Startup Stories

How Ex MobiKwik & Razorpay Execs’ Escrow As A Service Startup Castler Is Transforming B2B Payments

As businesses must embrace tech-driven strategies in times of rapid digitalisation and industrial automation, adopting digital escrow services is increasingly sought for fast and reliable digital payments.

The traditional escrow infrastructure has been here for a long time, though. Put simply, it is a legal arrangement where a neutral third party (usually a bank/financial institution) holds assets/funds on behalf of the transacting parties until the deal is closed satisfactorily after meeting the terms and conditions mutually agreed upon. Escrow keeps transactions safe and protects buyers and sellers from financial fraud or non-fulfilment of obligations. However, the traditional route to escrow operations has been inconvenient and time-consuming all along.

It was early 2020 when Vineet Singh (former CBO of the fintech unicorn MobiKwik) sold his car to an online platform that promised a fund transfer within 30 minutes. But after numerous follow-ups and a 10-day payment delay, frustration peaked, prompting him to find a way out of transaction mismanagement. But setting up an escrow account via the traditional route could have taken up to 140 days due to the enormous paperwork and lengthy verification procedures.

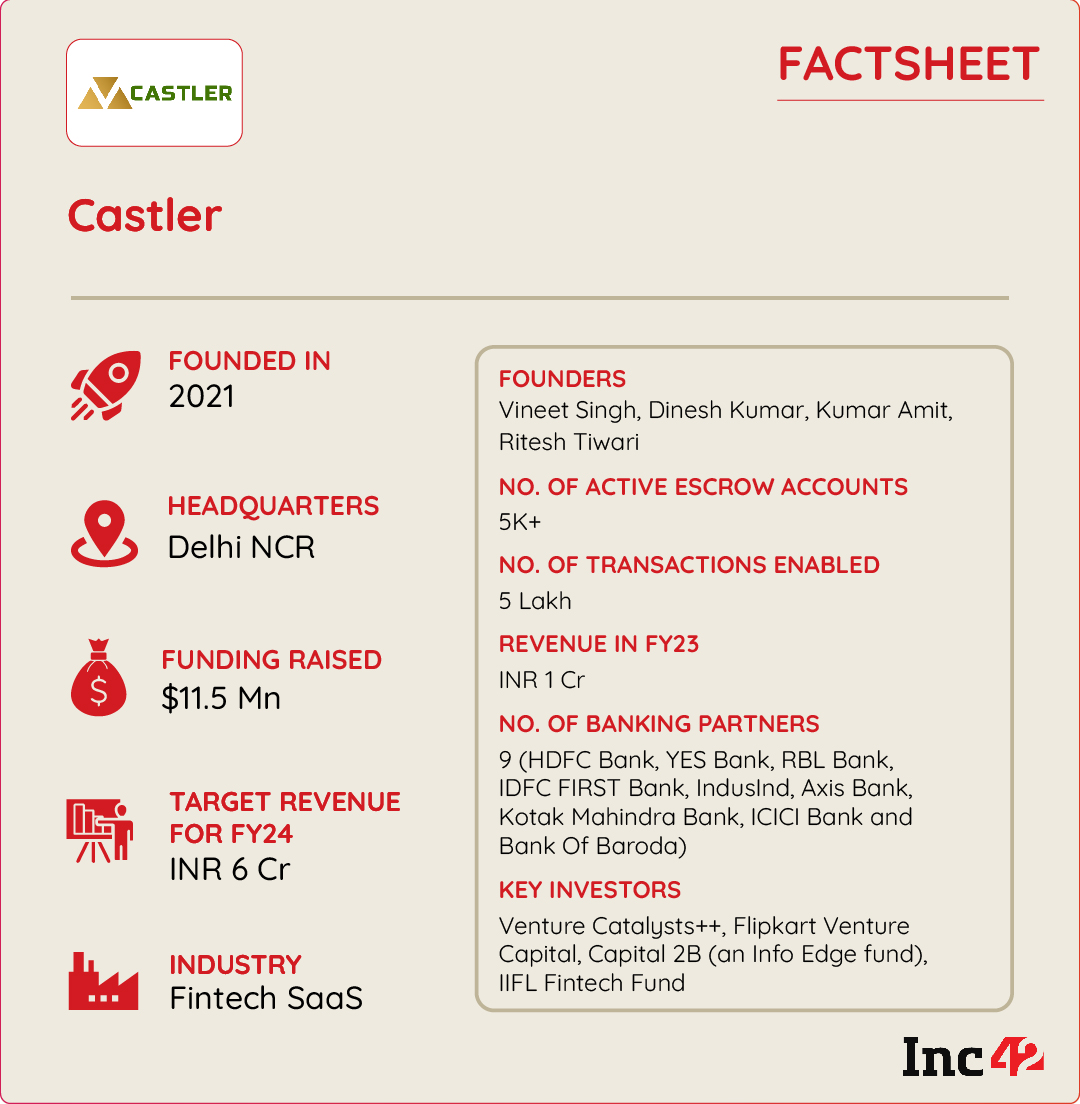

Taking note of the growing demand for plug-and-play digital escrow capabilities, Singh and Dinesh Kumar (former sales head at MagicBricks) launched Castler in 2021, a cloud-based EaaS (escrow as a service) web platform offering domestic and cross-border solutions for enterprises. In May 2023, Kumar Amit (former VP of enterprise business at Razorpay) joined the startup as cofounder & COO. Five months later, Ritesh Tiwari (former senior executive at Visa, the UK and Ireland) came in as cofounder and chief product officer.

The core mission of Castler is to significantly reduce the turnaround time required to open escrow accounts and provide quick and secure digital escrow solutions for B2B and B2C customers. The startup takes 14 business days to open a fully functional digital escrow account as it automates sign-ups, handles identity verification through eKYC, enables online e-agreement signing via eStamp and verifies the merchant’s identity at the time onboarding using AI/ML once the merchant is onboarded.

Post these procedures, it opens an escrow account on behalf of the transacting parties. Next, buyers can deposit the money in the escrow accounts; sellers can monitor the fund status, and the money is finally released from escrow accounts and sent to sellers’ accounts when buyers get their products.

The fintech SaaS startup has a subscription-based revenue model and caters to various industry segments such as logistics, retail, real estate, fintech and more. It has partnered with nine leading banks to help customers operate escrow accounts. Castler also raised $7 Mn from marquee investors, including Venture Catalysts++, Flipkart Ventures, Capital 2B (an Info Edge fund) and IIFL Fintech Fund, Zerodha’s Rainmatter, 9Unicorns among others.

According to Singh, the platform has more than 5K active escrow accounts and completed 5 Lakh transactions in November 2023. The fintech SaaS boasts a customer retention rate of 80%, clocked INR 1 Cr in revenue in FY23 and targets 6x revenue growth in the current financial year.

Bridging The Trust Gap: The Castler Way

“Globally, escrow has been proven effective in addressing trust deficits, securing financial transactions and verifying identities. With India poised to become a $5 Tn economy by 2025, the potential for escrow to solve key challenges faced by businesses and consumers is immense,” said Singh.

A look at India’s global status further solidifies his statement. According to a World Bank report, India ranked 163 in 2020 out of 190 countries in the ‘enforcing contracts’ category. To climb the ladder further and be in the top echelon, the country will require more streamlined processes, seamless payments management and enhanced transparency to iron out trust issues. Digital escrow could be the ideal solution to achieve these and more.

The startup lists various use cases demonstrating how customers can benefit from a fast and secure transaction ecosystem. Castler covers each service component, from business verification and opening escrow accounts (for sales, business deals, property leasing, lending, brokerage and more) to transaction processing and transaction management through a dedicated CRM system. In addition, transacting parties have constant access to a web dashboard for real-time status tracking.

Castler enables seamless API integration, allowing a user to sync its escrow solutions with existing systems and applications. Besides, API integration with partner banks helps it service various business requirements, such as cash collection or invoice discounting.

The startup has built multiple layers of protocols to ensure compliance and risk management per banking norms. Each transaction on the platform undergoes verification and approval by a SEBI-backed trusteeship company responsible for safeguarding assets or funds until the pre-set terms and conditions are fulfilled by all parties and the deal is completed.

Additionally, it is a PCI DSS-certified startup working closely with leading banks, which have in-house data security and compliance audit systems. For context, PCI DSS, short for Payment Card Industry Data Security Standard, is a compliance standard mandatory for any organisation handling card payments.

“Our PCI and bank partners conduct audits per defined time intervals to ensure there is no security or compliance gap in the system,” said Singh.

Apart from digital EaaS, the startup caters to B2B customers in various capacities. For example, it works like a trusted intermediary in digital lending scenarios, ensuring that loan disbursals and repayments are processed smoothly and securely. In the case of invoice discounting, it can assist lenders in securing their receivables.

In the B2C space, Castler currently provides escrow services for tenants’ security deposits. When a tenant moves into a rental property, a security deposit is typically paid to the landlord to cover potential damages or unpaid rent at the end of the lease. Now, a landlord can open a digital escrow account on Castler to safeguard this amount until the lease ends.

Castler has two revenue streams. On one hand, it operates like any other SaaS platform and charges a monthly or annual subscription fee to its customers. On the other hand, it works as TSP to banks.

Pitfalls And Growth

At first, Castler’s chances to hit it big dwindled as incumbent banks were sceptical about partnering with a digital escrow startup. The founders also realised that hard-selling their business pitches would not get a stamp of approval from these banks. To win them over, they sought investors who could validate the startup’s credibility. Once the startup proved its potential to the marquee investors, the banks followed the suit.

“We reached out to Venture Catalysts++ (VCats) during our idea stage in Jan 2021 and raised $1 Mn at the ideation stage,” said Singh.

Set up in 2016, Mumbai-based VCats is a sector-agnostic and multi-stage VC investor with BluSmart (EV ride-sharing), Beardo (D2C brand for men’s grooming), fintech unicorn BharatPe, Shiprocket and others in its portfolio. Given its track record, VCats’ backing turned out to be a game-changer for Castler, increasing its credibility among bankers and providing lucrative opportunities to expand its customer base through the VC firm’s extensive industry connections.

“VCats’ vast and active founders’ network enabled us to offer our escrow services to many startups seeking funding through the VCats syndicate,” added Singh.

Additionally, the VC firm gave access to top funding events attended by large domestic and global VCs and family offices.

Castler leveraged this exposure well and raised two more rounds of funding. In May 2023, it raised $5 Mn in a pre-Series A round led by Capital 2B (an Info Edge fund) and IIFL Fintech Fund. This round also saw participation from Venture Catalysts along with Stride Ventures, Rainmatter, 9Unicorns and FAAD Network. In September, it bagged an additional $5.5 Mn as part of its ongoing pre-Series A and got Flipkart Ventures to be part of this funding.

Castler aims to bolster its expansion strategy for both domestic and cross-border escrow services and establish partnerships with over 25 banks, targeting substantial growth in the coming years with the fresh funding.

Can New Entrants Dominate The Digital Escrow Market In India?

Globally, the SaaS escrow market is estimated to reach $18.4 Bn by 2031 from $5.4 Bn in 2021, growing at a CAGR of 13.4% for the projected period, a report by Allied Market Research says. It also suggests that the growth was fuelled by the Covid-19 pandemic when an increase in digital payments prompted the need for secure and cloud-based solutions.

Closer home, things could only get better. According to a Redseer report, India’s overall B2B payments market is estimated to grow from nearly $8 Tn in FY22 to $10-11 Tn by FY26. However, 50-60% of the current payments are done via cash and cheque. Given the growing adoption of digital payments, escrow transactions can rise exponentially, enhancing contract compliance and quickly resolving business disputes.

Aware of the shape of things to come, homegrown fintech super-apps like Razorpay and Cashfree Payments or proptech startup Square Yards have diversified into the digital escrow space, challenging a host of pure-play startups like Castler and Escrowpay.

One way to survive the growing competition is to move away from the broad-range escrow space and develop specialised services for niche customers. After all, various escrow markets are now emerging fast, dealing in M&A, real estate or even intellectual property. Others may look at focus and technology shifts and explore the scope of a decentralised escrow payment system, as blockchain technology is a core element triggering escrow growth. Think of Descrow and its community-driven solutions, which can give banks and big fintechs a run for their money.

However, industry insiders are still betting big on digital escrow players like Castler and its ilk, as this sub-industry is still scratching the surface. With the rise in digital-first enterprises and borderless business transactions, winners will be those who can improve and diversify their escrow services, prioritise data security and keep expenditures on a tight leash.

That’s a tall order, but certainly not undoable.

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Crptocurrency9 months ago

Crptocurrency9 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

E-commerce1 year ago

E-commerce1 year agoTop Online Couponing Trends To Watch Out For In 2016

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing