Crptocurrency

Solana DEX Weekly Volume Reaches 168% of Ethereum’s Mainnet

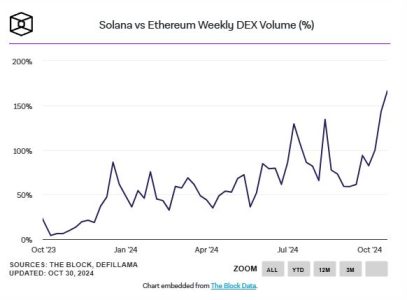

In a remarkable display of growth within the decentralized finance (DeFi) sector, Solana’s decentralized exchange (DEX) has achieved a weekly trading volume that is 168% of Ethereum’s mainnet volume, as reported by The Block. This substantial increase marks a significant leap from the 48.85% share observed at the beginning of the year. The surge is primarily attributed to the rapid market share expansion of Raydium (RAY), a leading automated market maker (AMM) on the Solana network.

Introduction to Solana’s DEX Performance

Overview of Solana and Its Ecosystem

Solana is renowned for its high-performance blockchain, capable of handling thousands of transactions per second with low latency and minimal fees. This scalability makes Solana an attractive platform for decentralized applications (dApps) and DeFi projects seeking efficiency and speed. The Solana ecosystem has grown rapidly, encompassing a wide range of projects, including DEXs, lending platforms, and NFT marketplaces.

Solana DEX vs. Ethereum Mainnet

While Ethereum remains the dominant platform for DeFi applications, Solana’s DEX performance showcases its potential to compete effectively in the DeFi space. Achieving 168% of Ethereum’s mainnet volume within a single week highlights Solana’s increasing adoption and the shifting dynamics of decentralized trading.

Factors Driving Solana DEX’s Significant Growth

Raydium’s Market Share Expansion

A pivotal factor behind Solana DEX’s impressive volume surge is the rapid increase in Raydium (RAY)‘s market share. In October, Raydium captured 18.4% of the DEX market, a substantial rise from 7.6% in January. This growth can be attributed to several strategic initiatives:

- Enhanced Liquidity Pools: Raydium has consistently expanded and optimized its liquidity pools, attracting more traders and liquidity providers.

- Innovative Features: Introduction of new trading pairs, yield farming opportunities, and integration with other Solana-based projects have boosted user engagement.

- User Experience Improvements: Continuous upgrades to the platform’s interface and performance have made trading more seamless and attractive to users.

Increased Adoption of Solana-Based DeFi Projects

Beyond Raydium, the broader adoption of Solana-based DeFi projects has contributed to the overall increase in DEX volume. Projects offering lending, borrowing, and yield optimization have attracted significant investment, enhancing the liquidity and trading activity on Solana’s DEXs.

Competitive Advantage of Solana’s Technology

Solana’s technological edge, characterized by its high throughput and low transaction costs, provides a competitive advantage over Ethereum, especially during periods of high network congestion and elevated gas fees on Ethereum. This advantage has made Solana an attractive alternative for traders seeking efficient and cost-effective trading solutions.

Implications for the DeFi and Cryptocurrency Markets

Shifting Market Dynamics

Solana DEX’s outperformance relative to Ethereum’s mainnet signals a potential shift in market dynamics within the DeFi ecosystem. As Solana continues to attract more users and projects, it could challenge Ethereum’s dominance, leading to a more diversified and competitive DeFi landscape.

Enhanced Liquidity and Market Stability

The increase in trading volume and liquidity on Solana DEXs contributes to greater market stability. Higher liquidity reduces price slippage and enhances the overall trading experience, making decentralized exchanges more viable for large-scale transactions.

Attraction of Institutional Investors

Solana’s robust performance and growing DeFi ecosystem may attract institutional investors looking for scalable and efficient blockchain solutions. Institutional interest can further bolster Solana’s market position and drive sustained growth in the DeFi sector.

Expert Opinions

Dr. Emily Carter, Blockchain Analyst

“The surge in Solana DEX volume, driven by Raydium’s market share expansion, underscores Solana’s potential to rival Ethereum in the DeFi space. Solana’s technological capabilities provide a strong foundation for sustained growth and innovation within decentralized exchanges.”

Mark Thompson, Financial Strategist

“Solana’s impressive performance relative to Ethereum highlights the evolving nature of the DeFi market. As more projects leverage Solana’s high-performance network, we can expect increased competition and further advancements in decentralized trading solutions.”

Sarah Lee, Cryptocurrency Researcher

“The rapid growth of Raydium and Solana’s DEX volume demonstrates the importance of scalability and user experience in driving DeFi adoption. Solana is well-positioned to capitalize on these factors, potentially reshaping the DeFi ecosystem in the coming years.”

Future Outlook

Continued Growth of Solana DEXs

With the current trajectory, Solana DEXs are poised for continued growth. Ongoing improvements in technology, strategic partnerships, and the launch of new DeFi projects will likely sustain and enhance trading volumes.

Expansion of DeFi Offerings

Solana’s DeFi ecosystem is expected to expand, with more projects introducing innovative financial products and services. This expansion will attract a broader user base, increasing demand for decentralized trading and lending platforms.

Regulatory Developments

As DeFi platforms like Solana’s DEXs grow, they may attract increased regulatory attention. Navigating these regulatory landscapes will be crucial for sustaining growth and ensuring compliance within the evolving legal frameworks governing decentralized finance.

Potential Collaboration with Ethereum

While Solana competes with Ethereum, there is also potential for collaboration and interoperability between the two ecosystems. Cross-chain solutions and partnerships could enhance the functionality and reach of both platforms, benefiting the broader cryptocurrency market.

Conclusion

The Solana DEX’s achievement of reaching 168% of Ethereum’s mainnet weekly volume is a testament to Solana’s growing influence and the effectiveness of its DeFi initiatives, particularly the rapid market share expansion of Raydium (RAY). This milestone not only highlights Solana’s competitive edge in the DeFi space but also signals a potential shift in the dynamics of decentralized trading.

As Solana continues to enhance its DeFi ecosystem through technological advancements and strategic partnerships, its DEX platforms are well-positioned to attract more users and liquidity, fostering a more robust and competitive DeFi market. The ongoing success of Solana DEXs underscores the importance of scalability, liquidity, and user experience in driving the adoption and growth of decentralized financial systems.

To stay updated on the latest developments in decentralized exchanges and blockchain innovations, explore our article on latest news, where we cover significant events and their impact on the digital asset ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

ADA Leads Crypto Gains as Bitcoin Eyes Path to $100K: Market Update and Analysis

Crptocurrency

Bitcoin’s Leverage Ratio Hits Two-Year High, Indicating Possible Correction Ahead

Crptocurrency

Bitcoin Mining Production Rises 13% in October, Reaching 3,630 BTC

Bitcoin Mining Production Rises 13% in October, Reaching 3,630 BTC

In October, Bitcoin mining production surged by 13%, with major listed mining companies producing a combined total of 3,630 BTC. This increase, reported by Farside Investors on X (formerly Twitter), highlights a robust month for the mining industry as it ramps up production amid favorable market conditions. According to the data, all major miners experienced production gains, except TeraWulf (WULF), which saw no increase.

This article will examine the key drivers behind the October rise in Bitcoin mining production, discuss the challenges and opportunities miners face, and explore what this increased output means for the broader cryptocurrency market.

October Bitcoin Mining Production: An Overview

The 13% increase in Bitcoin mining production marks a substantial uptick in output, reflecting miners’ response to rising market demand and improving profitability. October’s 3,630 BTC production by major miners is notable in the context of recent months, which saw lower production levels due to fluctuations in network difficulty and the impact of energy costs.

Key Highlights from October’s Bitcoin Mining Report

- Production Increase: Bitcoin mining production by major miners rose by 13% month-over-month, indicating a productive month for the industry.

- Total Output: A combined total of 3,630 BTC was mined by top listed companies, with all but one, TeraWulf, posting gains.

- Market Implications: The increase in production suggests strong confidence among miners in Bitcoin’s long-term prospects and may signal a response to anticipated market demand.

Factors Behind the Surge in Bitcoin Mining Production

Several factors contributed to the rise in Bitcoin mining production in October, including changes in network difficulty, energy efficiency improvements, and favorable market conditions.

1. Adjustments in Bitcoin Network Difficulty

Bitcoin’s mining difficulty is a metric that adjusts approximately every two weeks to ensure block production remains steady at an average of one block every 10 minutes. This adjustment is based on the total computational power, or “hashrate,” that miners contribute to the network. October’s difficulty level allowed miners to increase production slightly, reflecting stable competition and optimal network conditions.

2. Advances in Energy Efficiency and Hardware

In the face of rising energy costs, many mining companies have been upgrading to more efficient mining hardware. These upgrades reduce operational costs, allowing miners to increase production while maintaining profitability. High-performance mining rigs like the Antminer S19 XP and Whatsminer M50 have been instrumental in enhancing mining efficiency, allowing for more BTC production with less power consumption.

3. Favorable Market Conditions

October’s market conditions supported a favorable environment for Bitcoin mining. With BTC prices stabilizing and regulatory uncertainty beginning to ease, miners were able to operate with greater confidence, maximizing output without significant risk of loss.

Which Bitcoin Mining Companies Posted the Highest Gains?

The October increase in Bitcoin mining production reflects gains across multiple companies, though TeraWulf (WULF) was the one exception, reporting no increase. Here are some of the notable players:

- Marathon Digital Holdings (MARA): Marathon, one of the largest publicly traded Bitcoin mining companies, achieved impressive gains, contributing significantly to the 3,630 BTC total.

- Riot Platforms (RIOT): Riot saw a strong production month as it optimized mining operations and improved energy efficiency.

- Hut 8 Mining (HUT): Hut 8 recorded gains as it focused on increasing capacity, benefiting from upgraded mining equipment.

These leading mining companies have demonstrated resilience and adaptability, leveraging technological advancements and favorable conditions to enhance their production.

The Impact of Rising Bitcoin Mining Production on the Market

Bitcoin’s increased mining production could have several implications for the cryptocurrency market. From a supply perspective, higher production levels may contribute to increased liquidity in the market. Additionally, the surge in output reflects strong confidence among miners, which may support positive market sentiment.

1. Increased Liquidity in the Market

Higher Bitcoin mining production means more BTC entering circulation. This additional supply can enhance market liquidity, making it easier for investors to buy or sell BTC. Greater liquidity can reduce price volatility, benefiting traders and investors.

2. Positive Sentiment Among Miners and Investors

The increase in mining output reflects the confidence that miners have in Bitcoin’s value proposition. This optimism may encourage other investors to enter the market, supporting Bitcoin’s price and adoption. Historically, miner sentiment has often correlated with broader market trends, as miners are among the most committed stakeholders in the ecosystem.

3. Potential Price Pressure

While increased production adds liquidity, it can also create selling pressure if miners liquidate a substantial portion of their holdings. If Bitcoin’s price doesn’t rise in line with the increased supply, there could be downward pressure on the market. However, given the stable market conditions in October, this risk appears minimal for now.

Challenges Faced by Bitcoin Miners Amid Production Gains

Despite the production gains, Bitcoin miners face several challenges, including rising energy costs, regulatory uncertainties, and the upcoming Bitcoin halving event.

Rising Energy Costs

The energy-intensive nature of Bitcoin mining makes it highly susceptible to fluctuations in energy prices. As energy costs continue to rise globally, miners may struggle to maintain profitability. Many mining companies are now exploring renewable energy sources or partnering with energy providers to reduce costs.

Regulatory Uncertainty

In the United States and Europe, regulatory uncertainty surrounding Bitcoin mining remains a key concern. Policies regarding energy consumption, environmental impact, and financial oversight are still developing, and new regulations could impact the operations of mining companies.

The Upcoming Bitcoin Halving

The next Bitcoin halving event, expected in April 2024, will reduce the block reward from 6.25 BTC to 3.125 BTC. This event will effectively cut mining revenue by half, making it more challenging for miners to maintain profitability. Many companies are already preparing for this halving by upgrading hardware and expanding operations to offset the impact.

The Outlook for Bitcoin Mining Production

With October’s increase in Bitcoin mining production, the industry seems well-positioned to meet market demand, but several factors will influence future production levels:

- Technological Advancements: Continued advancements in mining hardware and energy efficiency will likely allow for increased production while minimizing costs.

- Renewable Energy Integration: As miners seek to cut costs and reduce environmental impact, the adoption of renewable energy sources is expected to grow. This transition could improve profitability and sustainability, supporting long-term production gains.

- Market Dynamics Post-Halving: The 2024 halving event will significantly affect production dynamics. Miners may consolidate operations or seek efficiency gains to counter the reduced block rewards.

Conclusion: A Promising Yet Challenging Path Ahead for Bitcoin Miners

Bitcoin mining production’s 13% rise in October reflects the industry’s adaptability and resilience. Major mining companies have capitalized on favorable conditions to increase output, showing confidence in the long-term value of Bitcoin. While increased production supports market liquidity and miner sentiment, challenges such as rising energy costs, regulatory uncertainty, and the impending halving event remain.

As Bitcoin’s price stabilizes and institutional interest grows, the industry is poised for further development. However, miners must continue to adapt to evolving conditions, particularly with the 2024 halving approaching. For investors, October’s production increase offers a glimpse into the mining industry’s current strength and future potential.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency8 months ago

Crptocurrency8 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing