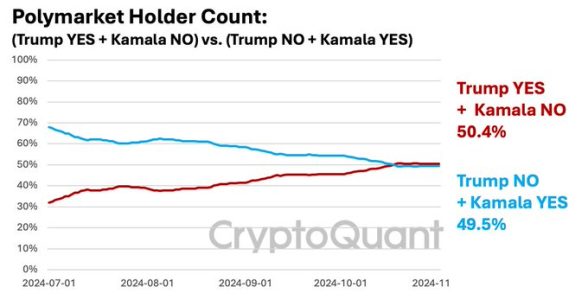

Based on participating addresses on Polymarket, Ki-young provides alternative probability estimates:

- Trump YES: 57.4%

- Trump NO: 50.4%

These figures suggest a closer race than Polymarket’s initial projection indicates.

Detailed Outcome Probabilities

Ki-young further breaks down the probabilities for specific electoral scenarios:

- Trump YES + Kamala Harris NO: 50.4%

- Trump NO + Kamala Harris YES: 49.5%

This near-even split underscores the uncertainty surrounding the election outcome.

Discrepancies Between Prediction Markets and Actual Elections

Understanding Prediction Markets

Prediction markets like Polymarket aggregate user bets to forecast event outcomes. However, they are influenced by factors such as:

- User Sentiment: Dominance of certain user groups with specific biases.

- Liquidity: Availability of funds to support bets, which can skew probabilities.

- Manipulation Risks: Potential for coordinated betting to influence outcomes.

Limitations Highlighted by Ki-young

Ki-young points out that prediction markets may not fully account for:

- Voter Turnout: Actual voting behavior can differ significantly from betting patterns.

- Swing States: Electoral outcomes often hinge on a few key states, which may not be adequately represented in prediction market data.

- External Factors: Campaign developments, debates, and unforeseen events can dramatically alter voter preferences.

Implications for the U.S. Presidential Election

Close Race Indicated by Alternative Metrics

The alternative probabilities provided by Ki-young suggest that the race between Trump and Vice President Kamala Harris is more competitive than initially portrayed by Polymarket. This could indicate a potentially close election, where small shifts in voter sentiment could determine the outcome.

Investor and Voter Behavior

The uncertainty reflected in these probabilities has implications for:

- Investors: May influence strategic decisions in financial markets based on perceived election outcomes.

- Voters: Reflects the need for voters to stay informed and engaged, as prediction markets may not provide a complete picture of electoral dynamics.

Expert Opinions

Dr. Emily Carter, Political Analyst

“Prediction markets offer valuable insights into public sentiment, but they are not infallible predictors of electoral outcomes. Factors such as voter mobilization and last-minute campaign strategies play a crucial role in determining the final result.”

Mark Thompson, Financial Strategist

“While decentralized platforms like Polymarket provide interesting data points, investors should exercise caution and consider multiple sources of information before making decisions based solely on prediction market probabilities.”

Sarah Lee, Cryptocurrency Researcher

“The critique by Ju Ki-young highlights the importance of understanding the underlying mechanics of prediction markets. Users should be aware of the limitations and potential biases inherent in these platforms when interpreting their predictions.”

Future Outlook

Enhancing Prediction Market Accuracy

To improve the reliability of prediction markets, several measures can be considered:

- Increased Transparency: Providing more detailed data on user demographics and betting patterns.

- Enhanced Security: Implementing safeguards to prevent manipulation and ensure fair participation.

- Integration with Traditional Data Sources: Combining prediction market data with polls and other traditional forecasting methods for a more comprehensive view.

Continued Role of Blockchain in Prediction Markets

Blockchain technology offers unique advantages for prediction markets, such as transparency and decentralization. As the technology evolves, it could enhance the accuracy and trustworthiness of platforms like Polymarket, provided that they address current limitations.

Voter Engagement and Information Dissemination

As the election approaches, it is crucial for voters to rely on a diverse array of information sources. Engaging with traditional polling, candidate platforms, and independent analyses can provide a more balanced perspective compared to prediction market data alone.

Conclusion

CryptoQuant CEO Ju Ki-young’s assessment that Polymarket’s 61.3% probability of Donald Trump’s election victory may be overstated serves as a critical reminder of the limitations inherent in prediction markets. While these platforms offer intriguing insights into public sentiment, they should be interpreted with caution and supplemented with broader analyses to gauge the true dynamics of electoral races.

As the U.S. presidential election draws near, the convergence of traditional polling, blockchain-based prediction markets, and real-time voter behavior will continue to shape the narrative. Investors, voters, and analysts alike must navigate these complex data sources to form informed opinions and make strategic decisions.

To stay updated on the latest developments in cryptocurrency prediction markets and their impact on political outcomes, explore our article on latest news, where we cover significant events and their influence on the digital asset ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

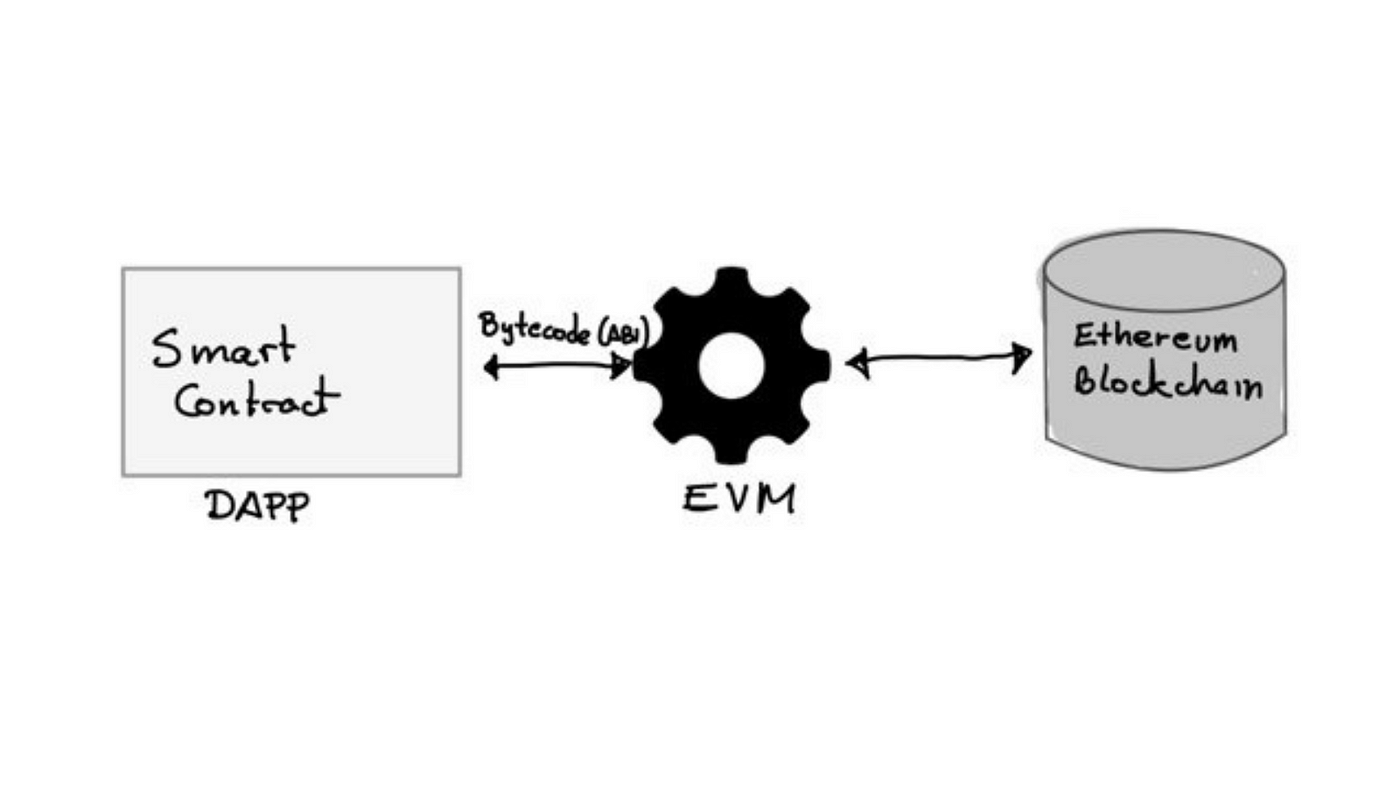

A Guide to The Ethereum Virtual Machine (EVM)

Crptocurrency

South Korea’s Financial Regulator to Strengthen Oversight on Trump-Related Stocks and Crypto Volatility

Crptocurrency

U.S. Spot Bitcoin ETFs Record Largest Single-Day Inflow of $1.37 Billion

U.S. Spot Bitcoin ETFs Record Largest Single-Day Inflow of $1.37 Billion

On November 7, 2024, U.S. spot Bitcoin exchange-traded funds (ETFs) witnessed their largest single-day net inflow, reaching a remarkable $1.37 billion. This record-breaking inflow underscores the growing interest from institutional and retail investors in Bitcoin as a mainstream investment asset. According to data from Trader T on X and Farside Investors, major financial firms such as BlackRock, Fidelity, Grayscale, and ARK Invest saw significant capital inflows into their Bitcoin ETFs, reflecting the increasing demand for Bitcoin-backed investment products.

Key ETF Inflows by Major Financial Institutions

The substantial inflow of funds into U.S. spot Bitcoin ETFs signals confidence in Bitcoin’s potential as a long-term asset class. Here’s a breakdown of the top ETFs and their respective inflows:

- BlackRock’s iShares Bitcoin Trust (IBIT): BlackRock led the surge with an astounding $1.11 billion inflow, marking the first time it surpassed the $1 billion mark in a single day. This historic inflow highlights BlackRock’s dominant position in the Bitcoin ETF market and the high level of trust investors place in its product.

- Fidelity’s Wise Origin Bitcoin Trust (FBTC): Fidelity secured the second-largest inflow of the day, with $190.9 million. Fidelity’s robust presence in the financial industry is enhancing investor confidence in Bitcoin as a viable investment vehicle.

- Grayscale’s Bitcoin Mini Trust: Grayscale recorded an inflow of $20.4 million into its Bitcoin Mini Trust, further solidifying its status as a key player in digital asset management.

- ARK Invest’s ARK 21Shares Bitcoin ETF (ARKB): ARK Invest attracted $17.6 million in capital for its Bitcoin ETF, underscoring the growing appeal of Cathie Wood’s investment products in the crypto sector.

- Bitwise’s Bitcoin ETF (BITB): Bitwise added $13.4 million to its Bitcoin ETF, emphasizing its relevance in the competitive Bitcoin investment market.

- Grayscale Bitcoin Trust (GBTC): Grayscale’s GBTC, one of the longest-standing Bitcoin investment products, saw an inflow of $7.3 million, maintaining its presence among popular Bitcoin-related assets.

- VanEck’s Bitcoin Trust (HODL): VanEck’s Bitcoin ETF rounded out the major inflows, adding $4.3 million.

No data was available for Invesco’s BTCO ETF as of this report, although the firm has been noted for its efforts in digital asset innovation.

The Significance of Record-High Inflows into U.S. Bitcoin ETFs

This unprecedented inflow of $1.37 billion into U.S. spot Bitcoin ETFs is a strong indicator of Bitcoin’s rising acceptance among institutional investors. Bitcoin ETFs have become an attractive option for those seeking regulated and transparent ways to invest in Bitcoin without directly purchasing the cryptocurrency. The inflows highlight Bitcoin’s growing reputation as a “digital gold” and hedge against economic volatility, appealing to both institutional and retail investors.

In particular, BlackRock’s $1.11 billion inflow signals a strong endorsement of Bitcoin as an institutional-grade asset. As the world’s largest asset manager, BlackRock’s focus on Bitcoin through its iShares Bitcoin Trust has set a precedent, encouraging other institutions to follow suit. This large-scale investment reflects increasing confidence in Bitcoin’s role in diversified portfolios, particularly as a hedge against inflation and traditional market fluctuations.

Why Institutional Interest in Bitcoin ETFs is Rising

Several factors have contributed to the increased interest in Bitcoin ETFs, particularly among institutions:

- Accessibility and Transparency: Bitcoin ETFs provide a regulated and transparent means for institutions and retail investors to gain exposure to Bitcoin without dealing with the complexities of digital wallets, private keys, and direct custody.

- Regulatory Approval: The approval of Bitcoin ETFs by U.S. financial regulators has bolstered investor confidence, as it offers a layer of security and compliance not found in direct cryptocurrency investments. This regulatory backing has opened doors for risk-averse investors who would otherwise shy away from digital assets.

- Market Demand for Diversification: With inflationary concerns and traditional market instability, investors are seeking alternative assets that offer long-term value preservation. Bitcoin’s limited supply and decentralized nature make it an appealing choice for those seeking a hedge against economic uncertainty.

- Mainstream Adoption: The involvement of prominent financial institutions like BlackRock and Fidelity signals a broader acceptance of Bitcoin within traditional finance. This acceptance encourages further adoption, as large-scale institutional investments pave the way for increased liquidity and stability in the Bitcoin market.

The Impact of Rising Bitcoin ETF Inflows on the Crypto Market

The record-breaking inflows into U.S. spot Bitcoin ETFs have significant implications for the cryptocurrency market as a whole. For one, the increased demand for Bitcoin-backed ETFs adds liquidity to the market, making it easier for investors to buy and sell Bitcoin with minimal impact on price. This added liquidity can help stabilize Bitcoin’s price, reducing its volatility over time and making it a more appealing asset for institutional investors.

The rise of Bitcoin ETFs also demonstrates the maturing infrastructure of the cryptocurrency market. With regulated investment products now readily available, more investors are comfortable allocating portions of their portfolios to Bitcoin. This evolution could lead to further innovations in digital asset investment products, including ETFs for other cryptocurrencies, futures, and hybrid products that combine various asset classes.

Moreover, the growing popularity of Bitcoin ETFs could shift the perception of Bitcoin from a speculative asset to a legitimate investment class within the broader financial industry. As more investors gain access to Bitcoin through these regulated products, Bitcoin’s status as “digital gold” could be further solidified, attracting more long-term holders and contributing to its price stability.

Future Outlook for U.S. Bitcoin ETFs and the Cryptocurrency Market

As U.S. spot Bitcoin ETFs gain momentum, experts predict continued growth in inflows as investors increasingly view Bitcoin as a viable asset. Institutions that were initially hesitant to invest in Bitcoin due to regulatory and custodial concerns now have a structured and compliant way to gain exposure. This development has not only widened the investor base for Bitcoin but also enhanced its appeal as a component of diversified portfolios.

Looking ahead, analysts anticipate that the success of Bitcoin ETFs could inspire similar products for other cryptocurrencies, broadening the investment landscape. With Bitcoin ETFs already proving successful, it’s plausible that products like Ethereum ETFs or multi-crypto ETFs could be on the horizon, catering to investors seeking diversified exposure within the digital asset space.

As the cryptocurrency market continues to evolve, the role of Bitcoin ETFs will likely expand, bridging the gap between traditional finance and digital assets. The record-breaking inflows into Bitcoin ETFs signal a strong demand for regulated Bitcoin investment options and reflect Bitcoin’s enduring appeal as a hedge against traditional financial risks.

Conclusion

The $1.37 billion single-day inflow into U.S. spot Bitcoin ETFs on November 7, 2024, marks a significant milestone for the cryptocurrency industry. Led by BlackRock’s $1.11 billion inflow, this surge in capital highlights the growing acceptance of Bitcoin as a legitimate asset class among institutional and retail investors. The involvement of major financial players like BlackRock, Fidelity, and Grayscale underscores the strong institutional demand for Bitcoin, with ETFs providing a secure and accessible way for investors to engage with the crypto market.

This record-breaking inflow signifies Bitcoin’s rising status within the financial landscape, potentially setting the stage for further innovation in digital asset investment products. As Bitcoin ETFs continue to attract large-scale investments, they are helping to stabilize the market and build a more mature ecosystem, ultimately solidifying Bitcoin’s role as a mainstream financial asset.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on the latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency8 months ago

Crptocurrency8 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016