Startup Stories

How SaaS Startup Unesync Is Simplifying Accounting, Streamlining Processes For Indian SMEs

[ad_1]

No business can survive without book-keeping and accounting, as these help organisations record, streamline and analyse financial data for efficient operations. India is home to 63 Mn MSMEs (micro, small and medium enterprises), collectively contributing nearly 30% to the country’s GDP but lacking the deep pockets to set up the operations in-house or opt for expensive full-service solutions. Even now, many companies do billing and accounting manually or rely on traditional spreadsheets.

Aware of the techno-financial requirements of new-age small businesses, many SaaS (Software as a Service) startups in India have ventured into the accounting space with a wide range of affordable and scalable solutions based on pay-as-you-grow subscription models. However, meticulous tracking and calculation of expenses and earnings tend to get more complex when small businesses expand their customer pools, explore cash flow management through business forecasting or seek improved workforce management for cost optimisation.

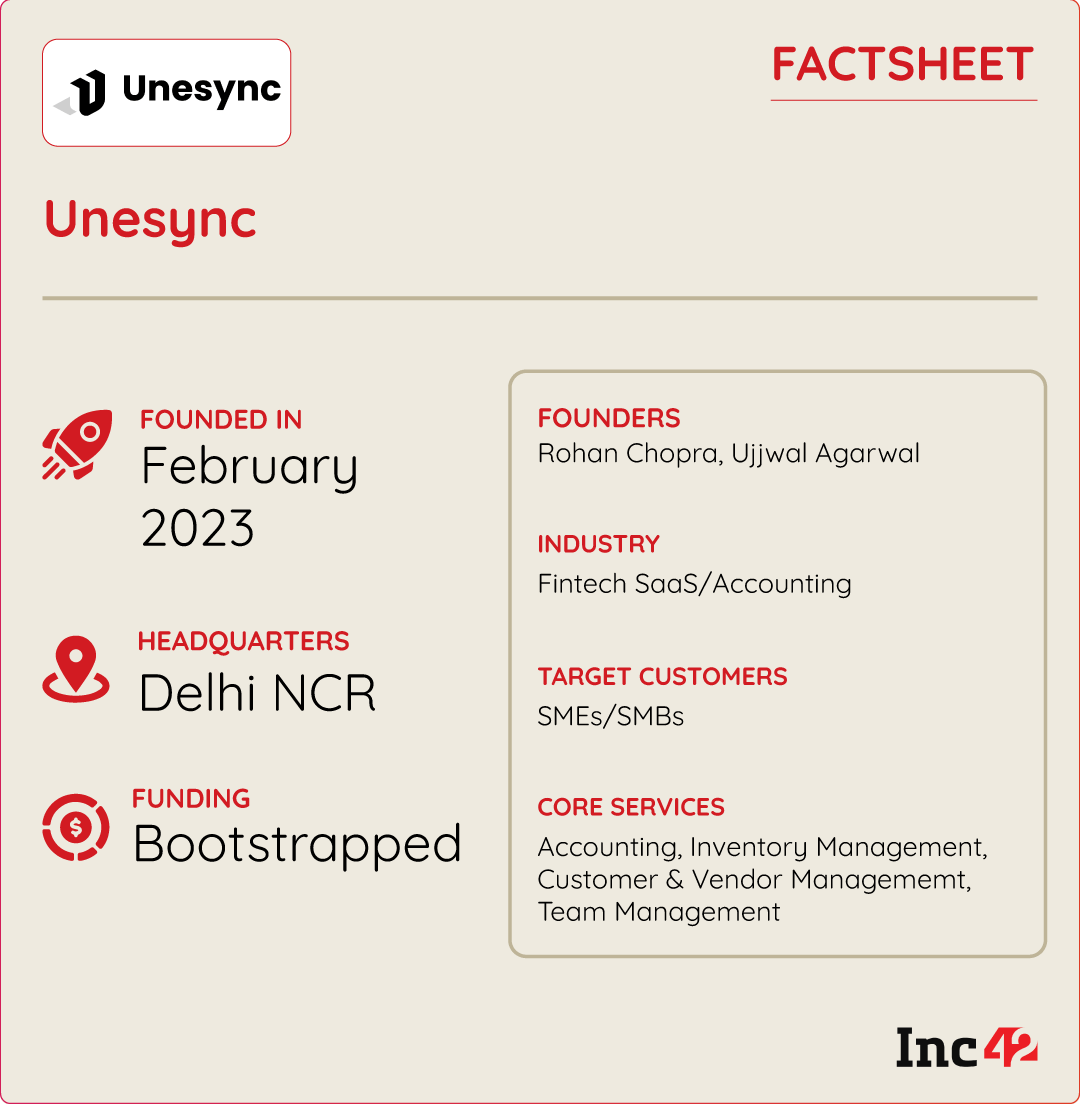

Gurugram-based Unesync is a new kid in the accounting space. But unlike pure-play SaaS players in this segment, the startup has adopted a holistic approach and put together a wide range of services to empower small and midsize enterprises (SMEs) in more ways than one.

Set up by serial entrepreneurs and childhood friends Rohan Chopra and Ujjwal Agarwal, the two-month-old startup provides end-to-end accounting services and inventory and team management tools to streamline processes. Plus, it helps SMEs communicate with external stakeholders such as vendors and customers instead of subscribing to a full-fledged (and expensive) CRM system.

Ever since starting its operations in October 2023, the startup has onboarded partners like Delhi-based café Chai Lelo, edtech platform Victory Point and advertising agency Span Advertising, among others. Furthermore, it aims to onboard 1K+ B2B customers by the end of FY24.

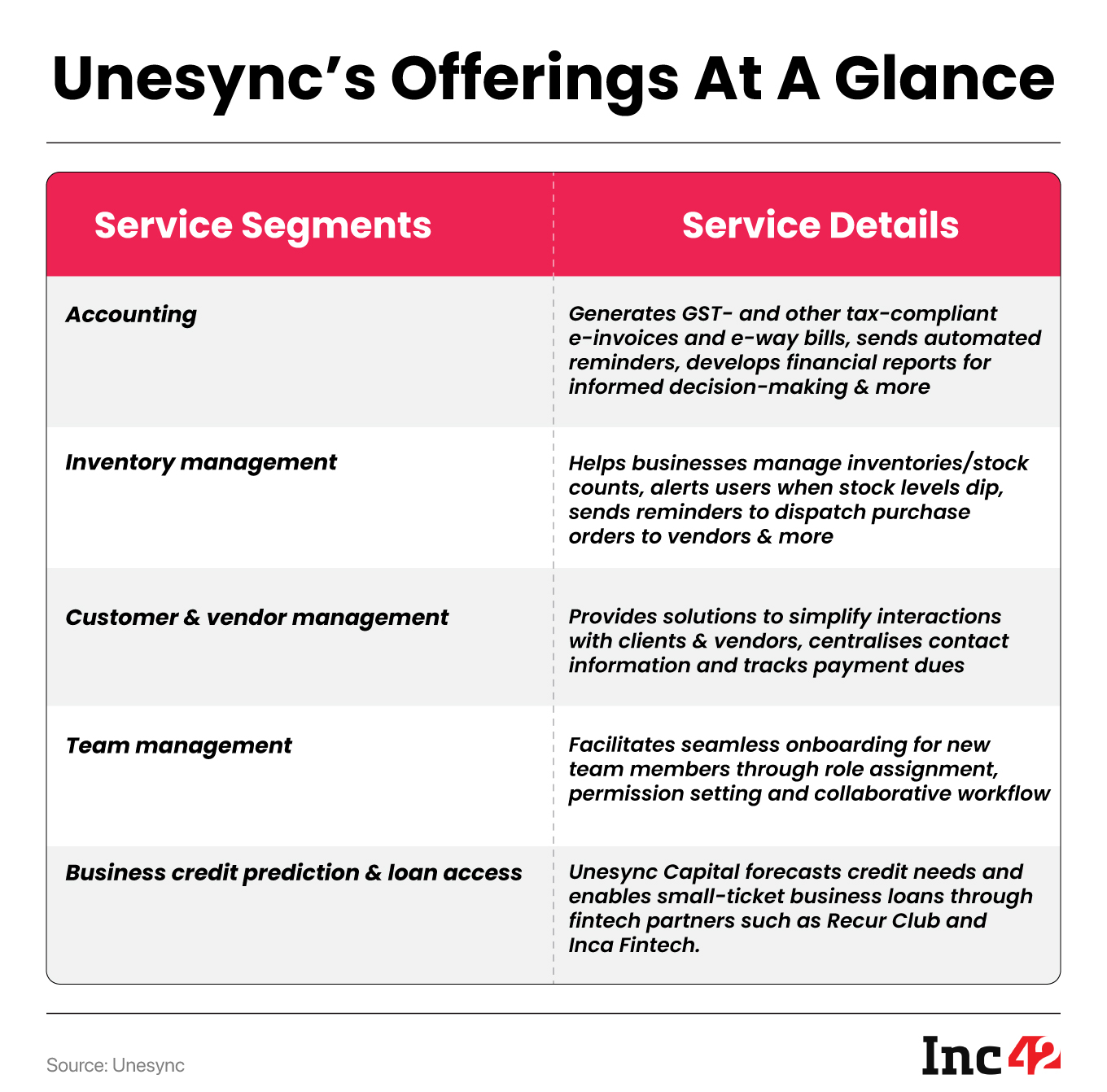

The web-based platform is also developing Unesync Capital, a tool to predict when companies may require credit, and provides them easy access to small-ticket business loans. Unesync uses data analytics and AI to enable these predictive analyses.

“Rather than businesses realising [at the eleventh hour] that they need credit for orders or projects, our platform helps them understand these requirements at the invoicing/purchase stage,” explained Chopra.

The credit market typically operates in a flow, from inquiry to approval, and raising back-to-back loans is not easy. However, the initial amount requested by a business often fails to suffice, as cost projections are not always reliable. Unesync aims to assist SMEs with more accurate calculations so they do not fall short or borrow more than needed.

To ensure easy access to small business loans, the startup has partnered with credit aggregators like Recur Club and Inca Fintech. The focus is on the micro-lending segment to help businesses raise capital for day-to-day operations.

Unesync Capital is still a nascent offering, available to a few B2B customers. Chopra says the service is still in the testing phase. Based on customer feedback, the platform will tie up with more fintech partners to open the feature to a bigger user base. The startup aims to onboard 1,000+ businesses by the end of FY24 and will also look for seed funding in 2024.

How Unesync Layers Tailored Solutions For Critical Tasks, Plans To Thrive On Scalability

Before starting Unesync, the founders set up Decimal Space in 2019. While running the software development firm, the duo acquired diverse businesses from the fintech sector and observed a crucial gap in terms of accounting solutions in the market.

According to the founders, most SMEs are compelled to outsource payment processing, tax compliance or credit line management in the absence of trained in-house staff. A few also purchase software programmes for digital accounting. However, aligning these critical tasks at the end of a financial year could be challenging for the uninitiated.

Recognising the necessity for a unified approach, the duo started Unesync to offer one-stop accounting solutions for SMEs with a yearly turnover of INR 5 Cr – INR 25 Cr. The revenue bracket has been strategically chosen to drive growth as Indian businesses with an annual turnover of INR 5 Cr or more must do e-invoicing for B2B transactions under the GST regime.

Queried about the core tech used for accounting, Chopra likens Unesync to Tally, which helps users generate E-Way bills and e-invoices (payable and receivable) without any hassle. The startup, too, has designed a data engine to gather information from various financial sources such as the GST E-Invoice portal, the GST E-WayBill portal and bank statements from account aggregators to streamline and automate a number of compliance procedures typically handled by chartered accountants.

For instance, a CA performs various tasks at the invoice level, including verifying GST returns and checking if suppliers have uploaded GST information correctly for credit processing. As the platform has enabled GST data integration, it can gather vendor data and retrieve their returns directly from the portal without requiring manual intervention.

The platform can track payments dues and manage payments. Besides, it provides various value-added solutions, including inventory management, team management and its proprietary credit prediction tool.

The startup’s ability to scale and conform to all new policies will also help it serve businesses of all sizes – a key differentiator that sets it apart from the rest. Chopra explained it with a simple use case.

“A business, starting with modest revenues, may opt for a product like Khatabook, which primarily caters to companies with an annual turnover of less than INR 5 Cr. It makes ample sense, given their limited requirements. As they progress, they may move up to a solution like myBillBook that focusses on SMEs [those earning INR 5 Cr and above a year, as per government definition]. But when these businesses reach a certain level, these products may be inadequate to address their requirements,” he pointed out.

Although Unesync is currently targeting the same clients as myBillBook, it will soon introduce enterprise-level solutions to serve the entire spectrum of businesses and gain a cutting edge.

Like most SaaS platforms, Unesync earns revenue through a pay-as-you-grow business model, spanning monthly, quarterly and yearly subscriptions. For basic accounting solutions like e-invoicing, the monthly fee starts at INR 250 and goes up to INR 900 if customers want to add additional features such as inventory and workflow management.

The Way Ahead For Unesync

Initially, enterprise tech incumbents paid scant attention to SaaS disruptors, predicting that old-timers (businesses minus digital-age tech exposure) would not find implementing brand-new technology easy. However, small, cash-strapped entities learnt to ‘adapt’ quickly after tasting the cost-efficient, consumption-based success sauce whipped up by SaaS players.

According to industry experts, the accounting and finance landscape is becoming digital worldwide, and the Asia-Pacific will witness the highest growth in this space. SaaS accounting software is driving this digital transformation to a large extent, given the emergence of small businesses and increasing investments by SMEs in the SaaS and cloud market. Globally, the market for online accounting software is estimated to reach $38 Bn by 2030, expanding at a CAGR of 8.1%.

Small businesses in India are also leaning towards digital tech and getting ‘SaaSy’ in a post-Covid world. An IDC report predicts that 30% of small and medium enterprises will shift one-third of their core workload to the cloud by 2024. This will broaden the integration of SaaS-based digital accounting (including data analytics and reporting) and lead to value-added offerings such as data-driven advisory services, business valuation, budgeting, financing and more.

However, scripting a success story in this space may be difficult due to an intensely competitive landscape. Think of the homegrown and bootstrapped unicorn Zoho, which claims India may soon become their second-largest market (after the US), powered by SMB and enterprise growth. Essentially, the market is rapidly getting crowded as desi and global firms like Zoho, FreshBooks or Vyapar have made successful inroads.

Chopra is not unduly worried. He insists that the market is wide open and the competition is healthy as more businesses adopt billing and accounting software. Unesync also recognises untapped potential as companies are willing to experiment with new products and services that correspond with their fast-changing requirements.

Aware of this evolving market, the founder has tweaked the startup’s promotional strategy and did not go for a marketing blitzkrieg. “SaaS-based offerings in our niche [accounting] is not a novel concept. End users are well versed in this model and have adopted it over the past decade, allowing us the freedom to do away with excessive marketing,” he said.

Instead, Unesync has gone ahead with word-of-mouth promotion and involved chartered accountants working with small businesses. The platform encourages CAs to sign up for free trials. After that, its customer support team guides them and helps them understand how the platform works.

Chopra says this approach has yielded positive results, and Unesync aims to onboard 1 Lakh customers in the next two years.

Amid the growing demand for digitalised business processes, SaaS-based accounting solutions are gaining traction among Indian SMEs. Moreover, SaaS providers can attract a diversified customer base with increased verticalisation or never-before silo-breaking. While established players cater to mainstream requirements, newcomers like Unesync seek to stand out with their unique value proposition – a combination of accounting, process management, and financing capabilities.

Of course, opportunities to innovate in SaaS are far from over. But savvy businesses that can develop more unified solutions to meet broader needs may have the potential to corner success. It will also benefit the SaaS industry, which can seize the future by evolving in sync with emerging trends.

[ad_2]

Source link

Startup Stories

Byju’s partially pays March salaries, pending February payouts.

Byju’s, a prominent player in the edtech industry, has encountered financial challenges resulting in delayed salary payments for its employees. As of April 20, the company has only disbursed a portion of March salaries, attributing the delay to a severe cash crunch. Despite earlier assurances from the company’s management that salaries for March would be paid by April 18, many mid-senior employees have reported receiving only 50% of their March salaries. Additionally, February salaries remain unpaid for a significant number of employees, further exacerbating the situation.

Founder and CEO, Byju Raveendran, has resorted to raising personal debt against his stakes in the company to facilitate salary payments. This underscores the severity of the financial challenges facing Byju’s and highlights the lengths to which Raveendran is willing to go to address the issue.

Employee testimonies reveal the extent of the salary delays, with one employee stating that they received only 50% of their March salary on April 20, with 80% of their February salary still pending. Another concerning aspect is the reported disparity between junior and senior employees, with junior staff receiving full salary payments while top management has gone without salaries for the past two months.

Byju’s has acknowledged the delay in salary payments but has not provided a detailed explanation for the situation. A company spokesperson declined to comment on queries from ET regarding the matter. In an email sent to employees on April 8, the management team expressed regret over the delay and attributed it to the inability to secure approval to access funds from a rights issue. The delay has been further compounded by actions from foreign investors, hindering the company’s access to necessary funds.

This revelation follows a previous report by ET on April 1, which highlighted Byju’s decision to delay salary payments due to constraints imposed by warring investors, limiting the company’s access to funds through a rights issue. The ongoing dispute with investors, including Dutch investor Prosus, has added to Byju’s financial woes and has led to further delays in resolving the issue.

In a separate development, Byju’s India chief executive, Arjun Mohan, announced his departure from the company in mid-April, just six months after assuming the role. This unexpected move prompted founder Byju Raveendran to take on the responsibility of overseeing day-to-day operations of the company’s India business, housed under Think & Learn, marking a significant shift in leadership.

Amidst these challenges, Byju’s is embroiled in a legal battle with a group of investors led by Prosus, who are seeking to block a rights issue and the removal of Byju Raveendran as CEO. The company has also initiated arbitration proceedings to address the dispute and find a resolution.

The rights issue undertaken by Byju’s is significant, as it is being offered at a staggering 99% discount to the company’s peak valuation of $22 billion. This steep discount has implications for investors who choose not to participate in the funding, potentially resulting in a significant dilution of their shareholding post-completion of the rights issue.

The unfolding events at Byju’s underscore the challenges facing the edtech giant as it navigates financial constraints, leadership transitions, and legal disputes. The company’s ability to address these issues effectively will determine its future trajectory and its ability to maintain its position in the competitive edtech landscape.

Startup Stories

Revolut India receives provisional approval for PPI license from RBI

Revolut India, a neobank backed by Tiger Global and Softbank, has secured an in-principle approval from the Reserve Bank of India (RBI) for issuing Prepaid Payment Instruments (PPI), encompassing prepaid cards and wallets. CEO Paroma Chatterjee shared this development in a LinkedIn post on Friday. This approval complements Revolut India’s existing licenses from the RBI, which allow it to function as a Category-II Authorised Money Exchange Dealer (AD II), enabling the issuance of multi-currency forex cards and cross-border remittance services.

Chatterjee emphasized the significance of this milestone, highlighting the opportunity it presents to provide Indian consumers with both international and domestic payment solutions on a unified platform. Revolut, Europe’s largest neobank, entered the Indian market in 2021 with aspirations to disrupt the domestic payments sector. The RBI’s approval is expected to bolster Revolut’s position as a key player in this domain.

Prepaid Payment Instruments (PPIs) are payment tools that utilize stored monetary value, including digital wallets, smart cards, or vouchers, for transactions. RBI Governor Shaktikanta Das proposed on April 5, 2024, to allow PPIs to be linked through third-party UPI applications, enabling PPI holders to conduct UPI payments akin to bank account holders.

Chatterjee underscored Revolut’s commitment to full compliance with regulatory requirements, particularly in India, where the neobank has undertaken significant efforts to localize its global tech-stack to adhere to local regulations.

In an interview with ET BFSI, Chatterjee disclosed Revolut’s plans to introduce a comprehensive suite of digital-first money management services for all Indian customers. These services will enable users to manage their finances, including payments and remittances, both domestically and internationally.

The app, currently in use by employees, will be officially launched once the internal testing phase is completed, according to Chatterjee. She also revealed that there are over 175,000 prospective customers on Revolut India’s waitlist, indicating strong interest in the product.

Startup Stories

Postman buys Orbit to extend developer community reach.

Postman, renowned as an API management platform tailored for enterprises, has recently made headlines with its acquisition of Orbit, a pivotal tool in the arsenal of developer companies for nurturing communities across a spectrum of platforms, including Discord, Slack, and GitHub. Although the specifics of the financial transaction remain undisclosed, Postman took to its blog to underline Orbit’s indispensable role in supporting major developer companies in fostering community management and fostering growth over the course of the past four years.

Within the ecosystem of Postman, the integration of Orbit is poised to be transformative, with the Orbit team set to assume a pivotal role in seamlessly embedding community-centric features into the fabric of the Postman Public API Network. This strategic move is aimed at catalyzing dynamic collaboration between content creators and end-users within the network. Postman, boasting a staggering valuation of $5.6 billion, stands as a stalwart in the realm of API collaboration platforms, serving a user base exceeding 30 million developers and 500,000 organizations.

Under the stewardship of Noah Schwartz, a recent addition to the Postman team hailing from Amazon Web Services, the Orbit team is primed to spearhead initiatives aimed at empowering API distributors to broaden the horizons of their communities, optimize API utilization, and solicit direct feedback from users entrenched within the network.

This integration is anticipated to embolden developers to unearth APIs tailored to their unique requirements and foster meaningful engagements with peers to extract maximum value from each API. However, as part of the transitionary phase, Orbit has outlined plans to gradually phase out its existing product and platform over the span of the next 90 days. Commencing July 11, all functionalities will be deactivated, with no provision for the creation of new users or workspaces.

Postman’s strategic maneuver comes on the heels of its triumphant fundraising endeavor in 2021, securing a whopping $225 million in funding. The fundraising round, spearheaded by Insight Partners, witnessed active participation from prominent entities such as Coatue, Bond Capital (helmed by Mary Meeker), and Battery Ventures.

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Millennials, GenZs Are Riding The Investment Tech Wave In India

-

Startup Stories1 year ago

Startup Stories1 year agoStartups That Caught Our Eyes In September 2023

-

Startup Stories1 year ago

Startup Stories1 year agoHow Raaho Is Using Tech To Transform India’s Fragmented Commercial Trucking

-

Startup Stories1 year ago

Startup Stories1 year agoMeet The 10 Indian Startup Gems In The Indian Jewellery Industry’s Crown

-

Startup Stories1 year ago

Startup Stories1 year agoWOW Skin Science’s Blueprint For Breaking Through In The $783 Bn BPC Segment

-

Crptocurrency12 months ago

Crptocurrency12 months agoLither is Making Crypto Safe, Fun, and Profitable for Everyone!

-

Startup Stories1 year ago

Startup Stories1 year agoHow Volt Money Is Unlocking The Value Of Mutual Funds With Secured Lending

-

Startup Stories1 year ago

Startup Stories1 year agoWhy Moscow-Based Kladana Considers Indian SME Sector As The Next Big Market For Cloud Computing