Crptocurrency

BlackRock’s U.S. Spot Bitcoin ETF Hits Record $30B AUM in 293 Days

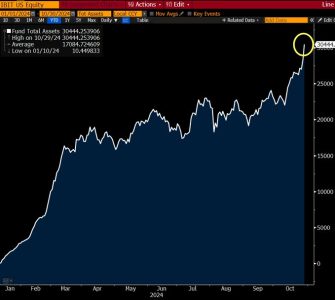

In a historic achievement for exchange-traded funds (ETFs), BlackRock’s U.S. spot Bitcoin ETF (ticker: IBIT) has surpassed $30 billion in assets under management (AUM) in just 293 days, setting a new record for ETF growth. This milestone, reported by Bloomberg’s senior ETF analyst Eric Balchunas on X (formerly Twitter), significantly outpaces the previous fastest-growing ETFs, including JPMorgan’s JEPI, which reached $30 billion in 1,272 days, and GLD, which achieved the same in 1,790 days.

Introduction to BlackRock’s Spot Bitcoin ETF

Who is BlackRock?

BlackRock is the world’s largest asset manager, overseeing trillions of dollars in assets across various investment vehicles. Known for its extensive range of ETFs and mutual funds, BlackRock has a significant influence on global financial markets. The launch of its spot Bitcoin ETF, IBIT, marks a pivotal moment in the mainstream adoption of cryptocurrencies within regulated financial products.

Overview of IBIT’s Rapid Growth

Since its inception, BlackRock’s IBIT has demonstrated exceptional growth, achieving $30 billion in AUM within 293 days. This rapid ascent highlights the strong investor demand for regulated cryptocurrency investment products and underscores BlackRock’s capability to attract substantial capital quickly.

Factors Driving IBIT’s Rapid Growth

Institutional Adoption

A significant portion of IBIT’s AUM is driven by institutional investors seeking exposure to Bitcoin within a regulated framework. Institutions prefer ETFs like IBIT for their compliance with regulatory standards, providing a secure and transparent way to invest in Bitcoin without directly holding the cryptocurrency.

Regulatory Approval and Trust

BlackRock’s spot Bitcoin ETF benefits from stringent regulatory approvals, enhancing investor trust and confidence. The SEC’s approval of IBIT signaled a broader acceptance of Bitcoin as a legitimate asset class, encouraging more investors to allocate funds to the ETF.

Market Sentiment and Bitcoin Performance

Positive market sentiment surrounding Bitcoin’s price movements has contributed to the ETF’s rapid growth. As Bitcoin approaches new price milestones and demonstrates resilience against market volatility, investor confidence in holding Bitcoin through ETFs like IBIT increases.

Diversification and Risk Management

IBIT offers investors a way to diversify their portfolios with Bitcoin, which is often seen as a hedge against inflation and traditional financial market fluctuations. The ETF structure allows for easier integration of Bitcoin into diversified investment strategies, attracting a broad range of investors.

Comparison with Other Leading ETFs

JPMorgan’s JEPI

JPMorgan’s JEPI took 1,272 days to reach $30 billion in AUM. While JEPI is focused on equity income strategies, its slower growth compared to IBIT highlights the unique appeal and high demand for cryptocurrency-based ETFs in the current market environment.

GLD

GLD, the SPDR Gold Shares ETF, reached $30 billion in AUM in 1,790 days. Gold has long been considered a safe-haven asset, but the accelerated growth of IBIT underscores the increasing prominence of Bitcoin as a comparable digital store of value.

Implications for the Cryptocurrency Market

Enhanced Liquidity and Stability

The influx of $30 billion into IBIT significantly enhances liquidity in the Bitcoin market. Increased liquidity can lead to more stable price movements, reducing volatility and making Bitcoin a more attractive asset for both retail and institutional investors.

Increased Mainstream Acceptance

BlackRock’s achievement with IBIT paves the way for greater mainstream acceptance of Bitcoin and other cryptocurrencies. The success of a major asset manager’s Bitcoin ETF legitimizes digital assets in the eyes of traditional investors and financial institutions.

Competitive Landscape

The rapid growth of IBIT intensifies competition among asset managers to offer cryptocurrency-based investment products. Other financial giants may accelerate their own cryptocurrency ETF launches to capture a share of the growing market demand.

Expert Opinions

Dr. Emily Carter, Blockchain Analyst

“BlackRock’s IBIT reaching $30 billion in just 293 days is a testament to the growing institutional appetite for Bitcoin within regulated investment vehicles. This milestone not only validates Bitcoin’s role as a significant asset class but also sets a benchmark for future cryptocurrency ETFs.”

Mark Thompson, Financial Strategist

“The unprecedented growth of BlackRock’s spot Bitcoin ETF highlights the shifting dynamics in asset management. Investors are increasingly seeking exposure to digital assets, and ETFs like IBIT provide a secure and compliant avenue to do so. This trend is likely to accelerate as more institutions recognize the benefits of including Bitcoin in their portfolios.”

Sarah Lee, Cryptocurrency Researcher

“IBIT’s rapid ascent underscores the importance of regulatory approval in driving investor confidence. BlackRock’s ability to secure substantial AUM so quickly demonstrates that there is significant demand for cryptocurrency investments within the traditional financial framework. This could lead to a surge in similar offerings from other major asset managers.”

Future Outlook

Continued Growth Potential

With Bitcoin’s price trajectory remaining positive and institutional interest unwavering, IBIT is well-positioned to continue its growth. BlackRock may explore additional offerings or related products to capitalize on the strong demand for cryptocurrency ETFs.

Expansion of Cryptocurrency ETFs

The success of IBIT is likely to inspire other asset managers to launch their own cryptocurrency-based ETFs. This could lead to a more diversified and competitive market, offering investors a variety of options to gain exposure to digital assets.

Regulatory Developments

Ongoing regulatory developments will play a crucial role in shaping the future of cryptocurrency ETFs. Continued clarity and support from regulatory bodies can further boost investor confidence and facilitate the launch of more innovative investment products.

Impact on Bitcoin’s Price

The substantial investment in IBIT can have a bullish impact on Bitcoin’s price, as increased demand from institutional investors drives the cryptocurrency’s market value higher. Additionally, the legitimacy provided by a major asset manager’s ETF can attract new investors, further fueling price growth.

Conclusion

BlackRock’s U.S. spot Bitcoin ETF (IBIT) achieving $30 billion in assets under management within just 293 days marks a historic milestone in the cryptocurrency investment landscape. This rapid growth, driven by strong institutional adoption, regulatory approval, and positive market sentiment, positions IBIT as a leading vehicle for Bitcoin investment. Outperforming major ETFs like JPMorgan’s JEPI and GLD, IBIT sets a new standard for cryptocurrency-based investment products, signaling a significant shift towards the mainstream acceptance of digital assets.

As BlackRock continues to leverage its expertise and resources, the success of IBIT is likely to inspire further innovation and competition within the ETF market, driving the broader adoption of Bitcoin and other cryptocurrencies among institutional and retail investors alike.

To stay updated on the latest developments in cryptocurrency ETFs and market trends, explore our article on latest news, where we cover significant events and their impact on the digital asset ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

52% of Bitcoin Trader Go Long the BTC Price and this Emerging Altcoin Expecting a Violent Move Upward

Crptocurrency

Top CoinMarketCap Altcoins Listing for the Post US Election Rally: PCHAIN, Trump47, Baby Maga

Crptocurrency

XRP Price Projection: Possible 11% Decline Causes Investors To Move Into AI Coin For 17,000% ROI In 28 Days

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency8 months ago

Crptocurrency8 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016