Startup Stories

How Kroop AI Might Free The World From Deepfake Pandemic

SUMMARY

Trained on high-quality synthetic data with a diverse set of identities, Kroop AI’s deepfake detector tools can accurately differentiate between real and fake audio and video

The startup works with clients in the ecommerce and pharma industries, but its tools have found the biggest use case in the BFSI sector

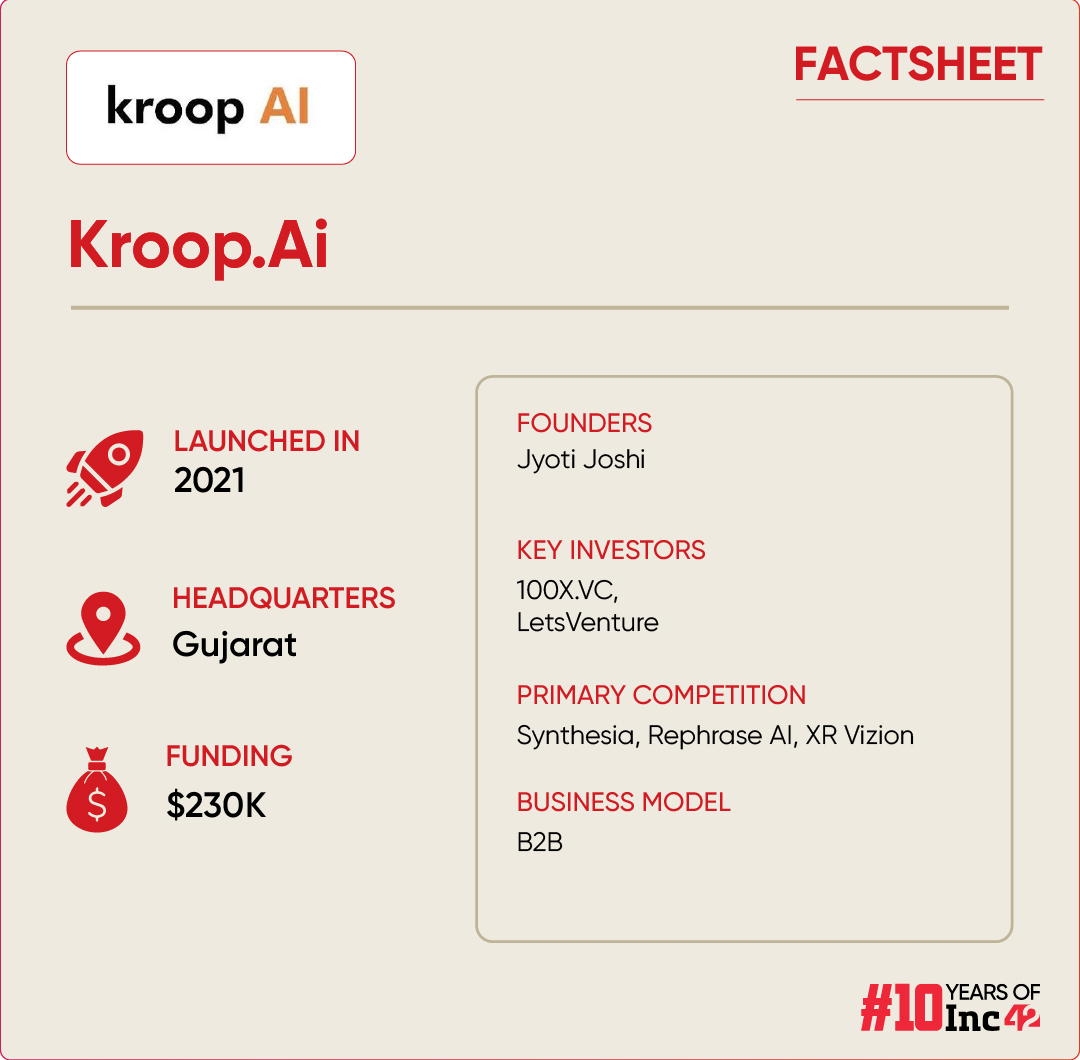

To date, Kroop AI has secured $230K in funding from investors such as 100X.VC and LetsVenture, along with support from several angels and family offices

Last year, an AI-generated deepfake video featuring Indian actor Rashmika Mandanna went viral, sparking widespread concern about the ethical implications of emerging technologies like AI and open-source GenAI models, as well as the regulations governing their use. Following Mandanna’s incident, several other celebrities became victims of deepfake manipulation.

Concerned with the rise in the number of such cases, Prime Minister Narendra Modi called for global regulation of AI to address the issue.

Interestingly, the founder and CEO of Ahmedabad-based Kroop AI, Jyoti Joshi, saw this coming a few years ago and, therefore, started to work on a deepfake detection solution in anticipation.

Founded in early 2021, Kroop AI is one of the first few GenAI startups in India that is on a mission to assuage this world from the deepfake menace. Kroop AI’s tools enable users to detect whether an image, video, or voice is AI-fabricated, AI-generated or real.

Trained on high-quality synthetic data with a diverse set of identities, Kroop AI’s deepfake detector can accurately differentiate between real and fake audio and video.

For the uninitiated, deepfake is synthetic media, generated using deep learning techniques to manipulate or create video, audio, or images to present something that has not happened.

The technology behind deepfakes primarily relies on deep learning algorithms, typically Generative Adversarial Networks (GAN). It engages two AI algorithms against each other with the generator network creating a manipulated image and the discriminator trying to detect whether the generated image is fake. This process continues until the discriminator can no longer differentiate between the real and the fabricated images.

It goes without saying that with the boom of GenAI platforms that can create video, audio, and images at the cues of a few prompts, the risk of deepfake has increased, and players like Kroop AI have a major role to play.

But Kroop AI Is More Than Just A Deepfake Detector

Kroop AI’s genesis dates back to the Covid-19 era when the GenAI wave had yet to hit Indians. This was the time, around the US elections in 2020, when instances of the misuse of deepfake technology were frequently making news.

Driven by the realisation of the significant consequences that could arise from the misuse of this technology, Joshi, also an AI scientist, seized upon the idea of developing a deepfake detection solution.

Recognising the sparse presence of players in the deepfake detection market, Joshi saw an opportune moment to enter the space. However, at the time, awareness of the risks associated with deepfake technology in India was limited, partly due to the delayed adoption of AI technology and GenAI in the country.

As Kroop AI began assembling vast datasets to train its deepfake detection models, the startup also recognised a significant opportunity in the area of ethical video generation. Consequently, having set out as a deepfake detection solution provider in 2021, the AI startup also shifted its focus towards developing and monetising other GenAI applications.

Employing deep-learning models with substantial visual inputs, Kroop AI developed a text-to-video generation platform using digital avatars. Unlike platforms such as OpenAI’s Sora, Kroop AI’s generative platform allows users to animate avatars and create videos in various languages simply by inputting text.

“Our platform is language agnostic, meaning you can choose any language,” explained Joshi. “Once selected, you provide the script as input, which is then converted to the desired audio and used to generate a video where the avatar narrates the script.”

Kroop AI’s video generation platform supports over 25 languages, including English, French, Korean, Arabic, Hindi, Tamil, Telugu, and Malayalam.

Currently, the startup serves clients in the ecommerce and pharma industries. Besides, Kroop AI has found its biggest use case in the Banking, Financial Services and Insurance (BFSI) sector.

For instance, many insurance companies are using the Kroop AI platform to improve communication with their various stakeholders such as agents and customers.

Using its generative video technology, some companies have also launched new products and marketing campaigns. Flipkart’s furniture arm also adopted Kroop AI’s platform to convert its furniture catalogues to video formats from text format.

Meanwhile, the startup is yet to start monetising its deepfake detection tool. However, it is currently in talks with a few cybersecurity companies for the deployment of the technology.

Kroop AI’s Monetisation Strategy

Kroop AI’s generative platform provides services through three pricing tiers: $12 per month, $60 per month, and a customisable option.

The $12 plan offers 15 free minutes and access to a limited number of languages and avatars, while the $60 plan includes 80 free minutes and access to all languages and avatars.

According to Joshi, most large enterprises opt for the custom option, where pricing is tailored to their specific requirements. Additionally, the platform offers a free 7-day trial period.

To date, Kroop AI has secured $230K in funding from investors such as 100X.VC and LetsVenture, along with support from several angels and family offices. The company has not disclosed its monthly or yearly revenue.

However, it anticipates that in the coming years, its deepfake detection tools will surpass its generative platform as the primary revenue driver for the company.

The Road Ahead

Currently, Kroop AI is experiencing a surge in inquiries for its deepfake detection platform. According to Joshi, an increasing number of banks are approaching cybersecurity companies, which then turn to Kroop AI for assistance.

“With the advancement of tools, anyone can create highly realistic facial manipulations, potentially using another person’s image as their identity. Unfortunately, there’s often no deepfake detection layer before biometric verification, posing a significant risk. “This has led to a growing demand for deepfake detection tools from various banking sectors,” Joshi said.

Meanwhile, Kroop AI is eyeing expansion into regions such as the EU, MENA, and APAC. Particularly, banks in the APAC region have shown significant interest in its deepfake detection tool.

We must note that Kroop AI operates in a highly cost-intensive industry that requires high-end graphics processing unit (GPU) machines for data training. The startup is also looking to raise a fresh funding round by 2024 end.

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency9 months ago

Crptocurrency9 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016

-

Startup Stories1 year ago

Startup Stories1 year agoWOW Skin Science’s Blueprint For Breaking Through In The $783 Bn BPC Segment