Startup Stories

GoldPe’s Bid To Change Investment Strategy Of Indians

SUMMARY

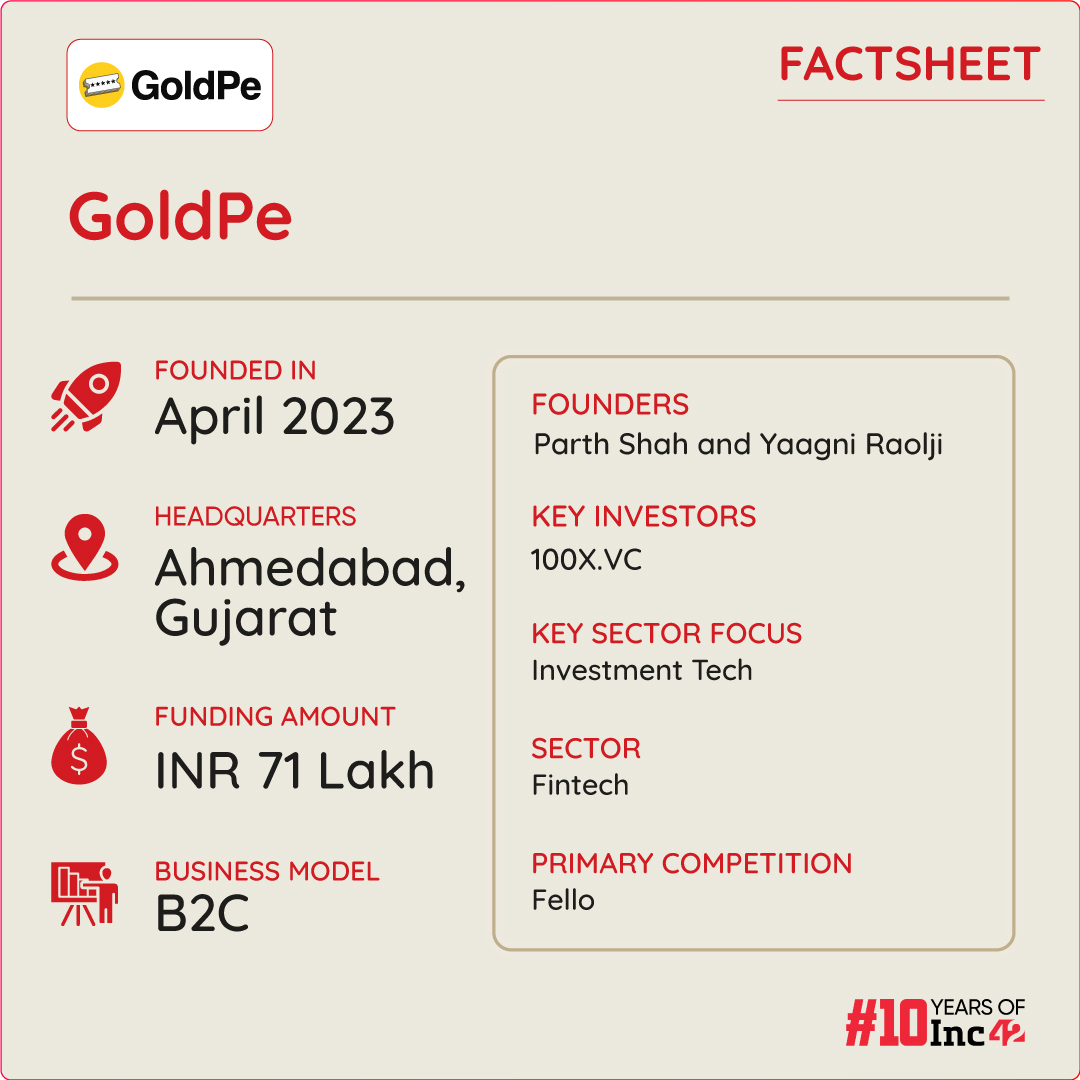

Launched in April 2023, GoldPe aims to “revolutionise the way Indians save” by making it a rewarding yet safe experience

The investment tech startup allows users to invest in digital gold with as little as INR 10 and offers a chance to win a maximum of INR 10 Lakh every week upon buying digital gold worth INR 100 and above

The startup operated in the investment tech space, which is expected to become a market opportunity of $74 Bn by 2030, growing from $9.2 Bn in 2022

Traditional methods of savings are going through a paradigm shift. This is because Indians are increasingly diversifying their investment portfolios, seeking higher returns than those offered by traditional instruments like Fixed Deposits (FDs), Recurring Deposits (RDs), and gold.

One of the major reasons behind this shift is the rise of fintech startups in the country. While players like Zerodha or Groww have seamlessly connected Indians with more volatile share market investment opportunities, others like Jar or Gullak have played a key role in offering less lucrative but much safer saving avenues.

However, the challenge lies in finding Indian fintech platforms that provide a balance between secure investment options and attractive rewards. Such platforms are relatively scarce in an investment landscape often characterised by either low-risk, low-return options or high-risk, high-return ventures.

In a bid to serve this addressable market, Ahmedabad-based Parth Shah and Yaagni Raolji introduced a fintech startup GoldPe, which allows users to invest in digital gold with as little as INR 10. It also offers a chance to win a maximum of INR 10 Lakh every week upon buying digital gold worth INR 100 and above.

Launched in April 2023, GoldPe aims to “revolutionise the way Indians save” by making it a rewarding yet safe experience,” according to the company’s website.

However, this is just one facet of the investment tech platform. GoldPe can also be seen as the answer to the growing number of fantasy apps that today leave many individuals in debt, as users continue to lose money in the hope of a hefty windfall someday.

Speaking with Inc42, Shah of GoldPe said, “Through the GoldPe app, users can cultivate the habit of savings with the potential for significant rewards, all while enjoying superior economic value compared to traditional savings avenues. Even in the absence of a prize, users’ funds accrue over time, offering a pathway to financial growth.”

The startup today has a user base of 2.25 Lakh individuals, who have invested in digital gold via GoldPe and actively leverage the startup’s prize-linked savings (PLS) offering. Since its inception, the company has served around 55K winners.

The Genesis Of GoldPe

Before founding GoldPe, Shah and Raolji launched a personal finance management (PFM) app, SPAC, in 2022. Despite raising INR 71 Lakh from 100X.VC and a group of angel investors in the same year, SPAC faced closure in May 2023 due to its inability to compete with established players like ETMoney, Fisdom, and Moneysights. The app garnered only 10K downloads throughout its 1.5-year lifespan.

While the founders were brainstorming on their next move, Shah recalled his childhood years in Kuwait, when his father used to put up his savings in Kuwait’s Gulf Bank, which would allure consumers with a lottery called AlDanah Millionaire draws.

This concept (aka prize-linked savings scheme) is also common in the UK, the USA and the Middle East. Under this scheme, users typically deposit funds into a PLS account at a regulated bank. Each deposit earns them entries into periodic cash prize draws, akin to a lottery but hosted exclusively by financial institutions, ensuring legality.

Thus began the modest beginnings of GoldPe. Notably, the founders utilised the remaining investor funds to establish their new startup.

All the puzzle pieces fit together, as GoldPe’s PLS system avoids regulatory hurdles as it falls within the realm of in-app rewards. Further, since GoldPe is not a registered bank or a non-bank financial institution (NBFC), the startup banked on digital gold to initiate its PLS foray.

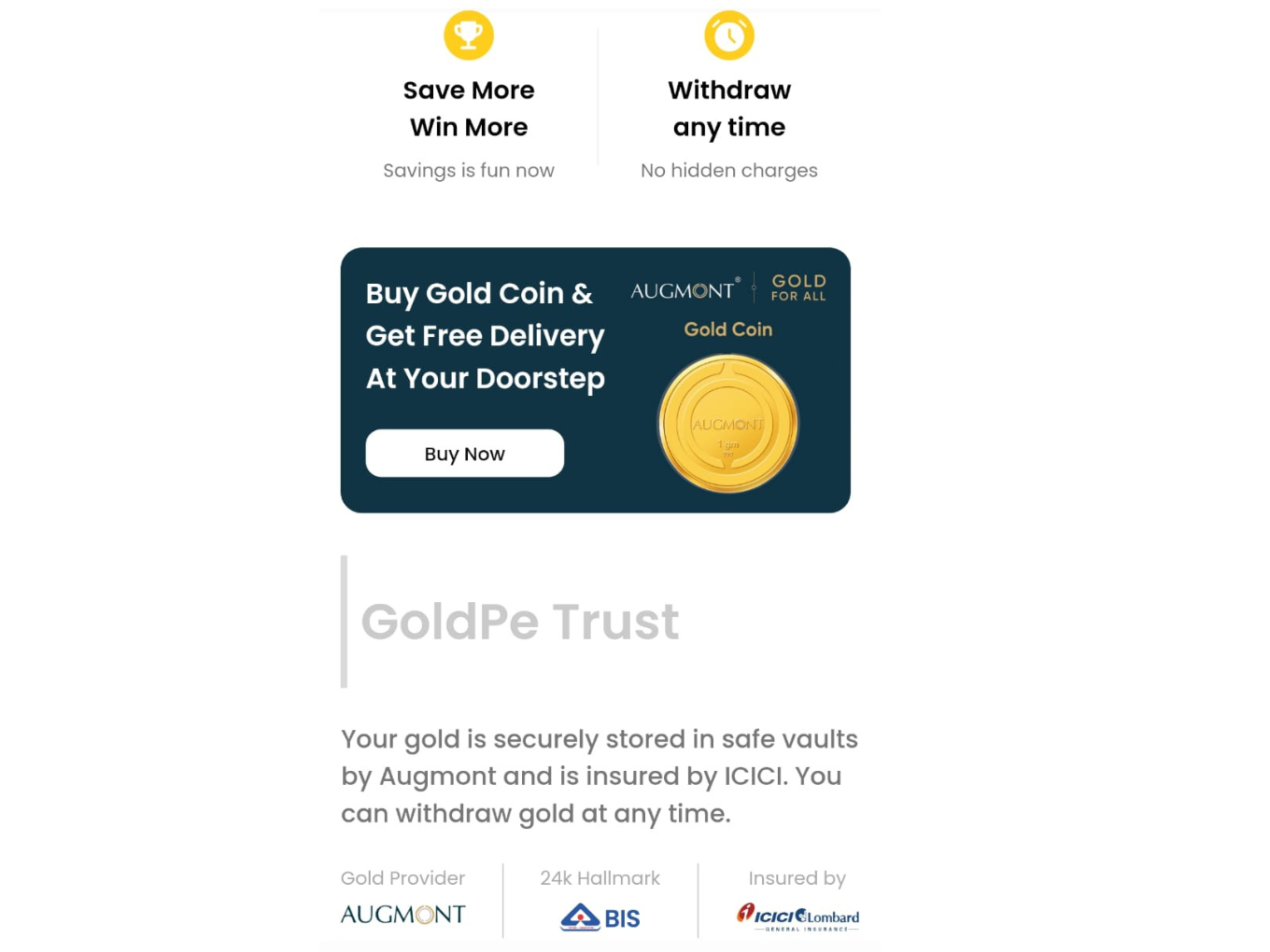

For this, the cofounders partnered with integrated gold player Augmont and facilitated payments through their banking partner DBS Bank to get the ball rolling.

“As a new startup, you wanted to remove all the barriers to conduct business smoothly. The only reason we chose gold was because there are very less compliances and users can start saving without any KYC requirement. Further, there is no cap for investments. With us, one can even invest as little as INR 10 to buy digital gold,” said Shah.

Fixed returns that one may get due to the fluctuation in the price of gold are independent of the winnings. Meanwhile, Shah credited startups like Jar and Gullak for educating people about the promise of digital gold, thus creating trust in the asset (Gold).

Moving on, users can invest as little as INR 100 to participate in weekly lucky draws — of course, you get to keep your gold. Every ticket has a total of six numbers. GoldPe unveils one digit every day for six days, generally announcing the winners on Saturdays. The company claims to have sold more than 10 Mn tickets. GoldPe earns a 3% commission from Augmont on every transaction. The startup fills the pot using 1% of the 3% commission it gets from Augmont.

Challenges And Way Ahead

As of now, GoldPe is faced with the mammoth task of retaining its users. This is because there are quite a few user complaints about delays they face during withdrawals.

“The delays usually occur because transactions are exclusively through Unified Payments Interface (UPI). With UPI, many times transactions get delayed or cancelled due to the recipient’s bank’s server or our banking partner DBS bank’s server being unresponsive,” Shah informed.

To address this, the startup has now empowered its users with the IMPS option to facilitate instant interbank electronic fund transfers.

The investment tech platform is also in talks with YES Bank to make their second banking partners. Shah claims that these measures would rectify 9 out of 10 withdrawal issues faced by users as of now.

On a macro level, GoldPe competes with startups like Jar, Gulak, YottaSavings and Prizepool.

As of now, the startup solely depends on the commissions it makes from the gold transactions. It plans to increase its offerings in the next six months. In addition, GoldPe is targeting to expand its network to 5 Lakh users, with 30% transacting users, in the next six months.

“If this goal is achieved, we will be introducing other asset classes. FDs will be the first asset that we plan to launch, followed by P2P lending. With the addition of each asset class, our revenue stream will grow with commissions earned from users’ purchase of assets other than the goal,” Shah added.

GoldPe’s only competitor in the PLS space is Fello, which surpassed a user base of 500K in January last year. Set up two years before GoldPe, Fello raised $4 Mn in a fresh funding round led by US-based Courtside Ventures early last year. Fello also sees users invest in digital gold to participate in weekly lucky draws.

With the lucrative PLS scheme, GoldPe aims to change how Indians invest in gold. The investment tech industry is on an expansion streak, and Inc42 estimates that the market opportunity in this space will surge to $74 Bn by 2030 from $9.2 Bn in 2022.

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency9 months ago

Crptocurrency9 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories1 year ago

Startup Stories1 year agoWOW Skin Science’s Blueprint For Breaking Through In The $783 Bn BPC Segment

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016