Crptocurrency

Crypto Futures Liquidated in the Last 24 Hours

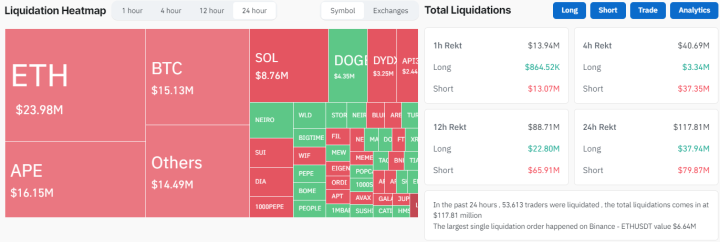

In a significant day for the cryptocurrency derivatives market, $117.81 million worth of crypto perpetual futures were liquidated over the past 24 hours, according to data from Coinglass. This substantial liquidation activity underscores the volatility and dynamic nature of the crypto futures market, impacting major cryptocurrencies and investor sentiment.

Breakdown of Liquidations

The total liquidation volume of $117.81 million comprised both long and short positions, highlighting the ongoing battle between bullish and bearish market participants.

Long Positions

- Total Long Liquidations: $37.94 million

Long positions represent bets on the price of a cryptocurrency rising. The liquidation of these positions indicates significant downward pressure on the market, forcing leveraged traders to close their positions to prevent further losses.

Short Positions

- Total Short Liquidations: $79.87 million

Short positions reflect bets on the price of a cryptocurrency falling. The higher liquidation volume in short positions suggests a bullish turn in the market, where rapid price increases forced short sellers to cover their positions, exacerbating the upward momentum.

Top Liquidated Cryptocurrencies

1. Ethereum (ETH)

- Liquidation Volume: $23.98 million

Ethereum led the liquidation surge, indicating substantial volatility in ETH’s price movements. The high liquidation volume suggests that ETH experienced significant price fluctuations, impacting leveraged traders.

2. ApeCoin (APE)

- Liquidation Volume: $16.15 million

ApeCoin saw the second-highest liquidation volume, surpassing Bitcoin in this category. This unexpected surge highlights the speculative nature and volatility associated with meme and utility tokens like APE.

3. Bitcoin (BTC)

- Liquidation Volume: $15.13 million

Bitcoin, the market leader, also faced considerable liquidation pressure. Despite its relatively stable position, the liquidation volume underscores ongoing market uncertainties and the influence of leveraged trading on BTC’s price.

Market Implications

Increased Volatility

The substantial liquidation of both long and short positions signifies heightened market volatility. Such movements can lead to rapid price swings, creating both opportunities and risks for traders and investors.

Impact on Market Sentiment

High liquidation volumes can influence overall market sentiment. The liquidation of long positions may indicate bearish sentiments or downward pressure, while the liquidation of short positions could signal a bullish trend or rapid price appreciation.

Leverage and Risk Management

The data highlights the critical importance of leverage management in crypto trading. High liquidation volumes suggest that traders are highly leveraged, increasing the risk of substantial losses during volatile market conditions.

Expert Insights

Dr. Laura Chen, Crypto Market Analyst

“The recent surge in liquidations reflects the inherent volatility of the cryptocurrency market, especially in leveraged trading environments. Ethereum’s leading position in liquidations indicates significant speculative activity and price sensitivity. Traders must exercise caution and implement robust risk management strategies to navigate these turbulent times.”

Michael Thompson, Financial Strategist

“ApeCoin’s liquidation surpassing Bitcoin’s is a testament to the speculative nature of altcoins and their susceptibility to rapid price changes. Investors should be mindful of the heightened risks associated with smaller cap cryptocurrencies and ensure they have adequate safeguards in place.”

Future Outlook

As the cryptocurrency market continues to evolve, the dynamics of leveraged trading and liquidations will remain critical indicators of market health and investor behavior.

Potential Market Stabilization

Following significant liquidation events, markets often experience periods of stabilization as prices adjust to the new levels of supply and demand. This can create a more balanced environment for future trading activities.

Regulatory Considerations

Increased volatility and liquidation activities may attract regulatory attention, prompting discussions on the need for stricter oversight and safeguards in crypto derivatives trading to protect investors and ensure market integrity.

Technological Advancements

Advancements in trading platforms and risk management tools can help mitigate the impact of liquidations. Enhanced analytics and real-time monitoring can provide traders with better insights to manage their positions effectively.

Conclusion

The $117.81 million in crypto futures liquidated within the last 24 hours highlights the ongoing volatility and complexity of the cryptocurrency derivatives market. With Ethereum leading the charge and ApeCoin surpassing Bitcoin in liquidation volumes, the data underscores the importance of strategic risk management and the need for cautious participation in leveraged trading environments.

As the market navigates these turbulent waters, both investors and traders must stay informed and adapt to the rapidly changing landscape to safeguard their investments and capitalize on emerging opportunities.

To stay updated on the latest trends and developments in the cryptocurrency market, explore our article on latest news, where we cover significant events and their impact on digital assets.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

Curly, but not Sam. The new crypto exchange Coytx.com built on AI by Kirill Sagitov.

Crptocurrency

SHIB vs DOGE: Which Memecoin Could Go From $0.0001 to $0.01 and Dominate in 2025?

Crptocurrency

ETH Crash Could Make These Altcoins Skyrocket – Top Picks Set for 500% ROI in 2025!

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency10 months ago

Crptocurrency10 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoWOW Skin Science’s Blueprint For Breaking Through In The $783 Bn BPC Segment

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016