[ad_1]

Short-Term Holders Offload $3.76B as BTC’s Price Falls Below $70K

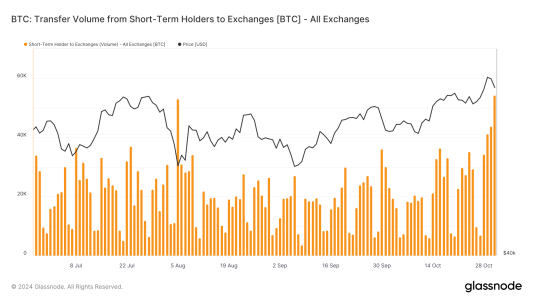

In a significant market movement, Bitcoin (BTC) experienced a substantial sell-off as short-term holders (STHs) offloaded 54,352 BTC, equivalent to approximately $3.76 billion, on October 31. According to data from Glassnode cited by Cointelegraph, this marks the largest single-day sell-off by STHs since April. The outflow coincided with BTC’s price dip below the $70,000 mark, following its proximity to all-time highs earlier in the month.

Introduction to the Sell-Off

Overview of the Event

On October 31, Bitcoin’s price fell below $70,000 after nearing its all-time peak, triggering a massive sell-off by short-term holders (STHs). These are wallets holding BTC for up to 155 days, indicating relatively recent investments. The outflow of 54,352 BTC represents a significant movement in the market, raising concerns about the sustainability of Bitcoin’s upward momentum and the profitability of short-term trading strategies.

Significance of the Largest Single-Day Sell-Off Since April

This sell-off is notable as it is the largest recorded since April, reflecting a shift in investor behavior and market sentiment. The substantial offloading by STHs suggests a reassessment of profit margins and risk tolerance among short-term investors, potentially signaling broader market trends.

Detailed Analysis of the Sell-Off

Reasons Behind the Massive Outflow

The sell-off by STHs is primarily attributed to shrinking profit margins. Glassnode’s Spent Output Profit Ratio (SOPR), a key indicator of profitability for holders, dropped from 1.04 on October 29 to below 1.01. An SOPR below 1 indicates that, on average, coins are being spent at a loss, suggesting diminishing profitability for short-term holders.

Impact of BTC’s Price Dip Below $70K

The drop below $70,000 acts as a psychological and technical barrier, triggering stop-loss orders and profit-taking strategies among STHs. This price level is critical, as it may influence future trading behavior and investor confidence.

Market Sentiment and Short-Term Investor Behavior

The sell-off reflects a cautious stance among short-term investors, who may be reacting to recent price volatility and uncertain market conditions. As profit margins decrease, the incentive to hold onto BTC diminishes, leading to increased selling activity.

Key Support Levels and Market Dynamics

CoinGlass’s Exchange Order Book Liquidity Data

CoinGlass identifies $68,000 as a key potential support level for BTC. This level is crucial for determining whether the price will stabilize and resume its upward trajectory or continue to face downward pressure.

Technical Indicators and Future Price Movements

- Bollinger Bands: BTC’s proximity to the upper Bollinger Band indicates overbought conditions, which often precede price corrections.

- Relative Strength Index (RSI): An RSI approaching 70 suggests that BTC may be overextended and due for a pullback.

- Moving Averages: Monitoring the 50-day and 200-day moving averages can provide insights into the long-term trend and potential support/resistance levels.

Implications for the Cryptocurrency Market

Enhanced Volatility and Investor Caution

The large-scale sell-off by STHs contributes to increased market volatility, making BTC a more unpredictable asset in the short term. Investors may adopt more cautious strategies, emphasizing risk management and diversification.

Potential Impact on Institutional Investments

Institutional investors, observing the behavior of STHs, might reassess their positions and strategies. While short-term sell-offs can present buying opportunities, they also indicate underlying market uncertainties that could influence institutional sentiment.

Broader Market Trends and Future Outlook

The sell-off by STHs may be indicative of a broader trend towards profit-taking and risk aversion among investors. As BTC approaches critical support levels, the market could see continued volatility until a clear direction is established.

Expert Opinions

Dr. Emily Carter, Blockchain Analyst

“The significant sell-off by short-term holders highlights the sensitivity of Bitcoin’s price to investor sentiment and market indicators like the SOPR. While this outflow may cause short-term volatility, it also presents a potential buying opportunity for long-term investors looking to capitalize on temporary price declines.”

Mark Thompson, Financial Strategist

“Short-term holders reacting to shrinking profit margins is a natural market behavior, especially in a highly volatile asset like Bitcoin. The drop below $70K could serve as a test for BTC’s resilience, and if the support at $68K holds, we might see a stabilization or even a new upward trend.”

Sarah Lee, Cryptocurrency Researcher

“The interplay between technical indicators and investor behavior is crucial in understanding Bitcoin’s price movements. The current sell-off by STHs underscores the importance of monitoring key support levels and market sentiment to anticipate future trends.”

Future Outlook

Monitoring Key Support Levels

Investors should closely monitor the $68K support level identified by CoinGlass. A successful hold above this level could signal a stabilization of BTC’s price, while a break below could lead to further declines.

Potential for Price Recovery

If BTC manages to stabilize and maintain support at $68K, it could pave the way for a recovery towards higher price targets. Factors such as increased institutional interest, positive regulatory developments, and advancements in blockchain technology could support this recovery.

Importance of Risk Management

Given the current volatility, investors should prioritize risk management strategies, including setting stop-loss orders, diversifying portfolios, and avoiding overexposure to highly volatile assets like Bitcoin.

Long-Term Trends and Market Maturity

The cryptocurrency market continues to mature, with increasing participation from institutional investors and the development of more sophisticated financial instruments. These trends could contribute to greater market stability and reduced volatility over the long term.

Conclusion

The $3.76 billion sell-off by short-term holders as Bitcoin’s price fell below $70K marks a significant event in the cryptocurrency market, signaling potential shifts in investor behavior and market sentiment. While the immediate impact is increased volatility and caution among investors, the broader implications point towards the importance of key support levels and the ongoing maturation of the cryptocurrency market.

As Bitcoin navigates these critical price levels, both short-term traders and long-term investors must remain vigilant, employing strategic risk management and staying informed about market developments. The interplay between technical indicators, investor sentiment, and broader market trends will continue to shape Bitcoin’s trajectory in the coming months.

To stay updated on the latest developments in cryptocurrency markets and investor behavior, explore our article on latest news, where we cover significant events and their impact on the digital asset ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

[ad_2]

Source link