[ad_1]

The stability of USDT amid EU regulations has defied widespread expectations, maintaining its market cap and dollar peg even after the European Union’s implementation of the Markets in Crypto-Assets (MiCA) regulatory framework. According to Glassnode co-founders Jan Happel and Yann Allemann, who post as “Negentropic” on X, Tether’s flagship stablecoin weathered significant challenges, including its withdrawal from the EU market. This development underscores USDT’s resilience and its crucial role in global crypto markets.

Understanding the MiCA Regulations and Their Impact

1. What Is MiCA?

The Markets in Crypto-Assets (MiCA) regulation is the European Union’s comprehensive framework designed to govern digital assets. Its goals include fostering innovation, protecting consumers, and ensuring financial stability.

2. Tether’s Withdrawal from the EU Market

In response to MiCA’s stringent compliance requirements, Tether chose to withdraw USDT from the EU market. This decision was expected to significantly impact USDT’s market share and stability but proved less disruptive than anticipated.

3. Delisting Concerns on European Exchanges

As European trading platforms began delisting USDT in late 2024, fears of a ripple effect in global markets emerged. However, USDT’s robust adoption in other regions mitigated these concerns.

USDT’s Resilience in the Face of Challenges

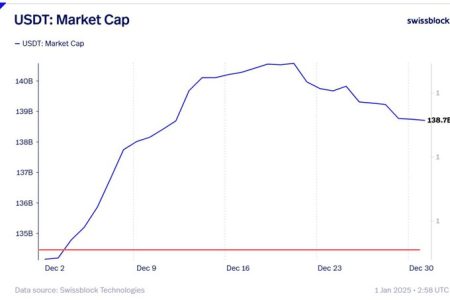

1. Maintaining Market Capitalization

Despite exiting the EU market, USDT’s market capitalization remained steady, reflecting its strong presence in other regions, particularly Asia and the Americas.

2. Dollar Peg Stability

Contrary to fears of de-pegging, USDT consistently maintained its 1:1 peg to the U.S. dollar, reinforcing investor confidence and its utility as a reliable stablecoin.

3. Strategic Diversification

Tether’s diversification strategy, including partnerships with non-EU trading platforms and adoption in emerging markets, played a key role in weathering regulatory challenges.

Why USDT Remains Resilient

1. Dominance in Non-EU Markets

USDT’s widespread adoption in countries outside the EU, such as the U.S., China, and Southeast Asia, has cushioned the impact of its withdrawal from Europe.

2. Use Cases Beyond Trading

USDT’s use cases extend beyond trading pairs on exchanges. It is extensively used for remittances, decentralized finance (DeFi), and cross-border transactions, contributing to its enduring demand.

3. Robust Reserve Management

Tether’s focus on transparency and reserve management has reassured investors about the stability of USDT, even under heightened scrutiny.

Implications of USDT’s Stability Amid EU Regulations

1. Reinforcing Market Trust

By maintaining its dollar peg and market cap, USDT has strengthened its reputation as a reliable stablecoin, even under adverse regulatory conditions.

2. Highlighting Regional Market Dynamics

The EU’s stringent stance has highlighted the importance of regional market dynamics. USDT’s stability demonstrates the crypto market’s resilience in adapting to diverse regulatory environments.

3. Encouraging Global Regulatory Engagement

Tether’s handling of MiCA’s challenges could encourage other stablecoin issuers to proactively engage with regulators and diversify their market presence.

Challenges Ahead for USDT

1. Increasing Regulatory Scrutiny

While MiCA is an EU-specific regulation, similar frameworks are being explored in other regions. Tether must continue to adapt to a rapidly evolving global regulatory landscape.

2. Competition from Emerging Stablecoins

With the rise of alternatives like USDC and government-backed Central Bank Digital Currencies (CBDCs), USDT faces increasing competition for market share.

3. Mitigating Perception Risks

Tether must address lingering market skepticism about its reserves and operational transparency to maintain investor trust.

Opportunities for USDT Post-MiCA

1. Strengthening Market Share in Emerging Economies

By focusing on underserved markets in Africa, South America, and Southeast Asia, USDT can capitalize on regions with growing crypto adoption.

2. Enhancing Partnerships in DeFi

The decentralized finance ecosystem remains a lucrative space for USDT, with opportunities to integrate into lending platforms, liquidity pools, and decentralized exchanges.

3. Advocating for Stablecoin Innovation

USDT can lead industry discussions on best practices for stablecoin innovation, including transparency, compliance, and technological advancements.

Conclusion

The resilience of USDT amid EU regulations highlights its pivotal role in the global crypto ecosystem. By maintaining its dollar peg and market cap despite delisting and withdrawal from the European market, USDT has demonstrated adaptability and strength. As regulatory frameworks like MiCA reshape the crypto landscape, Tether’s ability to navigate these challenges serves as a case study for stablecoin sustainability and innovation.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

[ad_2]

Source link