Crptocurrency

Binance Launches “Binance Wealth” for High-Net-Worth Clients and Wealth Managers

In a strategic expansion of its services, Binance Exchange has unveiled “Binance Wealth,” a specialized platform tailored for high-net-worth clients and wealth managers. Reported by The Daily Hodl, this initiative aims to streamline cryptocurrency access for wealth managers and bridge the divide between digital and traditional financial systems. Catherine Chen, Head of Binance VIP & Institutional, emphasized that Binance Wealth is designed to cater to the unique needs of affluent investors, providing them with comprehensive tools and resources to manage and grow their crypto portfolios effectively.

Introduction to Binance Wealth

Who is Binance?

Binance is one of the world’s leading cryptocurrency exchanges, renowned for its extensive range of digital assets, advanced trading features, and commitment to security and regulatory compliance. Established in 2017, Binance has rapidly grown to become a central hub for crypto enthusiasts, traders, and institutional investors alike.

Overview of Binance Wealth

Binance Wealth is Binance’s latest offering, specifically developed to serve high-net-worth individuals (HNWIs) and wealth managers. This platform is designed to provide a seamless and secure environment for managing large-scale cryptocurrency investments, offering personalized services and sophisticated financial tools that cater to the sophisticated needs of affluent clients.

Features of Binance Wealth

Personalized Investment Solutions

Binance Wealth offers tailored investment strategies that align with the financial goals and risk profiles of high-net-worth clients. Wealth managers can leverage advanced analytics and portfolio management tools to create diversified crypto portfolios that optimize returns while mitigating risks.

Enhanced Security Measures

Understanding the heightened security concerns of wealthy investors, Binance Wealth incorporates enhanced security protocols, including multi-signature wallets, advanced encryption, and dedicated security teams. These measures ensure that clients’ assets are protected against unauthorized access and potential cyber threats.

Comprehensive Reporting and Analytics

The platform provides detailed reporting and real-time analytics, enabling wealth managers to monitor portfolio performance, track market trends, and make informed investment decisions. Customized dashboards offer insights into asset allocation, performance metrics, and risk assessments, facilitating effective portfolio management.

Exclusive Access to New Opportunities

Binance Wealth grants high-net-worth clients and their wealth managers exclusive access to new investment opportunities, such as early-stage token offerings, private placements, and innovative DeFi projects. This privileged access allows clients to capitalize on emerging trends and high-potential assets within the cryptocurrency market.

Goals of Binance Wealth

Easing Crypto Access for Wealth Managers

Catherine Chen, Head of Binance VIP & Institutional, highlighted that Binance Wealth aims to simplify the process for wealth managers to integrate cryptocurrency into their clients’ portfolios. By providing specialized tools and dedicated support, Binance Wealth reduces the complexity associated with crypto investments, making it easier for wealth managers to offer crypto services to their clients.

Bridging the Gap Between Digital and Traditional Finance

Binance Wealth seeks to create a seamless connection between the digital and traditional financial worlds. By offering services that cater to both realms, the platform enables wealth managers to incorporate cryptocurrency into traditional investment strategies, fostering a more integrated and diversified financial ecosystem.

Implications for the Cryptocurrency and Financial Markets

Increased Institutional Adoption

The launch of Binance Wealth is expected to drive increased adoption of cryptocurrencies among institutional investors and high-net-worth individuals. By addressing the specific needs of these segments, Binance Wealth can attract significant capital flows into the crypto market, enhancing liquidity and market stability.

Enhanced Credibility and Trust

Binance’s introduction of a dedicated wealth management platform reinforces its position as a trusted and credible player in the cryptocurrency industry. This move can bolster investor confidence, particularly among those who may have been hesitant to engage with crypto assets due to perceived risks and complexities.

Market Expansion and Innovation

Binance Wealth’s focus on high-net-worth clients and wealth managers paves the way for further innovation in crypto financial services. The platform’s advanced features and personalized solutions can inspire other exchanges and financial institutions to develop similar offerings, driving competition and enhancing the overall quality of services available in the market.

Expert Opinions

Dr. Emily Carter, Blockchain Analyst

“Binance Wealth represents a significant advancement in the integration of cryptocurrency into mainstream finance. By catering specifically to high-net-worth clients and wealth managers, Binance is addressing a crucial segment that can drive substantial growth and stability within the crypto ecosystem.”

Mark Thompson, Financial Strategist

“The launch of Binance Wealth is a strategic move that aligns well with the increasing interest of affluent investors in digital assets. Providing tailored investment solutions and enhanced security measures is essential for gaining the trust and participation of high-net-worth individuals in the cryptocurrency market.”

Sarah Lee, Cryptocurrency Researcher

“Binance Wealth bridges the gap between traditional finance and the burgeoning world of digital assets. This platform not only simplifies crypto access for wealth managers but also opens up new avenues for diversified and sophisticated investment strategies, contributing to the maturation of the cryptocurrency industry.”

Future Outlook

Expansion of Services

Following the successful launch of Binance Wealth, Binance is likely to expand its range of services to include more personalized financial products, such as crypto-based derivatives, insurance, and estate planning tools. These additions will further enhance the platform’s value proposition for high-net-worth clients and their wealth managers.

Strengthening Strategic Partnerships

Binance may seek to form strategic partnerships with leading financial institutions, blockchain projects, and regulatory bodies to enhance the capabilities and reach of Binance Wealth. These collaborations can provide clients with access to a broader array of investment opportunities and ensure compliance with evolving regulatory standards.

Driving Global Adoption

Binance Wealth has the potential to drive global adoption of cryptocurrencies by providing a robust and secure platform for managing substantial digital asset portfolios. As the platform gains traction, it can attract clients from diverse geographical regions, contributing to the global integration of cryptocurrency into traditional financial systems.

Innovation in Wealth Management

The development of Binance Wealth is likely to spur further innovation in the wealth management sector, particularly in the integration of blockchain technology and digital assets. Wealth managers will have access to cutting-edge tools and resources, enabling them to offer more sophisticated and diversified investment options to their clients.

Conclusion

Binance’s launch of “Binance Wealth” marks a pivotal moment in the convergence of cryptocurrency and traditional wealth management. By providing a dedicated platform for high-net-worth clients and wealth managers, Binance is facilitating the seamless integration of digital assets into sophisticated investment portfolios. This initiative not only enhances crypto access for wealth managers but also bridges the gap between digital and traditional finance, fostering a more inclusive and diversified financial ecosystem.

As Binance Wealth continues to evolve, it is poised to play a crucial role in driving institutional adoption, enhancing market credibility, and spurring innovation within the cryptocurrency industry. Investors, wealth managers, and financial strategists should closely monitor the developments of Binance Wealth, as it sets new standards for the intersection of traditional finance and digital assets.

To stay updated on the latest developments in cryptocurrency wealth management and blockchain innovations, explore our article on latest news, where we cover significant events and their impact on the digital asset ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

Altcoin Season Index Rises to 34, Indicating Continued Bitcoin Dominance

What the Altcoin Season Index Tells Us About Market Trends

The Altcoin Season Index is a helpful tool for investors, analysts, and crypto enthusiasts seeking to understand the balance of power between Bitcoin and altcoins in the market. By excluding stablecoins and wrapped tokens, the index provides a focused view of the performance of traditional altcoins, offering insights into market sentiment and capital flow.

During “Bitcoin Season,” investors tend to favor Bitcoin over other assets, resulting in increased Bitcoin dominance. Conversely, “Altcoin Season” is characterized by a shift in investor sentiment toward alternative cryptocurrencies, with at least 75% of the top 100 coins outperforming Bitcoin. Historically, Altcoin Season often follows periods of significant Bitcoin price growth, as investors begin to seek opportunities for higher returns in smaller, often more volatile, altcoins.

The current score of 34 indicates that while some altcoins are performing well, Bitcoin remains the most sought-after asset. This trend suggests that market participants are still cautious about diversifying heavily into altcoins, likely due to Bitcoin’s perceived stability and appeal as a store of value.

Understanding Bitcoin Season vs. Altcoin Season

Bitcoin Season and Altcoin Season reflect investor preferences within the cryptocurrency market, influenced by various economic, regulatory, and market conditions. Here’s how each season typically unfolds:

- Bitcoin Season: This occurs when Bitcoin outperforms most altcoins. Investors turn to Bitcoin for its stability, liquidity, and security. This often happens during periods of macroeconomic uncertainty or when Bitcoin itself is experiencing strong upward momentum. During Bitcoin Season, the Altcoin Season Index typically registers lower scores, reflecting a market skewed towards Bitcoin dominance.

- Altcoin Season: Defined by a higher Altcoin Season Index score (above 75), Altcoin Season occurs when most top altcoins outperform Bitcoin. Altcoin Season tends to attract investors looking for high-risk, high-reward opportunities, as altcoins often exhibit more volatility and potential for rapid gains. Historically, Altcoin Seasons have been fueled by periods of exuberance in the market, where speculation and interest in new, innovative projects reach peak levels.

With the index score currently at 34, the market is clearly in Bitcoin Season, as Bitcoin has outperformed the majority of altcoins over the past three months. This shift toward Bitcoin may be influenced by recent macroeconomic developments, regulatory changes, and evolving market sentiment.

Factors Contributing to Bitcoin’s Current Dominance

Several factors may be contributing to Bitcoin’s strong performance relative to altcoins, maintaining the market in Bitcoin Season:

- Macroeconomic Stability: In times of economic uncertainty, Bitcoin is often viewed as a more stable asset within the crypto space. As a decentralized and limited-supply asset, Bitcoin has earned a reputation as a hedge against inflation and economic instability. This appeal may drive investors toward Bitcoin rather than altcoins, which are generally considered riskier.

- Institutional Adoption: Bitcoin’s established position and institutional acceptance have bolstered its credibility. Major financial institutions and corporations have shown interest in Bitcoin, viewing it as a long-term investment. This growing institutional involvement provides stability to Bitcoin’s market and attracts investors who might otherwise avoid cryptocurrencies altogether.

- Regulatory Clarity: Bitcoin has faced fewer regulatory uncertainties than some altcoins, making it a safer option for risk-averse investors. While many altcoins are still under scrutiny by regulators, Bitcoin’s status as a decentralized digital asset has generally been accepted, giving it an advantage in terms of regulatory clarity.

- Market Sentiment and Safety: When investor sentiment shifts towards caution, there is often a “flight to safety” in the cryptocurrency market. This flight typically benefits Bitcoin, as it is perceived as a safer asset compared to more speculative altcoins. During periods of uncertainty, investors may choose to hold Bitcoin over other cryptocurrencies due to its perceived resilience and stability.

The Road Ahead: Could Altcoin Season Return?

Despite Bitcoin’s current dominance, Altcoin Season could still make a return, particularly if market conditions shift in favor of altcoins. Historically, Altcoin Season has followed periods of sustained Bitcoin growth, as investors seek alternative opportunities for high returns. Several conditions could facilitate the emergence of Altcoin Season, including:

- New Project Launches and Innovations: The launch of innovative altcoins with real-world use cases could drive investor interest toward altcoins, especially in sectors like decentralized finance (DeFi), gaming, and artificial intelligence. If these projects gain traction, they could outperform Bitcoin and push the market closer to Altcoin Season.

- Lower Bitcoin Volatility: If Bitcoin’s price stabilizes following a period of rapid growth, investors might look to altcoins for higher returns. Lower volatility in Bitcoin could lead to an increased appetite for risk among investors, driving capital into altcoins.

- Increased Market Liquidity: Higher liquidity in the crypto market, potentially driven by institutional participation, could make it easier for altcoins to experience sustained price growth. As liquidity increases, altcoins might benefit from the influx of capital and improved trading conditions.

- Positive Regulatory Developments for Altcoins: Should regulators adopt clearer guidelines or positive policies for altcoins, investor confidence could increase, creating favorable conditions for an Altcoin Season.

While Bitcoin currently dominates the market, the cyclical nature of the cryptocurrency space means that an Altcoin Season could still be on the horizon, especially if conditions align to favor alternative digital assets.

Conclusion

The Altcoin Season Index’s rise to 34 reflects a market that remains in Bitcoin Season, with Bitcoin outperforming most top altcoins over the past 90 days. This trend highlights investor preference for Bitcoin amid macroeconomic stability concerns, regulatory clarity, and market sentiment that favors the perceived safety of the leading cryptocurrency.

As market conditions evolve, an eventual shift to Altcoin Season could occur, especially if innovative projects and favorable regulatory changes attract capital toward altcoins. For now, however, Bitcoin remains at the center of attention, solidifying its role as the market leader in the cryptocurrency space.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on the latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Crptocurrency

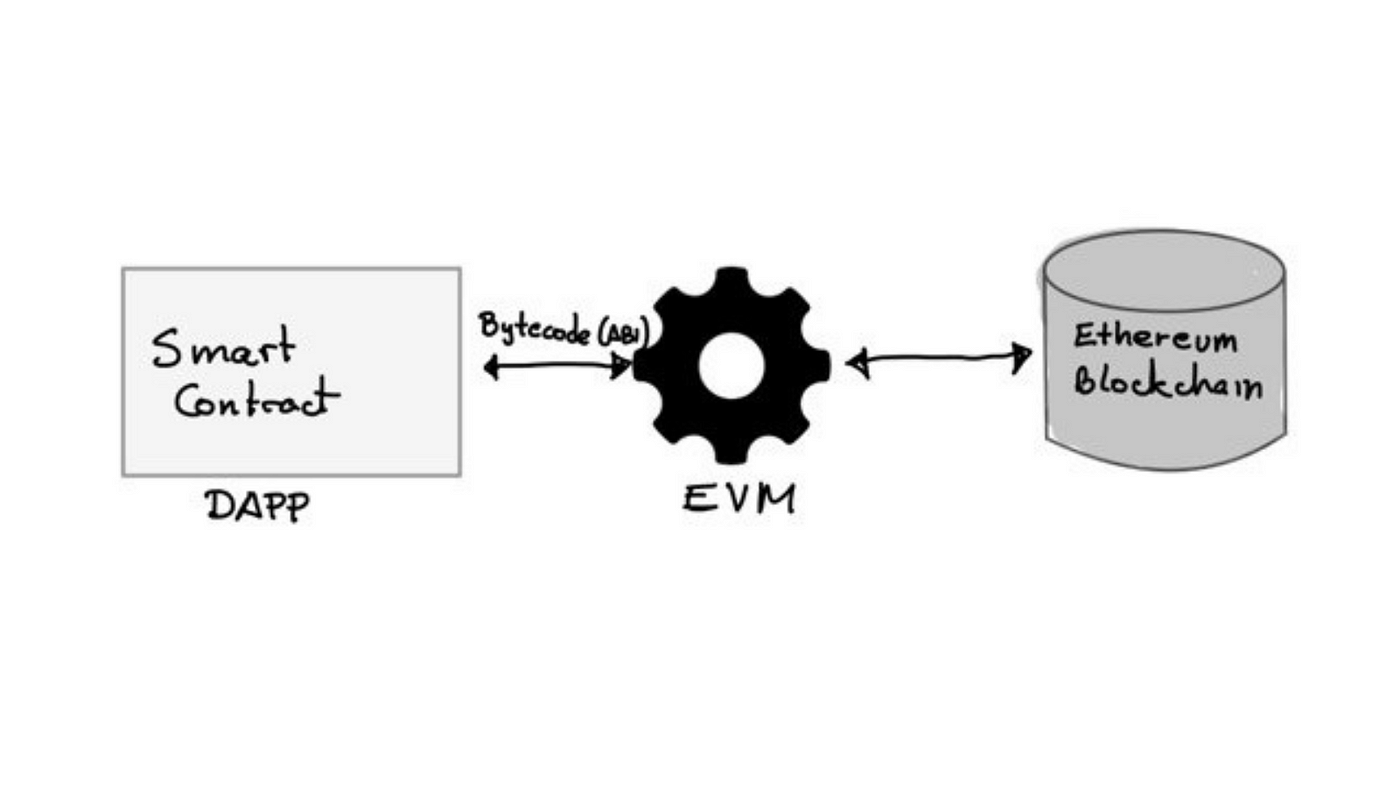

A Guide to The Ethereum Virtual Machine (EVM)

Crptocurrency

South Korea’s Financial Regulator to Strengthen Oversight on Trump-Related Stocks and Crypto Volatility

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency8 months ago

Crptocurrency8 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016