Crptocurrency

Bitcoin’s Dominance Hits Three-and-a-Half-Year High of 58.77%, Analyst Predicts Further Gains

Bitcoin’s dominance in the cryptocurrency market surged to 58.77% on October 15, marking its highest level since April 2021, according to Cointelegraph, which cited data from TradingView. This increase highlights Bitcoin’s growing influence within the broader crypto market, driven by a combination of market trends, investor sentiment, and macroeconomic factors. Benjamin Cowen, founder of Into The CryptoVerse, forecasted in an October 16 post on X (formerly Twitter) that Bitcoin’s dominance could peak at around 60% in the coming months. The rise in dominance comes at a time when altcoins are seeing reduced market activity, raising important questions about the future of both Bitcoin and the broader cryptocurrency ecosystem.

Understanding Bitcoin Dominance: A Key Market Indicator Bitcoin dominance refers to the percentage of the total cryptocurrency market capitalization that is held by Bitcoin relative to all other digital assets. A higher dominance figure suggests that Bitcoin is outperforming other cryptocurrencies, often driven by a combination of market dynamics and investor preference for Bitcoin over altcoins.

Key Drivers of Bitcoin Dominance:

- Increased Institutional Interest:

- Bitcoin has seen growing institutional adoption, with large companies and financial institutions recognizing it as a reliable store of value and hedge against inflation.

- Regulatory Focus on Bitcoin:

- Many regulatory frameworks are more focused on Bitcoin, which is seen as more established and less prone to the speculative nature of some altcoins.

- Market Uncertainty:

- During times of market uncertainty or macroeconomic instability, investors often retreat to Bitcoin, viewing it as a safer investment compared to altcoins, which can be more volatile.

Recent Trends Contributing to Bitcoin’s Surge Bitcoin’s rise in dominance to 58.77% is part of a broader trend that has been developing over the past year, driven by both internal factors within the crypto market and external global economic conditions.

1. Altcoin Underperformance:

- Many altcoins have underperformed relative to Bitcoin in 2024, with several projects struggling to maintain investor interest amid concerns over regulatory crackdowns, liquidity issues, and market volatility.

2. Bitcoin Halving Anticipation:

- With the Bitcoin halving event expected in April 2024, anticipation is building around the potential price surge historically associated with halving events. This has driven renewed interest in Bitcoin as investors position themselves ahead of the expected supply reduction.

3. Macro and Geopolitical Factors:

- Global economic conditions, including inflation fears, interest rate hikes, and geopolitical tensions, have led investors to seek safe-haven assets like Bitcoin, further boosting its dominance.

Benjamin Cowen’s Forecast: Bitcoin Dominance to Reach 60% In an October 16 post on X, Benjamin Cowen, founder of the market analytics platform Into The CryptoVerse, forecasted that Bitcoin’s dominance will continue to rise, potentially topping out at around 60%. This projection suggests that Bitcoin could see further market strength, especially as investor sentiment continues to favor the leading cryptocurrency over altcoins.

Cowen’s Key Insights:

- Continued Strength for Bitcoin:

- Cowen notes that Bitcoin’s historical patterns suggest that it performs well in environments where investor sentiment is cautious, often leading to increased dominance as altcoins struggle.

- Potential for Altcoin Weakness:

- As Bitcoin’s dominance rises, altcoins may continue to underperform, with investors reallocating funds into Bitcoin for greater stability.

Implications of Rising Bitcoin Dominance for the Crypto Market Bitcoin’s increasing dominance has significant implications for the broader cryptocurrency market, particularly in terms of market liquidity, investor sentiment, and the future trajectory of altcoins.

1. Shift in Investor Focus:

- As Bitcoin’s dominance increases, more investors are likely to focus their attention on Bitcoin, leading to reduced interest and investment in altcoins. This could result in lower liquidity and trading volumes for smaller projects.

2. Altcoin Market Struggles:

- A rise in Bitcoin’s dominance often coincides with a period of weakness for the altcoin market. Projects with less established use cases or smaller communities may struggle to attract new investors, leading to potential declines in market capitalization.

3. Long-Term Implications for Altcoins:

- While some altcoins may recover over time, particularly those with strong use cases and robust ecosystems, the short-term trend of rising Bitcoin dominance may create challenges for the broader altcoin market.

Expert Opinions: The Outlook for Bitcoin and Altcoins Industry analysts have provided their insights on the implications of Bitcoin’s rising dominance and its potential impact on the cryptocurrency market.

- Dr. Emily Zhang, Blockchain Analyst: “Bitcoin’s rising dominance signals a flight to safety among investors. In uncertain markets, Bitcoin has historically performed better than altcoins, and this trend is likely to continue as we approach the 2024 halving event.”

- Mark Thompson, Financial Services Consultant: “Bitcoin dominance tends to rise when market sentiment is cautious or when there’s a shift in institutional focus toward safer assets. If Bitcoin continues to outperform, we could see a prolonged period of underperformance for many altcoins.”

- Sophia Lee, Cryptocurrency Strategist: “The anticipated Bitcoin halving is creating renewed interest in the asset, driving up dominance. However, it’s important to remember that altcoins often have cyclical periods of underperformance followed by rallies, so while Bitcoin’s dominance may rise, the altcoin market could see a resurgence in the future.”

Future Outlook: What’s Next for Bitcoin and Altcoins? As Bitcoin’s dominance approaches the 60% mark, the crypto market is at a crossroads. Investors will be closely watching how this shift impacts the broader cryptocurrency ecosystem, particularly as the 2024 Bitcoin halving draws nearer. The halving event has the potential to spark a new bull run for Bitcoin, while altcoins may continue to face challenges in the short term.

Key Factors to Watch:

- Bitcoin Halving Impact:

- The halving event is expected to reduce Bitcoin’s supply, which historically has led to significant price appreciation. As Bitcoin gains more attention, its dominance could rise further, potentially surpassing the 60% mark.

- Altcoin Market Recovery:

- While altcoins may underperform in the near term, projects with strong use cases and development teams may eventually see a recovery, especially if new innovations or partnerships emerge.

- Institutional Participation:

- Institutional interest in Bitcoin remains strong, and as more financial products such as Bitcoin ETFs are introduced, Bitcoin’s dominance may continue to rise, reshaping the crypto landscape.

Conclusion: A New Era of Bitcoin Dominance? Bitcoin’s dominance reaching a three-and-a-half-year high of 58.77% reflects its growing influence within the cryptocurrency market. With analysts like Benjamin Cowen predicting that dominance could rise to 60%, the spotlight is firmly on Bitcoin as the market approaches the 2024 halving event. While the rise in dominance poses challenges for altcoins, the broader crypto ecosystem remains dynamic, and future developments could reshape the balance of power.

For more insights into the latest trends and analyses in the cryptocurrency market, explore our article on latest news, where we delve into the most significant events shaping the future of digital assets.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

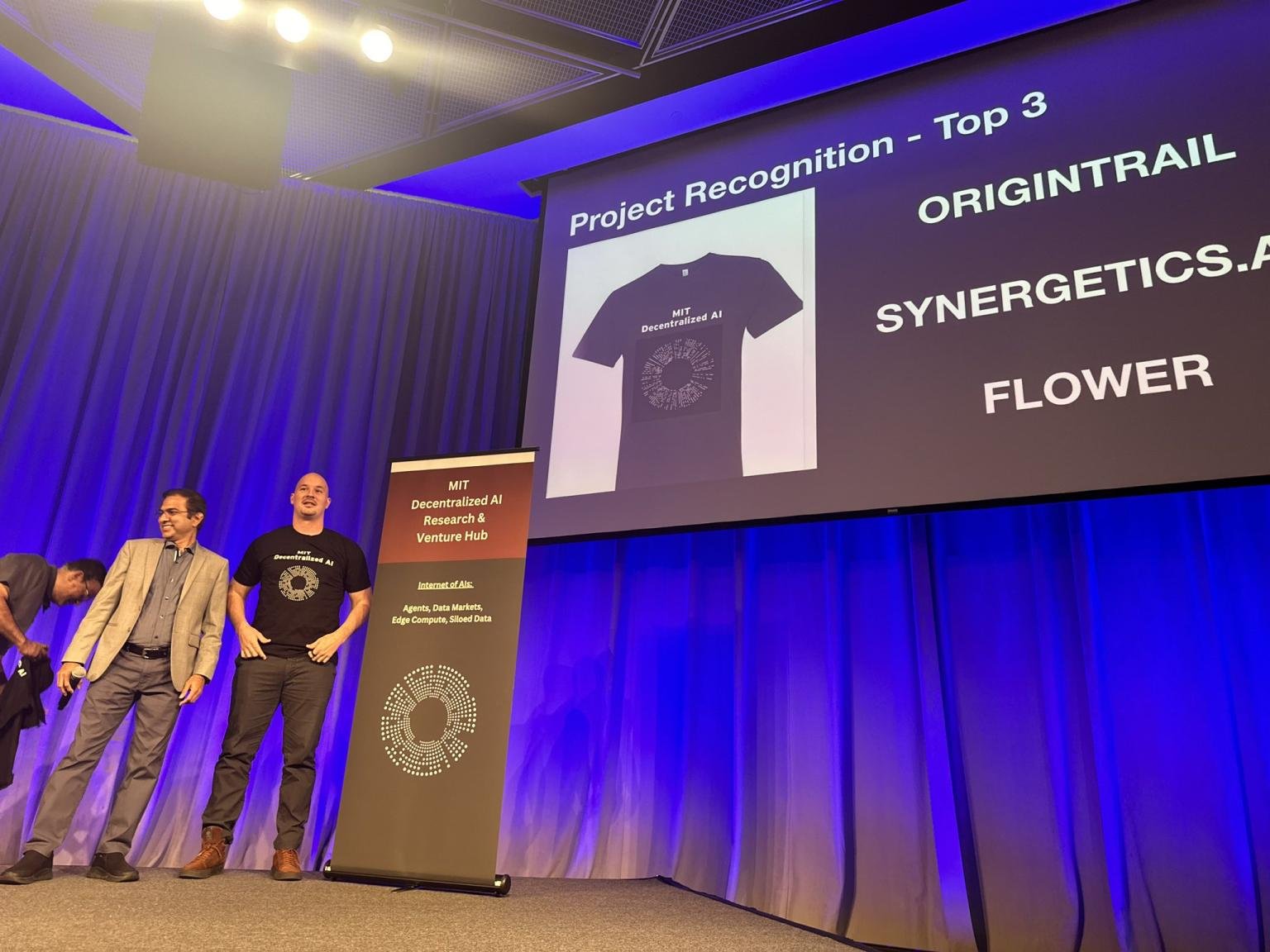

Decentralized AI Summit at MIT votes OriginTrail, powered by Polkadot, as the best decentralized AI project

Ljubljana, Slovenia, October 17th, 2024, Chainwire

OriginTrail, the ecosystem striving for a safe internet in the age of AI with its decentralized knowledge graph, was named the best project at the prestigious MIT Decentralized AI Summit. Held at the MIT Media Lab, the summit brought together top innovators, researchers, and industry leaders to explore the future of decentralized AI technologies.

The packed schedule saw contributions of representatives from Dell, Intell, NVIDIA and other notable AI companies. In his talk, the founder of OriginTrail Branimir Rakic explained how OriginTrail’s decentralized knowledge graph powered by Polkadot acts as a critical infrastructure in addressing some of the internet’s most important challenges in the age of AI such as misinformation, deep fakes, fake news or unreliable AI in a broader sense. The pioneering approach to powering trust in AI stood out amongst the numerous showcases at the event and led to being voted as the best project by the participants of the Decentralized AI Summit. This recognition highlights OriginTrail’s expected impact on driving mainstream adoption for both AI and Web3 technologies across diverse set of industries, from Real World Assets (RWA) in global supply chains, Decentralized Physical Infrastructure (DePIN) connecting knowledge of organizations and individuals, to advancements in improving AI models through federated access to training data.

“We are thrilled to see that OriginTrail is evolving in the direction many other industry giants are identifying as the cutting edge. I was particularly excited to hear many speakers highlight the importance of deploying the AI solutions at the edge of the network, where AI solutions with more sustainable resource use and privacy preserving data management can be implemented. It’s something that OriginTrail has been working on to enable for the last year and we’re excited to unveil it next week (Oct 24th) at the DKGcon in Amsterdam with the release of the DKG Edge node. And, of course, I wish to thank the participants of the event that selected OriginTrail as the best project of the DecAI Summit, it’s a great vote of confidence for our future work.” – Branimir Rakic, Founder at OriginTrail.

As the pathologies of the state-of-the-art AI solutions become more evident, the demand for trustworthy AI solutions being developed at the intersection of Web3 and AI grows. OriginTrail is determined to continue to lead that charge by driving mainstream adoption of this critical infrastructure to enable a safe internet in the age of AI.

As the pathologies of the state-of-the-art AI solutions become more evident, the demand for trustworthy AI solutions being developed at the intersection of Web3 and AI grows. OriginTrail is determined to continue to lead that charge by driving mainstream adoption of this critical infrastructure to enable a safe internet in the age of AI.

About OriginTrail

OriginTrail is an ecosystem dedicated to making the global economy work sustainably by enabling a universe of AI-ready Knowledge Assets, allowing anyone to take part in trusted knowledge sharing. It leverages the open-source Decentralized Knowledge Graph that connects physical and digital worlds in a single connected reality driving transparency and trust.

Advanced knowledge graph technology currently powers trillion-dollar companies like Google and Facebook. By reshaping it for Web3, the OriginTrail Decentralized Knowledge Graph provides a crucial fabric to link, verify, and value data on both physical and digital assets.

For more information, users can visit origintrail.io.

MIT DecAI summit event | LI OriginTrail announcement | X OriginTrail announcement

Contact

Communications department

Lucija Naranda

OriginTrail

lucija.naranda@origin-trail.com

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

SCRYPT partners with ORSEN to facilitate a global blockchain partnership between Polkadot and Inter Miami CF

Zurich, Switzerland, October 17th, 2024, Chainwire

SCRYPT, a Swiss-licensed leader in institutional-grade crypto asset services, today announced the successful implementation of a seminal deal with ORSEN, a global sports and entertainment partnerships enabler, that managed the agreement between Polkadot and prominent Major League Soccer club Inter Miami CF.

To facilitate the partnership, ORSEN utilized SCRYPT’s market leading over-the-counter desk to convert Polkadot’s native cryptocurrency, DOT, into USD. The partnership between Polkadot and Inter Miami CF places Polkadot as the club’s Global Training Partner, this will include visible presence throughout Chase Stadium with major signage and key visuals on LEDs and other stadium signage.

Sean O’Reilly, CEO of ORSEN, said: “We are thrilled to have partnered with SCRYPT to make this deal possible. Their expertise in handling large crypto transactions grants us the necessary infrastructure to bring Polkadot and Inter Miami together in a seamless partnership.”

Norman Wooding, Founder & CEO of SCRYPT, commented: “We are proud to have provided a financial solution to support the facilitation of this major deal between Polkadot and Inter Miami. SCRYPT’s mission is to provide institutions with trusted access to the crypto economy, and this deal exemplifies our capability to execute complex transactions at scale. This partnership exemplifies SCRYPT’s capacity to manage substantial crypto-to-fiat trades with precision and reliability.”

Gabriel Titopoulos, Head of OTC at SCRYPT, added: “This partnership showcases our team’s ability to manage substantial crypto-to-fiat conversions. Ensuring seamless execution for large-scale trades like this is our core strength and we’re excited to be a part of this groundbreaking collaboration between Polkadot and Inter Miami.”

About SCRYPT

SCRYPT is the leading Swiss-licensed partner for institutional crypto solutions, providing seamless access to the crypto economy through trusted infrastructure and expertise. We enable institutions to confidently manage, trade, and store digital assets.

Users can discover more: SCRYPT | info@scrypt.swiss

About ORSEN

ORSEN is THE sports and entertainment partnerships ENABLER. We are a Connector, Facilitator and Trusted Advisor. We work alongside our brand partners and rights holders to identify, create and optimize future-proofed partnerships.

Contact

Junior Consultant

Jacob McGoldrick

CW8 Communications

scrypt@cw8-communications.com

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

Swarm Markets to Offer Gold Bar Investment Opportunities on Bitcoin Network via Ordinals Protocol

In a groundbreaking move that merges traditional asset investment with cutting-edge blockchain technology, Swarm Markets, a real-world assets (RWA) platform licensed by Germany’s Federal Financial Supervisory Authority (BaFin), has announced a strategic partnership with OrdinalsBot. This collaboration aims to provide investors with unique gold bar investment opportunities on the Bitcoin network’s Ordinals protocol. As reported by CoinDesk, the partnership will enable users to invest in gold through Trio, a new marketplace developed by OrdinalsBot, slated for launch by the end of the year. The innovative service involves inscribing unique gold kilobar serial numbers onto satoshis—the smallest unit of Bitcoin—thereby facilitating their trade on the Ordinals protocol.

Understanding the Players: Swarm Markets and OrdinalsBot

Swarm Markets: Bridging Real-World Assets and Blockchain

Swarm Markets is a prominent player in the RWA sector, offering a platform that integrates traditional assets such as real estate, commodities, and precious metals with blockchain technology. Licensed by BaFin, Swarm Markets ensures compliance with stringent regulatory standards, providing a secure and trustworthy environment for investors to diversify their portfolios with tokenized real-world assets. By leveraging blockchain’s transparency and security, Swarm Markets enhances the accessibility and liquidity of traditionally illiquid assets.

OrdinalsBot and the Ordinals Protocol: Innovating on the Bitcoin Network

OrdinalsBot is an innovative project that utilizes the Ordinals protocol on the Bitcoin network to inscribe unique data onto individual satoshis. The Ordinals protocol allows for the creation of non-fungible tokens (NFTs) directly on Bitcoin by embedding data into the smallest units of the cryptocurrency. This method enables the tokenization of virtually any asset, providing a decentralized and immutable record of ownership. OrdinalsBot leverages this protocol to create and manage digital representations of physical assets, such as gold bars, enhancing their tradability and accessibility on the blockchain.

The Partnership: Swarm Markets and OrdinalsBot Collaborate

The collaboration between Swarm Markets and OrdinalsBot marks a significant milestone in the convergence of traditional asset investment and blockchain technology. By integrating Swarm Markets’ expertise in RWA with OrdinalsBot’s proficiency in the Ordinals protocol, the partnership aims to create a seamless and secure platform for investing in gold through the Bitcoin network.

Trio Marketplace: A New Frontier for Gold Investments

Trio is the forthcoming marketplace developed by OrdinalsBot, designed to facilitate the trading of inscribed satoshis representing gold kilobars. This platform will allow users to purchase, trade, and manage their gold investments digitally, leveraging the security and transparency of the Bitcoin blockchain. Trio aims to democratize access to gold investments, making it easier for both institutional and retail investors to participate in the precious metals market without the traditional barriers associated with physical asset ownership.

How It Works: Investing in Gold via the Ordinals Protocol

Inscribing Gold Kilobar Serial Numbers on Satoshis

The core innovation of this partnership lies in the inscription process, where unique serial numbers of gold kilobars are embedded onto individual satoshis using the Ordinals protocol. Each inscribed satoshi effectively represents a specific gold kilobar, creating a digital and tradable representation of the physical asset.

- Acquisition of Gold Kilobars: Swarm Markets acquires physical gold kilobars, ensuring their authenticity and quality through rigorous standards and certifications.

- Serial Number Inscription: Using the Ordinals protocol, each gold kilobar’s unique serial number is inscribed onto a satoshi. This process involves embedding data directly into the satoshi’s metadata, creating a permanent and tamper-proof record.

- Tokenization and Listing: The inscribed satoshis are then tokenized and listed on the Trio marketplace, where they can be bought, sold, and traded by investors.

- Ownership and Redemption: Investors who hold these inscribed satoshis have digital proof of ownership of the corresponding gold kilobars. Depending on the platform’s policies, investors may have the option to redeem their digital holdings for physical gold or continue trading them within the digital marketplace.

Benefits of the Inscription Process

- Transparency and Security: The use of the Ordinals protocol ensures that each inscribed satoshi is uniquely tied to a specific gold kilobar, providing transparency and preventing fraud.

- Liquidity and Accessibility: Tokenizing gold on the Bitcoin network increases liquidity, allowing investors to buy and sell gold assets quickly and easily without the need for intermediaries.

- Fractional Ownership: Investors can purchase fractions of gold kilobars through individual satoshis, lowering the barrier to entry and allowing for more flexible investment amounts.

Implications for the Investment Landscape

Enhancing Investment Flexibility and Accessibility

The integration of Swarm Markets’ gold investment opportunities with OrdinalsBot’s Ordinals protocol offers investors unprecedented flexibility and accessibility. By tokenizing gold on the Bitcoin network, the partnership enables fractional ownership, allowing investors to participate in gold investments with smaller capital outlays. This democratization of gold investment opens up new avenues for portfolio diversification and wealth preservation.

Strengthening Blockchain Adoption in Traditional Finance

This partnership exemplifies the potential of blockchain technology to revolutionize traditional financial markets. By bridging real-world assets with blockchain’s inherent advantages—such as transparency, security, and immutability—Swarm Markets and OrdinalsBot are paving the way for broader blockchain adoption in asset management and investment sectors.

Regulatory Compliance and Trust

Swarm Markets’ BaFin licensing ensures that the investment platform adheres to stringent regulatory standards, fostering trust and confidence among investors. The collaboration with OrdinalsBot further enhances this trust by leveraging a secure and transparent protocol for asset tokenization, ensuring that each investment is backed by verifiable and legitimate physical assets.

Potential Risks and Considerations

Market Volatility and Asset Fluctuations

While gold is traditionally seen as a stable investment, the cryptocurrency market is known for its volatility. The integration of gold investments with the Bitcoin network introduces additional layers of market risk, as fluctuations in Bitcoin’s price can indirectly impact the value of the inscribed satoshis representing gold.

Regulatory Uncertainties

Despite Swarm Markets’ compliance with BaFin regulations, the broader regulatory environment for cryptocurrency-based asset tokenization remains evolving. Future regulatory changes could impact the operations and feasibility of tokenized gold investments, necessitating ongoing compliance and adaptation.

Technological Risks

The reliance on the Ordinals protocol and blockchain technology introduces potential technological risks, including vulnerabilities in the protocol, security breaches, and issues related to the permanence of inscribed data. Ensuring robust security measures and continuous technological advancements is crucial to mitigate these risks.

Liquidity and Market Adoption

The success of the Trio marketplace depends on widespread adoption and sufficient liquidity. Without a critical mass of users and participants, the platform may struggle to provide the desired level of liquidity and seamless trading experiences for investors.

Future Outlook and Strategic Plans

Launch and Expansion of Trio Marketplace

With Trio slated to launch by the end of the year, the partnership between Swarm Markets and OrdinalsBot is poised to make a significant impact on the gold investment landscape. Initial efforts will focus on building a user-friendly interface, ensuring robust security protocols, and fostering a vibrant community of investors and traders.

Exploration of Additional Asset Classes

Building on the success of tokenizing gold, Swarm Markets and OrdinalsBot may explore the tokenization of other precious metals, commodities, or real estate assets. Expanding the range of tokenized assets can attract a broader investor base and enhance the platform’s utility.

Enhancing Technological Capabilities

Continued investment in technological infrastructure will be essential for maintaining the platform’s security, scalability, and user experience. Innovations such as improved smart contract functionalities, enhanced data encryption, and seamless integration with other blockchain protocols can further elevate the platform’s offerings.

Strategic Partnerships and Collaborations

Forming strategic alliances with other fintech companies, cryptocurrency exchanges, and blockchain technology providers can enhance the platform’s reach and capabilities. Collaborations can drive innovation, increase liquidity, and facilitate the seamless integration of new features and services.

Regulatory Engagement and Advocacy

Proactive engagement with regulatory bodies and industry associations will be crucial for navigating the evolving regulatory landscape. By participating in regulatory discussions and advocating for favorable policies, Swarm Markets and OrdinalsBot can help shape the future of asset tokenization and blockchain-based investments.

Conclusion

The partnership between Swarm Markets and OrdinalsBot marks a significant advancement in the integration of real-world asset investment with blockchain technology. By offering gold bar investment opportunities on the Bitcoin network’s Ordinals protocol through the Trio marketplace, the collaboration enhances investment flexibility, accessibility, and security. This innovative approach not only democratizes access to gold investments but also strengthens the broader adoption of blockchain technology in traditional financial markets.

While the venture presents exciting opportunities, investors must remain cognizant of the associated risks, including market volatility, regulatory uncertainties, and technological challenges. As the Trio marketplace approaches its launch, the collaboration between Swarm Markets and OrdinalsBot is set to redefine the landscape of digital asset investments, paving the way for a more inclusive and efficient investment ecosystem.

To learn more about the innovative startups shaping the future of the crypto industry, explore our latest news article, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories11 months ago

Startup Stories11 months agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency8 months ago

Crptocurrency8 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing