[ad_1]

Ozonetel, an industry-leading provider of unified customer experience intelligence platform (oneCXi), has launched CXi Switch, a first-of-its-kind internet communication product that powers instant voice and digital conversations across all touchpoints, as an alternative to telecom channels.

While customers expect instant communication when interest is highest, enterprises struggle to deliver effective real-time engagement despite the surge in digital adoption through apps and websites. Almost 75% of these engagements still rely on telecom, often through delayed and out-of-context calls. This causes customers to lose interest, resulting in missed business opportunities. Tighter regulations and rising spam complaints further add to the friction in customer journeys.

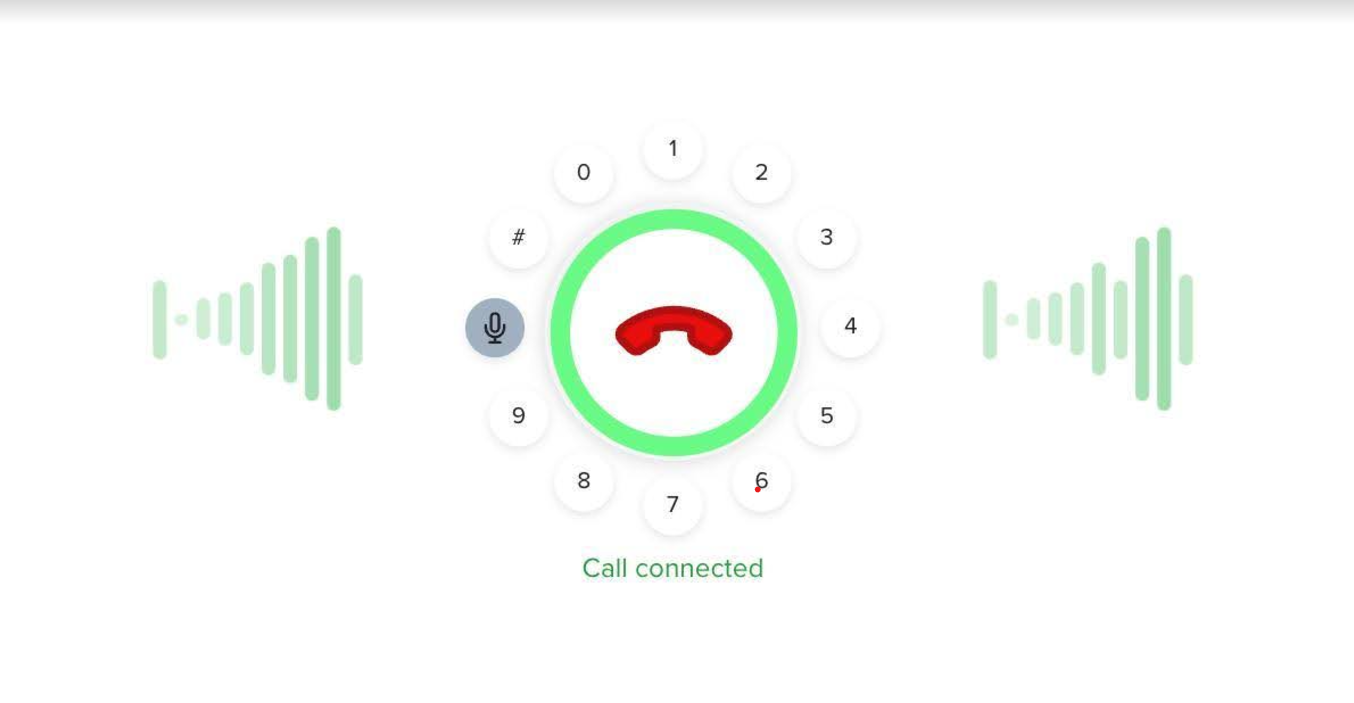

CXi Switch, the core routing engine of the oneCXi platform, drives instant one-click conversations between customers and businesses. A plug-and-play widget, it seamlessly integrates with apps, websites, online ads, newsletters, in-store displays, digital kiosks, and other touchpoints to power hassle-free voice and digital conversations across devices and form factors.

Using internet communication, CXi Switch empowers businesses to take full control of conversations across marketing, sales, and service, creating truly seamless journeys throughout the customer lifecycle. It delivers measurable outcomes with improved brand engagement, 4X higher conversions through contextual conversations and a 3X increase in lifetime value with improved retention.

“Ozonetel has significantly increased its strategic investments in AI to drive innovation in customer experience,” said Chaitanya Chokkareddy, Chief Technology Officer at Ozonetel. “With high-speed, cost-effective data now widely available, the market is primed for enterprises to leverage intelligent solutions like CXi Switch that drive customer interactions in newer ways and transform them into compelling experiences. This launch marks a major milestone in our mission to revolutionize CX with cutting-edge technology.”

In an exclusive conversation with ANI, Chaitanya added “We wanted to change the paradigm of business communication. People typically look for a phone number on a website or any digital property, then pick up the phone to call the organisation. Technology should be an enabler. With just one click, we can start instant conversations across customer touchpoints and deliver superior brand experience.“

[ad_2]

Source link