Startup

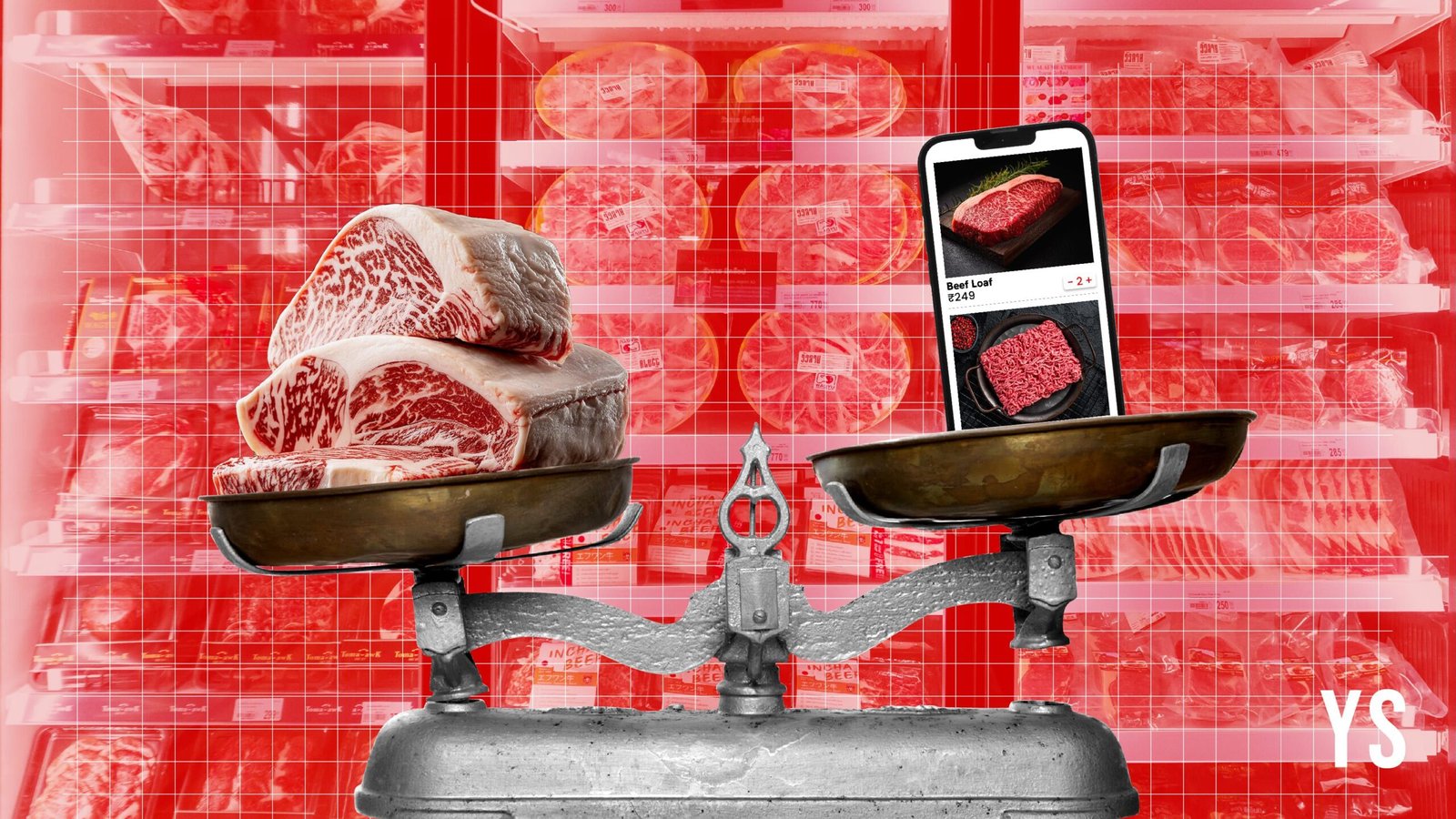

Catch and Release: Why are online meat startups still small fry in domestic markets?

[ad_1]

Meat buying has traditionally been a very hands-on process. Meat eaters generally prefer to personally select the cut, inspect the freshness of the catch, and understand its procurement tactics.

The pandemic brought in a new wave of online-first meat and seafood startups looking to make their mark on the sector, riding on the surge in funding into the Indian startup ecosystem between 2020 and 2022.

Meat distributor Licious turned into a D2C unicorn in 2021, after raising $52 million in its Series G round. It has raised $490 million in funding so far and has a valuation of $1.47 billion as on September 21, 2023, according to Tracxn. Meanwhile, its peer, FreshToHome, also raised $104 million in funding led by Amazon Sambhav Venture Fund in 2023, taking its cumulative funding to $286 million.

However, the meat startup sector’s fortunes has since taken a turn for the worse: consumer preferences have largely reverted back, and online meat and seafood retailers have either had to wind down their operations or continue with heavy losses with zero to little gains to show for it in the topline.

Licious clocked a 9.6% growth in its operating income to Rs 747.7 crore during FY23 from Rs 682.5 crore in FY22. It posted a loss of Rs 500 crore during the same period, marginally up from Rs 485 crore a year ago.

Meanwhile, FreshToHome recorded a revenue of Rs 110.3 crore, resulting in a loss of Rs 409.5 crore.

FreshtoHome did not respond to YourStory’s request for comment.

Expensive cold chain solutions, too much competition in a saturated market, unpredictable pricing, and ultimately, a lack of sufficiently appealing value additions to draw in a larger consumer base are just some of the challenges that dog online-first players, and are compelling them to look at alternative methods to bolster their bottomline.

Muddy waters

One of the biggest problems faced by online-first startups in the domestic seafood and meat market has been their inability to effectively disrupt the traditional supply chain to customers.

While consumers may have moved towards online channels for the convenience of delivery, especially during a lockdown, they now seek physical touchpoints to verify product freshness and that the meat cuts are processed in clean and hygienic conditions.

Mandrita, a Bengaluru-based Product Manager, says, she prefers shopping for her fish specifically from the nearby HAL market as opposed to ordering online.

“There is a larger variety to pick from and you get the option of choosing from a variety of sizes. While I do have to clean the meat afterwards, I know it is freshly cut and sold, moreover it is easily 20% cheaper than online alternatives,” she adds.

This consumer preference, combined with competition from FMCG brands like Godrej, Venky’s, and Nandus, makes climbing the profit peak a little too difficult for the meat startups.

Neighborhood stores do not invest in high-tech tech stack and cold chain infrastructure solutions, allowing for lower operational costs, which in turn enable them to sell at a lower price—a liberty online meat brands cannot afford.

Most players who try to reach their customers through Foodhalls and grocery marts just do it for the brand positioning, as these placements come with steep margins, explains Mark Alzawahra, MD and Founder of seafood wholesaler Catch Of Norway Seafood. Commission fees for Nature Baskets, Foodhalls, and the likes can go as high as 40% and in very rare cases it will go under 25% after hard negotiations, he adds.

Since branded cuts on grocery store shelves are too expensive, online food startups have had to go back to industry roots and set up brick and mortar shops, which come with high capex requirements and fewer neighborhoods which can absorb expensive meat outlets.

As a dire example of this, Chennai-based meat startup Fipola was forced to cease its operations in February 2023, when it failed to raise funds after its aggressive offline expansion.

What’s the catch?

To combat the crunch, meat players are shifting to alternatives to reach customers directly through brick and mortar outlets, including shifting customer bases to supply to businesses (B2B), or looking to export to other international markets.

Typically, in the food industry, clients of a B2B business include restaurants, hotels, caterers, or other marketplaces that place orders.

An increasing number of online meat startups are pivoting to this model to keep revenue up, as is the case for online seafood firm Captain Fresh, which sources directly from farms and fishermen and distributes to other retailers.

“This industry doesn’t need a B2C channel or a brand, because there is already a lot of real estate that the world has allocated for this product. If you walk into a retail chain across US or Europe, close to 30-35% of the overall floor space is allocated for meat, seafood,” says Utham Gowda, Founder, Captain Fresh.

Early on, Captain Fresh realised that a B2B channel was the only scope for growth in this industry. It later shifted its focus entirely to a B2B model outside of India.

Meanwhile, Gurugram-based ZappFresh sees a nearly 50-50 distribution in its B2B and direct-to-consumer (D2C) channels. It plans to clock a revenue of Rs 160 crore in FY24-FY25 with a significant jump in profit after tax, something its peers are yet to manage.

“While offline may look very promising and lucrative, it is extremely complex to crack that as well. And running and owning a store may not be the right format to build a profitable business in this space,” notes Deepanshu Manchanda, Co-founder and CEO of Zappfresh.

“As a business, you would want to liquidate the stock in time, it is a challenge to hold the inventory for a long period especially when the product is perishable. A B2B channel allows us to liquidate unsold inventory and bring more equilibrium across the board,” he adds.

Moreover, while seafood is a price-sensitive commodity, the industry, however, works on a mostly fixed-price basis. Therefore it is crucial for distributors to have a large enough base to mitigate any fluctuations in the distribution chain on the retail level.

Fluctuating market prices is a concern, especially for premium seafood like salmon, where market prices update every week globally.

“In India, domestic seafood prices are subject to daily or weekly fluctuations, largely influenced by seasonality, weather conditions, and availability of appropriate sizes to be caught and sold. Since hotels and restaurants update their menus quarterly or semi-annually, they prefer to enter into contracts to maintain price stability and stay competitive,” Alzawahra says.

A large base requires an even larger logistics channel. It is particularly difficult when the commodity is prone to spoilage if not stored properly and has a short shelf life.

Industry executives believe that a fragmented cold chain is one of the biggest challenges that needs to be addressed, as it allows companies to establish equilibrium with fluctuations in pricing and food inflation.

Long way from home

With the domestic market fraught with so many challenges, seafood players are looking towards thicker wallets across the sea.

Seafood is one of the biggest categories of export in the country. India exported 17,81,602 metric tonnes of seafood worth Rs 60,523.89 crore ($7.38 billion) during 2023-24; and exports improved 2.67% in quantity terms during the same period. The USA and China are the major importers of India’s seafood, according to the Indian Ministry of Commerce & Industry.

Online startups are vying to cash in on this significant revenue stream. The Indian market accounts for less than 10% of Captain Fresh’s total revenue. Its peer, FreshToHome, which picked up its latest bag of funds to expand its GCC and international operation, is also relying heavily on its global businesses.

“The take rates, the margin profile that you have in the international markets is very different compared to what you have in the Indian market. And if you have access to supply, you are better off chasing markets where monetisations are higher compared to markets like India,” adds Captain Fresh’s Gowda.

Meanwhile, Zappfresh, which recently acquired Mumbai-based Bonsaro and Bengaluru native Dr. Meat to expand its operation across Western and Southern regions, respectively, is now looking to expand to the Middle East in a format similar to its domestic markets.

Most of the biggest buyers globally in the meat sector are hotels and restaurants, and this provides the bulk of the volume for imported meat and seafood.

“The feasibility of online models in global markets depends on several factors. For one, the ability to adapt to diverse regulatory requirements and establish a reliable cold chain infrastructure is crucial,” says Prateek Toshniwal, Partner–MICS International & Co-founder, IVY Growth, and an investor in Zappfresh.

“Additionally, leveraging online platforms allows for efficient market entry with lower overhead compared to traditional retail setups,” he notes.

[ad_2]

Source link

Startup

How to onboard the right SEO partner in 2025

[ad_1]

SEO is rapidly evolving with AI-driven search experiences reshaping strategies. In 2025, staying competitive means focusing on market share, content optimisation, and efficient execution. With over 6,700 SEO service providers in India (registered on Clutch) and a global shift toward automation and AI, finding the right partner has never been more crucial.

The right agency doesn’t just address immediate goals—it builds a foundation for measurable growth and long-term success. However, the path to achieving this is not without its complexities.

The SEO challenge in 2025

SEO, for years, has been one of the most critical pillars of digital success, yet it remains misunderstood by many. India’s SEO market is booming, but saturation brings its challenges. This year presents both significant opportunities and complex challenges, requiring CMOs and other decision-makers to tread carefully when entrusting their digital growth to an agency.

Key challenges

- Algorithm updates: Search engines prioritise trust, user experience, and technical metrics like Core Web Vitals. Agencies must adapt continuously to these changes.

- AI and automation: Automation improves efficiency, but strategic direction is essential for ensuring alignment with business goals.

- Global competition: Businesses must address regional search nuances. Multilingual SEO plays a critical role in reaching India’s diverse audience, while mobile-first strategies dominate global markets.

According to HubSpot’s 2024 report, search, websites, and blogs deliver the highest ROI, making SEO the top priority for marketers looking to maximise their investments.

High-stakes decisions

Choosing the wrong SEO partner can lead to wasted resources and harm reputations. The right partner delivers:

- High ROI: SEO remains one of the most efficient digital marketing channels.

- Sustained visibility: Strong SEO provides consistent relevance, even as algorithms evolve.

- Trust and growth: Builds long-term credibility and higher conversions.

Why the challenges are growing in 2025

SEO continues to be misunderstood despite its role as a core pillar of digital success. Amid these challenges, the urgency to adopt SEO as a strategic priority has never been greater. Businesses that fail to act risk being overshadowed by competitors who are already leveraging advanced SEO tactics to secure a competitive edge and drive rapid growth.

The competitive edge you can’t ignore

SEO is no longer just an option—it’s a necessity to stay ahead of the competition. Many businesses have already embraced SEO as a core marketing channel, leveraging the expertise of agencies to achieve rapid growth.

By adopting advanced SEO strategies, competitors are dominating search rankings, attracting high-intent customers, and driving significant revenue growth. If your business isn’t investing in SEO, it risks falling behind in a crowded digital space. Missing out on implementing SEO strategies means:

- Your competitors are winning: Competitors who partner with skilled SEO agencies are gaining a massive edge, building visibility, trust, and authority in your industry. With 75% of marketers believing personalised experiences lead to increased sales, businesses leveraging tailored SEO strategies gain a competitive edge over lagging competitors.

- Lost opportunities: Every day without a robust SEO strategy is a day your competitors are converting leads that could have been yours.

- Not staying relevant: Search engines reward active and optimised efforts. If your business doesn’t adapt, it risks losing long-term relevance and market share.

Achieving this level of growth requires more than just implementation—it demands expertise that aligns technical precision, strategic planning, and a deep understanding of industry dynamics to deliver meaningful results.

Why SEO success demands expertise

In 2025, SEO extends beyond rankings, requiring a system that aligns technical precision, content strategies, and data-driven decisions with business objectives.

Key Insights

- Specialised strategies: SaaS brands target lead generation, while e-commerce focuses on product visibility.

- Data utilisation: Predictive analytics increases lead conversion rates by a huge margin. HubSpot reports that businesses using AI in content creation see 84% efficiency improvement and create more personalised, effective campaigns, driving greater impact.

- Global and local understanding: Multilingual efforts improve audience engagement in diverse regions.

Brands like Myntra and Amazon succeed by partnering with experts who understand industry-specific challenges and opportunities. However partnering with experts is just the first step—what truly sets a great SEO agency apart is its ability to combine proven experience, technical expertise, and a strategic approach tailored to your business needs.

What makes a great SEO agency

The best agencies combine proven experience, technical skills, and a client-focused approach. Some key qualities to look out for include a track record of expertise and proven expertise in the field, a strong technical team that can handle complex challenges, and the drive to craft tailored strategies aligned with your business objectives rather than cookie-cutter solutions.

A great SEO agency not only implements effective strategies but also delivers measurable outcomes and long-term advantages that go beyond rankings—benefits that are both tangible and strategic.

The benefits of SEO: Tangible and beyond

A strong SEO campaign balances measurable outcomes with adaptability. It offers tangible benefits like increased visibility through optimised keywords and technical improvements, conversions that directly connect site performance to revenue, and transparent reporting to ensure efforts align with goals.

There are also certain intangible perks to SEO, namely, a greater market understanding that reflects industry specifics, as well as adaptability, which helps maintain relevance through algorithm updates, and increased collaboration and integration with internal teams, which maximises a campaign’s success.

How to evaluate SEO agencies

Choosing the right partner involves asking the right questions:

- Case Studies: Can the agency show measurable success?

- Technical Expertise: How do they handle audits and updates?

- Thought Leadership: Are they recognised for setting industry standards?

- Trend Adaptation: Can they leverage emerging trends like zero-click content?

Questions to ask while evaluating

- How do you structure your communication and reporting processes?

- How do you ensure alignment between your efforts and our business goals?

Selecting an SEO partner in 2025 means moving beyond surface-level promises. The best agencies simplify the complexities of SEO while becoming strategic allies in your growth journey. Quality over cost is crucial. Low-cost agencies often cut corners, leading to missed opportunities and compromised results.

SEO in 2025 is a necessity for brands aiming to grow in an increasingly competitive industry. The right partner will go above and beyond delivering rankings, helping your business achieve sustainable growth and long-term relevance. By aligning with a team that understands your vision and has a proven track record of driving success, companies can set the stage for a brighter digital future.

(Nitin Manchanda is the Founder and Chief SEO Consultant at Botpresso.)

[ad_2]

Source link

Startup

Mudrex rides the crypto wave; Why India is “super important” for Freshworks

[ad_1]

Hello,

Something strange is brewing in the alco-bev sector, and it’s not the weekend buzz.

Johnnie Walker maker Diageo appears to have stumbled into a regulatory storm, amid accusations by the Central Bureau of Investigation (CBI) of attempting to influence favourable government decisions, Reuters reported.

To add to its woes, it is also one of the several alco-bev makers waiting on repayments of a hefty IOU from an Indian state, worth under half a billion dollars.

Diageo, Pernod Ricard and Carlsberg are demanding unpaid dues of about $466 million from Telangana, while Heineken has halted supplies altogether to southern Telangana, India’s biggest beer consumer.

Coming on the heels of a still-active investigation by the country’s anti-trust body into accusations of price collusion by Anheuser-Busch InBev and Pernod, this is just the latest in a series of regulatory challenges for the liquor industry in India.

Meanwhile, even globally, happy hours aren’t enough of a pick-me-up for liquor brands anymore, especially after the US Surgeon General’s call for cancer warnings on alcoholic drink labels earlier last week sent shares slipping for brands worldwide.

ICYMI: Is 2025 set to be the year of the teetotaller? The numbers say: potentially.

Here’s to your health!

In today’s newsletter, we will talk about

- Mudrex grows on crypto euphoria

- Why India is “super important” for Freshworks

- 158,000 startups and counting

Here’s your trivia for today: What was the name given to the first plane bought by Amelia Earhart?

Cryptocurrency

Mudrex grows on crypto euphoria

Indian crypto investment platform Mudrex said it saw a 200% rise in its user base in 2024 as the company doubled down on building customer relationships and focusing on educating its users.

“We put in a lot of effort in helping people understand what crypto is … giving them a sense of how they can participate in investing in crypto without risking a lot and figuring out what’s the right balance between risk and reward,” said Edul Patel, Co-founder and CEO at Mudrex in an interview with YourStory.

Key takeaways:

- Mudrex has also clocked in a 20X surge in monthly trading volume, touching $200 million. This refers to the total value of all trades executed on the platform.

- “India remains the company’s primary focus. “Our primary focus right now continues to stay in India. And we want to double down and first grow in India. And then as time progresses, take steps to move out,” Patel added.

- The company, which has received the Virtual Asset Service Provider registration in the European Union, is now in the process of applying for MiCA licence which is a permit to operate crypto-related services in the European Union.

Top Funding Deals of the Week

Startup: Innovaccer

Amount: $275M

Round: Series F

Startup: Fincorp

Amount: $35M

Round: Equity

Startup: Botanic Healthcare

Amount: Rs 250 Cr

Round: Equity

SaaS

Why India is “super important” for Freshworks

Freshworks CEO Dennis Woodside believes leveraging India’s vast engineering and software talent remains crucial for the software-as-a-service (SaaS) provider to innovate and expand globally.

“We have over 3,800 employees here spread across Hyderabad, Bengaluru, and Chennai. We built virtually all of our products—almost all of our code—here in India,” Woodside says in an exclusive interaction with YourStory.

Being bullish:

- Beyond being a development hub for Freshworks, India is also a crucial market in the CX (customer experience) segment to assist customers with vast user bases—PhonePe being a prominent example.

- Freshworks’ growth has been fueled by its latest AI offerings, most notably Freddy AI, an easy-to-deploy autonomous service agent built to enhance CX and employee experience. “We’ve been able to scale to support customers with millions of interactions with their end customers,” Woodside says.

- Freshworks is also bullish on nurturing the nation’s talent and providing pathways for professional growth. Its STS Software Academy equips underprivileged high school graduates with advanced tech skills.

Startup Ecosystem

158,000 startups and counting

India’s startup ecosystem has grown exponentially since the launch of the Startup India initiative in 2016, with the number of startups surging from around 400 then to over 158,000 today, according to the Department for Promotion of Industry and Internal Trade (DPIIT).

Up and up:

- The ecosystem’s reach is broadening with 48% of startups now originating from Tier II and III cities, DPIIT Joint Secretary Sanjiv Singh noted.

- India’s unicorn count has expanded dramatically, increasing from eight in 2016 to 118 by 2024. The sector has also created over 1.7 million jobs, he added.

- Key policy boosts, including removing the angel tax in the last Budget and launching the Fund of Funds for Startups scheme in 2016 have contributed to this growth.

News & updates

- Great debate: The US Supreme Court will hear arguments about the future of TikTok on Friday, only nine days before a federal law is set to ban the social media platform in the US if it isn’t sold by its Chinese parent company.

- Shelved: Disney’s ESPN, Fox Corp, and Warner Bros Discovery aren’t moving forward with their joint streaming venture Venu Sports, calling off what would have been a major bet as the industry’s dynamics shift rapidly.

- AI boom: Taiwan Semiconductor Manufacturing Co, the world’s largest contract chipmaker, reported on Friday fourth-quarter revenue that easily beat market forecasts and hit its own expectations as it reaped the benefit of AI demand.

What was the name given to the first plane bought by Amelia Earhart?

Answer: Canary.

We would love to hear from you! To let us know what you liked and disliked about our newsletter, please mail [email protected].

If you don’t already get this newsletter in your inbox, sign up here. For past editions of the YourStory Buzz, you can check our Daily Capsule page here.

[ad_2]

Source link

Startup

The rise of hyperlocal marketing: How FMCG brands are connecting with diverse regional markets

[ad_1]

In today’s fast-paced, competitive environment, providing customers with a personalised experience is more crucial than ever. That is where hyperlocal marketing steps in. It helps the brands connect on a different level by zeroing in on other locations, local preferences and languages and cultures. Hyperlocal marketing is becoming the need of the hour for FMCG brands to not only exist but to compete in today’s rapidly evolving market.

What is hyperlocal marketing?

Hyperlocal marketing refers to tailoring marketing efforts to particular local areas, which sometimes can be focused on a relatively small radius around a business location.

This means adjusting campaigns to fit the tastes, needs, and behaviours of people in the local areas. The ultimate target of hyperlocal marketing is ready-to-buy customers, making it a good tool for increasing sales, building brand loyalty, and fostering stronger community connections.

Brands have learned that one size does not fit all in the consumer marketplace of today. Brands have to evolve and fit into the varied demands of the market to stay relevant, making sure products are priced right, and marketed directly to the consumer.

The rise of a focused approach

Technological advances and changes in consumer behaviour are helping in the growth of the hyperlocal marketing model. The deep penetration of both smartphones and the internet is opening doors for businesses to communicate directly with customers in Tier II and III cities.

This has led brands to focus on creating content relevant to specific regions to address the cultural and linguistic identity of local consumers and thus, improve engagement as well as returns on investments.

Hyperlocal strategy is cheaper compared to the other traditional broad-spectrum marketing tactics, as it is more targeted at delivering specific results by having a small, well-defined audience to target.

For instance, instead of going for a nationwide campaign, one may go for the specific product in a region where they know it is in great demand. This saves money and boosts the effectiveness of a campaign.

The art of digital localisation

Digital marketing localisation is a key component of hyperlocal strategies. It translates to tailoring content, campaigns, and messaging according to regional linguistic and cultural preferences.

The most central element remains language, as having websites and advertisements translated along with social media posts into local languages makes content more accessible and relatable.

Localisation, however, is more than just translation. It demands cultural adaptation to ensure that the tone, imagery, and references come across authentically to the reader. For example, a regional festival, tradition, or icon in an ad can help consumers feel emotionally attached to the brand, leading to loyalty and trust.

Leveraging technology for personalisation

Technological developments like geo-targeting and data analytics further reinforce hyperlocal marketing. Geo-targeting allows brands to serve appropriate offers or content for users from the same geographical location in which they exist. Hence, it can also be significantly deployed to know the regional requirements.

Amazon and Flipkart, among the other big ecommerce companies, dominate at geo-targeting—suggesting products that may best suit a specific local preference, shipping options, and discounts. They evaluate customer data and provide customized solutions according to market preference.

The hyperlocal strategies are also supported by social media platforms. Social media helps brands create campaigns based on region, work with local influencers, and target ads at specific audiences.

An uplift for FMCG brands

Hyperlocal marketing has proven to be an important tool in reaching diverse markets for FMCG brands. They mostly work across various cultural and economic backgrounds and hence need to attend to local tastes and expectations. They can, by using hyperlocal strategies, connect better with the customer, enhance visibility for their brand, and get an edge in their reputation as a reliable local brand.

Hyperlocal marketing also boosts word-of-mouth promotion, the most potent weapon for establishing trust. Customers are more likely to talk about a brand which is making authentic efforts to understand their needs and preferences.

The road ahead

The growth of the internet in small towns as well as rural setups can expand the horizon of prospects for hyper-local marketing. Increasing mobile adaption with localized search preference represents something big for brands—being able to attract new customer profiles while furthering their foothold in different markets.

With a deep understanding of the cultural subtleties and preferences of the local communities, hyperlocal marketing can portray brands as trustworthy and relevant companions for their customers. As companies continue to grow, such a niche approach can become an anchor for meaningful relations and business growth in FMCG.

Kush Aggarwal, Head of Marketing, Bikano

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)

[ad_2]

Source link

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Startup Stories1 year ago

Startup Stories1 year agoWOW Skin Science’s Blueprint For Breaking Through In The $783 Bn BPC Segment

-

Crptocurrency11 months ago

Crptocurrency11 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016