Crptocurrency

Student Coin Announces Comprehensive STC Token Redemption Following Operational Shutdown

New York, United States of America, October 29th, 2024, Chainwire

Student Coin, an educational crypto project established in 2019, has initiated a structured token redemption process following the decision to wind down its primary operations. This move aims to protect the interests of STC token holders as the team transitions its focus towards new ventures.

Originally launched by undergraduates from Kozminski University in Warsaw, Poland, Student Coin began as a student-focused initiative designed to explore blockchain applications in academia. The project quickly expanded, reaching over 15,000 students at more than 500 universities by the end of 2020. Throughout its development, Student Coin introduced various products, including the STC Wallet, STC Terminal, STC Academy, and Coinpaper, which supported blockchain education and fostered community engagement.

Following the success of its 2021 STC Launchpad, the project experienced continued growth, culminating in a user base of over 200,000. However, as the crypto market evolved, the team faced challenges ranging from legal obstacles and university resistance to the collapse of major exchanges, all of which impacted its operational outlook.

Challenges and Strategic Reassessment

Despite significant milestones, Student Coin encountered mounting difficulties in achieving its goals. Efforts to scale the STC Wallet as a multi-functional exchange faced legal risks and the collapse of exchanges like FTX forced a rethink. Attempts to expand the STC Terminal were met with resistance from institutions wary of token-based applications. By 2023, it became evident that scaling $STC to meet its desired utility and market value was increasingly difficult.

After careful consideration, the Student Coin team opted to phase out products such as the STC Terminal, STC Academy, and other initiatives. This decision reflects the company’s intention to act responsibly by redeeming $STC tokens instead of continuing with limited prospects for growth.

The decision was made to distribute all remaining project funds between token holders, ensuring that through winding down the token, everyone receives fair compensation based on their individual situation.

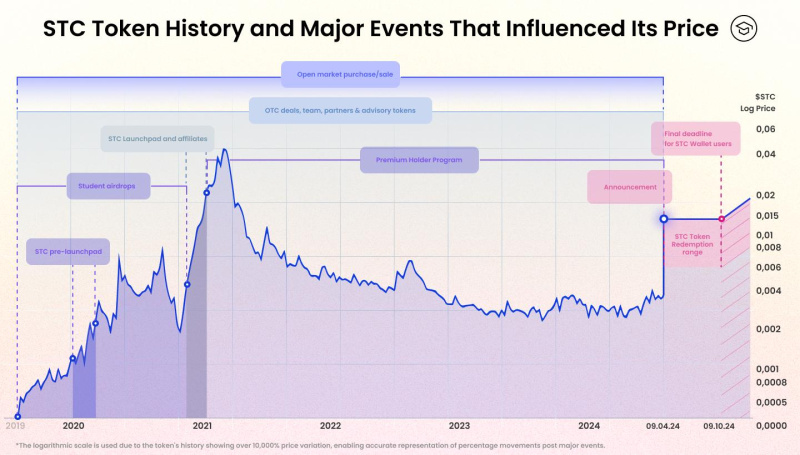

The established redemption prices range between $0.006 and $0.0137 per STC Token and are tailored to individual user profiles. Factors such as purchase price, purchase date, token holdings, and participation in programs like the Premium Program influence the final redemption value. This tiered system rewards those who have been with the project from the start and actively engaged with the Student Coin ecosystem.

Image: STC token’s historical price index along with the major events affecting its fluctuations.

STC Token Redemption Process

Student Coin’s token redemption program began on April 9, 2024, with an initial window for STC Wallet users that closed on June 9. An additional deadline for redeeming tokens via redemption request on October 9, 2024, marks the closure of the STC Wallet, while on-chain token holders have time until April 9, 2029, to redeem their tokens. This extended timeline accommodates the shutdown of on-chain support and ensures ample opportunity for token holders to complete the redemption process.

On-chain holders can transfer tokens to a designated burn address. Users should expect a processing time of up to three months to receive the USDC back to the address.

Keep in mind that USDC can only be sent to the address that burned $STC. Users cannot receive USDC at any other address. Furthermore, it is extremely important to remember that users cannot send $STC to the burn address directly from an exchange, as they would lose all of their funds.

Read the detailed on-chain burn procedure.

About Student Coin

Founded in 2019 by a group of university students in Warsaw, Poland, Student Coin sought to harness blockchain technology for educational and community-building purposes. Initially targeting students and academia, the project grew to encompass a global community of over 200,000 users and introduced products such as the STC Wallet, STC Terminal, STC Academy, and Coinpaper. Focused on accessible blockchain education and tokenized solutions, Student Coin rapidly expanded to more than 500 universities worldwide. As the project winds down, the team remains committed to supporting the community through a comprehensive token redemption program and plans to pursue new initiatives in the crypto media sector.

For more information, please visit StudentCoin.org.

Contact

Coinpaper

contact@coinpaper.com

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

Altcoin Season Index Rises to 34, Indicating Continued Bitcoin Dominance

What the Altcoin Season Index Tells Us About Market Trends

The Altcoin Season Index is a helpful tool for investors, analysts, and crypto enthusiasts seeking to understand the balance of power between Bitcoin and altcoins in the market. By excluding stablecoins and wrapped tokens, the index provides a focused view of the performance of traditional altcoins, offering insights into market sentiment and capital flow.

During “Bitcoin Season,” investors tend to favor Bitcoin over other assets, resulting in increased Bitcoin dominance. Conversely, “Altcoin Season” is characterized by a shift in investor sentiment toward alternative cryptocurrencies, with at least 75% of the top 100 coins outperforming Bitcoin. Historically, Altcoin Season often follows periods of significant Bitcoin price growth, as investors begin to seek opportunities for higher returns in smaller, often more volatile, altcoins.

The current score of 34 indicates that while some altcoins are performing well, Bitcoin remains the most sought-after asset. This trend suggests that market participants are still cautious about diversifying heavily into altcoins, likely due to Bitcoin’s perceived stability and appeal as a store of value.

Understanding Bitcoin Season vs. Altcoin Season

Bitcoin Season and Altcoin Season reflect investor preferences within the cryptocurrency market, influenced by various economic, regulatory, and market conditions. Here’s how each season typically unfolds:

- Bitcoin Season: This occurs when Bitcoin outperforms most altcoins. Investors turn to Bitcoin for its stability, liquidity, and security. This often happens during periods of macroeconomic uncertainty or when Bitcoin itself is experiencing strong upward momentum. During Bitcoin Season, the Altcoin Season Index typically registers lower scores, reflecting a market skewed towards Bitcoin dominance.

- Altcoin Season: Defined by a higher Altcoin Season Index score (above 75), Altcoin Season occurs when most top altcoins outperform Bitcoin. Altcoin Season tends to attract investors looking for high-risk, high-reward opportunities, as altcoins often exhibit more volatility and potential for rapid gains. Historically, Altcoin Seasons have been fueled by periods of exuberance in the market, where speculation and interest in new, innovative projects reach peak levels.

With the index score currently at 34, the market is clearly in Bitcoin Season, as Bitcoin has outperformed the majority of altcoins over the past three months. This shift toward Bitcoin may be influenced by recent macroeconomic developments, regulatory changes, and evolving market sentiment.

Factors Contributing to Bitcoin’s Current Dominance

Several factors may be contributing to Bitcoin’s strong performance relative to altcoins, maintaining the market in Bitcoin Season:

- Macroeconomic Stability: In times of economic uncertainty, Bitcoin is often viewed as a more stable asset within the crypto space. As a decentralized and limited-supply asset, Bitcoin has earned a reputation as a hedge against inflation and economic instability. This appeal may drive investors toward Bitcoin rather than altcoins, which are generally considered riskier.

- Institutional Adoption: Bitcoin’s established position and institutional acceptance have bolstered its credibility. Major financial institutions and corporations have shown interest in Bitcoin, viewing it as a long-term investment. This growing institutional involvement provides stability to Bitcoin’s market and attracts investors who might otherwise avoid cryptocurrencies altogether.

- Regulatory Clarity: Bitcoin has faced fewer regulatory uncertainties than some altcoins, making it a safer option for risk-averse investors. While many altcoins are still under scrutiny by regulators, Bitcoin’s status as a decentralized digital asset has generally been accepted, giving it an advantage in terms of regulatory clarity.

- Market Sentiment and Safety: When investor sentiment shifts towards caution, there is often a “flight to safety” in the cryptocurrency market. This flight typically benefits Bitcoin, as it is perceived as a safer asset compared to more speculative altcoins. During periods of uncertainty, investors may choose to hold Bitcoin over other cryptocurrencies due to its perceived resilience and stability.

The Road Ahead: Could Altcoin Season Return?

Despite Bitcoin’s current dominance, Altcoin Season could still make a return, particularly if market conditions shift in favor of altcoins. Historically, Altcoin Season has followed periods of sustained Bitcoin growth, as investors seek alternative opportunities for high returns. Several conditions could facilitate the emergence of Altcoin Season, including:

- New Project Launches and Innovations: The launch of innovative altcoins with real-world use cases could drive investor interest toward altcoins, especially in sectors like decentralized finance (DeFi), gaming, and artificial intelligence. If these projects gain traction, they could outperform Bitcoin and push the market closer to Altcoin Season.

- Lower Bitcoin Volatility: If Bitcoin’s price stabilizes following a period of rapid growth, investors might look to altcoins for higher returns. Lower volatility in Bitcoin could lead to an increased appetite for risk among investors, driving capital into altcoins.

- Increased Market Liquidity: Higher liquidity in the crypto market, potentially driven by institutional participation, could make it easier for altcoins to experience sustained price growth. As liquidity increases, altcoins might benefit from the influx of capital and improved trading conditions.

- Positive Regulatory Developments for Altcoins: Should regulators adopt clearer guidelines or positive policies for altcoins, investor confidence could increase, creating favorable conditions for an Altcoin Season.

While Bitcoin currently dominates the market, the cyclical nature of the cryptocurrency space means that an Altcoin Season could still be on the horizon, especially if conditions align to favor alternative digital assets.

Conclusion

The Altcoin Season Index’s rise to 34 reflects a market that remains in Bitcoin Season, with Bitcoin outperforming most top altcoins over the past 90 days. This trend highlights investor preference for Bitcoin amid macroeconomic stability concerns, regulatory clarity, and market sentiment that favors the perceived safety of the leading cryptocurrency.

As market conditions evolve, an eventual shift to Altcoin Season could occur, especially if innovative projects and favorable regulatory changes attract capital toward altcoins. For now, however, Bitcoin remains at the center of attention, solidifying its role as the market leader in the cryptocurrency space.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on the latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Crptocurrency

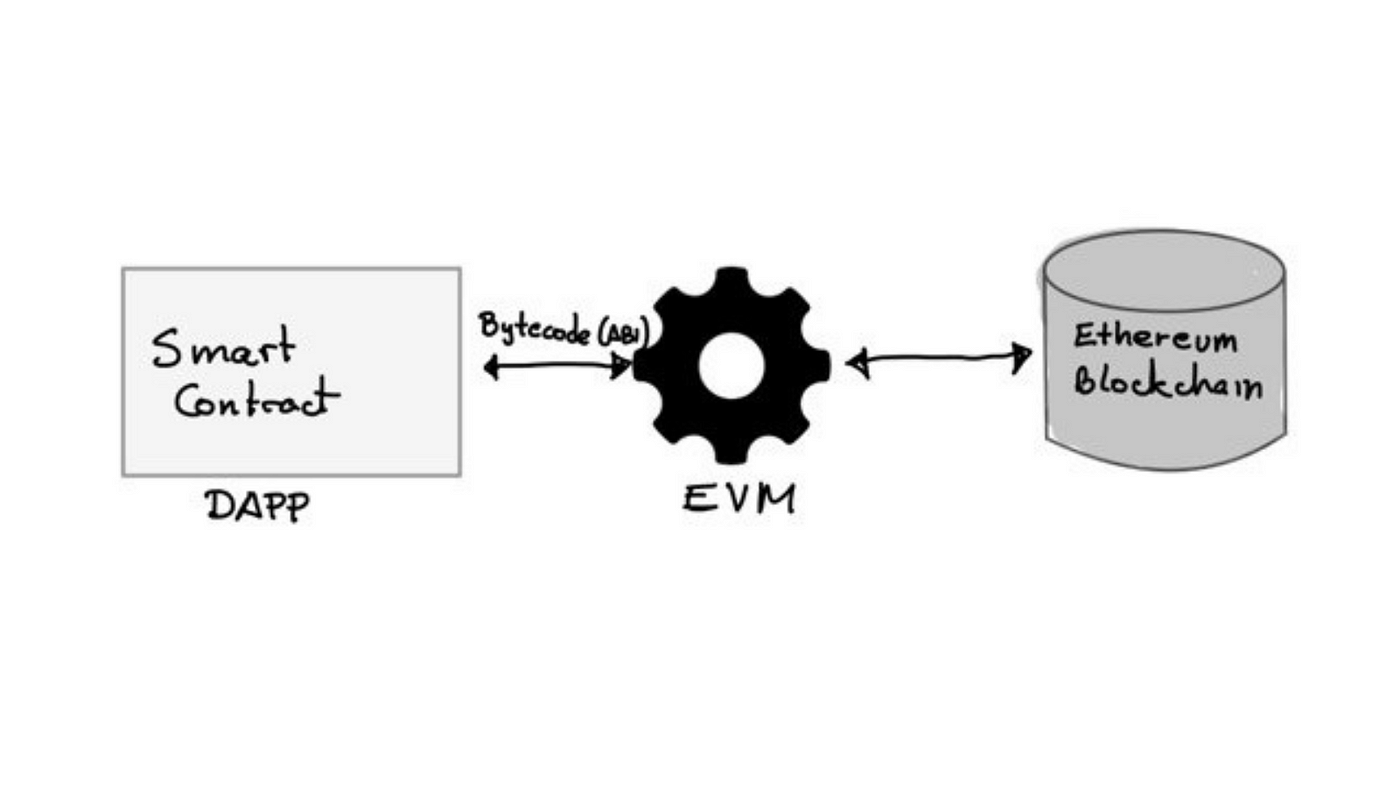

A Guide to The Ethereum Virtual Machine (EVM)

Crptocurrency

South Korea’s Financial Regulator to Strengthen Oversight on Trump-Related Stocks and Crypto Volatility

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency8 months ago

Crptocurrency8 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016