Startup

Ford’s CEO Drives a Xiaomi EV and Can’t Get Enough: What This Means for Global EV Competition?

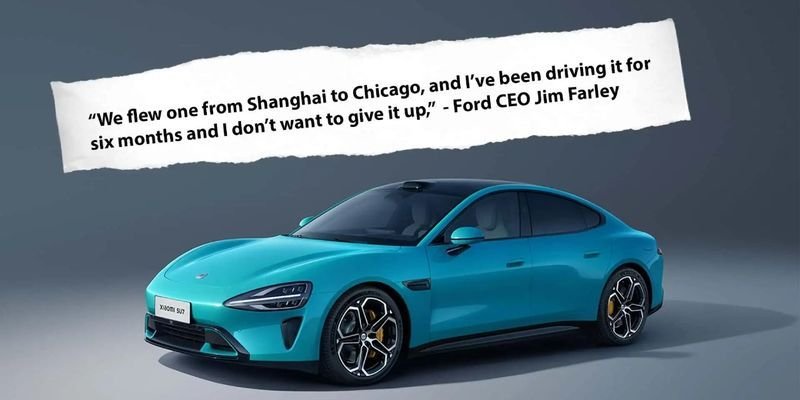

Jim Farley, Ford’s CEO, has recently shared his unusual yet impactful automotive choice—he’s been driving a Xiaomi EV, specifically the SU7, for over half a year, and he’s not eager to switch back. Known for his keen insights and pioneering spirit, Farley’s endorsement of the Xiaomi vehicle has drawn attention to China’s booming EV industry. This move is more than a personal preference; it symbolises the rising influence of Chinese EVs on global markets and highlights the potential disruption they pose to established automotive giants.

The Xiaomi SU7: A ‘Techy’ Twist on Traditional EVs

Xiaomi’s SU7, the company’s debut electric vehicle, is a sedan that marries Xiaomi’s tech heritage with the rigor of automotive engineering. It’s available in three models: the SU7, SU7 Pro, and SU7 Max, all of which come with Xiaomi’s signature minimalist design and smart integration, positioning the brand not just as a carmaker but as a lifestyle innovator. Priced around $30,000 in China, the vehicle brings a suite of technological features, making it particularly appealing to younger, tech-driven consumers. But the real shocker is that Xiaomi’s tech-savvy user base has embraced the SU7 so fully that the car is sold out six months in advance, with demand climbing monthly.

Farley’s Perspective: A Glimpse into the Future of EVs

Farley’s choice to import and test-drive the SU7 is part of his broader strategy to keep a close eye on competitors. His admiration for the car, which he calls an “industry juggernaut,” underscores Xiaomi’s strength as a consumer electronics brand transitioning seamlessly into the EV market. In an interview on The Fully Charged Podcast, Farley elaborated that the car is “fantastic” and has sold impressively since launch, with Xiaomi producing and selling between 10,000 and 20,000 units monthly. This demand underscores a shift in consumer expectations as technology and connectivity become integral to modern cars.

Behind the Wheel: What Makes the SU7 Stand Out

Xiaomi’s approach with the SU7 emphasises affordability, connectivity, and convenience, showcasing the brand’s deep understanding of what today’s car buyers value. The SU7’s in-car technology is comparable to advanced smartphone features, with smart device compatibility, intuitive navigation, and adaptive controls that appeal to a tech-focused audience. Xiaomi is able to harness its deep experience in consumer electronics, applying insights from the smartphone market to develop a vehicle that feels familiar to its customers.

Though the car is competitively priced, Xiaomi’s EV division reported a significant quarterly loss of $252 million, translating to about $9,200 per unit sold. Xiaomi’s leadership sees this as a necessary cost, a “loss leader” strategy, to establish itself in the EV market. The company has emphasised that scaling production and achieving cost efficiencies will be key to future profitability. As Xiaomi expands its production capacity, it aims to balance profitability with its aggressive market capture strategy.

Chinese EV Market: The “Existential Threat” to Western Brands

Farley’s comments extend beyond his admiration for Xiaomi’s vehicle. He has called the rise of China’s EV sector an “existential threat” to Western automotive brands. With China now accounting for a significant portion of the global EV market, it’s no surprise that automakers worldwide are feeling the pressure. According to ABI Research, Chinese brands captured a stunning 88% of Brazil’s EV market and 70% in Thailand in Q1 2024 alone, revealing a shift in global EV leadership that might be hard for legacy automakers to compete with.

Breaking Down the Specs For You “Car Nerds”: Xiaomi SU7

To round out the details on this highly-touted vehicle, here’s a look at the specs that have garnered it such demand:

- Variants: SU7, SU7 Pro, SU7 Max

- Pricing: Starting around $30,000 (INR 25,22,199)

- Battery & Range: Lithium-ion battery with an estimated range of 400–500 km depending on the variant.

- Performance: Acceleration from 0-100 km/h in approximately 6.5 seconds (Pro and Max variants).

- Features: Advanced in-car tech, smartphone integration, intelligent navigation, adaptive cruise control, and Xiaomi’s unique ecosystem integration.

- Production: Limited to China currently, but expansion is in the works to meet the surging demand.

The Road Ahead: What Farley’s Decision Signals for Ford

Ford, meanwhile, is grappling with its own challenges as it redefines its EV strategy. The company recently adjusted its approach, scaling back on planned electric SUVs in favor of hybrid models due to declining demand. In light of its second-quarter earnings miss and a costly $1.14 billion loss from its EV segment, Ford is looking at a leaner, more strategic approach moving forward. Farley’s experience with the SU7 offers insights into how future Ford models might need to adapt, drawing inspiration from Xiaomi’s efficient, tech-driven designs.

Startup

Northern Arc secures $65M debt commitment for maiden climate fund

Northern Arc has raised $65 million in debt commitments for its maiden Climate Fund, through its fund management arm, Northern Arc Investments IFSC Trust.

The debt commitments include $50 million from the United States International Development Finance Corp (DFC) and $15 million from the official Development Bank of the Republic of Austria, OeEB, it said in a statement on Thursday.

The non-banking financial institution’s (NBFC) fund aims to address critical funding gaps of growth stage startups in the solar energy, e-mobility, sustainable agriculture, and circular economy spaces.

“The significant investment from DFC and OeEB reinforces our ongoing commitment to revolutionise climate finance and transform the financial landscape for all households and businesses in India. By channelling these funds into green projects across our focus sectors of MSME, affordable housing, vehicle finance, agriculture finance, microfinance, and consumer finance, we aim to create a cascading effect that promotes sustainable development,” said Ashish Mehrotra, Managing Director and CEO, Northern Arc.

In October, the company launched its performing credit AIF fund (Category II), ‘Finserv Fund’, through its subsidiary Northern Arc Investment Managers (NAIM).

The fund aims to raise a target corpus of Rs 1,500 crore, including a greenshoe option of Rs 500 crore.

Northern Arc has assets under management (AUM) worth Rs 15,121 crore through its balance sheets and active AIF funds, as of September 30. It is backed by investors such as Sumitomo Mitsui Banking Corporation, LeapFrog, and 360 ONE, among others.

Startup

PhysicsWallah’s losses widen FY24 as rising expenses overshadow 2.6X revenue growth

Edtech unicorn PhysicsWallah (PW) saw its losses widen significantly in FY 2023-24, fueled by a sharp rise in employee benefit costs and other expenditures, casting a shadow over a 2.6-fold increase in operating revenue.

The Noida-based company also revised its FY 2022-23 figures, now reporting a loss of Rs 84.1 crore, in contrast to the Rs 8.9 crore profit previously stated in its earlier consolidated financial statements.

The heavy losses come on the back of the edtech company’s rapid expansion over the past couple of years. PW, which initially focused on the test-prep segment, has rapidly diversified its educational offerings over the past few years to encompass everything—from school education to skills training—casting its learning net over a wide base of learners.

PW’s rapid expansion comes amid a turbulent period for BYJU’S, once the leading edtech platform and the poster child of the Indian startup ecosystem.

The Alakh Pandey-led firm reported a consolidated loss of Rs 1,131.3 crore in FY24, up 13.5X from Rs 84.1 crore recorded in the earlier fiscal period.

The reported losses were impacted by non-cash adjustments, such as Compulsorily Convertible Preference Shares (CCPS) amounting to Rs 756 crore, according to the company. This CCPS expense is recorded in relation to the buyback clause provided in the issued CCPS, based on the conversion of accounting standards from IGAAP to INDAS, it added.

After excluding the non-cash adjustment, the company’s actual cash losses come to approximately Rs 375 crore, up 4.4X.

The company had remained the only profitable edtech firm until FY22, while steadily growing its top line.

Its operating revenue surged 160.7%, touching Rs 1,940.4 crore in FY24 compared to Rs 744.3 crore in FY23, as per its recent consolidated financial statements.

The startup’s total income reached Rs 2,015.1 crore, up 160.8% increase year-on-year (YoY).

For context, BYJU’S surpassed the Rs 2,000 crore revenue mark in FY20 and Eruditus in FY23, while PW achieved this milestone in its fourth year of operations. BYJU’S was incorporated in 2011, Eruditus in 2010, and PW in 2020.

Meanwhile, the company’s expenses surged by 280.4% to Rs 3,279.1 crore in FY24 compared with Rs 862 crore in FY23.

The sharp rise in expenses was driven by employee benefits, the firm’s second-largest cost centre, which jumped to Rs 1,159 crore—a 180.9% YoY.

Its other expenses surged by 442.4% YoY to Rs 1,660 crore, including a significant increase in miscellaneous expenses, which rose by 755.9% to Rs 1,452.7 crore.

Interestingly, PW also reduced its advertising and promotional expenses by 39.9%, although these still accounted for the company’s second-largest expense, totalling Rs 37.3 crore in FY24 compared with Rs 62.1 crore in FY23.

PW has experienced impressive growth, however, sustainable growth and profitability are essential, and it must navigate its own challenges as it expands.

Earlier this year, PW Co-founder Prateek Maheshwari told YourStory that FY24 was the year of “growth,” while FY25 is the year of “sustainable growth,” as PW aims to return to a profitable path.

“We have bounced back this year, with the first two quarters being EBITDA profitable for the first time in our company’s history,” he added. EBITDA, or earnings before interest, taxes, depreciation and amortisation, is a measure of core operational efficiency.

While the profitability metric for FY25 cannot be determined due to the transition from I-GAAP to Ind-AS, this fiscal year is expected to be the highest in absolute EBITDA profitability since inception, according to Maheshwari.

I-GAAP (Indian Generally Accepted Accounting Principles) refers to the traditional accounting standards used in the country, while Ind-AS (Indian Accounting Standards) is a set of accounting standards aligned with IFRS (International Financial Reporting Standards) for greater transparency and consistency.

In September, PW raised $210 million in a Series B funding round led by investment firm Hornbill Capital, with a sizable participation from venture capital firm Lightspeed Venture Partners. This was a significant milestone given the scarcity of substantial deals in India’s edtech sector lately.

With the latest funding round, PW’s post-money valuation has soared to $2.8 billion, making it the third-most valued edtech firm, trailing only Unacademy ($3.4 billion) and Eruditus ($3.2 billion), based on their last valuations.

Startup

RenewBuys pares FY24 losses by 40% amid merger reports

D2C Consulting Services, the parent company of digital insurance startup RenewBuy, pared its losses by 42% to Rs 114.44 crore in FY24 from Rs 197.19 crore in the previous year.

The online insurance aggregator clocked 40% rise in operating revenue to Rs 394.40 crore from Rs 280.75 crore in FY23, according to a filing made with the Registrar of Companies.

D2C Consulting Services is reportedly in talks with its larger peer InsuranceDekho for a potential merger in a cash-and-stock deal. The combined entity is expected to be valued over Rs 8,000 crore, with RenewBuy valued at about Rs 3,000 crore.

The RenewBuy platform offers comparison for motor, health and life insurance. Its total expenses rose 8% to Rs 524.24 crore, mainly driven by higher interest payments and other expenses.

RenewBuy is valued at $364 million according to the data available on data intelligence platform Tracxn. It last raised $40 million in a Series D round from Dai-ichi Life Holdings in July 2023.

The startup was founded in 2016 by Balachander Sekhar and Indraneel Chatterjee. RenewBuy plans to expand beyond India, especially in the Asian markets.

Its peer PolicyBazaar, a unit of listed entity PB Fintech, reported a 43.81% year-over-year jump in operational revenue at Rs 1,167 crore in Q2. During the same period, it clocked a profit after tax of Rs 51 crore, marking a turnaround from a loss of Rs 21.11 crore incurred in the corresponding year-ago period.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories12 months ago

Startup Stories12 months agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency8 months ago

Crptocurrency8 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016