[ad_1]

India is one of the largest energy-consuming countries in the world, and the nation’s energy needs are only going to increase with time.

Having foreseen this a decade ago, the Union government had set a target of installing 100 GW of solar power capacity in the country by 2022. Although the deadline has now been extended to 2026, the seriousness for solar rooftop installations, which are supposed to account for 40% of the total solar energy generation, runs unrestricted among industry stakeholders, including climate tech entrepreneurs.

Even the government of India has taken it a step further with the launch of PM Surya Ghar Yojana, which aims to help up to 10 Mn families across India install rooftop solar panels.

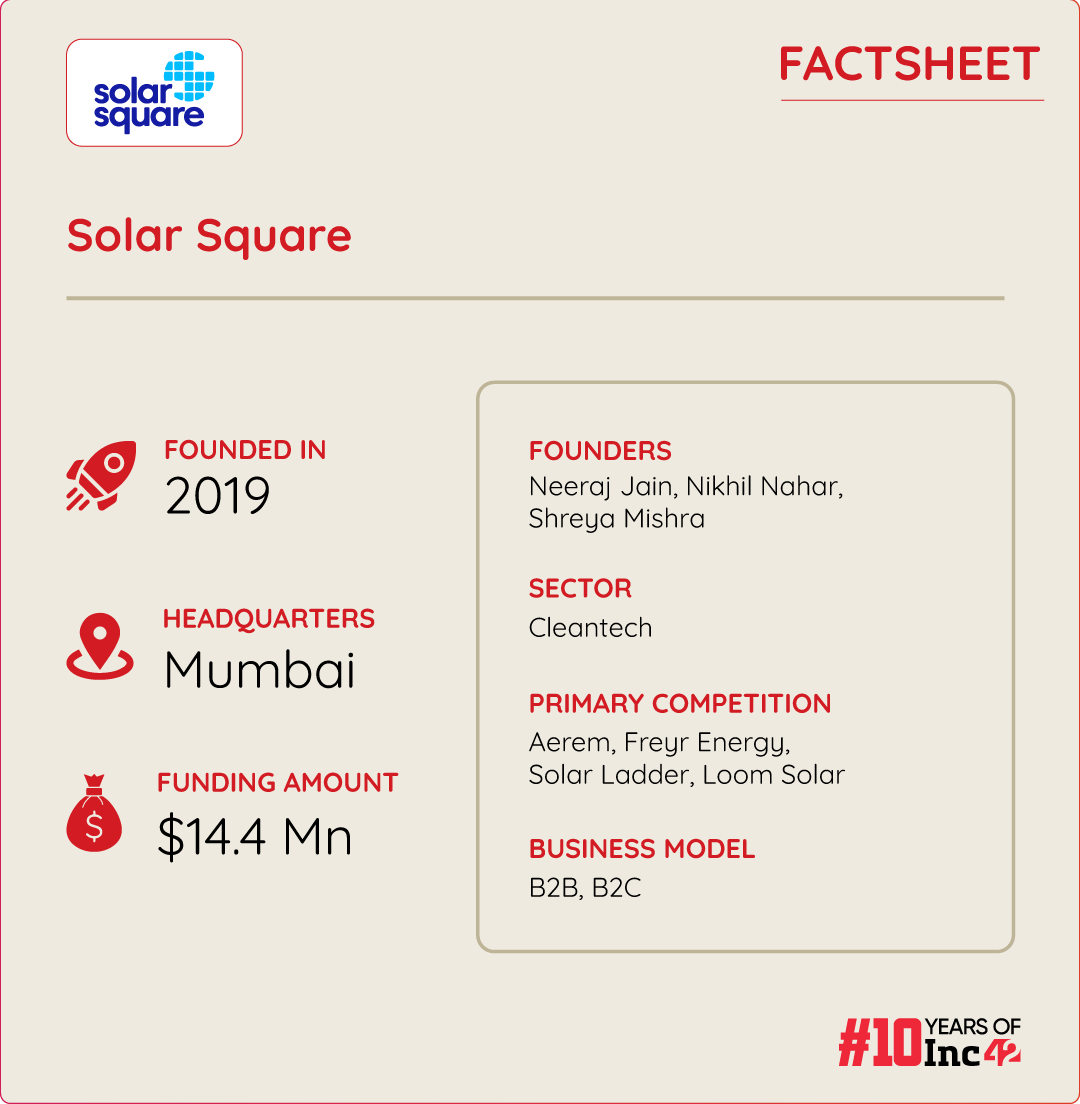

In line and drawing support from the government’s vision of building a solar energy surplus nation is SolarSquare Energy, a full-stack rooftop solar solutions startup founded in 2015 by Neeraj Jain and Nikhil Nahar. Shreya Mishra, the third cofounder, joined the startup in 2019-20.

The startup initially commenced operations with B2B rooftop solar solutions. However, the founders later realised that the residential market, comprising housing societies and individual homes, had immense untapped potential in the field of solar energy. To harness this potential, SolarSquare ventured into the B2C segment in 2021.

The startup is operational in 15+ Indian cities and has identified that cities with high population density, including Bengaluru, Mumbai, and Delhi NCR, possess high potential for the solar industry.

A Full-Stack Solar Energy Maverick At Your Service

Although SolarSquare is not a manufacturer of rooftop solar panels, this does not restrict the climate tech startup from offering full-stack support, which ranges from free inspection, installation and after-sales services.

Notably, the startup procures solar panels from vendors like Premier, Navitas, Adani and Rayzon.

Mishra told Inc42 that their customer onboarding process starts with a free consultation session with a SolarSquare team, which guides individuals through the entire solar energy harvesting journey.

Included in this consultation is an instant virtual 3D design of a post-installation look. Once the startup gets a go-ahead from customers, it calculates the energy needs of a family before finally proceeding to install SolarSquare WindPro Mount, which is designed to withstand high-velocity winds and combat all weather conditions.

“Our IIT Bombay-certified product comes with a 10-year warranty and is 100% rust-proof,” Mishra said.

Breaking Myths Around Solar Energy

Speaking with Inc42 about why solar energy adoption has been a laggard in a Sun-surplus country like India, Mishra said that several misconceptions currently shroud this clean source of energy, and one of the most common rebuttals is that solar energy is not very efficient to power entire households.

“Not only is solar energy sufficient to power your entire home, it also helps you bring your electricity bill to almost zero. Additionally, solar is a one-time investment,” Mishra added.

A 2 to 3 BHK house with lights, fans, and a washing machine needs panels to support up to 3 KW of energy. This may go up to 5 KW in case a house has up to two air conditioning units. Notably, one solar panel can produce 0.5 KW of energy.

Mishra told Inc42 that its team of solar experts does not blindly follow the one-size-fits-all approach and carefully calculates the energy needs of every family, including future requirements, before suggesting a final capacity.

The startup offers a five-year maintenance package with every purchase, which includes monthly cleaning and quarterly preventive health checks of the solar panels. Beyond the period of 5 years, the startup charges an annual maintenance fee of INR 10,000.

The startup caters to a wide network of 500 to 1,000 customers daily in every city it operates. Besides, it offers regular maintenance and repairs within 48 hours of receiving a complaint.

In a bid to improve its after-sales service, the startup recently acquired PV Diagnostics, a consultancy solutions provider in the solar industry. According to Mishra, the acquisition will help the company deploy service teams across several cities.

The acquisition came shortly after it bagged INR 100 Cr ($12.08 Mn) as part of its Series A funding round led by Elevation Capital and the US-based climate-focussed fund, Lowercarbon Capital.

Mishra said that the startup’s FY23 revenues stood at INR 100 Cr. The company is looking to double its revenues by FY25.

According to the cofounder, they have successfully powered 10,000 homes and 100 housing societies so far. Despite this, the entity has yet to emerge in the black.

Making Solar Energy A Pocket-Friendly Affair

As 50%-60% of customers prefer EMI options, SolarSquare has forged partnerships with several banks. Interestingly, the monthly amount generated for a five-year EMI plan is close to the electricity bill of an average household.

The startup does not take any down payment from its customers, as it is covered by the subsidy offered by the Indian government.

Under PM-Surya Ghar: Muft Bijli Yojana, the government provides a central financial assistance (CFA) of 60% of system cost for 2 KW systems and 40% of additional system cost for systems between 2 to 3 KW capacity.

At current benchmark prices, this means INR 30,000 subsidy for 1 KW system, INR 60,000 for 2 KW systems and INR 78,000 for 3 KW systems or higher.

Moving on, the startup claims to have harnessed 10%-20% of the rooftop solar market share across each of the cities it operates.

Apart from SolarSquare, one of the key companies in this segment is Zunroof, backed by Godrej Investment Office, which specialises in solar rooftop design, installation, and management using technologies such as computer vision, AI and VR. Among the corporates, Tata Power has emerged as one of the key players. It offers a one-stop service for setting up rooftop solar, uses satellite images to assess the rooftop capacity of a property and maintains the panels.

Speaking about competition in the solar rooftop space, Mishra said that several companies, including battery manufacturers, offer solar panels today. However, such companies have multiple channel partners, who make this market highly unorganised.

She said that there are barely any companies in the space that offer end-to-end services, including post-purchase maintenance. It is these grounds that have helped SolarSquare stay relevant in the ecosystem.

While SolarSquare primarily operates in major cities, accessing roofs remains a significant challenge, particularly for apartment dwellers. To address this, many emerging startups are introducing the concept of Digital Solar.

This innovative approach allows users to contribute to larger solar projects, effectively reserving panels and earning discounts on their electricity bills proportional to the solar energy generated. SundayGrids is one such company offering the option to invest in digital solar – a unit of a portion of a solar plant hosted online that can be purchased by investors

Although the concept of Digital Solar has yet to gain active prominence in India, it presents a promising opportunity for urban residents and companies like SolarSquare to bank on for a more sustainable green future.

[Edited by Shishir Parasher]

[ad_2]

Source link