Startup Stories

How Android-POS Software QueueBuster Empowers 65K+ Businesses With A Super-App-Like Tech Stack

When a McKinsey study forecast a few years ago that automation would be the way to ease retail’s margin strain and meet fast-evolving customer expectations, not many players were prepared for a leap of technology. For starters, it was 2019 and the Covid-19 pandemic was still a year away. Small and medium businesses were still stuck with labour-intensive retail operations instead of adopting best-in-class digital solutions, and the app economy had yet to peak.

Since then the retail landscape has undergone a tectonic shift. Most businesses are now combining online and offline retail formats to embrace an omnichannel model and looking to optimise workflows using at-scale tech tools. Whatever the size or the business format, the winners are those automating critical functions like billing, inventory, customer interaction and data analysis to future-proof business continuity and sustainable growth investments.

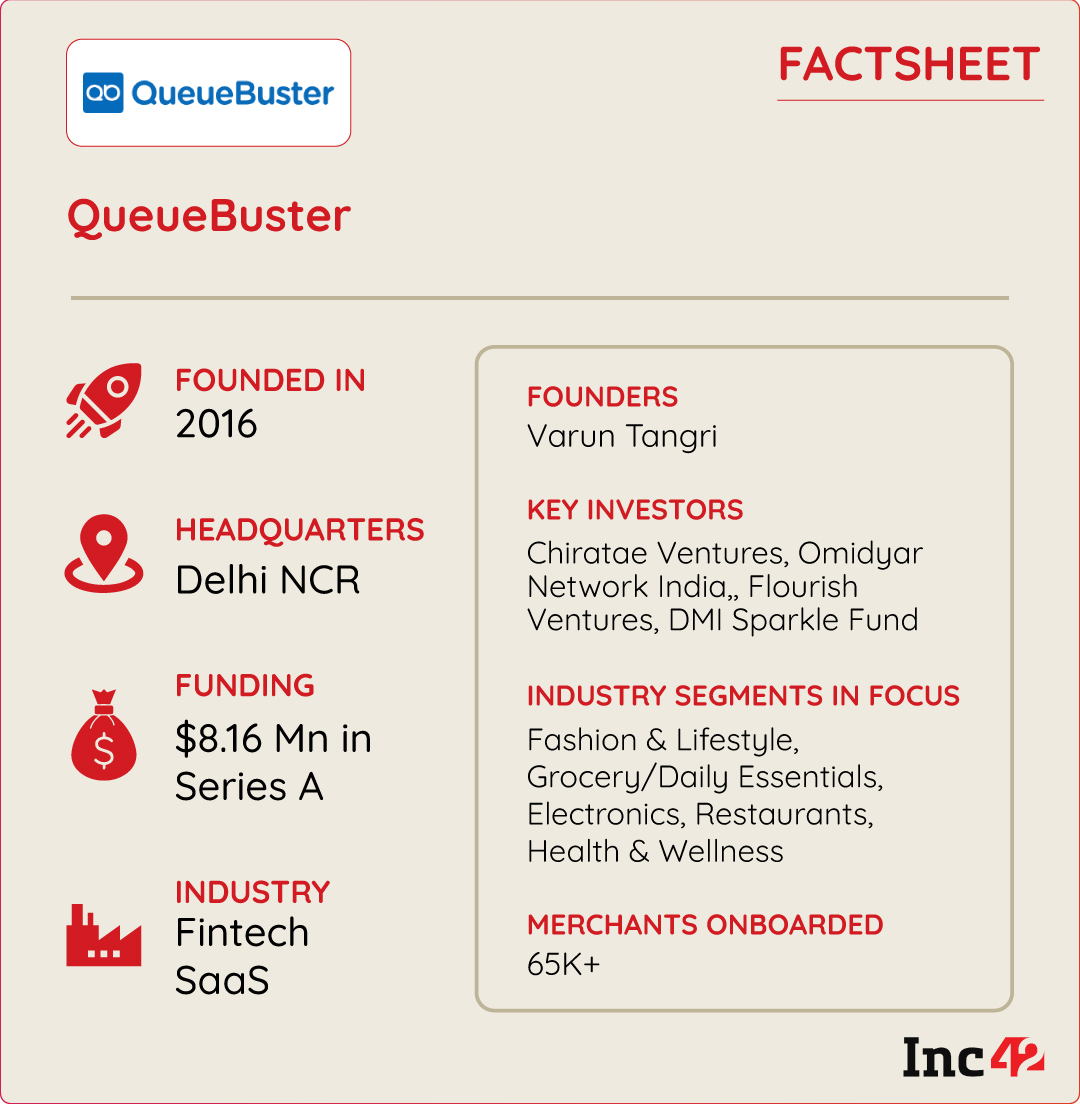

A fintech SaaS startup with a long-term business vision has already understood the benefits of a technology suite for automating and streamlining store operations. Set up in 2016 by Varun Tangri, QueueBuster initially rolled out cloud-based Android-based POS (point of sale) solutions for billing and inventory management to help small and medium retailers.

Understandably, an android cloud-based POS system offers far-reaching advantages compared to traditional on-premises cash registers, many of which are bulky legacy machines. Today, Queuebuster offers a full-stack Android-based POS solution to both large industries and MSMEs. Its Android app can be downloaded from Google Play Store on any Android device such as a smartphone, Android POS billing machine, card swipe machine and more.

“At QueueBuster, we aim to not only streamline the process but also enhance flexibility and adaptability in modern business environments through our intuitive and user-friendly design and generate invoices in much fewer clicks than a traditional POS,” said Tangri.

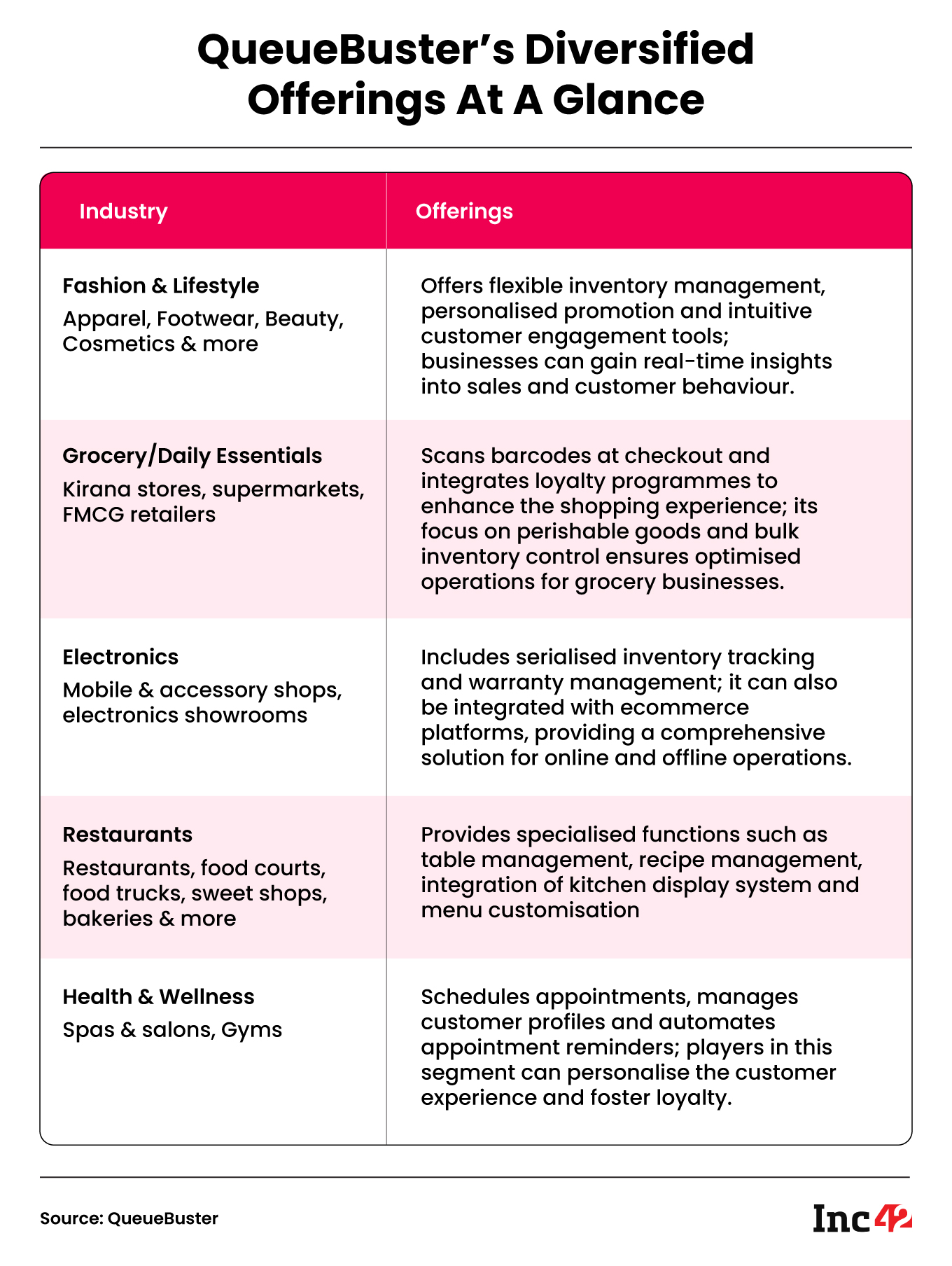

It also equips its customers with a host of features such as quick billing, inventory management, online store setup, CRM, loyalty programmes and advanced data analysis. QueueBuster’s Android POS solutions are used by companies such as HUL, CocoCart, DLF Brands, Happilo and more

As of December 2023, QueueBuster claims to have onboarded 65K+ merchants, with an eye on 55% YoY revenue jump in FY24.

In 2022, the fintech SaaS startup raised $8.16 Mn in Series A from investors like Chiratae Ventures, Omidyar Network India,, Flourish Ventures and DMI Sparkle Fund.

How A Global Health Crisis Set A SaaS Fintech On The Super-App Path

Tangri worked as a software engineer at Samsung and learnt everything about mobile app development during his three-year stint. That’s when the entrepreneurial bug bit him. In 2012, he teamed up with his brother Arun to launch MaplePOS, a POS app streamlining restaurant operations . The app soon caught Zomato’s attention and the foodtech giant acquired it in 2015, rebranding it as Zomato Base.

After the acquisition, Tangri mentioned that the original team stayed on board with Zomato for 15 months. However, he eventually decided to strike out on his own again and founded QueueBuster in 2016.

While he was confident in the potential of the POS Android software market, his startup initially faced challenges in acquiring customers due to the lack of Android infrastructure (POS hardware) in the Indian retail landscape, he said.

“There was a slow and limited penetration of Android payment machines in the market and retailers were also not keen to use their Android phones for POS billing,” he added.

However, a significant boost came after demonetisation, which led to a record rise in digital transactions and POS terminal deployments. Traditional merchants began seeking cash alternatives and in 2019, the RBI allowed smart screens to accept PINs on payment devices.

Tangri recognised the growing opportunity in the Android payment machine segment and scaled up his POS offerings to cater to small businesses and big corporations. During this period, the startup also tied up with payment providers like Pine Labs and Mosambee (later acquired by Pine Labs) which opened up new avenues and allowed the startup to offer a comprehensive suite of services on Android hardware.

While POS solutions picked up pace, there came another curveball in 2020 in the form of COVID-19. “Retailers, who formed a big chunk of our clientele, saw closures and reduced footfall for months due to lockdowns and supply chain issues. What happened during Covid directly affected our business,” the CEO said.

He noticed how the pandemic prompted small players to adopt digital business solutions and decided to roll out an array of features, including an online store builder, Khata (digital ledger), e-CRM solutions, ERP components and more.

However, the biggest differentiator is QueueBuster’s super-app approach – full-stack POS applications for retail going beyond basic billing and inventory management (more on that later).

Aware that its USP would require targeted marketing to reach every customer segment, the startup leveraged digital channels like social media and online forums to reach out and educate micro and small businesses, and large retailers through training sessions, workshops, virtual conferences and trade shows, demonstrating how its Android-based billing apps and business management solutions could help them.

QueueBuster’s ‘Super-App’ Advantage

Post demonetisation and the havoc wreaked by the Covid-19 pandemic, small-to-medium business owners in India increasingly turn to SaaS partners for help with business operations, sales tracking, customer management and overall improvement in user experience. POS billing software is a much sought-after solution, especially in the retail and restaurant segments, where customers are now physically present and servicing them well during busy times is bound to drive sales.

The rising adoption of Android POS software has led to quite a few players vying for traction. Tangri said that in the Restaurant space, it is competing with the likes of Petpooja and Posist Technologies, while in retail, it competes with Gofrugal and Ginesys.

However, the startup’s overarching super-app approach and Android-based solutions helps it stand out.

“Our interface allows single-user, multi-user and multi-partner businesses to run their daily operations efficiently and provides data-driven insights to improve productivity. From large-format retail stores to small carts and kiosks, QueueBuster is an all-in-one POS solution for all businesses,” said Tangri.

QueueBuster’s services aim to make the retailtech experience better for different industry players and their unique needs. Therefore, the startup has integrated with over 50 top software and hardware brands to offer a reliable solution for big businesses.

It facilitates integrations with industry giants like Zoho, Tally, GST Suvidha Provider (GSP), Microsoft Dynamics, and Shopify. The platform has also partnered with prominent payment providers like Razorpay, PayU and PayPal to enable smooth transactions. Additionally, QueueBuster works together with POS hardware providers such as TVS Electronics, Epson,and VeriFone to offer ready-to-use solutions for businesses.

Knowing that managing business data, especially in retail, comes with security challenges, QueueBuster is focused on keeping user data safe. It uses advanced security measures like encryption and multi-layered authentication to protect transactions and user information, ensuring a secure environment for businesses and their customers.

Tangri claims that the startup has secured SOC 2 certification, a voluntary compliance standard developed by the American Institute of Certified Public Accountants (AICPA). It specifies how service organisations should manage customer data. It also has an ISO 27001 certification in place to ensure user security.

As in other SaaS companies, revenue is generated through monthly and annual subscriptions. Small businesses can access the monthly subscription starting at INR 999. Meanwhile, larger enterprises benefit from customisable plans tailored to their needs, with prices determined accordingly.

The Final Take

According to the QueueBuster CEO, the startup is on an expansion spree, aiming to grow its merchant base to 5 Lakh+ by 2025. With a team of 40+ in-house engineers, it is actively upgrading its current product portfolio and enhancing its capabilities in cloud-based solutions, especially in mobile billing. The startup has taken initial steps to enter global markets and is set to make a full-fledged entry, starting with the MENA region, in 2024

If this seems super-ambitious at a time when a global funding freeze and macroeconomic headwinds are rocking the startup ecosystem, a look at the global POS market would not be out of context. The market size is estimated to reach $81.1 Bn by 2030 from $25.3 Bn in 2022, growing at a CAGR of 15.8% during the forecast period.

What’s more, the Asia-Pacific market stood at $8.5 Bn in 2022, one-third of the global value. So, it is not surprising that startups in the POS space (hardware, software and mPOS) are looking for exponential growth in the future.

“Android’s strength lies in its modern, user-friendly and efficient interface, overshadowing the conventional operating systems like MS Windows. Unlike those bulky and costly relics, Android is an adaptive and affordable mobile solution,” said Tangri.

While cloud-based Android solutions continue to gain significance in the contemporary landscape, it is imperative for businesses to stay abreast of the latest technologies to excel in optimising their business operations. Consider the revolutionary AI-powered retail POS systems that global leaders are developing to thrive in a competitive market.

For example, predictive analytics can enhance demand forecasting, customer behaviour analysis can provide valuable insights for inventory and sales, and computer vision streamlines the checkout process, making it faster and smoother. As one industry expert notes, integrating AI into retail POS systems offers the same speed and convenience as online shopping, coupled with the real-life advantage of touch and feel.

In this dynamic landscape, Indian startups like QueueBuster and their counterparts have the exciting opportunity to align with these global trends to stay ahead in the race, ensuring they not only keep pace but lead the way in shaping the future of retail technology.

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency9 months ago

Crptocurrency9 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016

-

Startup Stories1 year ago

Startup Stories1 year agoWOW Skin Science’s Blueprint For Breaking Through In The $783 Bn BPC Segment