BitcoinWorld

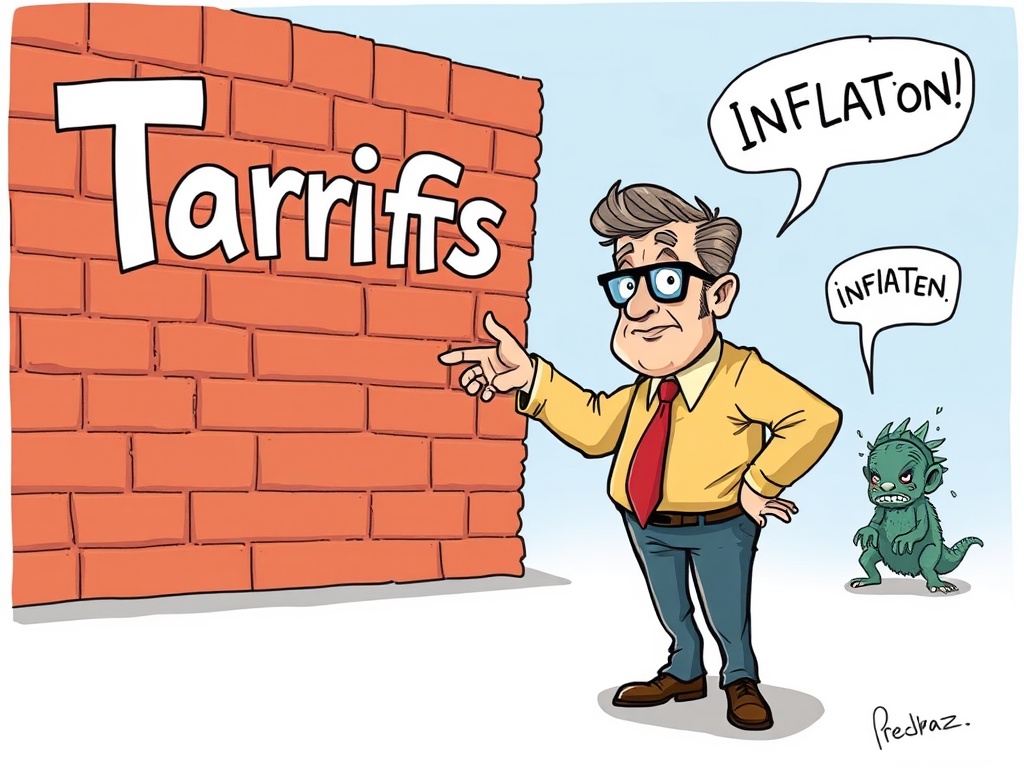

Tariffs and Inflation: Stephen Miran’s Bold Claim Rocks Economic Debate

The financial world is currently buzzing with a fascinating economic debate. Stephen Miran, a prominent figure nominated for the Federal Reserve Board of Governors, has put forward a controversial stance: he claims that tariffs and inflation are not directly linked. This declaration challenges long-held economic theories and has ignited discussions across various sectors, from policymakers to everyday consumers. Understanding this perspective is crucial for anyone monitoring global economic trends and their potential impact on market stability.

What’s the Core of the Tariffs and Inflation Debate?

Miran, a former top aide to President Donald Trump, asserted unequivocally that tariffs “will absolutely not cause inflation.” This statement stands in stark contrast to the conventional economic understanding, which often views tariffs as a tax on imported goods. Typically, these taxes are expected to raise the cost of those goods for consumers or businesses, thereby contributing to inflationary pressures. Miran’s position suggests a different mechanism at play, one that warrants closer examination.

For decades, economists have largely agreed that tariffs, by increasing the cost of imported products, inevitably lead to higher domestic prices. This happens as importers pass on the added cost to retailers, who then pass it to consumers. The debate around tariffs and inflation is therefore not just academic; it has real-world implications for household budgets and corporate strategies.

How Do Tariffs Typically Impact Prices?

Let’s consider the traditional view. When a country imposes tariffs on imported steel, for example, foreign steel becomes more expensive. Domestic steel producers might then raise their prices, knowing their foreign competitors now face higher costs. This ripple effect can spread throughout industries that use steel, from car manufacturing to construction, ultimately pushing up the prices of finished goods. It’s a classic supply-side shock that can fuel inflation.

Businesses face a dilemma when tariffs are introduced. They can either absorb the increased costs, which cuts into their profit margins, or they can pass these costs onto consumers through higher prices. Often, a combination of both occurs. This dynamic is a primary reason why many economists warn about the inflationary potential of widespread tariffs. The relationship between tariffs and inflation is often seen as direct and predictable.

Stephen Miran’s Unique Perspective: Why No Inflation?

So, why does Stephen Miran believe tariffs won’t cause inflation? While he hasn’t provided extensive public details on his full reasoning, potential arguments supporting such a view often include:

- Market Competition: Domestic producers might choose not to raise prices aggressively, fearing that doing so would invite new competitors or lead to a loss of market share.

- Currency Fluctuations: A stronger domestic currency could potentially offset the impact of tariffs, making imports cheaper in local currency terms despite the tariff imposition.

- Supply Chain Adjustments: Companies might adapt by finding new, tariff-free suppliers or by shifting production to avoid the tariffs entirely, thus mitigating price increases.

- Demand Elasticity: If consumers are highly sensitive to price changes, businesses might be hesitant to pass on tariff costs, opting to absorb them instead to maintain sales volume.

Miran’s perspective suggests that the market possesses more adaptive mechanisms than traditionally assumed to prevent tariffs from automatically translating into widespread inflation. This nuanced view challenges the straightforward link between tariffs and inflation, inviting a deeper look into complex economic interactions.

Potential Repercussions for Financial Markets and Consumers

The implications of Miran’s stance, especially if he were to join the Federal Reserve Board, are significant. The Fed’s primary mandate includes maintaining price stability, meaning controlling inflation. If a key policymaker believes tariffs are not inflationary, it could influence monetary policy decisions, potentially leading to different responses to trade policies.

For financial markets, clarity on how policymakers view the relationship between tariffs and inflation is vital. Uncertainty can lead to volatility. Investors and businesses rely on predictable economic frameworks to make decisions. If the prevailing view shifts, it could impact everything from commodity prices to bond yields and stock market performance. Consumers, too, would be directly affected by whether prices genuinely remain stable or rise despite tariff implementations.

What Does This Mean for You?

This ongoing debate highlights the complexities of modern economics. While Miran’s views are unconventional, they prompt a necessary re-evaluation of how various economic tools interact. Keeping an eye on these discussions helps us understand the broader economic landscape and anticipate potential shifts in policy and market conditions.

A Crucial Economic Debate on Tariffs and Inflation

Stephen Miran’s assertion that tariffs do not cause inflation is a powerful challenge to established economic thought. This discussion is not merely academic; it has tangible consequences for how we understand price stability, trade policy, and the role of central banks. As the debate continues, it underscores the dynamic nature of economics and the need for continuous analysis of how global factors influence our financial lives. The future trajectory of tariffs and inflation will remain a critical topic for economists and investors alike.

Frequently Asked Questions (FAQs)

1. What is the traditional economic view on tariffs and inflation?

The traditional view holds that tariffs, acting as taxes on imported goods, increase the cost of those goods. This higher cost is typically passed on to consumers, leading to an increase in overall prices and contributing to inflation.

2. Why does Stephen Miran believe tariffs do not cause inflation?

While Miran’s full reasoning isn’t exhaustively detailed, his perspective may stem from beliefs in market competition, currency fluctuations, supply chain adjustments, or demand elasticity. These factors could potentially mitigate the direct inflationary impact of tariffs by allowing markets to adapt.

3. How might Miran’s view impact the Federal Reserve’s policy decisions?

If a Federal Reserve Governor holds the view that tariffs are not inflationary, it could influence the Fed’s approach to monetary policy. This might lead to different responses to trade policies, potentially affecting interest rate decisions and other measures aimed at maintaining price stability.

4. What are the potential effects of tariffs on consumers and businesses?

For consumers, tariffs can lead to higher prices for imported goods and potentially domestic alternatives. Businesses might face increased input costs, impacting their profit margins, or they might choose to absorb costs or adjust supply chains to mitigate the effects.

5. Is there historical evidence to support Miran’s claim?

Historical data on the relationship between tariffs and inflation is complex and subject to interpretation. Some economists might point to specific periods or circumstances where tariffs had a limited inflationary impact due to other economic factors, while others maintain that the inflationary effect is generally evident.

We hope this exploration of Stephen Miran’s views on tariffs and inflation has provided valuable insights. Share this article with your colleagues and on social media to spark further discussion on this crucial economic debate!

To learn more about the latest financial markets trends, explore our article on key developments shaping global economic stability and future outlook.

This post Tariffs and Inflation: Stephen Miran’s Bold Claim Rocks Economic Debate first appeared on BitcoinWorld and is written by Editorial Team