Crptocurrency

Bitcoin Touches $73K on Verge of Breaking All-Time High Price

Bitcoin (BTC) continues its impressive upward trajectory, recently touching the $73,000 mark. According to CoinNess Market Monitoring, this achievement marks the first time Bitcoin has entered the $73,000 range since reaching its record price of $73,777 on March 14, based on Binance trading data. Currently, Bitcoin is approximately 1% away from breaking its all-time-high (ATH) unit price. As of the latest update, Bitcoin is trading at $72,916 on the Binance BTC/USDT trading pair, reflecting a significant increase of 5.74%.

Introduction to Bitcoin’s Price Surge

Historic Milestone

Bitcoin’s recent performance signals a strong bullish sentiment within the cryptocurrency market. Breaking into the $73,000 range, even briefly, demonstrates renewed investor confidence and heightened trading activity. This surge comes after a period of consolidation and indicates potential momentum towards reaching a new ATH.

Market Context

The cryptocurrency market has been volatile, with Bitcoin often leading the charge in terms of price movements. The current rally is supported by various macroeconomic factors, technological advancements, and increasing institutional interest in digital assets.

Factors Driving Bitcoin’s Upward Trend

Macroeconomic Influences

- Inflation Hedge: Amid rising inflation concerns globally, Bitcoin is increasingly viewed as a hedge against currency devaluation. Its limited supply and decentralized nature make it an attractive alternative to traditional fiat currencies.

- Monetary Policies: Central banks’ accommodative monetary policies, including low-interest rates and quantitative easing, have injected liquidity into the markets, some of which flows into Bitcoin as investors seek higher returns.

Institutional Investment

Institutional investors are playing a crucial role in Bitcoin’s price appreciation. Increased participation from hedge funds, pension funds, and large-scale investment firms adds significant buying pressure, driving prices higher.

Technological Developments

Advancements in Bitcoin’s infrastructure, including improvements in scalability and transaction efficiency, enhance its utility and appeal. Layer-2 solutions like the Lightning Network are making Bitcoin transactions faster and cheaper, encouraging more widespread adoption.

Regulatory Clarity

Positive regulatory developments and increased clarity around cryptocurrency regulations in major markets provide a more secure environment for investors. Clearer guidelines reduce uncertainty and attract more participants to the market.

Expert Opinions

Dr. Emily Carter, Blockchain Analyst

“Bitcoin’s recent surge to $73K is a testament to its enduring value proposition as digital gold. With institutional backing and favorable macroeconomic conditions, Bitcoin is well-positioned to reach new heights in the near future.”

Mark Thompson, Financial Strategist

“The convergence of inflationary pressures and Bitcoin’s finite supply is creating a perfect storm for bullish sentiment. As more institutions allocate funds to Bitcoin, we can expect continued upward momentum.”

Sarah Lee, Cryptocurrency Researcher

“Technological improvements and regulatory advancements are removing barriers to Bitcoin adoption. This, coupled with increasing institutional interest, sets the stage for Bitcoin to potentially break its all-time high.”

Implications for the Cryptocurrency Market

Increased Market Confidence

Bitcoin nearing its ATH boosts overall market confidence, attracting more retail and institutional investors. This positive sentiment can lead to broader market gains and increased participation across various digital assets.

Ripple Effect on Altcoins

Bitcoin’s bullish trend often has a cascading effect on altcoins. As Bitcoin strengthens, investors may seek opportunities in other cryptocurrencies, driving up prices and trading volumes across the board.

Enhanced Liquidity

Higher trading volumes and increased liquidity make the cryptocurrency market more efficient. Enhanced liquidity reduces price volatility and facilitates smoother transactions for large investors and institutions.

Future Outlook

Potential to Reach New ATH

With Bitcoin only 1% away from its ATH, the momentum suggests that a breakout could be imminent. Continued positive sentiment, coupled with ongoing macroeconomic support, may propel Bitcoin beyond the $73,777 mark.

Monitoring Key Indicators

Investors should keep an eye on key indicators such as institutional inflows, macroeconomic data, and regulatory developments. These factors will play a critical role in determining Bitcoin’s ability to sustain its upward trajectory.

Long-Term Sustainability

While short-term gains are promising, the long-term sustainability of Bitcoin’s price will depend on its adoption as a mainstream financial asset, continued technological advancements, and the ability to navigate regulatory landscapes effectively.

Conclusion

Bitcoin’s recent climb to $73,000 marks a significant milestone as it edges closer to breaking its all-time high. Driven by favorable macroeconomic conditions, increasing institutional investment, and ongoing technological advancements, Bitcoin demonstrates strong potential for continued growth. As the cryptocurrency market evolves, Bitcoin remains at the forefront, embodying the intersection of digital innovation and financial resilience.

To stay updated on the latest developments in Bitcoin’s price movements and cryptocurrency trends, explore our article on latest news, where we cover significant events and their impact on the digital asset ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

Altcoin Season Index Rises to 34, Indicating Continued Bitcoin Dominance

What the Altcoin Season Index Tells Us About Market Trends

The Altcoin Season Index is a helpful tool for investors, analysts, and crypto enthusiasts seeking to understand the balance of power between Bitcoin and altcoins in the market. By excluding stablecoins and wrapped tokens, the index provides a focused view of the performance of traditional altcoins, offering insights into market sentiment and capital flow.

During “Bitcoin Season,” investors tend to favor Bitcoin over other assets, resulting in increased Bitcoin dominance. Conversely, “Altcoin Season” is characterized by a shift in investor sentiment toward alternative cryptocurrencies, with at least 75% of the top 100 coins outperforming Bitcoin. Historically, Altcoin Season often follows periods of significant Bitcoin price growth, as investors begin to seek opportunities for higher returns in smaller, often more volatile, altcoins.

The current score of 34 indicates that while some altcoins are performing well, Bitcoin remains the most sought-after asset. This trend suggests that market participants are still cautious about diversifying heavily into altcoins, likely due to Bitcoin’s perceived stability and appeal as a store of value.

Understanding Bitcoin Season vs. Altcoin Season

Bitcoin Season and Altcoin Season reflect investor preferences within the cryptocurrency market, influenced by various economic, regulatory, and market conditions. Here’s how each season typically unfolds:

- Bitcoin Season: This occurs when Bitcoin outperforms most altcoins. Investors turn to Bitcoin for its stability, liquidity, and security. This often happens during periods of macroeconomic uncertainty or when Bitcoin itself is experiencing strong upward momentum. During Bitcoin Season, the Altcoin Season Index typically registers lower scores, reflecting a market skewed towards Bitcoin dominance.

- Altcoin Season: Defined by a higher Altcoin Season Index score (above 75), Altcoin Season occurs when most top altcoins outperform Bitcoin. Altcoin Season tends to attract investors looking for high-risk, high-reward opportunities, as altcoins often exhibit more volatility and potential for rapid gains. Historically, Altcoin Seasons have been fueled by periods of exuberance in the market, where speculation and interest in new, innovative projects reach peak levels.

With the index score currently at 34, the market is clearly in Bitcoin Season, as Bitcoin has outperformed the majority of altcoins over the past three months. This shift toward Bitcoin may be influenced by recent macroeconomic developments, regulatory changes, and evolving market sentiment.

Factors Contributing to Bitcoin’s Current Dominance

Several factors may be contributing to Bitcoin’s strong performance relative to altcoins, maintaining the market in Bitcoin Season:

- Macroeconomic Stability: In times of economic uncertainty, Bitcoin is often viewed as a more stable asset within the crypto space. As a decentralized and limited-supply asset, Bitcoin has earned a reputation as a hedge against inflation and economic instability. This appeal may drive investors toward Bitcoin rather than altcoins, which are generally considered riskier.

- Institutional Adoption: Bitcoin’s established position and institutional acceptance have bolstered its credibility. Major financial institutions and corporations have shown interest in Bitcoin, viewing it as a long-term investment. This growing institutional involvement provides stability to Bitcoin’s market and attracts investors who might otherwise avoid cryptocurrencies altogether.

- Regulatory Clarity: Bitcoin has faced fewer regulatory uncertainties than some altcoins, making it a safer option for risk-averse investors. While many altcoins are still under scrutiny by regulators, Bitcoin’s status as a decentralized digital asset has generally been accepted, giving it an advantage in terms of regulatory clarity.

- Market Sentiment and Safety: When investor sentiment shifts towards caution, there is often a “flight to safety” in the cryptocurrency market. This flight typically benefits Bitcoin, as it is perceived as a safer asset compared to more speculative altcoins. During periods of uncertainty, investors may choose to hold Bitcoin over other cryptocurrencies due to its perceived resilience and stability.

The Road Ahead: Could Altcoin Season Return?

Despite Bitcoin’s current dominance, Altcoin Season could still make a return, particularly if market conditions shift in favor of altcoins. Historically, Altcoin Season has followed periods of sustained Bitcoin growth, as investors seek alternative opportunities for high returns. Several conditions could facilitate the emergence of Altcoin Season, including:

- New Project Launches and Innovations: The launch of innovative altcoins with real-world use cases could drive investor interest toward altcoins, especially in sectors like decentralized finance (DeFi), gaming, and artificial intelligence. If these projects gain traction, they could outperform Bitcoin and push the market closer to Altcoin Season.

- Lower Bitcoin Volatility: If Bitcoin’s price stabilizes following a period of rapid growth, investors might look to altcoins for higher returns. Lower volatility in Bitcoin could lead to an increased appetite for risk among investors, driving capital into altcoins.

- Increased Market Liquidity: Higher liquidity in the crypto market, potentially driven by institutional participation, could make it easier for altcoins to experience sustained price growth. As liquidity increases, altcoins might benefit from the influx of capital and improved trading conditions.

- Positive Regulatory Developments for Altcoins: Should regulators adopt clearer guidelines or positive policies for altcoins, investor confidence could increase, creating favorable conditions for an Altcoin Season.

While Bitcoin currently dominates the market, the cyclical nature of the cryptocurrency space means that an Altcoin Season could still be on the horizon, especially if conditions align to favor alternative digital assets.

Conclusion

The Altcoin Season Index’s rise to 34 reflects a market that remains in Bitcoin Season, with Bitcoin outperforming most top altcoins over the past 90 days. This trend highlights investor preference for Bitcoin amid macroeconomic stability concerns, regulatory clarity, and market sentiment that favors the perceived safety of the leading cryptocurrency.

As market conditions evolve, an eventual shift to Altcoin Season could occur, especially if innovative projects and favorable regulatory changes attract capital toward altcoins. For now, however, Bitcoin remains at the center of attention, solidifying its role as the market leader in the cryptocurrency space.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on the latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Crptocurrency

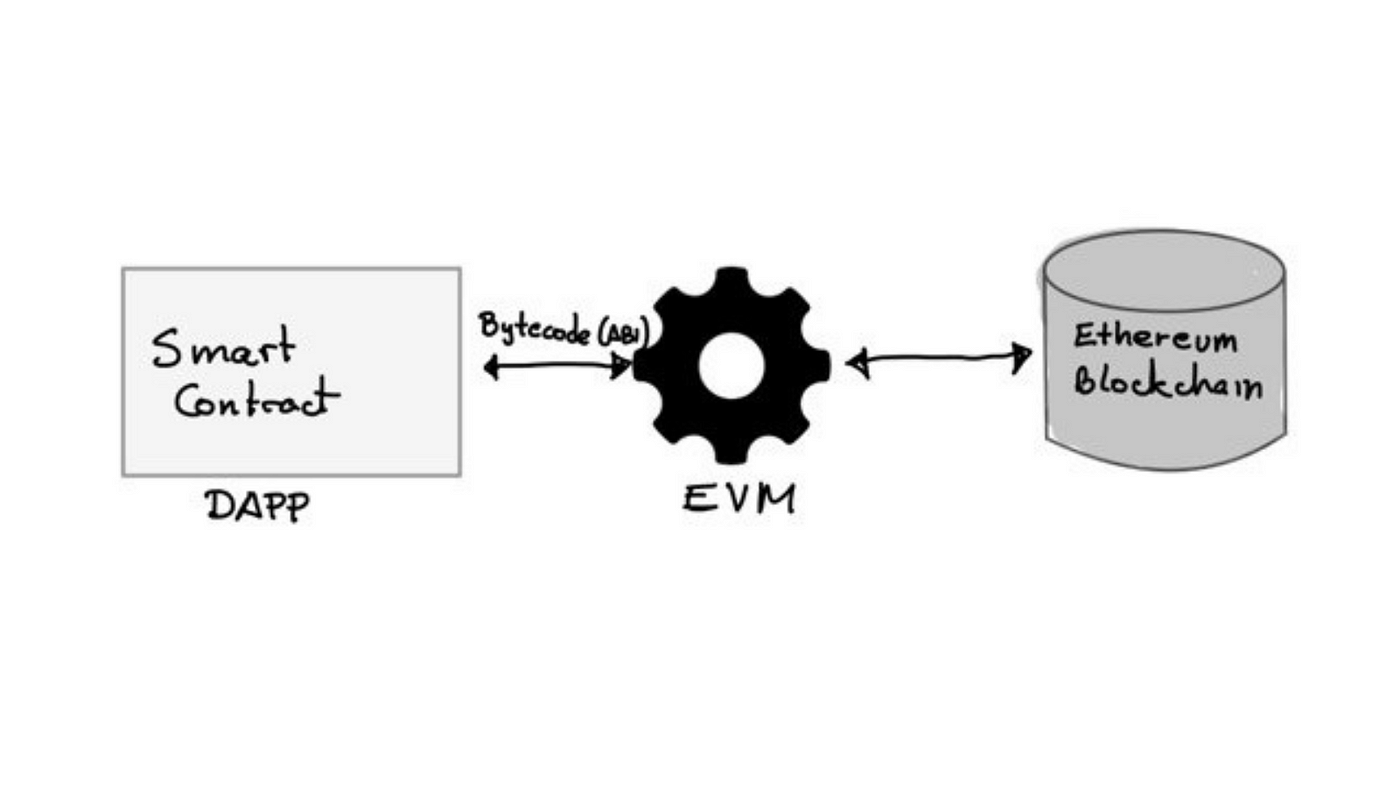

A Guide to The Ethereum Virtual Machine (EVM)

Crptocurrency

South Korea’s Financial Regulator to Strengthen Oversight on Trump-Related Stocks and Crypto Volatility

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency8 months ago

Crptocurrency8 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016