Crptocurrency

Liquidity.io to launch with over a Billion in LOIs in Alternative Investments after ARQ Securities receives its Digital Alternative Trading System (ATS) License

Whitefish, Montana, October 29th, 2024, Chainwire

ARQ Securities is pleased to announce it has received its Digital Alternative Trading System (ARQ Securities ATS) and is launching the platform on Liquidity.io [today October 29th, 2024].

Liquidity.io is a cutting-edge platform designed to revolutionize the trading and settlement of private credit and private stock for accredited and institutional investors. It took nearly three years of extensive software development while acquiring all necessary regulatory approvals to finally take the platform live. Additionally, the Liquidity Transfer Agency bridges transactions to public blockchains like Solana, Polygon, and soon Avalanche.

“The approval of our digital ATS license is a monumental step forward in our mission to transform the private markets,” said Eric Choi, CEO of ARQ Securities. “Liquidity.io will provide institutional and accredited investors with unprecedented access to Private Assets that are hard to trade and settle. We are going to set a new standard for efficiency and liquidity in credit and private stock. We’re excited to launch with over a billion dollars in Letters of Intent from key industry players and look forward to growing our pipeline of assets in 2025.”

“Liquidity.io creates a seamless and secure environment for trading private assets,” added Ram Praturi, VP of Engineering at Liquidity.io. “By bridging our Liquidity Transfer Agency to Solana, Polygon, and soon Avalanche, we’re ensuring transparency, interoperability, and flexibility for our issuers and investors.”

ThinkEnergy Debuts as Liquidity.io’s Inaugural Issuance: A Milestone in Sustainable Energy Investments

With its groundbreaking refining technology that reduces CO2 emissions by 50%, ThinkEnergy exemplifies our commitment to investments that offer financial returns while positively impacting the global energy landscape. This opportunity allows investors to join ThinkEnergy’s transformative mission toward a more sustainable and efficient energy sector.

Focus on Private Credit and Private Stock

Liquidity.io will initially concentrate on two key asset classes: private credit and private stock, offering institutional and accredited investors a streamlined and transparent way to trade these traditionally illiquid assets. The private credit market has seen significant growth, driven by investors seeking higher yields and diversification. However, the lack of standardized processes and limited transparency have been persistent challenges. Liquidity.io aims to address these issues by leveraging its digital platform to document and automate the trading and settlement processes, thereby reducing operational complexity and improving liquidity.

Strategic Partnerships and Advanced Technology

Over the past year, ARQ Securities has forged strategic partnerships with players in the private credit and private equity sectors, collecting over a billion dollars in Letters of Intent to list on the platform, including:

- Leading private credit originators with significant portfolios, who have committed to listing their assets on Liquidity.io.

- Multiple private companies seeking to provide liquidity options for their shareholders through the platform.

- Various banks, broker-dealers, and registered investment advisors (RIAs) are interested in utilizing Liquidity.io for the efficient execution of private asset transactions.

Looking Forward

With the digital ATS license secured and the launch of Liquidity.io imminent, ARQ Securities is poised to transform the trading landscape for private credit and private stock markets. We encourage interested parties to contact us to explore listing opportunities and to discuss assets available on our platform at launch. If you manage a private asset class with complex settlement processes, we invite you to partner with us to automate these procedures. Our company is enthusiastic about fostering partnerships and seeking new opportunities to offer issuers and investors more efficient and transparent access.

For more information or to discuss partnership opportunities, interested parties can contact:

Eric Choi, ARQ Securities: CEO, https://www.linkedin.com/in/eric-choi-10750241/

Austin Trombley, Satschel, Inc: CEO, https://www.linkedin.com/in/austintrombley/

For more information about ARQ Securities and Liquidity.io, visit www.liquidity.io.

About ARQ Securities:

ARQ Securities LLC., a subsidiary of Satschel, Inc., is at the forefront of financial technology, dedicated to reshaping the future of securities trading through innovation and efficiency. With a focus on digital asset tokenization and alternative trading systems, ARQ Securities is committed to empowering issuers, brokers, and investors with cutting-edge platforms and solutions.

Contacts

CEO

Eric Choi

ARQ Securities

echoi@arqsecurities.com

CEO

Austin Trombley

Satschel, Inc.

austin.trombley@satschel.com

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

Altcoin Season Index Rises to 34, Indicating Continued Bitcoin Dominance

What the Altcoin Season Index Tells Us About Market Trends

The Altcoin Season Index is a helpful tool for investors, analysts, and crypto enthusiasts seeking to understand the balance of power between Bitcoin and altcoins in the market. By excluding stablecoins and wrapped tokens, the index provides a focused view of the performance of traditional altcoins, offering insights into market sentiment and capital flow.

During “Bitcoin Season,” investors tend to favor Bitcoin over other assets, resulting in increased Bitcoin dominance. Conversely, “Altcoin Season” is characterized by a shift in investor sentiment toward alternative cryptocurrencies, with at least 75% of the top 100 coins outperforming Bitcoin. Historically, Altcoin Season often follows periods of significant Bitcoin price growth, as investors begin to seek opportunities for higher returns in smaller, often more volatile, altcoins.

The current score of 34 indicates that while some altcoins are performing well, Bitcoin remains the most sought-after asset. This trend suggests that market participants are still cautious about diversifying heavily into altcoins, likely due to Bitcoin’s perceived stability and appeal as a store of value.

Understanding Bitcoin Season vs. Altcoin Season

Bitcoin Season and Altcoin Season reflect investor preferences within the cryptocurrency market, influenced by various economic, regulatory, and market conditions. Here’s how each season typically unfolds:

- Bitcoin Season: This occurs when Bitcoin outperforms most altcoins. Investors turn to Bitcoin for its stability, liquidity, and security. This often happens during periods of macroeconomic uncertainty or when Bitcoin itself is experiencing strong upward momentum. During Bitcoin Season, the Altcoin Season Index typically registers lower scores, reflecting a market skewed towards Bitcoin dominance.

- Altcoin Season: Defined by a higher Altcoin Season Index score (above 75), Altcoin Season occurs when most top altcoins outperform Bitcoin. Altcoin Season tends to attract investors looking for high-risk, high-reward opportunities, as altcoins often exhibit more volatility and potential for rapid gains. Historically, Altcoin Seasons have been fueled by periods of exuberance in the market, where speculation and interest in new, innovative projects reach peak levels.

With the index score currently at 34, the market is clearly in Bitcoin Season, as Bitcoin has outperformed the majority of altcoins over the past three months. This shift toward Bitcoin may be influenced by recent macroeconomic developments, regulatory changes, and evolving market sentiment.

Factors Contributing to Bitcoin’s Current Dominance

Several factors may be contributing to Bitcoin’s strong performance relative to altcoins, maintaining the market in Bitcoin Season:

- Macroeconomic Stability: In times of economic uncertainty, Bitcoin is often viewed as a more stable asset within the crypto space. As a decentralized and limited-supply asset, Bitcoin has earned a reputation as a hedge against inflation and economic instability. This appeal may drive investors toward Bitcoin rather than altcoins, which are generally considered riskier.

- Institutional Adoption: Bitcoin’s established position and institutional acceptance have bolstered its credibility. Major financial institutions and corporations have shown interest in Bitcoin, viewing it as a long-term investment. This growing institutional involvement provides stability to Bitcoin’s market and attracts investors who might otherwise avoid cryptocurrencies altogether.

- Regulatory Clarity: Bitcoin has faced fewer regulatory uncertainties than some altcoins, making it a safer option for risk-averse investors. While many altcoins are still under scrutiny by regulators, Bitcoin’s status as a decentralized digital asset has generally been accepted, giving it an advantage in terms of regulatory clarity.

- Market Sentiment and Safety: When investor sentiment shifts towards caution, there is often a “flight to safety” in the cryptocurrency market. This flight typically benefits Bitcoin, as it is perceived as a safer asset compared to more speculative altcoins. During periods of uncertainty, investors may choose to hold Bitcoin over other cryptocurrencies due to its perceived resilience and stability.

The Road Ahead: Could Altcoin Season Return?

Despite Bitcoin’s current dominance, Altcoin Season could still make a return, particularly if market conditions shift in favor of altcoins. Historically, Altcoin Season has followed periods of sustained Bitcoin growth, as investors seek alternative opportunities for high returns. Several conditions could facilitate the emergence of Altcoin Season, including:

- New Project Launches and Innovations: The launch of innovative altcoins with real-world use cases could drive investor interest toward altcoins, especially in sectors like decentralized finance (DeFi), gaming, and artificial intelligence. If these projects gain traction, they could outperform Bitcoin and push the market closer to Altcoin Season.

- Lower Bitcoin Volatility: If Bitcoin’s price stabilizes following a period of rapid growth, investors might look to altcoins for higher returns. Lower volatility in Bitcoin could lead to an increased appetite for risk among investors, driving capital into altcoins.

- Increased Market Liquidity: Higher liquidity in the crypto market, potentially driven by institutional participation, could make it easier for altcoins to experience sustained price growth. As liquidity increases, altcoins might benefit from the influx of capital and improved trading conditions.

- Positive Regulatory Developments for Altcoins: Should regulators adopt clearer guidelines or positive policies for altcoins, investor confidence could increase, creating favorable conditions for an Altcoin Season.

While Bitcoin currently dominates the market, the cyclical nature of the cryptocurrency space means that an Altcoin Season could still be on the horizon, especially if conditions align to favor alternative digital assets.

Conclusion

The Altcoin Season Index’s rise to 34 reflects a market that remains in Bitcoin Season, with Bitcoin outperforming most top altcoins over the past 90 days. This trend highlights investor preference for Bitcoin amid macroeconomic stability concerns, regulatory clarity, and market sentiment that favors the perceived safety of the leading cryptocurrency.

As market conditions evolve, an eventual shift to Altcoin Season could occur, especially if innovative projects and favorable regulatory changes attract capital toward altcoins. For now, however, Bitcoin remains at the center of attention, solidifying its role as the market leader in the cryptocurrency space.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on the latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Crptocurrency

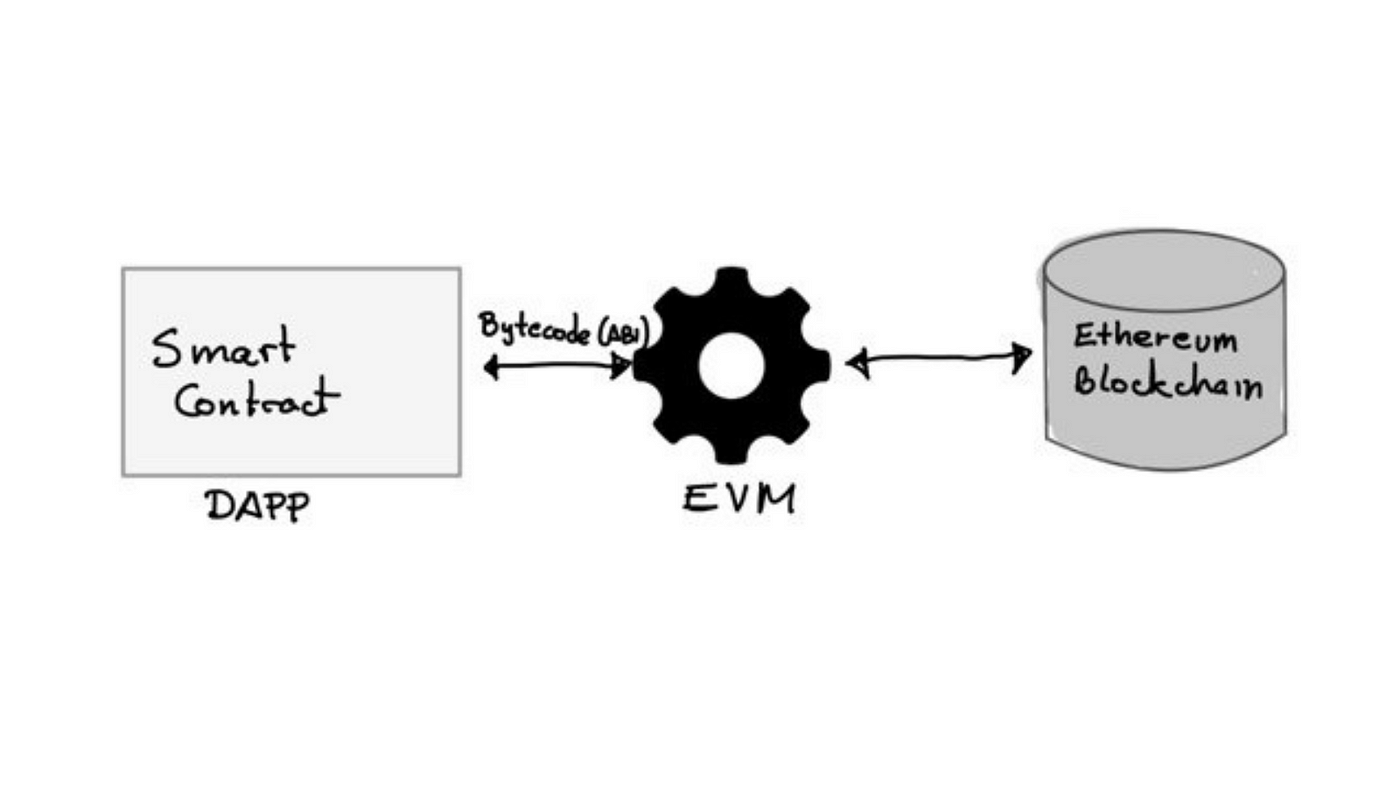

A Guide to The Ethereum Virtual Machine (EVM)

Crptocurrency

South Korea’s Financial Regulator to Strengthen Oversight on Trump-Related Stocks and Crypto Volatility

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency8 months ago

Crptocurrency8 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016