[ad_1]

SUMMARY

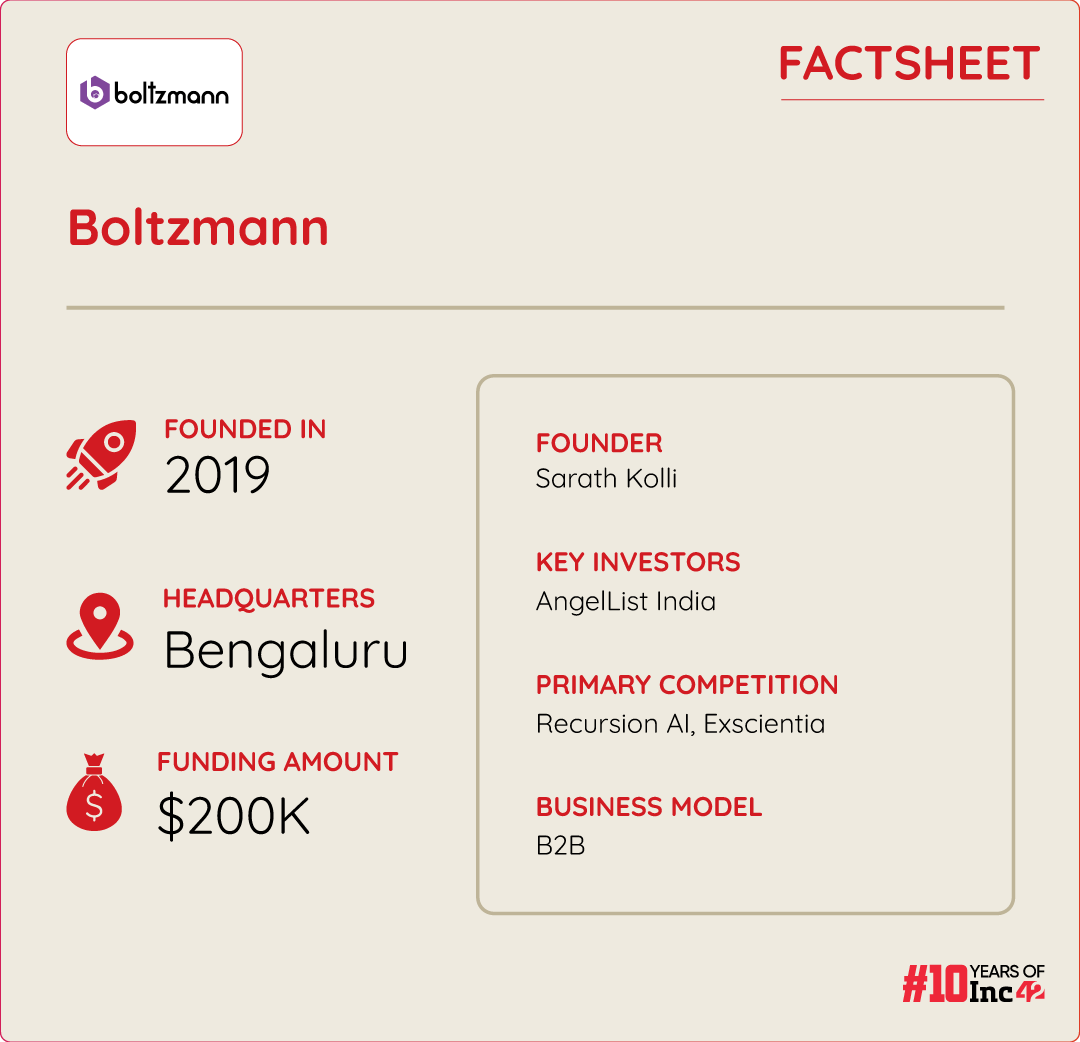

Founded in 2019, the Bengaluru-based startup wants to make a breakthrough in the drug discovery space with its AI models

Boltzmann’s AI drug discovery tech stack comprises four more platforms — ReBolt, BoltPro, BoltBio, and ClinBolt

The startup is looking to collaborate with top international players in the larger drug discovery space, which is dominated by the likes of Pfizer, GSK, and Eli Lilly

At a time when GenAI is demonstrating its might in serving every industry possible, healthcare is one of the domains that, too, stands poised to harness its true potential across a range of applications, including lab assistance, clinical diagnosis, health monitoring, and drug discovery.

Though the application of GenAI today is largely restricted to text, video, and audio generation, there is a whole treasure trove of use cases being unlocked for healthcare professionals in pharma companies, clinics and hospitals.

It is pertinent to note that despite being one of the top global players in the pharmaceutical space, the Indian drug discovery ecosystem has faced multiple hurdles, including high failure rates and high costs.

However, with GenAI making exponential strides, the Indian pharmaceutical space is expected to witness a major boost, as the tech has the potential to substantially reduce cost and failure rates in the drug development process.

Interestingly, entrepreneur and AI researcher Sarath Kolli was able to connect these dots right before the buzz around GenAI and started leveraging the tech to enable drug discovery and improve the success rate of clinical trials.

This led to the incorporation of Boltzmann, an Indian GenAI startup working in the fields of AI and Drug Discovery, in 2019. Bengaluru-based startup Boltzmann began building AI models, with an aim to make a breakthrough in AI drug discovery.

Speaking with Inc42, Boltzmann’s founder and CEO Kolli said, “In India, if we look at the drug discovery landscape, we will observe that big companies like Redis Labs, Piramal, and many others closed their drug discovery units. Overall, the drug discovery landscape in the country has shrunk in the last decade. So, we started with the vision to enable this industry with better technologies to reduce the risks and improve success rates in clinical trials.”

Boltzmann’s AI Stack For Drug Manufacturers

Initially started as a community, which ran for almost a year for conducting experiments and research related to problems in drug discovery, Boltzmann started developing its first product BoltChem in 2020.

The platform (BoltChem) enables the designing of novel drugs using open-source models. The startup claims that the BoltChem platform makes predicting properties and exploring the chemical space of a molecule significantly less time-consuming. The platform has been developed to help drug developers come up with novel small molecules within a few months as against several years taken in traditional methods.

“We have also fine-tuned these open-source models and built our own models that are incorporated into our platforms. Users have the option to automatically fine-tune them according to their requirements,” Kolli said.

The startup has four more platforms — ReBolt, BoltPro, BoltBio, and ClinBolt.

Using GenAI and by extracting data from BoltChem, ReBolt generates a synthetic pathway for making a molecule in the chemistry labs. The ReBolt platform has been developed with a vision to optimise R&D processes for Indian drug manufacturers.

Its BoltBio platform helps to identify the real reason behind a particular disease, hence making the treatment of any rare or common diseases easier. The product’s beta launch is expected this year.

Similarly, ClinBolt uses patient data to design clinical trials and predict the outcomes of a certain treatment. Both BoltBio and ClinBolt are the latest products in Boltzmann’s quiver.

Meanwhile, BoltPro is an AI-powered protein engineering platform, which helps in designing vaccines and antibodies.

Boltzmann has built models, along with utilising the open-source large language models (LLMs) and other GenAI models available in the market today. For instance, it has leveraged protein language models such as ESM, developed by Meta and Google DeepMind’s AlphaFold2 to build the platforms.

While the startup did not reveal the names of its clients, it claimed to be currently working with certain Indian drug research institutes. The startup is also in talks with the top 10 global pharma companies for the deployment of its platforms.

Boltzmann has raised about $200K from a few angel investors since its inception.

How Does Boltzmann Make Money?

Currently, the startup has three means of revenue generation, including its SaaS (available in monthly, quarterly, and yearly subscriptions) and a fee-for-service model. Besides, it also partners with other biotech and pharma companies in drug development for particular diseases.

Interestingly, Boltzmann has opted not to limit the use of its GenAI models solely for third-party deployment. Instead, the startup ventured into in-house drug discovery last year utilising its platforms.

Kolli said that while its GenAI application vertical has a quick commercial prospect, given the increasing use of technology in healthcare, its in-house drug discovery vertical will take a few years before it starts generating revenue. However, going forward, the second vertical has the largest prospect in terms of revenue generation for Boltzmann.

The startup’s current ARR stands at around $200K, which is expected to gain increased momentum as Boltzmann has set its eyes on global expansion.

What Lies Ahead?

Currently, Boltzmann is focused on cracking deals with a global pharma giant for the deployment of its product. Besides, the startup is also looking to raise $3 Mn in a fresh funding round from VCs.

The company is also exploring a few mergers and acquisitions (M&A) opportunities. It has already onboarded the leader of Bengaluru-based Serocode Biolabs and Eviogen, Dr Paritosh Prashar as its cofounder.

In 2024, the startup is aiming to launch a general version of its BoltPro and ClinBolt platforms.

The startup is looking to collaborate with top international players in the larger drug discovery space, which is dominated by the likes of Pfizer, GSK, and Eli Lilly. In the AI drug discovery space, Boltzmann currently competes with global companies including Insilico Medicine, Recursion AI, and Exscientia.

As per a report, the Indian market for AI in drug discovery is projected to become an INR 2.57 Lakh Cr market opportunity by 2028. For now, it will be interesting to see how Boltzmann succeeds in creating a niche in the Indian drug discovery market by leveraging the power of GenAI.

[Edited by Shishir Parasher]

[ad_2]

Source link