[ad_1]

Kalshi Expands U.S. Election Betting Markets with $144M in Volume

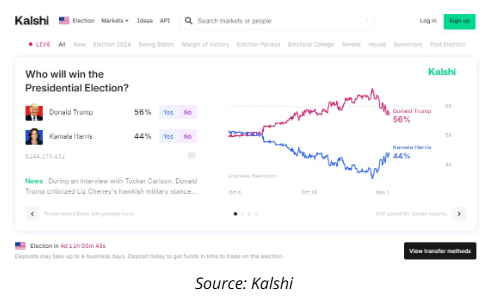

In a significant move within the prediction market landscape, Kalshi has expanded its U.S. election betting options ahead of the November 5, 2024 presidential election. The platform has introduced new political betting categories, including bets on individual state outcomes and the Associated Press’s final state call. Since its launch on October 7, Kalshi’s main market focused on the presidential race has amassed a substantial $144 million in volume, reflecting strong investor interest and engagement.

Introduction to Kalshi’s Expansion

Overview of the New Betting Options

Kalshi, a regulated prediction market platform, has broadened its offerings by adding diverse betting options related to the upcoming U.S. presidential election. These new markets allow users to place bets on specific state results and the final state determination by the Associated Press (AP). This expansion aims to provide a more granular and engaging betting experience, catering to users interested in both national and state-level election outcomes.

Significance of the $144 Million Volume

Since its inception, Kalshi’s primary market for the presidential race has seen a robust $144 million in betting volume. This impressive figure underscores the platform’s growing popularity and the increasing appetite for regulated prediction markets in the political arena. Kalshi’s approach offers a transparent and secure environment for bettors, distinguishing itself from less regulated competitors.

Comparison with Competitors

Polymarket’s Dominance in Election Betting

While Kalshi has achieved notable success, Polymarket, another prominent decentralized prediction platform, leads the market with an astonishing $2.9 billion in bets. Polymarket’s current odds favor Donald Trump at 61%, compared to Kalshi’s 56% for Trump over Kamala Harris at 44%. This disparity highlights the varying levels of market penetration and user trust between centralized and decentralized platforms.

Regulatory Environment and User Trust

Kalshi operates under stringent regulatory oversight, ensuring compliance with U.S. laws and providing a secure betting environment. In contrast, Polymarket’s decentralized nature, while offering greater accessibility, poses challenges related to regulatory compliance and user protection. Kalshi’s regulated framework may appeal more to institutional investors and users seeking a safer betting experience.

Current Betting Odds and Market Sentiment

Kalshi’s Betting Odds

Kalshi’s current odds position Donald Trump at 56% likelihood of winning the election, while Kamala Harris stands at 44%. These odds reflect user sentiment and the collective wisdom of the market participants, providing an aggregated forecast of the election outcome based on real-time betting activity.

Polymarket’s Betting Odds

On Polymarket, the odds for Donald Trump are slightly higher at 61%, indicating a stronger market confidence in his victory compared to Kalshi’s predictions. This difference may be attributed to Polymarket’s larger user base and higher liquidity, allowing for more significant bet sizes and potentially more accurate odds.

Implications for the Future of Political Betting Platforms

Growth Potential for Regulated Platforms

Kalshi’s success with $144 million in volume demonstrates the potential for regulated prediction markets to gain traction in the political betting sector. As more users seek reliable and legally compliant platforms, Kalshi is well-positioned to capitalize on this demand, potentially attracting more institutional investors and mainstream participants.

Impact on Decentralized Prediction Markets

The competitive landscape between regulated platforms like Kalshi and decentralized ones like Polymarket will shape the future of prediction markets. While decentralized platforms offer greater freedom and lower entry barriers, the regulatory and security assurances provided by platforms like Kalshi could drive a shift towards more compliant and trustworthy betting environments.

Expert Insights

Dr. Emily Carter, Blockchain Analyst

“Kalshi’s expansion into more granular election betting markets is a strategic move that aligns with the increasing demand for regulated prediction platforms. The substantial betting volume indicates strong user confidence, and Kalshi’s regulatory compliance sets a benchmark for the industry.”

Mark Thompson, Financial Strategist

“The contrast between Kalshi’s $144 million in volume and Polymarket’s $2.9 billion highlights the varied user preferences in the prediction market space. As regulatory frameworks become more defined, platforms like Kalshi could see accelerated growth by attracting users who prioritize security and compliance.”

Sarah Lee, Cryptocurrency Researcher

“Political betting platforms are evolving rapidly, and Kalshi’s success underscores the importance of trust and regulatory adherence. As these platforms innovate, they will play a crucial role in how market sentiment is gauged and how information is aggregated ahead of major political events.”

Future Outlook

Potential for Market Expansion

Kalshi is likely to continue expanding its betting options beyond the current state outcomes and AP’s final call. Future additions could include more specific electoral events, such as debates, voter turnout milestones, and other key election-related occurrences, enhancing user engagement and betting diversity.

Regulatory Developments

As prediction markets grow, regulatory bodies may introduce more comprehensive guidelines to ensure fair play and protect bettors. Kalshi’s proactive compliance measures position it well to adapt to future regulatory changes, maintaining its competitive edge.

Technological Innovations

Advancements in blockchain technology and data analytics will further enhance the accuracy and reliability of prediction markets. Kalshi could leverage these technologies to provide more sophisticated betting options and real-time insights, enriching the user experience and market intelligence.

Conclusion

Kalshi’s expansion of its U.S. election betting markets, achieving $144 million in volume since its launch, marks a significant milestone in the regulated prediction market sector. By introducing new betting options and maintaining a secure, compliant platform, Kalshi is poised to compete effectively with established players like Polymarket. The platform’s success highlights the growing demand for trustworthy and regulated betting environments, setting the stage for continued innovation and growth in the political prediction market landscape.

As the U.S. presidential election approaches, Kalshi’s enhanced offerings will provide bettors with more opportunities to engage with the election process, while also contributing to the broader discourse on the role of prediction markets in political forecasting. The interplay between user sentiment, regulatory frameworks, and technological advancements will continue to shape the future of platforms like Kalshi, driving the evolution of prediction markets in the years to come.

To stay updated on the latest developments in prediction markets and political betting platforms, explore our article on latest news, where we cover significant events and their impact on the digital asset ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

[ad_2]

Source link