Startup Stories

How Axis Bank Helped Cashfree Solidify Its Payments & Improve User Experience

In a landscape dominated by digital transactions, fintech startups are redefining traditional banking by extending financial services to a broader swath of the Indian population — many of whom were previously underserved. Given this massive opportunity, India’s fintech market is poised for significant growth, with projections showing a potential to reach $2.1 Tn in market size, expanding at an 18% CAGR.

Nonetheless, incumbent banks remain indispensable due to their longstanding trust and reliability. Embracing the agility, technological innovation and customer-centric approaches of fintechs, these established players are actively adapting to the digital landscape to ensure their continued relevance and growth. Rather than a competitive landscape, it’s an ecosystem of collaboration where fintechs can leverage the banks’ extensive customer base, regulatory know-how and financial muscle.

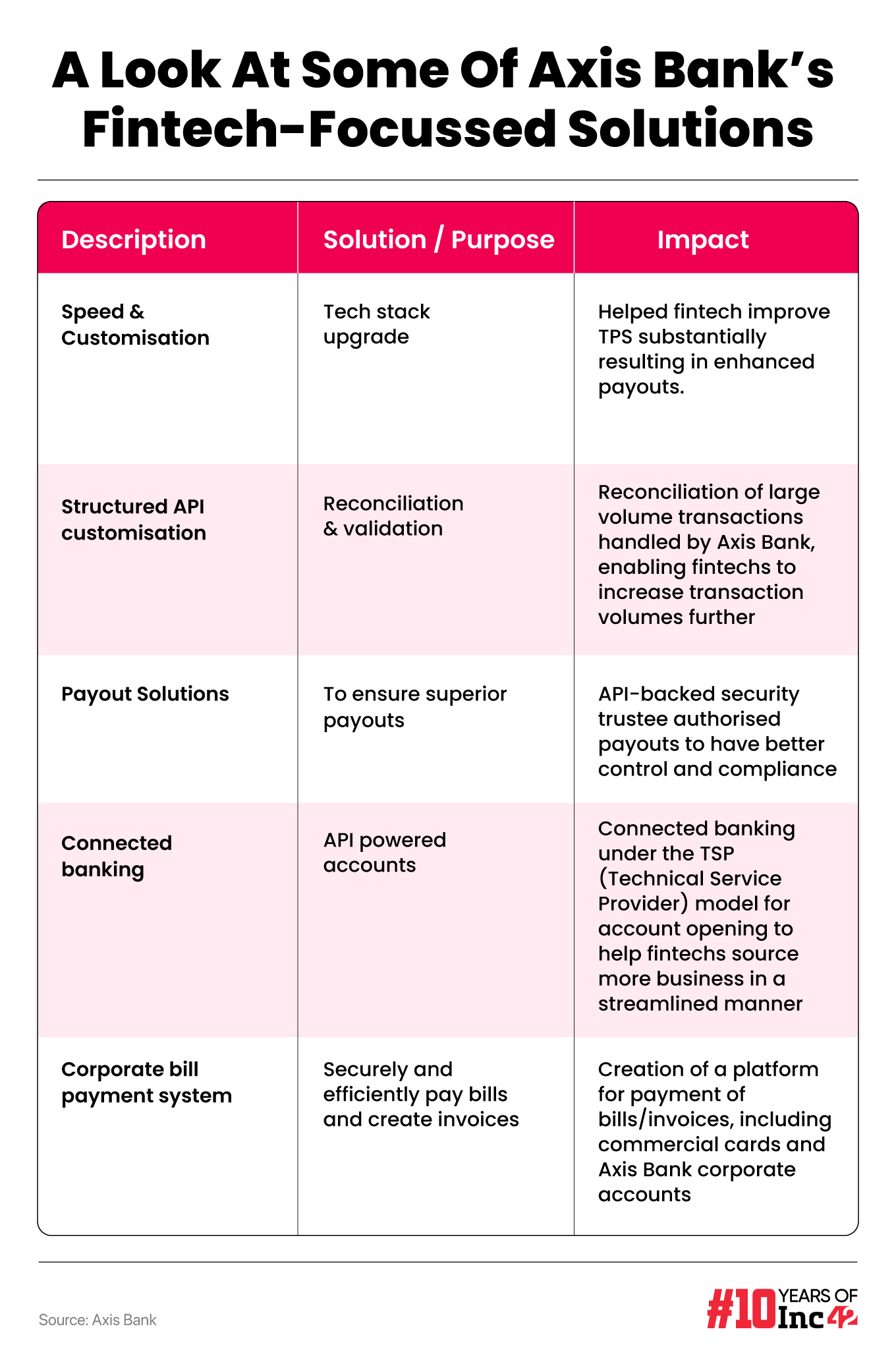

Axis Bank, one of the largest private banks in India’s banking sector has notably embraced such collaborations. From cash management and core banking solutions to structured API customisation and Bharat Bill Payment System (BBPS) — Axis Bank equips new-age players with a variety of capabilities. This fosters a mutually beneficial alliance between the parties.

Its partnership with full-stack digital payments platform Cashfree Payments serves as a relevant example to showcase how such synergies come into play. The Bengaluru-based fintech startup, which specialises in critical areas like collection, disbursal/payout, verification and more, partnered with Axis Bank in 2021 to strengthen its payout and other solutions.

The partnership encompasses three major areas: Payments through API, connected banking and escrow services. Presently, Axis Bank serves as the primary escrow bank for the startup, offering settlement solutions for 360 days a year in India. Additionally, it facilitates direct rails with international payment gateways like CyberSource and Mastercard Payment Gateway Services (MPGS), enabling Cashfree’s Payments’ merchants to accept global payments.

According to Cashfree Payment’s founder Akash Sinha, Axis Bank has enabled the fintech startup to process substantially improved transactions per second (TPS). It also ensures seamless handling of high transaction volumes which has been instrumental in achieving a success rate of over 95% across various modes.

“The collaboration combines Cashfree Payments’ expertise in digital payments with Axis Bank’s strong banking infrastructure, providing businesses with a secure platform to streamline their financial processes,” Sinha said.

Axis Bank’s partnership with Cashfree Payments has evolved from a PAPG (Payment Aggregators and Payment Gateways) solution, providing fintechs with a more integrated banking partnership, where they are closely working together to support Cashfree Payments’ growth.

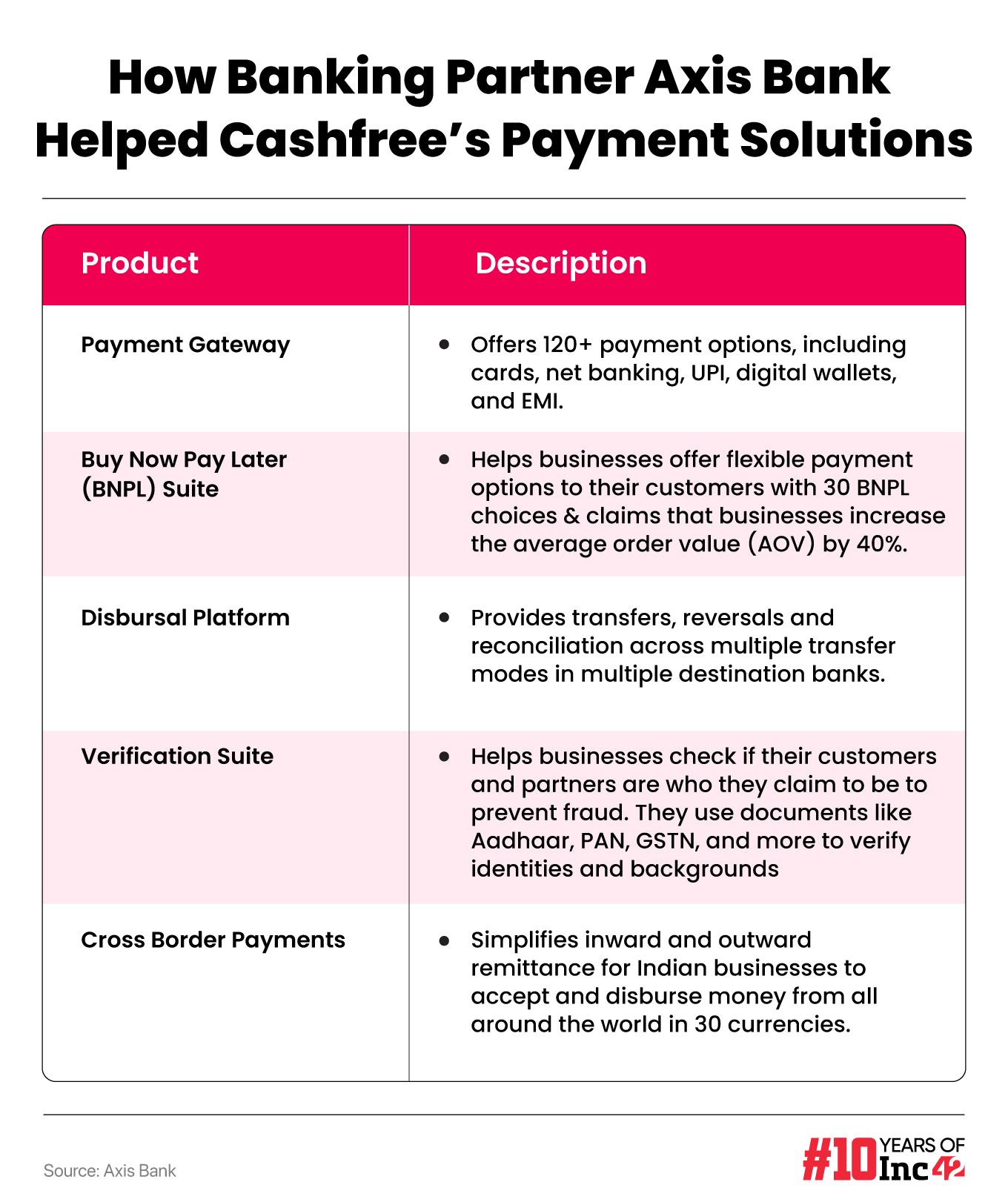

How Cashfree Payments Empowers Businesses With Digital Payments

Cashfree Payments was founded in 2015 by Akash Sinha and Reeju Datta at a time when UPI was still a year away and the boom in digital payments post-demonetisation across India was a long way off.

The founders identified complicated payment issues across ecommerce, education, fintech and more. Each required customised solutions to address unique challenges and the duo decided to build the essential blocks first. Later, these could be integrated to introduce automated solutions for BaaS or even big legacy companies.

It launched its payment gateway in 2016, followed by its Payouts service in 2017 — the major pillars of its payment solutions. And soon, its growth trajectory found its momentum as Cashfree expanded its offerings in partnership with banking players like Axis Bank.

Today, the platform claims to provide 120+ payment options on the collection front, enabling businesses to scale up fast and cater to a wide range of customers. It also claims to serve more than 6 Lakh businesses across various sectors.

Sinha added that Cashfree Payments processes 2 Lakh Cr transactions every year (1,000 per second) and has serviced 6 Lakh+ businesses across sectors and 200 Mn bank accounts. Besides, the startup also has an automated verification suite in place to help authenticate individual users and business partners (suppliers, service providers and more).

It follows a commission-based model, where it charges businesses for using its payment gateway to receive payments from its customers. However, the fee may vary depending on the cost of the product. For instance, merchants pay Cashfree Payments up to 1.9% of the transaction for using its payment gateway.

For settlements, Cashfree Payments charges companies between INR 2.5 to INR 10 for every transaction, depending on the transaction size.

For a payment centric platform like Cashfree Payments, forging a strategic partnership was imperative. At first, Sinha revealed the complexities of stakeholder mapping within various banking verticals posed a significant challenge. However, he said that Axis Bank’s dedicated team, which acted as a single point of contact, helped the startup streamline processes and expedite the integration process.

Since 2021, Cashfree Payments has leveraged Axis Bank’s comprehensive suite of banking API integrations — spanning bill collections, payments, trade and more, to deliver support to its customers across a wide spectrum of virtual accounts such as UPI, RTGS (Real Time Gross Settlement) and NEFT (National Electronic Fund Transfer). This diversity not only allows users to transact using their preferred payment method, but also enhances their banking experience.

Through its bank transfer API, Cashfree Payments also refers merchants to Axis Bank and encourages them to open accounts with it. Moreover, Sinha revealed that Axis Bank’s support in enabling APIs for collections and disbursals has streamlined the fintech’s operations and helped it offer comprehensive banking solutions.

Further, he disclosed that Axis Bank’s clear communication on compliance and product guidelines about rate updates, merchant category code rates and information on regulations has empowered the startup to make informed decisions swiftly and create a sustainable business model.

Expanding on this, Amitabh Chaudhry, MD & CEO at Axis Bank says, “Whether it is an API-powered escrow, robust and quick TPS or cutting-edge tech to handle payments, we’ve striven to build it all for our fintech clients”.

The Indian fintech landscape is experiencing rapid growth with 23 unicorns and 34 soonicorns. This surge is driven by several key factors, including increasing internet penetration, widespread smartphone adoption and government initiatives such as Digital India and Make in India.

For these new-age disruptors, partnering with Indian banks isn’t merely a strategy for expansion, it’s a catalyst for credibility. Banks generally have years of trust and reliability and by collaborating with them, these startups can gain an invaluable stamp of approval, foster trust among their customers and grow. Moreover, such collaborations speed up the process of navigating the complex regulatory landscapes, thus, enabling fintechs to comply with stringent norms and regulations efficiently.

Axis Bank, in particular, has demonstrated a strong commitment to partnering with fintech firms, highlighting the trend of mainstream financial institutions embracing fintech partnerships.

Chaudhry further revealed “Through its team of experts in products, technology and client relationships, the bank collaborates closely with fintechs to understand their specific challenges and provide tailored solutions across services with secure transactions and more”.

Today, Axis Bank works with 110 global and homegrown fintech firms including the likes of Paytm, PhonePe, PayU, Razorpay, Google Pay, CRED, PineLabs and Cashfree Payments among others.

It is also important to note that banking partnerships today extend beyond the utilisation of technological capabilities and banking infrastructure as banks and fintechs are also increasingly joining forces to co-create products like connected banking, co-branded cards that offer customers distinct benefits and rewards and more

Moreover, banks are providing customers with a broader range of financial services and opening up their APIs to fintech companies, thereby empowering the latter to innovate and create new financial products and services.

This collaborative approach signifies a profound shift in the financial services industry, as traditional players and fintech disruptors work together to meet the evolving needs of consumers in the digital age.

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency10 months ago

Crptocurrency10 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoWOW Skin Science’s Blueprint For Breaking Through In The $783 Bn BPC Segment

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016