Crptocurrency

South Korean Lawmaker Proposes Real-Name Requirement for Crypto Transactions

In a significant move towards tightening cryptocurrency regulations, South Korean lawmaker Min Byoung-dug has proposed legislation mandating the use of real names in virtual asset transactions, according to Yonhap Infomax. This proposed amendment to the Virtual Asset User Protection Act aims to enhance transparency and protect Korean investors from potential financial harm by ensuring that all crypto transactions are conducted under verified identities.

Introduction to the Real-Name Requirement Proposal

Overview of the Proposed Legislation

Lawmaker Min Byoung-dug has introduced a bill that seeks to enforce a real-name system for all cryptocurrency transactions within South Korea. Under this amendment, individuals engaging in crypto trading will be required to verify their identities using official documentation. Failure to comply with these regulations could result in severe penalties, including five-year prison terms or fines of up to 50 million won ($36,000).

Rationale Behind the Proposal

Min emphasized that the introduction of a real-name system is a fundamental measure to safeguard Korean investors. He expressed concerns over market disruptions allegedly caused by foreign nationals of Korean descent, who have reportedly amassed substantial profits through cryptocurrency trading. Min highlighted instances where these individuals have mockingly thanked Korea on social media platforms, suggesting that their unregulated trading activities pose risks to the stability and integrity of the local crypto market.

Background on the Virtual Asset User Protection Act

Purpose and Objectives

The Virtual Asset User Protection Act (VAUPA), enacted in July 2024, serves as South Korea’s comprehensive regulatory framework for virtual assets. The act aims to protect investors, prevent money laundering, and ensure the integrity of the cryptocurrency market. It imposes strict Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols on cryptocurrency exchanges and service providers operating within the country.

Existing Regulations and Compliance Measures

Prior to this proposal, VAUPA already mandated various compliance measures, including mandatory KYC processes for users and stringent reporting requirements for exchanges. However, the introduction of a real-name requirement seeks to further enhance these measures by ensuring that all crypto transactions are transparently linked to verified identities, thereby reducing the potential for fraudulent activities and market manipulation.

Details of the Real-Name Requirement

Implementation and Enforcement

The proposed real-name system will require cryptocurrency exchanges to verify the identities of their users before allowing any transactions. This involves collecting and validating official identification documents, such as passports or national ID cards, to ensure that each account is tied to a real individual. Exchanges will be obligated to maintain detailed records of user information and report suspicious activities to regulatory authorities.

Penalties for Non-Compliance

To enforce the real-name requirement, the legislation outlines stringent penalties for non-compliance. Individuals found violating the regulations could face imprisonment for up to five years or fines reaching 50 million won ($36,000). These penalties are designed to deter fraudulent activities and ensure that cryptocurrency transactions are conducted within a secure and regulated environment.

Lawmaker Min Byoung-dug’s Concerns

Market Disruptions by Foreign Nationals

Min has raised alarms about market disruptions believed to be orchestrated by foreign nationals of Korean descent. He contends that these individuals have leveraged unregulated trading practices to generate significant profits, which not only distort the market but also pose risks to the broader financial ecosystem in South Korea.

Impact on Domestic Investors

Min underscores that the absence of a real-name requirement leaves domestic investors vulnerable to financial harm. By ensuring that all transactions are linked to verified identities, the legislation aims to enhance investor protection, reduce fraud, and promote market stability.

Implications for Cryptocurrency Users and the Market

Enhanced Transparency and Security

The introduction of a real-name system is expected to increase transparency within the cryptocurrency market. Users will benefit from a more secure trading environment, as the verification of identities will make it harder for malicious actors to engage in market manipulation or fraudulent activities.

Potential Impact on Market Liquidity

While the real-name requirement aims to protect investors, it may also have implications for market liquidity. Some users might find the additional verification steps cumbersome, potentially leading to a temporary decline in trading volumes. However, in the long run, enhanced security measures are likely to boost investor confidence and contribute to a more stable and robust market.

Competitive Landscape

South Korea’s proactive stance in regulating cryptocurrency could influence the global regulatory landscape. Other countries may look to South Korea’s example when formulating their own crypto regulations, leading to a more harmonized and secure global crypto market.

Expert Opinions

Dr. Emily Carter, Blockchain Analyst

“The proposal to enforce a real-name system in cryptocurrency transactions is a significant step towards enhancing market integrity and investor protection. While it may introduce some initial friction for users, the long-term benefits of a more transparent and secure trading environment outweigh the short-term challenges.”

Mark Thompson, Financial Strategist

“Regulatory measures like South Korea’s proposed real-name requirement are essential for mitigating risks associated with unregulated crypto trading. By ensuring that all transactions are tied to verified identities, regulators can better prevent fraud and market manipulation, fostering a healthier investment climate.”

Sarah Lee, Cryptocurrency Researcher

“The real-name system could serve as a model for other nations looking to regulate their cryptocurrency markets effectively. While there may be concerns about privacy and accessibility, the overarching goal of protecting investors and maintaining market stability is paramount.”

Future Outlook

Legislative Process and Approval

The proposed amendment to the VAUPA is currently under parliamentary review. The legislative process will involve debates and potential amendments before the bill is either passed into law or rejected. Stakeholders from the cryptocurrency industry are likely to engage in discussions to advocate for balanced regulations that protect investors without stifling innovation.

Technological Solutions for Compliance

To facilitate compliance, cryptocurrency exchanges may adopt advanced verification technologies, such as biometric authentication and blockchain-based identity verification systems. These technologies can streamline the verification process, making it easier for users to comply with the new regulations while maintaining a seamless trading experience.

Long-Term Impact on South Korea’s Crypto Ecosystem

If enacted, the real-name requirement is poised to transform South Korea’s cryptocurrency ecosystem by fostering a more secure and transparent market. Enhanced regulations can attract institutional investors seeking a regulated environment, thereby driving further adoption and growth within the crypto industry.

Alignment with EU’s MiCA Framework

With the upcoming Markets in Crypto-assets (MiCA) framework set to take effect in December, South Korea’s regulatory measures will need to align with broader EU standards to ensure global regulatory harmony. This alignment will facilitate cross-border compliance and encourage international collaboration in regulating digital assets.

Conclusion

South Korean lawmaker Min Byoung-dug‘s proposal to implement a real-name requirement for cryptocurrency transactions marks a pivotal moment in the country’s regulatory approach to digital assets. By amending the Virtual Asset User Protection Act, the legislation aims to enhance transparency, protect investors, and prevent fraudulent activities within the cryptocurrency market. While the proposal faces opposition from some lawmakers concerned about its potential impact on market dynamics, the overarching goal of safeguarding Korean investors and ensuring market integrity remains a priority.

As South Korea continues to refine its cryptocurrency regulations, the introduction of a real-name system could set a precedent for other nations striving to balance innovation with regulatory oversight. The success of this initiative will depend on effective implementation, industry collaboration, and the ability to address concerns related to user privacy and market accessibility.

To stay updated on the latest developments in cryptocurrency regulations and market trends, explore our article on latest news, where we cover significant events and their impact on the digital asset ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

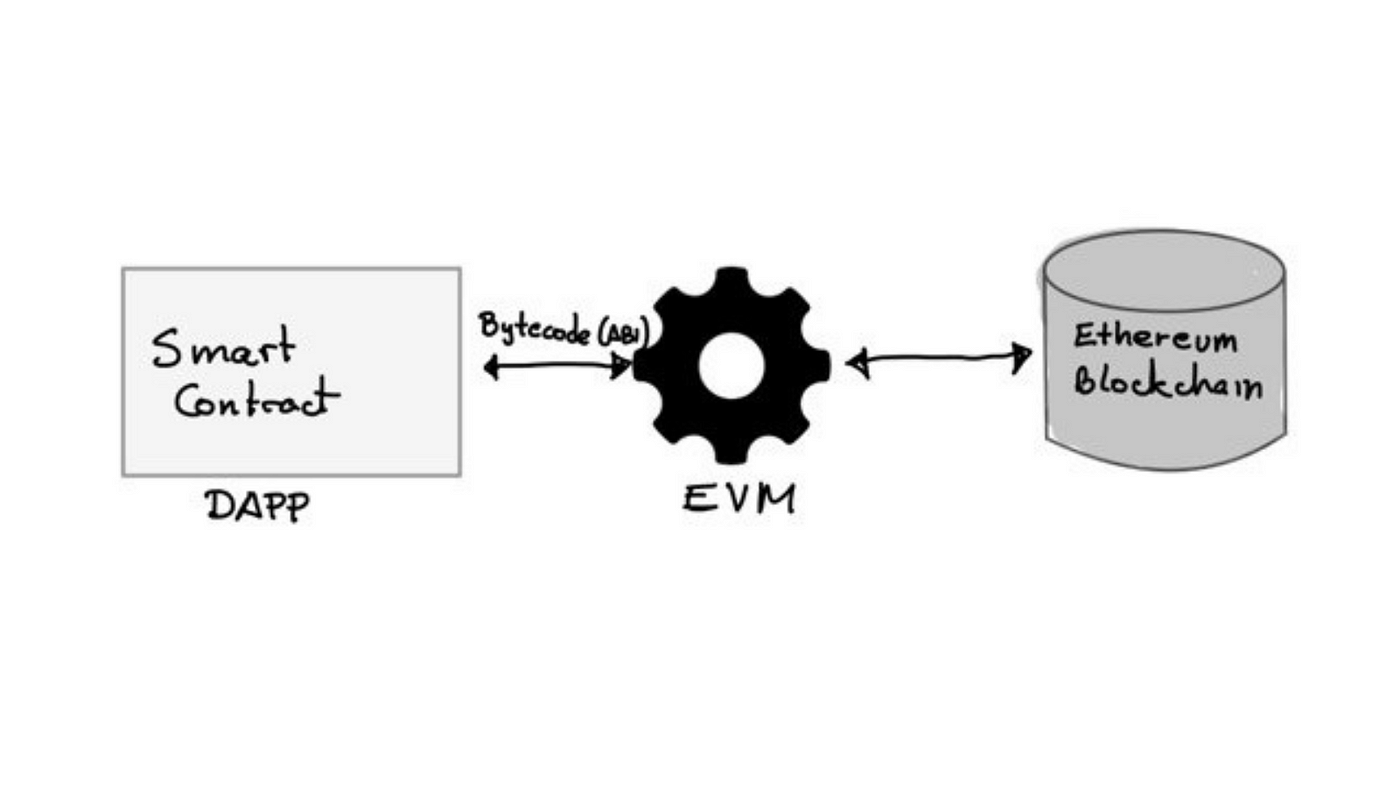

A Guide to The Ethereum Virtual Machine (EVM)

Crptocurrency

South Korea’s Financial Regulator to Strengthen Oversight on Trump-Related Stocks and Crypto Volatility

Crptocurrency

U.S. Spot Bitcoin ETFs Record Largest Single-Day Inflow of $1.37 Billion

U.S. Spot Bitcoin ETFs Record Largest Single-Day Inflow of $1.37 Billion

On November 7, 2024, U.S. spot Bitcoin exchange-traded funds (ETFs) witnessed their largest single-day net inflow, reaching a remarkable $1.37 billion. This record-breaking inflow underscores the growing interest from institutional and retail investors in Bitcoin as a mainstream investment asset. According to data from Trader T on X and Farside Investors, major financial firms such as BlackRock, Fidelity, Grayscale, and ARK Invest saw significant capital inflows into their Bitcoin ETFs, reflecting the increasing demand for Bitcoin-backed investment products.

Key ETF Inflows by Major Financial Institutions

The substantial inflow of funds into U.S. spot Bitcoin ETFs signals confidence in Bitcoin’s potential as a long-term asset class. Here’s a breakdown of the top ETFs and their respective inflows:

- BlackRock’s iShares Bitcoin Trust (IBIT): BlackRock led the surge with an astounding $1.11 billion inflow, marking the first time it surpassed the $1 billion mark in a single day. This historic inflow highlights BlackRock’s dominant position in the Bitcoin ETF market and the high level of trust investors place in its product.

- Fidelity’s Wise Origin Bitcoin Trust (FBTC): Fidelity secured the second-largest inflow of the day, with $190.9 million. Fidelity’s robust presence in the financial industry is enhancing investor confidence in Bitcoin as a viable investment vehicle.

- Grayscale’s Bitcoin Mini Trust: Grayscale recorded an inflow of $20.4 million into its Bitcoin Mini Trust, further solidifying its status as a key player in digital asset management.

- ARK Invest’s ARK 21Shares Bitcoin ETF (ARKB): ARK Invest attracted $17.6 million in capital for its Bitcoin ETF, underscoring the growing appeal of Cathie Wood’s investment products in the crypto sector.

- Bitwise’s Bitcoin ETF (BITB): Bitwise added $13.4 million to its Bitcoin ETF, emphasizing its relevance in the competitive Bitcoin investment market.

- Grayscale Bitcoin Trust (GBTC): Grayscale’s GBTC, one of the longest-standing Bitcoin investment products, saw an inflow of $7.3 million, maintaining its presence among popular Bitcoin-related assets.

- VanEck’s Bitcoin Trust (HODL): VanEck’s Bitcoin ETF rounded out the major inflows, adding $4.3 million.

No data was available for Invesco’s BTCO ETF as of this report, although the firm has been noted for its efforts in digital asset innovation.

The Significance of Record-High Inflows into U.S. Bitcoin ETFs

This unprecedented inflow of $1.37 billion into U.S. spot Bitcoin ETFs is a strong indicator of Bitcoin’s rising acceptance among institutional investors. Bitcoin ETFs have become an attractive option for those seeking regulated and transparent ways to invest in Bitcoin without directly purchasing the cryptocurrency. The inflows highlight Bitcoin’s growing reputation as a “digital gold” and hedge against economic volatility, appealing to both institutional and retail investors.

In particular, BlackRock’s $1.11 billion inflow signals a strong endorsement of Bitcoin as an institutional-grade asset. As the world’s largest asset manager, BlackRock’s focus on Bitcoin through its iShares Bitcoin Trust has set a precedent, encouraging other institutions to follow suit. This large-scale investment reflects increasing confidence in Bitcoin’s role in diversified portfolios, particularly as a hedge against inflation and traditional market fluctuations.

Why Institutional Interest in Bitcoin ETFs is Rising

Several factors have contributed to the increased interest in Bitcoin ETFs, particularly among institutions:

- Accessibility and Transparency: Bitcoin ETFs provide a regulated and transparent means for institutions and retail investors to gain exposure to Bitcoin without dealing with the complexities of digital wallets, private keys, and direct custody.

- Regulatory Approval: The approval of Bitcoin ETFs by U.S. financial regulators has bolstered investor confidence, as it offers a layer of security and compliance not found in direct cryptocurrency investments. This regulatory backing has opened doors for risk-averse investors who would otherwise shy away from digital assets.

- Market Demand for Diversification: With inflationary concerns and traditional market instability, investors are seeking alternative assets that offer long-term value preservation. Bitcoin’s limited supply and decentralized nature make it an appealing choice for those seeking a hedge against economic uncertainty.

- Mainstream Adoption: The involvement of prominent financial institutions like BlackRock and Fidelity signals a broader acceptance of Bitcoin within traditional finance. This acceptance encourages further adoption, as large-scale institutional investments pave the way for increased liquidity and stability in the Bitcoin market.

The Impact of Rising Bitcoin ETF Inflows on the Crypto Market

The record-breaking inflows into U.S. spot Bitcoin ETFs have significant implications for the cryptocurrency market as a whole. For one, the increased demand for Bitcoin-backed ETFs adds liquidity to the market, making it easier for investors to buy and sell Bitcoin with minimal impact on price. This added liquidity can help stabilize Bitcoin’s price, reducing its volatility over time and making it a more appealing asset for institutional investors.

The rise of Bitcoin ETFs also demonstrates the maturing infrastructure of the cryptocurrency market. With regulated investment products now readily available, more investors are comfortable allocating portions of their portfolios to Bitcoin. This evolution could lead to further innovations in digital asset investment products, including ETFs for other cryptocurrencies, futures, and hybrid products that combine various asset classes.

Moreover, the growing popularity of Bitcoin ETFs could shift the perception of Bitcoin from a speculative asset to a legitimate investment class within the broader financial industry. As more investors gain access to Bitcoin through these regulated products, Bitcoin’s status as “digital gold” could be further solidified, attracting more long-term holders and contributing to its price stability.

Future Outlook for U.S. Bitcoin ETFs and the Cryptocurrency Market

As U.S. spot Bitcoin ETFs gain momentum, experts predict continued growth in inflows as investors increasingly view Bitcoin as a viable asset. Institutions that were initially hesitant to invest in Bitcoin due to regulatory and custodial concerns now have a structured and compliant way to gain exposure. This development has not only widened the investor base for Bitcoin but also enhanced its appeal as a component of diversified portfolios.

Looking ahead, analysts anticipate that the success of Bitcoin ETFs could inspire similar products for other cryptocurrencies, broadening the investment landscape. With Bitcoin ETFs already proving successful, it’s plausible that products like Ethereum ETFs or multi-crypto ETFs could be on the horizon, catering to investors seeking diversified exposure within the digital asset space.

As the cryptocurrency market continues to evolve, the role of Bitcoin ETFs will likely expand, bridging the gap between traditional finance and digital assets. The record-breaking inflows into Bitcoin ETFs signal a strong demand for regulated Bitcoin investment options and reflect Bitcoin’s enduring appeal as a hedge against traditional financial risks.

Conclusion

The $1.37 billion single-day inflow into U.S. spot Bitcoin ETFs on November 7, 2024, marks a significant milestone for the cryptocurrency industry. Led by BlackRock’s $1.11 billion inflow, this surge in capital highlights the growing acceptance of Bitcoin as a legitimate asset class among institutional and retail investors. The involvement of major financial players like BlackRock, Fidelity, and Grayscale underscores the strong institutional demand for Bitcoin, with ETFs providing a secure and accessible way for investors to engage with the crypto market.

This record-breaking inflow signifies Bitcoin’s rising status within the financial landscape, potentially setting the stage for further innovation in digital asset investment products. As Bitcoin ETFs continue to attract large-scale investments, they are helping to stabilize the market and build a more mature ecosystem, ultimately solidifying Bitcoin’s role as a mainstream financial asset.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on the latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency8 months ago

Crptocurrency8 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016