Crptocurrency

Event Organizers Charged with Fraud for Allegedly Posing as ‘Satoshi’

In a startling development within the cryptocurrency community, Mr. Anderson and Stephen Mollah, organizers behind an event promoting the much-anticipated “Satoshi’s Identity Reveal” scheduled for October 31, 2024, have been charged with fraud. According to reports from cryptocurrency news outlet db on X (formerly Twitter), the individuals were recently released on bail after facing serious allegations of misrepresentation, with Mollah specifically accused of posing as Satoshi Nakamoto, the pseudonymous creator of Bitcoin.

Introduction to the Fraud Charges

Who are Mr. Anderson and Stephen Mollah?

Mr. Anderson and Stephen Mollah have been notable figures within the cryptocurrency space, primarily known for organizing events and projects that claim to advance or revolutionize Bitcoin. Over the years, they have been involved in various “Bitcoin 2.0” initiatives, promising enhancements and new functionalities to the original Bitcoin protocol. However, their recent activities have drawn legal scrutiny, culminating in fraud charges related to their attempts to unveil Satoshi Nakamoto’s true identity.

Overview of the Fraud Allegations

The core of the allegations against Mr. Anderson and Stephen Mollah revolves around their fraudulent representation of themselves as key figures in the Bitcoin community, with Mollah specifically impersonating Satoshi Nakamoto. This deception not only undermines the credibility of legitimate Bitcoin initiatives but also exploits the intrigue surrounding Bitcoin’s elusive creator for personal gain.

Details of the Fraudulent Activities

The “Satoshi’s Identity Reveal” Event

The event titled “Satoshi’s Identity Reveal” was marketed as a groundbreaking announcement that would finally disclose the true identity of Bitcoin’s creator. Promoted through various channels, including social media platforms and cryptocurrency forums, the event garnered significant attention and anticipation within the community. However, investigations revealed that Mollah falsely claimed to be Satoshi Nakamoto, leveraging the mysterious persona to attract participants and funding.

Legal Proceedings and Charges

Following an investigation by law enforcement agencies, Mr. Anderson and Stephen Mollah were charged with fraud for their deceptive practices. The charges include:

- Misrepresentation: Claiming to be associated with Satoshi Nakamoto and misleading the public about their identities.

- Fraudulent Promotion: Organizing events under false pretenses to solicit investments and participation.

- Identity Theft: Illegally assuming the identity of a real individual (Satoshi Nakamoto) to deceive others.

Both individuals were released on bail, with court dates set to address the severity of their actions and the potential impact on the cryptocurrency community.

Impact on the Cryptocurrency Community

Erosion of Trust

The fraudulent actions of Mr. Anderson and Stephen Mollah have significantly eroded trust within the cryptocurrency community. Trust is a cornerstone of decentralized financial systems, and such high-profile fraud cases can deter new investors and participants from engaging with legitimate projects.

Regulatory Implications

This case underscores the need for stringent regulatory oversight within the cryptocurrency sector. Regulators may implement more robust measures to prevent identity fraud and ensure that event organizers and project leaders maintain transparency and authenticity in their dealings.

Effect on Bitcoin’s Reputation

Bitcoin, as the leading cryptocurrency, relies heavily on its reputation for security and decentralization. Incidents like these can tarnish Bitcoin’s image, making it vulnerable to skepticism and reduced adoption among mainstream investors.

Similar Incidents and Patterns

History of Fraud in Cryptocurrency

The cryptocurrency space has seen numerous fraud cases over the years, ranging from Ponzi schemes to fake ICOs (Initial Coin Offerings). These incidents highlight the challenges in regulating a decentralized and rapidly evolving market.

Patterns of Identity Fraud

Impersonating influential figures or creating fictitious identities to gain trust and manipulate markets is a recurring theme in cryptocurrency fraud. The anonymity and borderless nature of digital currencies make them attractive for such deceptive practices.

Expert Opinions

Dr. Emily Carter, Blockchain Analyst

“The charges against Mr. Anderson and Stephen Mollah are a stark reminder of the vulnerabilities within the cryptocurrency ecosystem. As the market continues to grow, it is imperative that both regulators and community members remain vigilant to protect against fraudulent activities.”

Mark Thompson, Financial Strategist

“Identity fraud undermines the foundational principles of trust and transparency in blockchain technology. This case will likely prompt a reevaluation of how events and projects are vetted within the crypto space to prevent similar occurrences in the future.”

Sarah Lee, Cryptocurrency Researcher

“While decentralized systems offer numerous benefits, they also pose unique challenges in terms of security and accountability. Strengthening these aspects is crucial for the sustained growth and legitimacy of cryptocurrencies like Bitcoin.”

Legal and Regulatory Responses

Upcoming Court Proceedings

Mr. Anderson and Stephen Mollah are scheduled to appear in court to address the fraud charges. The outcomes of these proceedings will set precedents for how similar cases are handled in the future, potentially influencing regulatory frameworks.

Potential Regulatory Changes

In response to this incident, regulatory bodies may introduce stricter guidelines for event organizers and cryptocurrency projects. These could include:

- Identity Verification: Mandatory verification processes for individuals representing themselves as key figures in crypto projects.

- Transparency Requirements: Clear disclosure of organizers’ backgrounds and affiliations to prevent misinformation.

- Penalties for Fraud: Enhanced penalties for fraudulent activities to deter potential offenders.

Implications for Future Crypto Projects

Enhanced Due Diligence

Crypto projects and event organizers will need to implement more rigorous due diligence processes to verify the authenticity of individuals and ensure the legitimacy of their initiatives. This could involve third-party audits and transparent disclosure of project details.

Community Vigilance

The cryptocurrency community must remain vigilant and skeptical of sensational claims, especially those that promise significant revelations or breakthroughs. Educating users about the risks of fraud and promoting best practices for verifying information can help mitigate such threats.

Strengthening Security Measures

Implementing advanced security measures, such as decentralized identity verification and blockchain-based authentication, can enhance the integrity of crypto projects and protect against identity fraud.

Conclusion

The fraud charges against Mr. Anderson and Stephen Mollah for allegedly posing as Satoshi Nakamoto highlight significant challenges within the cryptocurrency ecosystem. As the community grapples with the implications of this case, it becomes increasingly clear that robust regulatory frameworks, enhanced security measures, and heightened community vigilance are essential for safeguarding the integrity and trust that underpin the crypto market.

As the court proceedings unfold, stakeholders across the cryptocurrency landscape will closely monitor the developments, seeking to reinforce the principles of transparency and authenticity that are vital for the continued growth and adoption of digital assets.

To stay updated on the latest developments in cryptocurrency fraud and regulatory measures, explore our article on latest news, where we cover significant events and their impact on the digital asset ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

Altcoin Season Index Rises to 34, Indicating Continued Bitcoin Dominance

What the Altcoin Season Index Tells Us About Market Trends

The Altcoin Season Index is a helpful tool for investors, analysts, and crypto enthusiasts seeking to understand the balance of power between Bitcoin and altcoins in the market. By excluding stablecoins and wrapped tokens, the index provides a focused view of the performance of traditional altcoins, offering insights into market sentiment and capital flow.

During “Bitcoin Season,” investors tend to favor Bitcoin over other assets, resulting in increased Bitcoin dominance. Conversely, “Altcoin Season” is characterized by a shift in investor sentiment toward alternative cryptocurrencies, with at least 75% of the top 100 coins outperforming Bitcoin. Historically, Altcoin Season often follows periods of significant Bitcoin price growth, as investors begin to seek opportunities for higher returns in smaller, often more volatile, altcoins.

The current score of 34 indicates that while some altcoins are performing well, Bitcoin remains the most sought-after asset. This trend suggests that market participants are still cautious about diversifying heavily into altcoins, likely due to Bitcoin’s perceived stability and appeal as a store of value.

Understanding Bitcoin Season vs. Altcoin Season

Bitcoin Season and Altcoin Season reflect investor preferences within the cryptocurrency market, influenced by various economic, regulatory, and market conditions. Here’s how each season typically unfolds:

- Bitcoin Season: This occurs when Bitcoin outperforms most altcoins. Investors turn to Bitcoin for its stability, liquidity, and security. This often happens during periods of macroeconomic uncertainty or when Bitcoin itself is experiencing strong upward momentum. During Bitcoin Season, the Altcoin Season Index typically registers lower scores, reflecting a market skewed towards Bitcoin dominance.

- Altcoin Season: Defined by a higher Altcoin Season Index score (above 75), Altcoin Season occurs when most top altcoins outperform Bitcoin. Altcoin Season tends to attract investors looking for high-risk, high-reward opportunities, as altcoins often exhibit more volatility and potential for rapid gains. Historically, Altcoin Seasons have been fueled by periods of exuberance in the market, where speculation and interest in new, innovative projects reach peak levels.

With the index score currently at 34, the market is clearly in Bitcoin Season, as Bitcoin has outperformed the majority of altcoins over the past three months. This shift toward Bitcoin may be influenced by recent macroeconomic developments, regulatory changes, and evolving market sentiment.

Factors Contributing to Bitcoin’s Current Dominance

Several factors may be contributing to Bitcoin’s strong performance relative to altcoins, maintaining the market in Bitcoin Season:

- Macroeconomic Stability: In times of economic uncertainty, Bitcoin is often viewed as a more stable asset within the crypto space. As a decentralized and limited-supply asset, Bitcoin has earned a reputation as a hedge against inflation and economic instability. This appeal may drive investors toward Bitcoin rather than altcoins, which are generally considered riskier.

- Institutional Adoption: Bitcoin’s established position and institutional acceptance have bolstered its credibility. Major financial institutions and corporations have shown interest in Bitcoin, viewing it as a long-term investment. This growing institutional involvement provides stability to Bitcoin’s market and attracts investors who might otherwise avoid cryptocurrencies altogether.

- Regulatory Clarity: Bitcoin has faced fewer regulatory uncertainties than some altcoins, making it a safer option for risk-averse investors. While many altcoins are still under scrutiny by regulators, Bitcoin’s status as a decentralized digital asset has generally been accepted, giving it an advantage in terms of regulatory clarity.

- Market Sentiment and Safety: When investor sentiment shifts towards caution, there is often a “flight to safety” in the cryptocurrency market. This flight typically benefits Bitcoin, as it is perceived as a safer asset compared to more speculative altcoins. During periods of uncertainty, investors may choose to hold Bitcoin over other cryptocurrencies due to its perceived resilience and stability.

The Road Ahead: Could Altcoin Season Return?

Despite Bitcoin’s current dominance, Altcoin Season could still make a return, particularly if market conditions shift in favor of altcoins. Historically, Altcoin Season has followed periods of sustained Bitcoin growth, as investors seek alternative opportunities for high returns. Several conditions could facilitate the emergence of Altcoin Season, including:

- New Project Launches and Innovations: The launch of innovative altcoins with real-world use cases could drive investor interest toward altcoins, especially in sectors like decentralized finance (DeFi), gaming, and artificial intelligence. If these projects gain traction, they could outperform Bitcoin and push the market closer to Altcoin Season.

- Lower Bitcoin Volatility: If Bitcoin’s price stabilizes following a period of rapid growth, investors might look to altcoins for higher returns. Lower volatility in Bitcoin could lead to an increased appetite for risk among investors, driving capital into altcoins.

- Increased Market Liquidity: Higher liquidity in the crypto market, potentially driven by institutional participation, could make it easier for altcoins to experience sustained price growth. As liquidity increases, altcoins might benefit from the influx of capital and improved trading conditions.

- Positive Regulatory Developments for Altcoins: Should regulators adopt clearer guidelines or positive policies for altcoins, investor confidence could increase, creating favorable conditions for an Altcoin Season.

While Bitcoin currently dominates the market, the cyclical nature of the cryptocurrency space means that an Altcoin Season could still be on the horizon, especially if conditions align to favor alternative digital assets.

Conclusion

The Altcoin Season Index’s rise to 34 reflects a market that remains in Bitcoin Season, with Bitcoin outperforming most top altcoins over the past 90 days. This trend highlights investor preference for Bitcoin amid macroeconomic stability concerns, regulatory clarity, and market sentiment that favors the perceived safety of the leading cryptocurrency.

As market conditions evolve, an eventual shift to Altcoin Season could occur, especially if innovative projects and favorable regulatory changes attract capital toward altcoins. For now, however, Bitcoin remains at the center of attention, solidifying its role as the market leader in the cryptocurrency space.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on the latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Crptocurrency

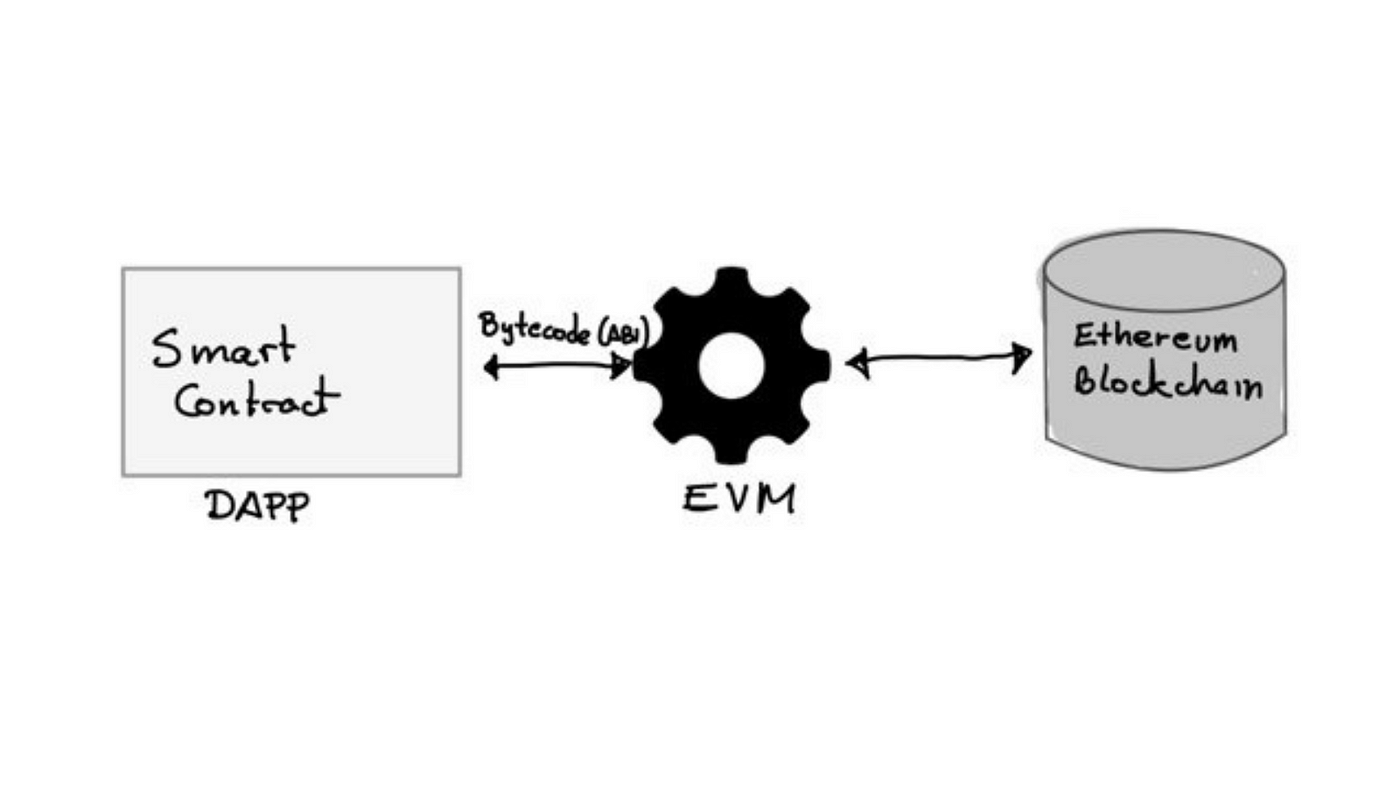

A Guide to The Ethereum Virtual Machine (EVM)

Crptocurrency

South Korea’s Financial Regulator to Strengthen Oversight on Trump-Related Stocks and Crypto Volatility

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency8 months ago

Crptocurrency8 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016