Crptocurrency

The TEAMZ Web3/AI Summit Tokyo 2024 is Counting Down 50 Days

The TEAMZ Web3/AI Summit is scheduled to be held over two days from April 13th to 14th, 2024, at Toranomon Hills in Tokyo, Japan. The summit will attract over 5,000 participants from Japan and the international Web3 industry to discuss the construction and development of the Web3 ecosystem.

Summit homepage:

Summary of the 2024 Japanese Web3 Market Features/Key Points

In 2024, the Japanese market will introduce an official stablecoin

The key word for the Japanese Web3 market in 2024 is “stablecoin”. The Japanese government’s Financial Services Agency (FSA) is preparing to approve an official Japanese stablecoin. Currently, several Japanese banks and technology giants, including Circle+SBI, GMO Trust, Mitsubishi Bank+Progmat+Ginco, are positioning themselves in the Japanese stablecoin market. With the introduction of the official Japanese stablecoin, this significant move not only solves the conversion issue between domestic fiat currency and digital cryptocurrencies but also greatly enhances the depth of cooperation between the Japanese Web3 industry and the international Web3 market.

Changes in the tax system for corporations and individuals holding digital cryptocurrencies

To prevent the outflow of excellent Japanese Web3 entrepreneurs and businesses, and to attract outstanding global Web3 companies to the Japanese market, the Japanese government abolished the tax on digital cryptocurrency valuation based on market value at the end of the period for corporate entities holding digital cryptocurrencies on December 22, 2023. At the same time, the government introduced a reduction in the income tax rate for corporations and individuals holding digital cryptocurrencies

The country with the most digital cryptocurrency exchange licenses issued in the world

As of now, there are 30 cryptocurrency exchanges in the Japanese market that have been issued trading licenses by the government. All exchanges, especially those in the coin listing sector, follow the regulations of the JVCEA and the Japanese Financial Services Agency (FSA). However, starting from the fiscal year 2024, every operating cryptocurrency exchange will have one to two slots for conducting IEOs and listing mechanisms for global high-quality Web3 projects. At the same time, the entire industry’s coin listing cycle and costs are significantly decreasing.

The Country with the Most Institutional Participation in the Web3 Industry Globally

While there is no exact number indicating how many institutions have entered the Web3 market in Japan, the current market is active with major Japanese corporations such as SBI, GMO, DMM, Softbank, NTT Docomo, KDDI, MUFG, SMBC, Sony, NEC, Fujitsu, JAL, INPEX, MATSUDA, JR Kyushu, Hakuhodo, Casio, Tokyo Energy, etc., all laying out their Web3 business segments. NTT Docomo is set to release its own digital cryptocurrency wallet product in 2024, which means these corporations are not just superficially participating in the Web3 industry but are already in the stage of deploying products and service lines.

IP as a Natural Advantage for the Growth of Japan’s Web3 Market

Japan is a global powerhouse in top IP. A vast array of anime and other IPs provide strong content support for the NFT, gaming, and metaverse project development within the Web3 industry. IP is also a unique natural advantage for the Japanese market in developing the Web3 industry.

A Large Community and Group Foundation

Compared to other global markets, Japan is undoubtedly one of the most active markets for the Web3 community and groups globally. The Bitflyer exchange and Coincheck exchange alone have about 2.5 million registered users each. The activity level of the Japanese community and groups in domains such as blockchain gaming, NFTs, DeFi, X to Earn, mining, Staking, etc., is also very high.

Overall, the Japanese Web3 market in 2024 is undoubtedly one of the most watched markets in the global Web3 arena. The TEAMZ Web3/AI Summit also hopes to send more information and signals about the Japanese market to the global Web3 market through this conference. Meanwhile, through keynote speeches, roundtable forums, VIP closed meetings, conference exchanges, project exhibitions, and peripheral activities, the summit aims to provide participants with various opportunities for in-depth exchanges, hoping that we can together build a new global Web3 ecosystem under the new market environment.

Highlights of the Conference:

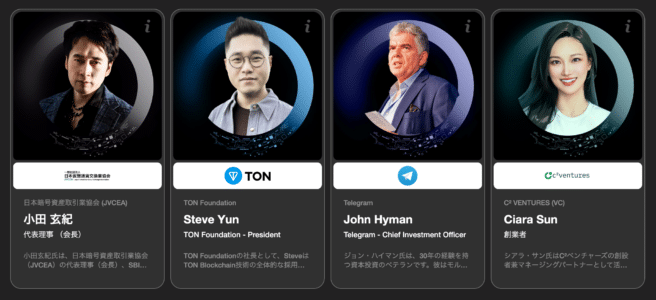

- 120 TOP industry keynote speakers

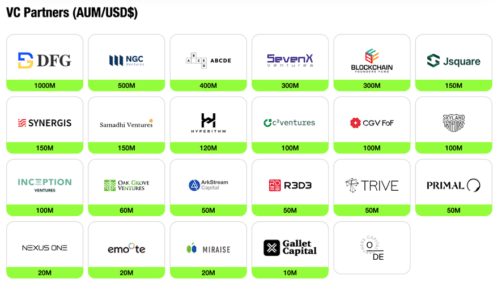

- 100+ official summit VCs

- 89 booths

- 100+ official summit communities

- 100+ official summit media partners

- 450+ summit specially invited industry TOP KOLs (Key Opinion Leaders)

- 5000+ summit participants

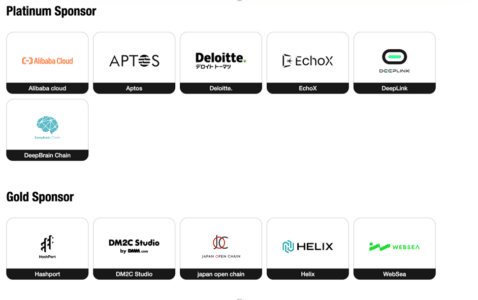

Up to now, a total of 178 institutions and projects have been confirmed as co-organizers, sponsors, VC partners, community partners, and media partners attending this conference.

For more information on the conference partners, please visit the conference homepage:

Partial list of conference keynote speakers:

The TEAMZ 2024 conference will be held at the International Conference Center on the 4th and 5th floors of Toranomon Hills. The 5th floor will primarily serve as the main stage for keynote speeches and project exhibition area. It will also provide spaces for television stations, media partners, and KOL interviews and live broadcasts. The 4th floor will mainly offer spaces for conference VIPs, keynote speakers, and sponsor representatives for private meetings and networking.

The timing of the conference coincides with one week before the Bitcoin halving period. Additionally, April is the peak season for cherry blossoms in Tokyo, making it an ideal time for the event. The conference aims to gather more industry colleagues in Tokyo to celebrate the start of the next new cycle in the industry.

Contact us: [email protected].

Official conference website: https://en.web3.teamz.co.jp/

TEAMZ official Twitter: https://twitter.com/teamz_inc

Crptocurrency

Cross-border Payments Using Crypto? How Remittix (RTX) Is Transforming Finance With PayFi

Crptocurrency

U.S. Spot Bitcoin ETFs Record $226M in Net Outflows on December 23

U.S. Spot Bitcoin ETFs Record $226M in Net Outflows on December 23

The U.S. spot Bitcoin ETFs faced significant net outflows totaling $226.42 million on December 23, marking the third consecutive day of declines, as per data from Trader T on X. This shift reflects varying investor sentiment during the holiday season amidst ongoing market volatility.

Key Insights Into ETF Activity

Despite the overall outflows, BlackRock’s IBIT stood out with a net inflow of $31.78 million, suggesting continued confidence among investors in the world’s largest asset manager’s Bitcoin fund.

On the other hand, major outflows were recorded across several ETFs:

- Fidelity’s FBTC: $146 million

- Grayscale’s GBTC: $38.4 million

- Bitwise’s BITB: $23.7 million

- Invesco’s BTCO: $25.6 million

- ARK Invest’s ARKB: $15.7 million

- Grayscale’s Mini BTC: $6.2 million

- VanEck’s HODL: $2.6 million

Other ETFs reported minimal or no significant net flows.

Factors Influencing the Outflows

The net outflows indicate a period of caution among investors, driven by:

- Year-End Portfolio Adjustments

Many investors rebalance their portfolios during the year-end, which could contribute to these withdrawals. - Market Volatility

Bitcoin has seen significant price fluctuations, raising concerns over near-term risks. - Institutional Strategy Changes

Institutional investors might be re-evaluating their strategies, leading to temporary shifts in capital.

BlackRock’s Resilience Amid Outflows

While most ETFs faced declines, BlackRock’s IBIT recorded notable inflows. This resilience underscores BlackRock’s growing influence in the cryptocurrency sector and its reputation as a trusted brand among retail and institutional investors alike.

Implications for Bitcoin and ETF Markets

- The combined outflows emphasize the short-term uncertainty in Bitcoin’s trajectory.

- However, consistent inflows into select funds like BlackRock’s IBIT suggest that institutional confidence in Bitcoin remains intact.

- This divergence highlights the importance of ETF management and branding in attracting and retaining investor capital.

Conclusion

The net outflows from U.S. spot Bitcoin ETFs signal cautious investor sentiment but also showcase pockets of resilience, particularly in BlackRock’s IBIT. With the cryptocurrency market navigating a volatile period, ETF flows will remain a critical indicator of market dynamics and institutional confidence in Bitcoin.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Crptocurrency

U.S. Spot Ethereum ETFs Record $130.11M in Net Inflows on December 23

U.S. Spot Ethereum ETFs Record $130.11M in Net Inflows on December 23

Ethereum ETFs See Strong Inflows as Institutional Interest Grows

On December 23, U.S. spot Ethereum ETFs recorded a total net inflow of $130.11 million, underscoring growing institutional interest in Ethereum. The data, sourced from Trader T on X (formerly Twitter), highlighted significant contributions from leading asset management firms.

Top Gainers Among Ethereum ETFs

- BlackRock’s ETHA

- Led the inflow chart with a staggering $88.81 million.

- Continues to attract significant interest as BlackRock maintains its dominant presence in the ETF space.

- Fidelity’s FETH

- Secured the second spot with $46.4 million in net inflows.

- Demonstrates Fidelity’s strong positioning in the Ethereum ETF market.

- Bitwise’s ETHW

- Experienced a modest gain of $1 million.

Outflow Trends and Stagnant ETFs

- Grayscale’s ETH:

- Recorded a net outflow of $6.1 million, showing some divergence from the broader trend.

- Other ETFs:

- Displayed no significant change in inflows or outflows, reflecting stability in investor sentiment for those products.

Key Takeaways from the Inflows

The $130.11 million inflow highlights a growing shift toward Ethereum-focused financial instruments in the institutional market. It follows recent trends where Ethereum-based products have garnered increased interest due to the blockchain’s utility in decentralized finance (DeFi) and smart contract platforms.

With BlackRock and Fidelity leading the charge, it’s evident that major financial players are betting on Ethereum’s long-term potential.

What This Means for Ethereum and Investors

The influx of capital into Ethereum ETFs could bolster Ethereum’s price and enhance its market stability, signaling greater mainstream acceptance of crypto assets. For investors, it indicates confidence from institutional players, often seen as a bellwether for market trends.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency10 months ago

Crptocurrency10 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoWOW Skin Science’s Blueprint For Breaking Through In The $783 Bn BPC Segment

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016