Crptocurrency

Top SHIB Trader Buys Dogecoin, RCOF, and FUD to Show It’s Possible to Grow a $1M Portfolio in 4 Months

A top Shiba Inu (SHIB) investor is making rounds across the crypto market for something that can be considered daring and bold.

The SHIB trader claims that he can prove that it’s possible to grow one’s portfolio to $1 million by picking the right crypto assets ahead of a bull run.

Three crypto coins currently make up most of his portfolio. These coins are Dogecoin (DOGE), RCO Finance (RCOF), and FUD (FUD). But why is this crypto investor so confident, and what makes these altcoins so special? Read on to find out!

Smart Contracts are Coming to Dogecoin: Will DOGE and SHIB Take Off?

Dogecoin is on the verge of a major evolution with the planned introduction of smart contracts. Blockchain developers Nexus and QED Protocol have announced a layer-2 scaling solution to bring smart contract functionality to the Dogecoin network.

The L2 solution, a zero-knowledge virtual machine (zkVM), is designed to allow Dogecoin to compete with leading smart contract platforms such as Ethereum and Solana.

For context, Dogecoin operates on a proof-of-work (PoW) blockchain similar to Bitcoin’s but cannot support smart contracts.

Currently priced at $0.1094, DOGE has been experiencing a rollercoaster of market movements. Like many cryptocurrencies, DOGE took a hit at the start of October 2024, losing 7.36% on the weekly charts. However, the meme coin already shows signs of recovery, pumping 4.16% in the last 24 hours.

Expert predictions paint an optimistic future for Dogecoin. Ali, a well-known crypto analyst on X, recently pointed out that Dogecoin is retesting a breakout point from its falling wedge pattern.

Ali suggests that DOGE could rebound and move toward $0.16 if this support level holds.

Interestingly, CoinCodex makes an even more bullish prediction: If bullish sentiments take over the market, DOGE could reach a maximum price of $0.4552 by 2025.

RCO Finance: A Fully AI and ML-Based Platform Rising in Popularity

RCO Finance is quickly gaining attention, much like the top SHIB trader’s recent Dogecoin, RCOF, and FUD purchases in his journey to grow a $1 million portfolio.

RCO Finance basically changes how investors engage with financial markets through a fully AI—and machine learning (ML) system that removes the complexity typically associated with financial management.

By automating investment strategies, RCO Finance makes it easy for users to grow their portfolios without needing expert knowledge or human intervention. This innovative approach makes RCO Finance a popular choice for those seeking the best returns in the next few months.

A unique feature of RCO Finance is its AI-powered Robo Advisor, which delivers personalized investment strategies tailored to individual risk tolerance and financial goals.

The platform grants access to over 120,000 assets across 12,500 asset classes, including stocks, bonds, cryptocurrencies, and tokenized RWAs like real estate.

The platform also prides itself on security, having its smart contract audited by the reputable security firm SolidProof. That’s one reason savvy investors are assured of its security and trustworthiness.

And then there is its presale. That’s where the real profit game begins!

FUD Lands on Suilend: Is 10x Coming for the Meme Coin?

On September 26, 2024, Suilend announced that FUD would be listed with an initial deposit limit of $100,000 and a 0% loan-to-value (LTV) ratio. This listing marks a major milestone for FUD, becoming the first memecoin on the Sui network to be included on the platform.

As an added incentive, users who deposit FUD into the Suilend pool can earn additional FUD rewards until October 31.

Currently priced at $0.0000008849, FUD has seen an impressive price pump since its launch in early 2024. After a rapid rise during the early-year rally, FUD reached a high of $0.0000006968 in March.

However, the coin soon lost steam, plummeting to a low of $0.0000001076 in August. Despite this downturn, FUD has defied the broader market downtrend by experiencing a massive price pump in early October, bringing it to its current value. On the monthly chart, the price of FUD is up 397%.

Market analysts are becoming increasingly bullish on FUD’s prospects. Kong Trading, a well-known crypto analyst, believes that FUD is all set for an enormous rally. The analyst suggests that a 10x run from its current price is possible.

The Promise of Over 1,600% Gains on the RCOF Presale Fuels Investors’ Interest

RCO Finance’s RCOF token is currently in Stage 2 of its public presale, priced at $0.0343 per token. The current price point implies a 169% increase from its Stage 1 price of $0.0127. The ongoing stage promises potential gains of over 1,600% to its launch price of $0.6000.

With over 42% of the allocated 80 million tokens already sold, the demand for RCOF is increasing as investors aim to capitalize on the current presale opportunity.

One of these investors is the SHIB trader. With such enormous gains on the horizon, RCOF makes a major part of his portfolio.

For more information about the RCO Finance Presale:

Join The RCO Finance Community

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

Top 7 Ways to Earn Passive Income Through Cryptocurrency in 2024

Investing in cryptocurrency for passive income in 2024 is one of the most interesting options in the constantly evolving digital finance. With new technologies such as AI-driven crypto staking platforms and optimized investment strategies, investors now have more ways to grow their assets passively. One platform that stands out is CryptoBox, which offers an innovative, AI-enhanced staking experience with a range of impressive rewards, including a $100 sign-up bonus, referral commissions, and lucrative staking plans.

Here are the top 7 ways to generate passive income through cryptocurrency, with a focus on why CryptoBox should be your platform of choice.

Key Takeaways:

- CryptoBox offers AI-enhanced staking solutions to optimize profits.

- New investors receive a $100 trial bonus and earn commissions by inviting friends.

- Staking plans that are secure and flexible ensure high returns with risk management.

-

Staking Cryptocurrency with AI-Powered Platforms

Staking involves locking up your digital assets to support the operations of a blockchain network, and in return, you earn rewards. The process is becoming friendlier, facilitated by systems like CryptoBox through AI-powered automated trading strategies for maximum returns. CryptoBox automatically optimizes staking plans through real-time market analysis to ensure users get the best possible results with minimum effort. This way, one can start earning instant profits while managing risks effectively. Be it Bitcoin, Ethereum, or Cardano, CryptoBox provides seamless staking powered by smart algorithms.

-

Referral Commissions

One of the easiest ways to increase your passive income through CryptoBox is by using the referral program available through the service. By inviting friends, using your unique referral link, you get 4% on every purchase that they will make. What’s even better? There is no limit to how many you can refer, therefore, there is no limit to how much you can make. This gives you a low-effort, high-reward opportunity to significantly amplify your crypto income.

-

Liquidity Staking for Flexible Earnings

Liquidity staking allows you to earn passive income while maintaining flexibility with your assets. CryptoBox brings together liquidity staking and AI-powered trading strategies to adapt more easily to market ups and downs, making the optimization of returns much easier. This will be ideal for investors looking to enjoy high yields without necessarily having to lock up their funds for long periods. CryptoBox’s liquid staking plans offer great returns across a wide range of cryptocurrencies, from Ethereum and Polkadot to XRP.

-

CryptoBox Risk-Free Staking Bonus

New users can take advantage of CryptoBox’s generous $100 trial bonus, which provides a risk-free opportunity to start staking. With this bonus, you can begin earning rewards without having to invest any of your own funds. All the profits earned from this trial bonus are yours to keep, allowing you to grow your portfolio effortlessly. Additionally, CryptoBox ensures that your funds are secure, offering 2FA, strong encryption, and continuous monitoring, making it one of the safest platforms for staking.

-

Earn with the Million Bounty Program

CryptoBox Million Bounty Program is another breathtaking passive income opportunity. You can complete a few simple promotional tasks on Facebook, YouTube, or X with bonuses starting from $1 to $100 and instantly start building your stream of income using your referral link by promoting the platform.

-

Maximize Your Profits with Diverse Staking Plans

CryptoBox has varying staking plans, depending on the magnitude of investment a user would want to make. For as low as $100 and as high as $300,000, the platform has flexible options promising users payouts daily. For example, staking $3,500 in Avalanche for 21 days yields a daily profit of $38.85, while staking $100,000 in Solana for 56 days reaps a daily profit of $2,400. These plans let you choose your risk and reward level to fit your investment goals, while you can be assured of earning consistently from your digital assets.

-

Secure and Automated Staking for Maximum Convenience

First and foremost, CryptoBox pays great attention to security and automation. With AI-enhanced algorithms behind your investments, you can rest assured that at any given moment, the platform is hard at work to ensure the best returns possible. This fits perfectly for investors who cannot afford to spend all day and night tracking the market. Moreover, CryptoBox provides top-notch security for your assets, including McAfee-tested protection that lets you earn via staking with your assets secure.

Getting Started on CryptoBox

To start, create an account at CryptoBox by providing your email, username, and password. Make sure to include your referral code at the time of registration; that will give you some extra advantages.

Go to CryptoBox’s list of profitable staking plans and select your option. Whether you’re staking $100 or $300,000, there is a plan best suited for your needs.

Once you have your plan, be prepared to watch the magic of CryptoBox AI-driven strategies work for you in generating profits daily. You can opt to withdraw your earnings at any moment throughout the staking period.

Conclusion

CryptoBox offers a unique blend of AI-enhanced staking solutions with flexible rewards for passive income earners in cryptocurrency. Join CryptoBox today and start earning through advanced technology and rewarding programs that you will find easier than ever.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

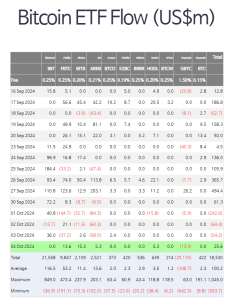

USA Spot Bitcoin ETFs Record Net Inflow of $25.6M on October 4, Led by Bitwise and Fidelity

USA Spot Bitcoin ETFs Record Net Inflow of $25.6M on October 4, Led by Bitwise and Fidelity

On October 4, U.S. spot Bitcoin ETFs witnessed a significant net inflow of $25.6 million, according to data from Farside Investors. The inflows were driven primarily by Bitwise’s BITB, which recorded the largest inflow of $15.3 million, followed by Fidelity’s FBTC with $13.6 million, Ark Invest’s ARKB and VanEck’s HODL, both registering $5.3 million.

In contrast, Grayscale’s GBTC saw a net outflow of $13.9 million, making it the only major ETF to experience a negative flow on the day. Other ETFs did not see any notable changes in net inflows or outflows.

Breakdown of ETF Movements

- Bitwise’s BITB led the market with $15.3 million in net inflows, reflecting growing confidence in its strategy for tracking spot Bitcoin prices.

- Fidelity’s FBTC followed closely with $13.6 million, demonstrating strong investor interest in Bitcoin ETFs offered by traditional financial institutions.

- Ark Invest’s ARKB and VanEck’s HODL both recorded $5.3 million in net inflows, further highlighting the broader investor demand for Bitcoin exposure.

- Grayscale’s GBTC, which has traditionally been a major player in the Bitcoin ETF space, faced $13.9 million in net outflows, signaling a potential shift in investor preferences as newer ETFs gain traction.

Investor Sentiment Shifting Toward Spot Bitcoin ETFs

The latest net inflows indicate a growing appetite for Bitcoin ETFs, as more institutional and retail investors seek to gain exposure to Bitcoin’s price movements without directly holding the cryptocurrency. The performance of Bitwise, Fidelity, and Ark Invest’s ETFs suggests a shift in market sentiment toward newer, more dynamic Bitcoin offerings, with spot ETFs becoming the preferred vehicle for gaining exposure.

Grayscale’s Outflow: A Sign of Shifting Preferences?

The $13.9 million outflow from Grayscale’s GBTC could reflect a growing preference for more liquid and straightforward Bitcoin ETFs, particularly those structured around spot prices. As newer ETFs with lower fees and better liquidity enter the market, GBTC’s traditional appeal may be waning, leading to increased outflows in favor of alternative products.

Conclusion

The net inflow of $25.6 million into U.S. spot Bitcoin ETFs on October 4 highlights the sustained demand for Bitcoin exposure via ETFs. With Bitwise and Fidelity leading the charge, investors are showing increasing confidence in the spot ETF market. However, Grayscale’s GBTC outflow serves as a reminder that competition in the space is intensifying, as newer ETFs gain favor among investors seeking better liquidity and transparency.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

USA September Payroll Report Boosts Likelihood of Quarter-Point Rate Cut in November

USA September Payroll Report Boosts Likelihood of Quarter-Point Rate Cut in November

The stronger-than-expected U.S. payroll report for September has increased the likelihood that the Federal Reserve will opt for a quarter-point rate cut during its November meeting, according to Nick Timiraos, the chief economics correspondent for The Wall Street Journal (WSJ). Timiraos suggested that this moderate approach aligns with the Fed’s recalibration strategy following a half-point cut in the previous month, which was prompted by signs of mild inflation and a cooling labor market.

September Payrolls Strengthen Fed’s Cautious Approach

The recent payroll data revealed stronger hiring trends than initially anticipated, especially in July, August, and September. The September report indicated a healthier labor market, leading the Fed to reassess its stance on further rate cuts. This aligns with Federal Reserve Chair Jerome Powell’s statement on September 30, in which he emphasized that the Fed is not in a hurry to implement additional rate cuts.

While some analysts had speculated about the possibility of another half-point rate cut, September’s robust employment figures have made it more likely that the Fed will take a measured approach and reduce rates by 0.25% instead.

The Fed’s Recalibration Strategy

Following last month’s half-point reduction, the Fed appears to be adopting a more gradual strategy as it responds to evolving economic conditions. The initial larger-than-usual rate cut was a response to emerging concerns about inflation and signs of weakness in the labor market. However, with recent revisions indicating stronger-than-expected hiring in July and August, the Fed may now opt for caution, avoiding overly aggressive moves that could risk overstimulating the economy.

Implications for the Economy

If the Federal Reserve proceeds with a quarter-point rate cut in November, it could signal the central bank’s commitment to balancing economic growth with inflation control. A moderate cut would provide support to businesses and consumers while ensuring that the economy doesn’t overheat. The Fed’s cautious approach reflects its need to maintain flexibility as it navigates the complexities of post-pandemic economic recovery.

Conclusion

With the September payroll report showing stronger-than-expected job growth, the Federal Reserve is likely to favor a quarter-point rate cut in November rather than a more aggressive reduction. This aligns with the Fed’s strategy of calibrating monetary policy in response to evolving economic conditions, ensuring stability while addressing inflation concerns.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

-

Startup Stories12 months ago

Startup Stories12 months agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories12 months ago

Startup Stories12 months agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories11 months ago

Startup Stories11 months agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency7 months ago

Crptocurrency7 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories12 months ago

Startup Stories12 months agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce12 months ago

E-commerce12 months agoTop Online Couponing Trends To Watch Out For In 2016

-

Startup Stories12 months ago

Startup Stories12 months agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing