[ad_1]

Imagine stepping into a room filled with lifelike robots that resemble a person. Now picture these humanoids engaging in meaningful conversations, expressions and thoughts with uncanny accuracy.

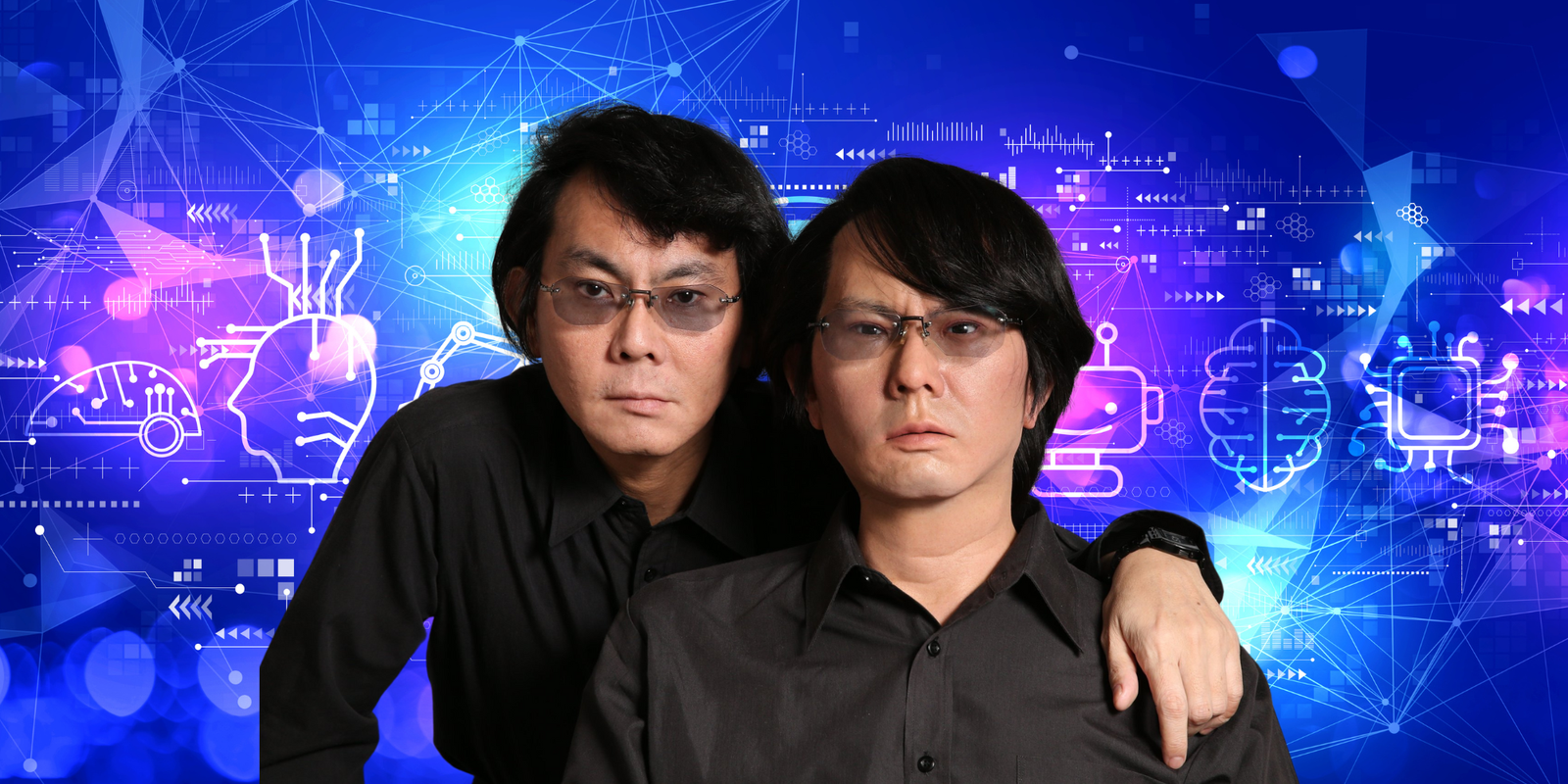

This is the reality brought to life by Hiroshi Ishiguro, a Japanese inventor who has taken the art of robotics to new heights by creating 6 clones of himself!

As these humanoid robots challenge our understanding of artificial intelligence and human interaction, they also prompt us to reflect on a serious question: Are we ready for a future where machines can so closely resemble us? Let’s explore Ishiguro’s groundbreaking work and what it means for our society!

Hiroshi Ishiguro: The man behind 6 robotic clones

Hiroshi Ishiguro is no stranger to the field of robotics and is a professor at Osaka University. His previous creations include androids that closely resemble human beings, but his latest project takes this concept to a whole new level.

Meet Geminoid HI-6, also known as Hiroshi’s newest clone robot. It is currently on display at Osaka University. However, it’s not just a mere showpiece; it can also replicate Ishiguro’s facial expressions, engage in conversations, and answer questions like its creator.

According to Ishiguro, Geminoid HI-6 knows 10 books written by the creator including media interviews and is equipped with a Large Language Model (LLM). This level of realism is a testament to the advancements in AI and robotics, raising the bar for what we expect from machines in terms of interaction and response.

The only problem is that this clone robot cannot walk despite being equipped with advanced features and a realistic facial design.

Key features of Geminoid HI-6

The robotic clone measures 50 cm in height and 25 cm in width, and it features a generic adult male voice. Its skin is made from silicone, giving it a strikingly human-like appearance. This android is powered by an external supply and is equipped with 16 pneumatic actuators, providing it with various movements.

It has a plastic head and a metal skeleton, as stated by Ishiguro’s lab. The implications of such technology extend far beyond research; they could revolutionise fields like customer service, education, and even therapy.

Are we ready for humanoids?

Imagine a world where robots assist us and mimic our behaviours so closely that it’s hard to tell them apart from actual humans. Today we are already noticing the deep impacts of AI bots like ChatGPT 4o that mimic human-like emotions.

While Ishiguro’s robotic clones showcase astonishing technological advancements, but they also push us to confront deep ethical and societal dilemmas.

Are we truly prepared to engage with machines that can replicate our responses and emotions? The most intriguing question is about the emotional connections we might form with such robots. Additionally, as humanoid robots continue to advance, their impact on the job market is undeniable.

What if all customer service roles or teaching positions are filled by robots? This shift poses a pressing challenge: how do we incorporate these innovations without leaving our workforce in the dust?

Society will need to navigate this intricate balance, ensuring that humans continue to play a vital role even as machines become increasingly capable. The journey ahead will surely be intriguing, but it demands careful consideration of both the benefits and its potential risks.

The takeaway

Hiroshi Ishiguro’s robotic clones serve as a fascinating glimpse into the future of robotics and artificial intelligence. As we continue to push the boundaries of what is possible, it is crucial to remain vigilant about the implications of our creations. The question isn’t just whether we can create such machines, but whether we should—and how we can coexist with them in a rapidly changing world.

[ad_2]

Source link