Startup Stories

How GMO Backed Bureau ID Is Helping Businesses Curb Financial Fraud, Protect Their Users

In a post-pandemic world, regulated industries and new-age businesses have jumped on the digital bandwagon to optimise reach and maximise profits. Consumers have evolved in sync, happy to access every convenience with a click or a tap. But super-exposure to cyberspace leaves the world increasingly vulnerable to cybercrimes, and businesses, ranging from SMEs to BFSI leaders, tend to suffer the most.

Consider this. Cyber-financial fraud accounted for 77.4% of the cybercrimes in India between January 2020 and June 2023, per a survey by the Future Crime Research Foundation (FCRF). A 2023 India Threat Landscape report by Cyfirma says startups and SMEs top the ‘most targeted’ list in 2023, while banking and financial services institutions saw 9.5% of all cyberattacks in the last three years. The losses of India Inc. are still not quantified, but globally, cybercrime costs can reach $10.5 Tn annually by 2025, according to industry research and media organisation Cybersecurity Ventures.

As businesses across industry segments, especially those in the financial sector, are compelled to navigate a fast-growing digital minefield, they require cutting-edge financial crime solutions for protection against sophisticated cyberfraud.

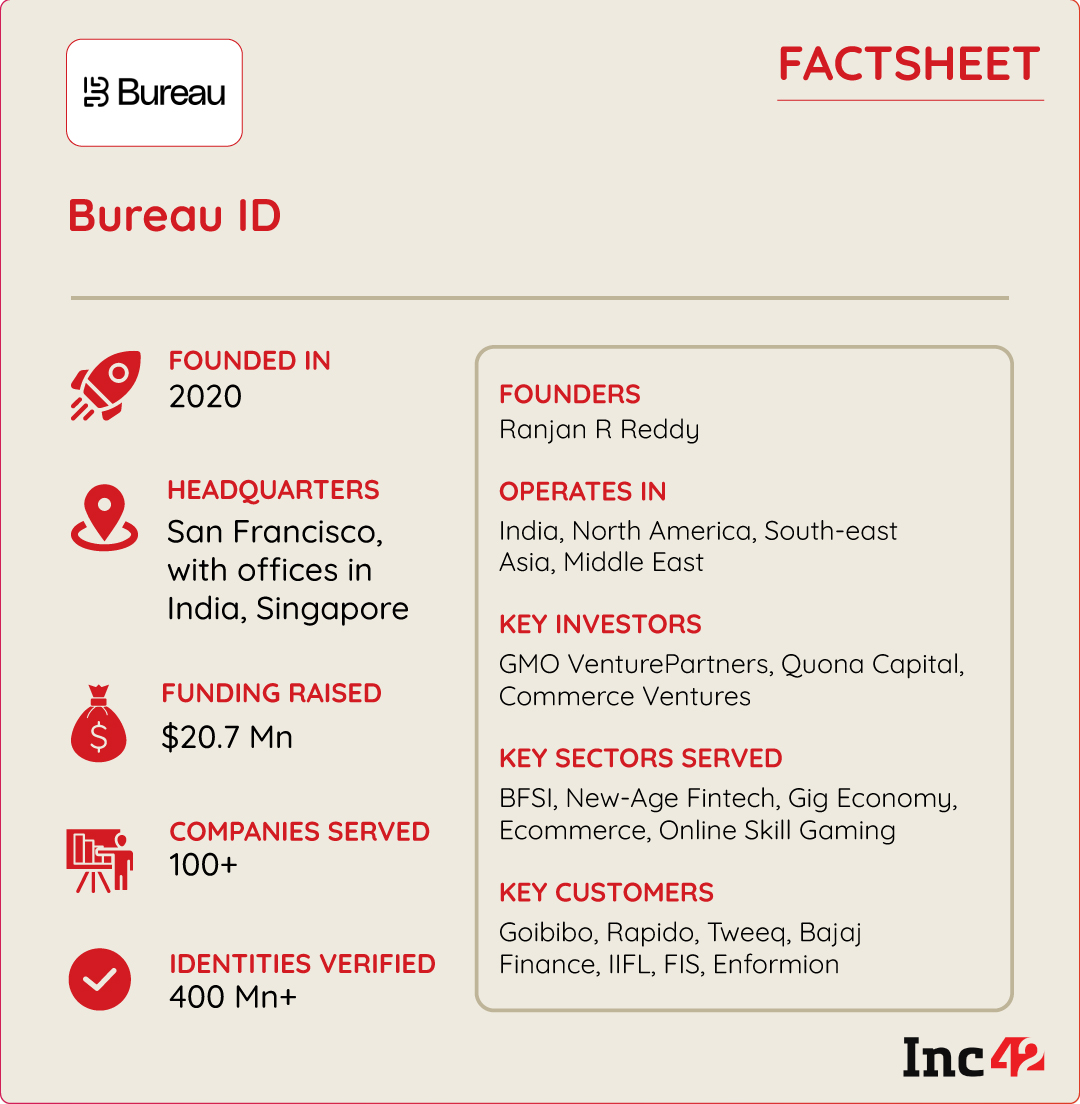

To help tackle online fraud at scale, serial entrepreneur Ranjan R Reddy launched the B2B SaaS startup Bureau ID, a global, real-time risk decisioning platform for identity verification, fraud prevention and compliance management in sync with country-specific cybercrime laws and anti-money laundering (AML) checks. It primarily enables banks, fintechs, financial institutions (FIs) and enterprises to fight fraud, and compliance abuse across the customer journey, using its proprietary fraud detection suite.

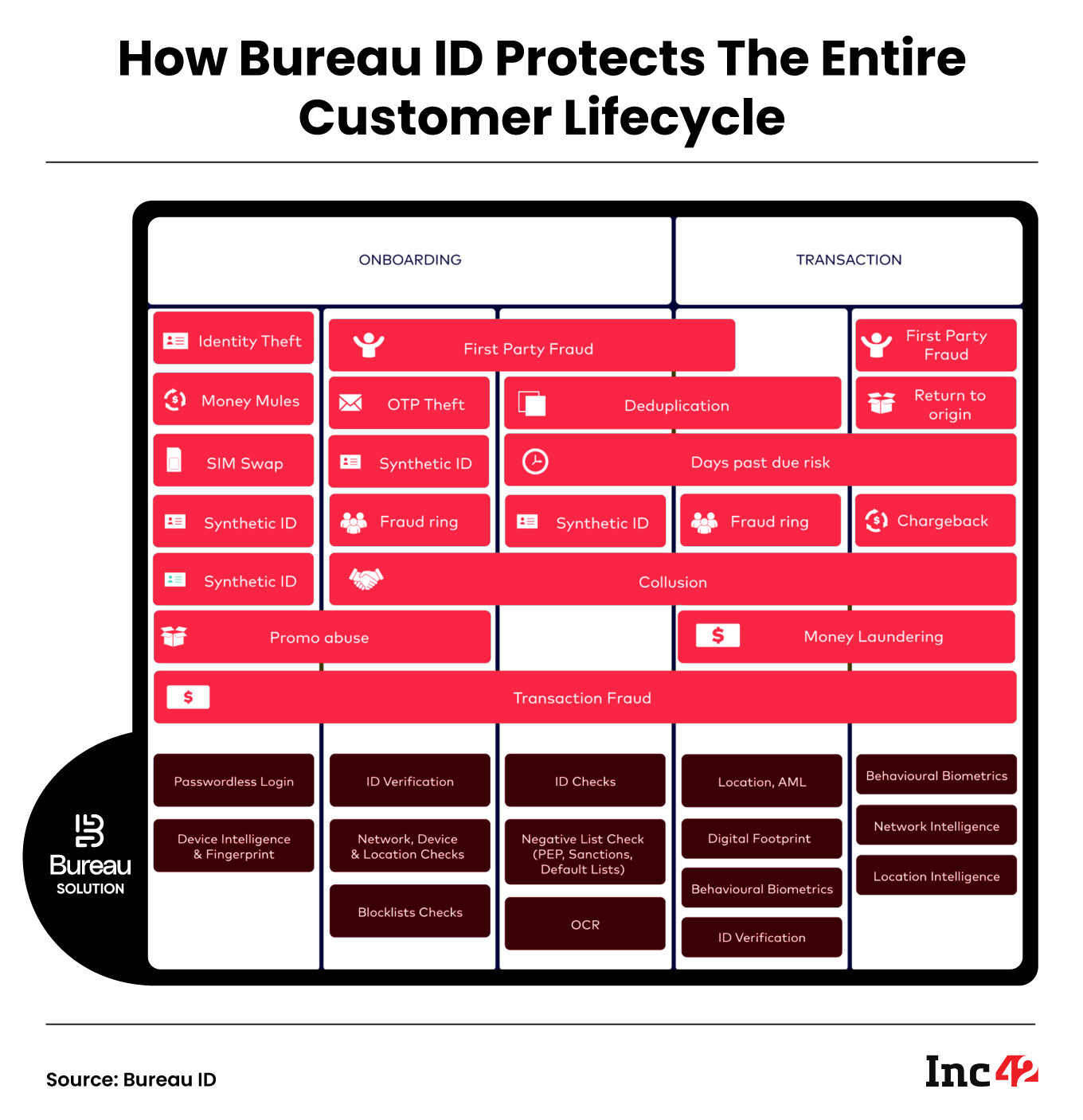

Using link analysis (examines data connections and relationships for potential fraud) and its predictive AI models, Bureau employs an identity graph to detect fraud networks. This is a critical step when securing a business against use-cases such as fraud rings, money mules and synthetic identity frauds amongs others. Bureau uses its proprietary technology and alternate data points to validate and match digital identifiers to physical identities and analyse their unique behaviour patterns to track anomalies in real-time.

An identity network is thus built over time, securing businesses against cyberfraud throughout users’ life cycles and protecting users when they interact and transact with businesses. Bureau monitors all transactions in real time and provides data insights to companies via a unified dashboard.

The startup’s mission is to provide an all-in-one risk decisioning platform for fraud detection and prevention that ensures digital trust. With its no-code workflows and a single API integration, businesses can validate their customer’s identities, and get continuous fraud monitoring at onboarding, as well as the transaction stage. Reddy claims businesses can reduce fraud by 80% and speed up identity decisioning time by 95% using Bureau solutions.

The startup claims to have serviced organisations worldwide including banks, NBFCs, micro-finance institutions, BaaS platforms and companies in the gig economy, insurance, gaming and payments. Bureau’s customer base spans India, South-east Asia, Middle east and North America. According to Reddy, the startup has successfully verified 400 Mn+ identities and protected over $500m of digital transactions against vulnerabilities to date. Some of Bureau’s customers include US-based FIS Global and Enformian, KSA’s Tweeq and companies like Goibibo, Rapido, Bajaj Finance, IIFL and others from India.

Bureau has raised over $20 Mn since inception, most recently from a clutch of global investors such as GMO VenturePartners, Quona Capital and Commerce Ventures. Noted angel investors, including Mark Britto, EVP-chief product officer at PayPal, and Bobby Mehta, former president and CEO of TransUnion, also supported the cyber fraud prevention platform.

Inside Bureau’s State-Of-The Art Fraud Prevention Offerings

Going by its overarching cybercrime prevention strategy, it is clear that Bureau was not built in a day. For starters, Reddy dedicated much of his career to building and scaling businesses in the mobile payment space. In 2012, he founded Qubecell, a Mumbai-based payments startup, acquired a year later by San Francisco-based mobile payments company Boku. At Boku, a now publicly listed company, he served as chief business officer in his last leadership role.

Reddy elaborated that during his time at the company, he incubated and scaled its identity division which was later sold to Twilio. This experience made him realise that the existing cybersecurity solutions were fragmented and siloed when it came to crucial components like compliance, fraud and security.

“I aspired to build a single platform, with a single API integration, that proactively and holistically monitors identities and transactions against fraud and abuse by providing real-time decisions,” said Reddy.

Hence, Bureau ID was set up in 2020 to accomplish that through its comprehensive fraud detection suite that includes no-code workflows, device intelligence, behavioural AI, compliance APIs, alternate data solutions, visualised through an identity graph.

Regarding the issue of increasing cyberfraud, Reddy stresses that smart identity decisioning should consider how fraudsters use mule accounts to launder stolen money. Money mules are mostly individuals typically recruited by fraudsters to transfer huge sums between accounts and across locations until all links to the eventual receivers are lost (however, some mule accounts are also opened by bots).

As human mules use multiple phone numbers, email IDs, stolen or spoofed identities for these activities, mapping digital and physical identity verifications through alternate data solutions plays a critical role in detecting them, especially when businesses onboard new customers.

Next comes device intelligence, making the procedure more foolproof. Bureau cross-checks device fingerprints, which are unique patterns generated through device configurations and usage. Pitting a device ID/fingerprint against a specific user helps prevent a fraudster from switching devices too frequently. The platform also validates IP addresses, operating systems (to analyse if they are genuine or spoofed), VPN and tracks remote desktop and malware, which are commonly used by mules to bypass security measures.

“Mules open multiple accounts for money transfers from different devices in a very short period. With data intelligence, we can identify anomalous activity,” explained Reddy.

Bureau identifies bots in action and scans user behaviour with behavioural AI tools that look at unique human behaviour patterns such as, typing speed, scrolling patterns, and hesitation percentage to successfully authenticate an identity.

“A criminal using stolen identities to open accounts is unfamiliar with personal data. Hence, the person may display hesitation or rely on copy-pasting to enter account details,” the Bureau CEO said.

Finally, an identity network is created with the help of link analysis. “The risk associated with an identity is assessed based on the type and number of such links while factoring in indications of past fraudulent activities reported by Bureau’s customers,” he added.

Bureau’s no-code solutions can be easily integrated with business backends via API, allowing companies to set up customised security features as easily as dragging and dropping pre-configured blocks created for every step of the customer journey.

According to Reddy, the startup has secured SOC2 compliance, a voluntary compliance standard developed by the American Institute of CPAs (certified public accountants) that specifies how service organisations should manage customer data. More importantly, unlike many data brokers, Bureau does not store personally identifiable information (PII) and only relevant, tokenised insights are generated for identity verification.

The startup has set up a pay-per-API revenue model, where businesses pay for the APIs and workflows tailored to suit their specific needs. It also generates revenue through a fixed monthly/annual platform fee for essential functions like building workflows, transaction monitoring and continuous screening, regardless of API usage.

Tapping Into Investors’ Network For Growth

Although Bureau’s strong value proposition positioned it well in the niche space, raising awareness and onboarding B2B customers proved difficult for the early stage startup. Promotion through digital marketing is a common but costly tactic. What if a startup could capitalise on its investors’ network to expand its customer base? That’s precisely what Bureau did.

The startup recently raised additional capital in a Series A funding round in July 2023. Japan’s GMO VenturePartners (GMO-VP) was the lead investor in this round, and its sister company GMO Payment Gateway, the largest payment service provider in Japan, also pitched in along with existing investors. As part of the Japanese internet conglomerates GMO Internet Group, both firms specialize in fintech investments within the Indo-Pacific region, promoting cross-border innovation. GMO Payment Gateway also runs an AIF in India, providing debt funding to fintech startups.

While the funding helped Bureau enhance its data and AI capabilities, Reddy was more than impressed when his investors stepped in to help with customer acquisition.

Leveraging GMO-VP’s connections, Bureau serviced Jai Kisan, GroMo, OTO, Niro and MobiKwik of its portfolio companies.

“GMO has been an invaluable partner in our journey. Its extensive scale and unique perspective make it an exceptional guide and partner. Bureau has already reaped significant benefits due to its impressive portfolio and network,” he said.

Asked about this holistic hand-holding, Ryu Muramatsu, director and founding partner from GMO-VP said the benefits were mutual. “Digital trust is pivotal for all financial transactions where many challenges originate, especially the upsurge in fraudulent activities. Tackling these hurdles is crucial for the entire fintech sector. That’s why we think Bureau is a significant player [in the identity decisioning space].”

Bureau has reportedly agreed to a strategic partnership with GMO Payment Gateway. Bureau is eyeing expansion across the Middle East and Southeast Asia and aggressively marketing its solutions to increase awareness. It will also cater to more institutional players, especially in the banking sector. This makes ample sense as the BFSI sector remains the primary target for cyberattacks and accounted for more than 70% of the spend on anti-fraud measures in 2022.

To speed up its operations, Bureau completed its strategic acquisition of Delhi-based inVOID in 2023. The digital identity verification and KYC authentication platform typically works with fintechs and FIs.

“This is a timely acquisition as the convergence of new regulations and a sharp uptick in fraud cases in recent years have escalated the demand for robust compliance and risk management solutions,” said Reddy.

The Future Is Now For Fraud Detection Businesses

Globally, the fraud detection and prevention market is estimated to reach $66.6 Bn by 2028 from $27.7 Bn in 2023, growing at a CAGR of 19.1%, a report by MarketsandMarkets says. Although this augurs well for FDP players, businesses are still not looking at the problem in its entirety.

As a Deloitte report points out, most organisations depend on homegrown systems where fraud detection rules are framed on an ‘if-then’ scenario. This logic works well in a structured data environment. However, given the humongous and complex data in circulation, complete automation and advanced AI/ML will be required instead of the traditional logic.

Moreover, organisations still seek use-case-specific solutions or try to integrate authorisation logic in disparate tools instead of opting for a centralised ecosystem. Unless identity decisioning is embedded as a core solution, it cannot secure the end-to-end digital journeys of businesses and their customers in real time.

Reddy seconds this, saying businesses must leverage tools and technologies to champion consumer trust and proactively prevent fraud, instead of waiting for the regulators to introduce and enforce penalties that focus more on compliance.

Currently, Bureau does not face direct competition from Indian players, although startups like HyperVerge and Helloverify exist in niche segments of fraud detection. The platform also holds a distinct advantage with a global presence across three regions.

Nevertheless, there is no shortage of global players in the market, including Bureau ID, New York-based Alloy, London-based Onfido and others that provide comprehensive fraud detection solutions. This also highlights that the West has recognised the need for comprehensive identity verification due to the increasing financial fraud.

Will the homegrown startup ecosystem gear up similarly and emerge as a major FDP hub, catering tailored solutions that align with the unique compliance needs of Indian banks and FIs?

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency10 months ago

Crptocurrency10 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoWOW Skin Science’s Blueprint For Breaking Through In The $783 Bn BPC Segment

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016