Startup Stories

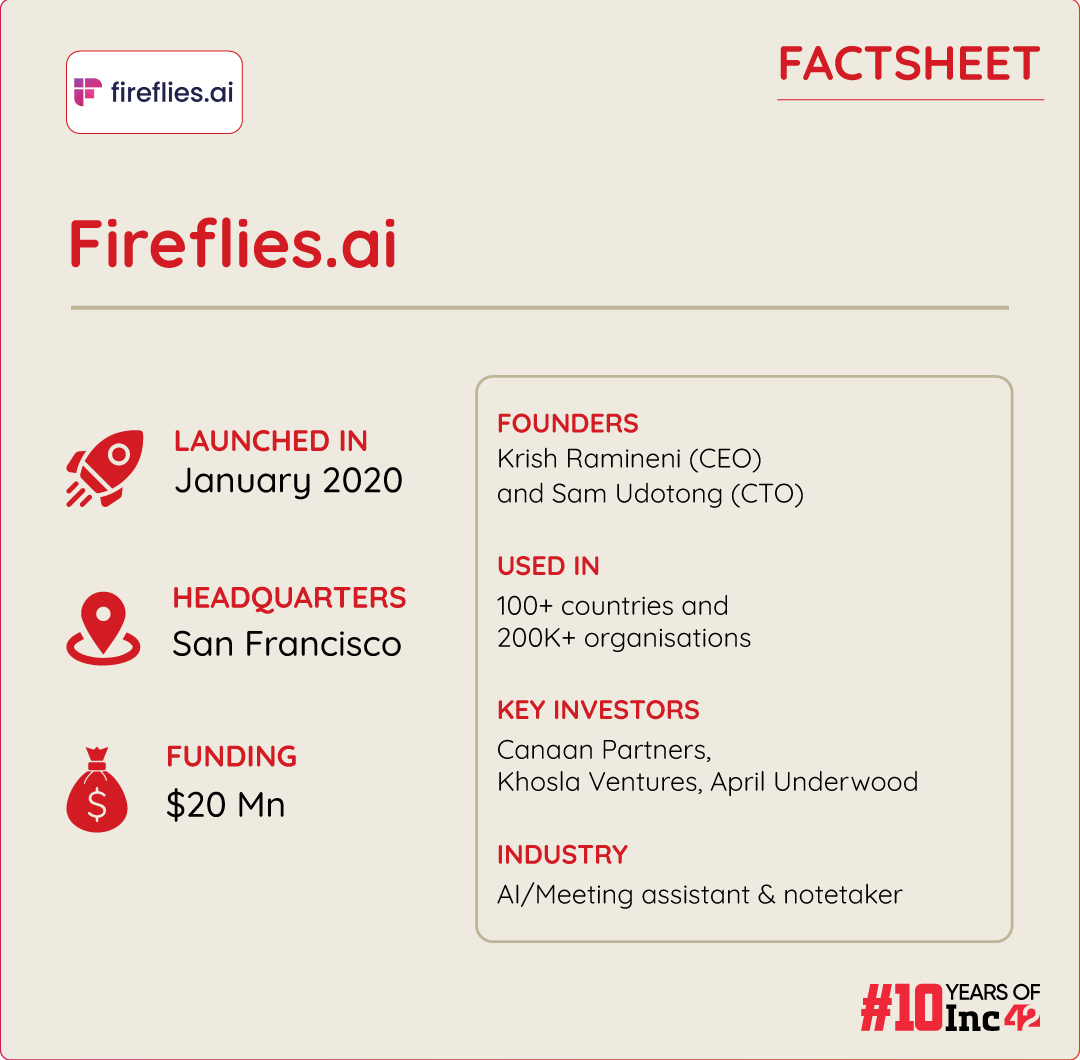

How AI Startup Fireflies Is Transforming Workplace Meetings For 10 Mn+ Users Across 100+ Countries

What first thought comes to mind when we discuss new-age office automation? Many want to create stunning presentations in a snap to wow their audience. But talk about preparing meeting minutes; almost everyone would declare it tedious and time-consuming. Whether one takes down key points of discussion or records the entire session to be transcribed later (using a suitable tech tool), people are bound to lose track of valuable insights and action items as too much noise creeps in (read discussions and dialogues during a meeting that diverts our attention).

Essentially, attendees require summarised text to recap the gist, while accurate audio-video transcriptions provide access to event details documented in a convenient format. Summary points are essential here, as these help meeting-goers review and analyse outcomes quickly without browsing the whole document or going back and forth.

Realising how feature-packed, automated speech transcriptions would make workplace meetings more productive and effective, Krish Ramineni, who was previously one of the youngest product managers at Microsoft and MIT alumn Sam Udotong launched Fireflies.ai, an AI meeting assistant for SMBs, enterprises and individual users.

The startup offers an easy-to-use web interface and mobile app (iOS & Android) for recording, transcribing and summarising in-person meetings and video conferences. Its AI Notetaker joins major web-conferencing platforms (Zoom, Google Meet, MS Teams) to take notes and sync vital information to business applications (Slack, Salesforce, Zoho, Asana, Zapier)

For B2B customers, transcribed documents are stored in a secure central repository in the cloud, enabling smart search, seamless integration and meeting analytics via its conversation intelligence suite.

“Fireflies provides 95% accuracy and covers more than 60 languages. It also enables collaboration, essential for distributed work environments, thus enhancing efficiency and productivity,” said Ramineni.

The startup claims that there are users across 70% of Fortune 500 companies. Fireflies has taken notes for more than 10 Mn people across 200K+ organisations and 100+ countries.

Globally, the market size for AI meeting assistants is estimated to reach $17.3 Bn by 2032 from $2.2 Bn in 2023, growing at a CAGR of 25.6%. The burgeoning growth is attributed to growing automation and the rise of cross-border and hybrid work cultures worldwide, adopted by many companies keen to operate beyond boundaries without adding to their capex. It is not surprising, therefore, that investors see greater ROI potential in AI startups/generative AI (genAI) businesses building robust productivity tools.

Fireflies raised $20 Mn from investors, including Canaan Partners, Khosla Ventures, Stanford University, April Underwood (chief product officer at Slack), Armando Mann (head of sales at Dropbox), Susan Kimberlin (director of search at Salesforce) and Bill Macaitis (former CMO of Salesforce), among others.

From Meeting Capture To Analytics & GenAI Assistant: How Fireflies.ai Adds Value In Eight Ways

With the rise in efficiency quotient and the spread of hybrid office culture, hassle-free recording, prompt transcription and effective summarising of key discussion points have rapidly automated meeting processing, once a routine but dreaded task. Fireflies.ai does it in eight simple steps after it is synced with the required platform. Here is a quick look at how the AI notetaker works.

- Instant recording: To use Fireflies.ai, users need to log in to its website/app and allow it access to other relevant apps like calendars on their devices. After that, it will automatically seek permission to join an audio or a video meeting for instant recording. One can also deny permission to keep these proceedings confidential.

- Transcription & review: After capturing live meetings, Fireflies transcribes the same and all files are stored in the cloud. One can log in to the account to access these via the user dashboard and review transcripts while the audio plays to ensure transcription accuracy. Users can also upload other audio files for transcription.

- Summarisation benefits: Next, the AI meeting assistant generates meeting summaries, notes and audio snippets so that key discussion points, action items, ideas and strategies can be meticulously explored and focussed upon. This leads to better engagement among meeting attendees, collaborative discussions and effective brainstorming.

- Workplace collaboration: When transcriptions are ready, team members can add time-stamped comments, highlight vital points and flag issues. They can manually create audio snippets for further review/clarification, organise these snippets and pin important sections of transcriptions for greater emphasis and knowledge-sharing.

- Smart search & topic tracker in action: The startup has developed AI filters to search transcripts of all previous meetings. Additionally, a topic tracker allows users to add search words and phrases, shows how many times they have been used during a meeting and quickly identifies all parts of the transcription containing them.

- Integration, inside out: Integration at Fireflies happens at two levels. While the AI notetaker supports all major conferencing platforms and diallers, it also plays a critical role by ensuring that information is perused in context. The platform’s seamless integration with collaboration systems such as CRM, sales, project management, or workflow management helps contextualise all data (recordings, transcripts, notes and more) for better insights, strategising and streamlining operations.

Ramineni says there are multiple use cases across services and sectors, such as sales & marketing, recruitment, people & project management, consulting, healthcare, education, media and more. For instance, sales teams can identify sales opportunities and narrow down the critical criteria for future candidates by streamlining call notes and skimming through the interviews of successful candidates. Sales can further use these recordings and transcriptions to coach new joiners.

Similarly, customer support agents can benefit from instant recall of interactions and sentiment analysis for service improvement and automated follow-ups. Project managers can skip extensive details and auto-generate action items to keep their teams aligned and focussed. Individual contributors, too, can enhance productivity by transcribing interviews, analysing brainstorming sessions and revisiting key points effortlessly.

- AI-driven meeting analytics: Its conversation intelligence analyses proceedings and provides insights around content, context, talk time, topic trends, sentiment and more. This helps users better understand the matter, leading to optimised communication strategies and better action plans. With easy access to meeting analytics for every critical interaction, businesses can clinch more deals, hire great performers and develop better products in sync with customer preferences.

- AskFred, a ChatGPT-like assistant, for smooth ops: Aware of the rapid rise of generative AI assistants like ChatGPT and Google Bard, Fireflies has recently launched AskFred, which is built on top of its core transcription offerings. One can ask any question about a meeting in an informal, conversational manner, and pat comes the reply. It can also transcribe audio files, summarise meeting points, help users write post-meeting email messages, generate out-of-the-box ideas and draft reports.

Ramineni says AskFred is bringing the power of ChatGPT to workplace meetings. However, only pro and business users can access it for a minimum monthly fee of $5, which covers 50 prompts. This can shoot up to $600 a month for 10K prompts.

Not ‘Just Another Covid Offshoot’: How Fireflies Is Evolving For The Long Haul

Fireflies.ai was launched during the Covid-19 pandemic when remote work became the new normal, and there was a growing need for audio-video calls to keep distributed workplaces connected and operational. However, as a product manager at Microsoft, Ramineni recognised the importance of automated note-taking/transcription in 2016, as he and his team spent significant time and effort recalling meeting conversations.

His idea was to develop an AI assistant to help workplaces recall and manage meaningful discussions from their meetings. To turn the idea into reality, Ramineni turned down a master’s programme at Cambridge, and flew to Boston to meet his friend from MIT, Sam Udotong, to start working on various startup products. Finally, they launched Fireflies in 2020 from San Francisco.

Ramineni says Fireflies.ai is “not just another startup born during the pandemic”. Undoubtedly, it was initially considered a temporary solution to tide over the pandemic. But the startup witnessed 10-15x user growth in 2023, proving it was no flash in the pan. Ramineni added, “Fireflies is growing 10x faster today than during the peak of the pandemic.”

Since the beginning, the startup has solely depended on organic growth. “If one of our users went to a meeting, the AI assistant automatically logged in and sparked curiosity,” recalled Ramineni. After the meeting, the recording and notes were mailed to attendees on the mailing list, instantly delivering value. The platform also kept the user interface (UI) pretty simple for quick adoption and easy self-service.

The founders faced a series of challenges, from requiring rapid technology advancements for a quicker turnaround at a lower cost to addressing privacy concerns. The duo knew that AI notetaking must be accurate and affordable enough to retain and grow the customer base. Besides, securing sensitive enterprise data would be critical, as meeting transcriptions could push traditional privacy threats to new arenas. Consequently, Fireflies focussed on three major areas to drive growth and mitigate risks.

Advanced AI models are used for transcribing at scale. Scaling the platform to handle millions of conversations was a major hurdle. So, the entire code was rewritten after releasing the minimum viable product. Another key challenge was driving down transcription costs without compromising quality. The team tackled this by employing better AI models. Ramineni and Udotong explored multiple optimisation methods and used a large language model (LLM) to summarise transcriptions in a way that resembles human work as closely as possible.

Additionally, a new version was developed using LLM technology to ensure Fireflies would deliver 10 times the value at one-tenth of the cost. At first, convincing customers to shift to the new system was difficult. But that was addressed through phased onboarding.

Stringent measures are taken to safeguard enterprise data. All data (user audio, transcripts and other details captured during meetings) is encrypted and kept in a secure cloud storage (Google Cloud and AWS), and only users can grant access to it. The startup is also GDPR- and HIPAA-compliant, providing appropriate safeguards per global standards. The company also offers private storage and dedicated storage for enterprises.

Price advantage is a key differentiator. Fireflies has adopted a SaaS-like freemium model and monthly/annual subscription plans for organisations of all sizes. Its flexible pricing remains its USP, which could be as low as $10 per user per month.

“Pricing depends on plans and additional features, but the structure has been deliberately kept affordable, positioning the startup as a cost-effective option and ensuring minimal friction for signups,” said Ramineni.

What’s Next For Fireflies, AI Notetakers?

Ramineni did not disclose his India plans for Fireflies.ai or its global growth prospects. However, the AI startup will double down on advanced AI features and LLM capabilities to maximise accuracy and productivity. It also aims to scale the platform to accommodate larger teams while expanding its range of functionalities.

Talking about investor sentiment, the founder says investors have been bullish towards AI since 2016. Investors showed faith in the concept back then and the ‘VC appetite’ for AI was still going strong in 2023. Their interest has not waned, but investors are now keen to back early and growth stage genAI startups. Given this ‘favourable’ environment amid a funding winter, Fireflies can further work on Ask Fred and enhance its genAI offerings. Interestingly, 5.6% of companies that raised a VC-backed equity round in 2023 had a ‘.ai’ domain, according to market intelligence platform CB Insights.

Fireflies may look for more funding in 2024, as per media reports. But the critical challenge lies elsewhere. To begin with, deep-pocketed industry giants like Zoom, Microsoft and Google (its NotebookLM, powered by Gemini Pro AI, is already doing the rounds) have entered the arena. Many of these have gone beyond routine tasks and offer data intelligence customised for users (Gong has been doing this for a long time), while others have come up with bots that can go to meetings on one’s behalf. Then again, AI bots could work as notetakers and meeting co-ordinators, calling out human participants if they override meeting protocols and overwhelm other attendees. Of course, all these AI tools are not mainstream yet. However several U.S. companies are okay with their AI notetakers multitasking to increase efficiency.

This is bound to put the older stock of AI companies in a spot of bother. The likes of Fireflies, Gong, Chorus and more specialise in automated notetaking, but can they play a more pivotal role beyond their current expertise? Additionally, more and more AI meeting assistants use cutting-edge technologies like natural language processing (NLP) and advanced speech recognition systems to produce more accurate, searchable, shareable and organised digital records generated in real time or after meetings. Therefore, the key to success in this space is to stay up-to-date with technology trends and suitably diversify one’s services to leverage the full potential of traditional and generative AI.

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency10 months ago

Crptocurrency10 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoWOW Skin Science’s Blueprint For Breaking Through In The $783 Bn BPC Segment

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016