[ad_1]

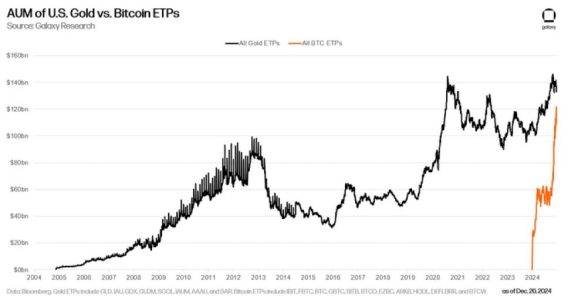

Spot Bitcoin ETF Assets Near Gold ETF Size Within a Year

The cryptocurrency market reached another significant milestone as spot Bitcoin ETFs nearly matched the size of gold ETFs, just one year after their debut. According to Nate Geraci, CEO of U.S.-based wealth management firm The ETF Store, this development underscores the rapid adoption of cryptocurrency as a mainstream asset class.

Bitcoin ETFs vs. Gold ETFs: A Quick Comparison

Gold has long been considered the ultimate store of value, with ETFs making it easily accessible to investors. However, Bitcoin’s rise as “digital gold” has accelerated its competition with traditional safe-haven assets.

1. Growth of Spot Bitcoin ETFs

- In just one year, spot Bitcoin ETFs have amassed billions in assets under management (AUM).

- The introduction of ETFs like BlackRock’s IBIT and Fidelity’s FBTC has made Bitcoin more accessible to institutional and retail investors.

2. Gold ETFs’ Established Dominance

- Gold ETFs, such as SPDR Gold Shares (GLD), have dominated for decades, with AUM consistently exceeding $100 billion globally.

- The near parity between Bitcoin and gold ETF assets reflects Bitcoin’s increasing credibility among traditional investors.

Key Drivers of Spot Bitcoin ETF Growth

1. Institutional Adoption

- High-profile financial institutions like BlackRock, Fidelity, and ARK Invest have introduced Bitcoin ETFs, attracting significant inflows.

- Institutional investors appreciate Bitcoin ETFs for their regulated structure and simplified exposure to cryptocurrency.

2. Retail Investor Participation

- Bitcoin ETFs simplify crypto investment for retail investors by eliminating the need for wallets, private keys, and direct custody.

- The ease of access through existing brokerage accounts has driven adoption.

3. Mainstream Acceptance of Bitcoin

- Bitcoin’s recognition as a legitimate asset has grown, bolstered by macroeconomic factors like inflation concerns and currency devaluation.

- Major corporations like Tesla and MicroStrategy adding Bitcoin to their balance sheets has further validated its appeal.

How Spot Bitcoin ETFs Compare to Gold ETFs

| Feature | Bitcoin ETFs | Gold ETFs |

|---|---|---|

| Age of Market | ~1 Year | ~20 Years |

| AUM Growth Rate | Rapid (Billions in 1 Year) | Steady (Billions over Decades) |

| Volatility | High | Low |

| Adoption Catalyst | Rising Institutional Participation | Historical Safe-Haven Asset |

| Future Potential | Blockchain and DeFi Integration | Established Stability |

Expert Opinions on Bitcoin ETFs vs. Gold ETFs

Nate Geraci, The ETF Store CEO

- Geraci highlights the swift rise of Bitcoin ETFs, stating they demonstrate “growing investor appetite for innovative, alternative assets.”

- He believes Bitcoin ETFs will likely surpass gold ETFs in size within the next few years if the current growth trajectory continues.

Peter Schiff, Gold Advocate

- Schiff remains skeptical, arguing that Bitcoin’s volatility and lack of intrinsic value make it unsuitable as a long-term store of value.

Cathie Wood, ARK Invest CEO

- Wood predicts that Bitcoin ETFs will continue to attract significant inflows, given Bitcoin’s capped supply and growing adoption.

Potential Challenges Ahead for Bitcoin ETFs

While the growth of spot Bitcoin ETFs is impressive, several hurdles remain:

- Regulatory Uncertainty

- Continued regulatory scrutiny in regions like the U.S. could hinder growth.

- Market Volatility

- Bitcoin’s price fluctuations may deter risk-averse investors.

- Competition from Alternatives

- Gold ETFs maintain a reputation for stability that Bitcoin ETFs lack.

What This Means for Investors

1. Diversification Opportunities

- Investors can consider allocating to both Bitcoin and gold ETFs to hedge against different types of market risk.

2. Short-Term Volatility vs. Long-Term Gains

- While Bitcoin ETFs offer higher potential returns, they come with greater short-term volatility compared to gold ETFs.

3. Growing Market Validation

- The rapid growth of Bitcoin ETFs underscores a shift in market sentiment toward cryptocurrencies, offering opportunities for forward-looking investors.

Conclusion

The near parity between spot Bitcoin ETF assets and gold ETFs marks a historic milestone in the financial markets, reflecting Bitcoin’s growing role as a mainstream asset. While challenges remain, the continued adoption of Bitcoin ETFs by institutional and retail investors signals a promising future.

As cryptocurrencies increasingly compete with traditional assets, the financial landscape is poised for significant transformation in the years to come.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

[ad_2]

Source link