[ad_1]

ClearDekho was founded with a vision to provide affordable eyewear to low-income individuals living in Indian Tier III cities and towns and beyond

The cofounder and CEO, who is now focussed on expanding the startup’s footprint to Bihar, Chhattisgarh, West Bengal, and Assam, is confident that the company will achieve profitability in the next two years

The eyewear market in India is projected to reach $5.58 Bn in 2023, with prescription glasses dominating at an expected $2.52 Bn

In the burgeoning eyewear market of India, organised players such as Lenskart, Fastrack, and Titan Eye Plus have been gaining ground on the back of a diverse range of stylish and high-quality eyewear solutions. Despite this, a stark visual disparity persists throughout the country.

A significant portion of India’s population, particularly those from low-income communities and from Tier III parts of the country and beyond, have vision impairment and hardly any access to affordable eyewear. It is worth noting that an estimated 270 Mn people in the country face vision issues, with up to 40% lacking access to a basic pair of spectacles.

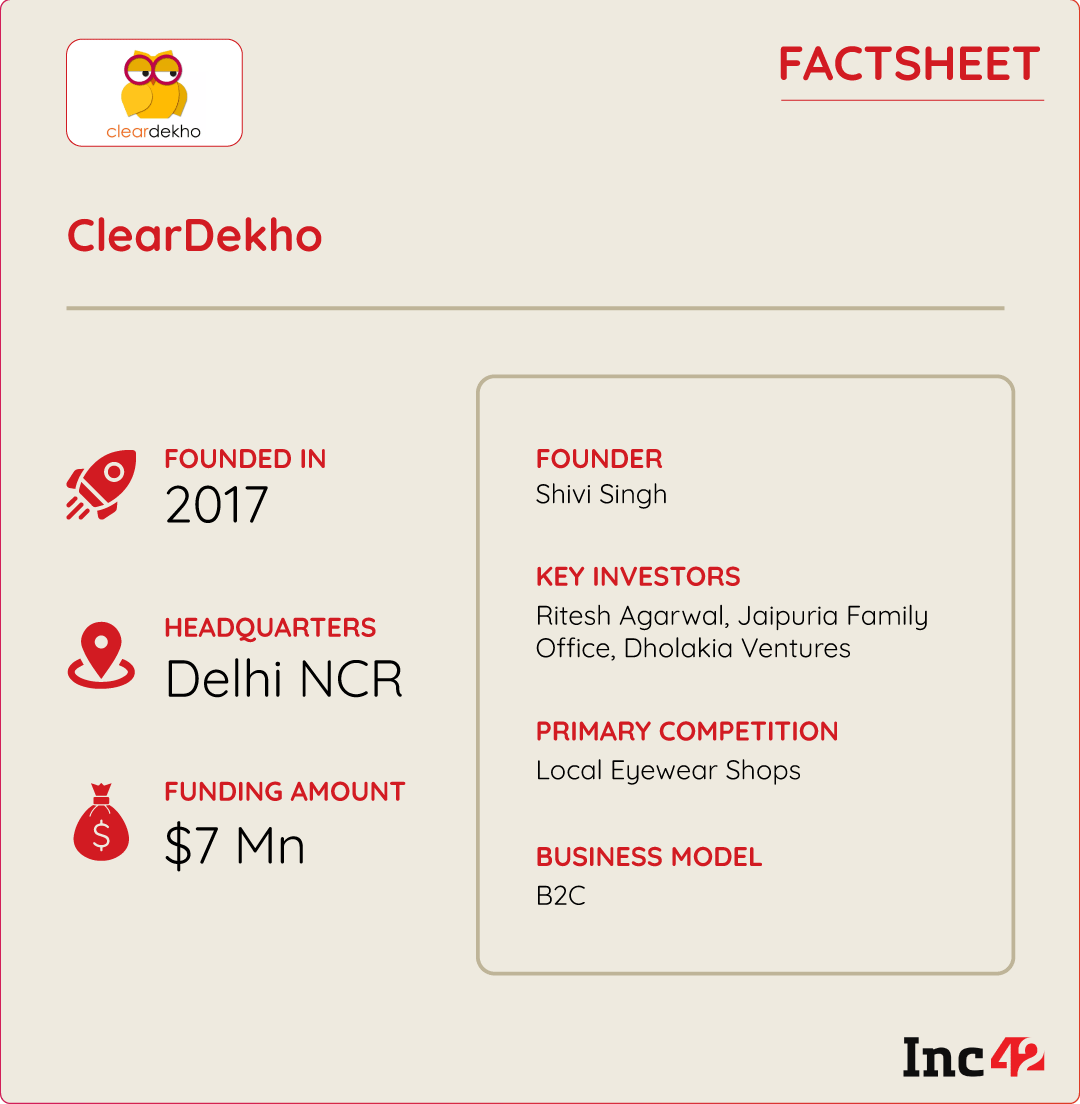

Interestingly, Ghaziabad-based ClearDekho has been addressing this issue since 2017. It offers affordable glasses and eye check programmes via its stores in small towns and cities to address the scarcity of eye care facilities and essential vision care services.

The Vision Behind ClearDekho

Before starting ClearDekho, cofounder and CEO Shivi Singh worked with VisionSpring, a programme aimed at delivering affordable and high-quality eyewear services across Southeast Asian markets, including India.

During his tenure with VisionSpring, where he managed the supply side and sourcing for Warby Parker’s social initiative, he recognised that low-income families were not getting access to affordable eyewear.

“At the time, LensKart was doing very well and I was inspired by their growth and their disruption in Tier-I cities. Then I recognised a significant gap in the eyewear market at Tier III & IV levels. That’s when ClearDekho was born, and the idea behind its incorporation was to standardise eyewear accessibility for consumers in smaller towns and cities, providing a value-for-money experience,” Singh said.

ClearDekho started its journey focussing on online presence, and as it aspired to offer a cost-effective eyewear experience, it realised the importance of reliable eye testing and also looked at offline expansion in 2018. Due to financial constraints, they had to engage in frugal marketing activities.

Navigating The North

The eyewear startup, which commenced its journey from Ghaziabad, has been focussed on the North Indian market since inception, particularly Uttar Pradesh (UP).

This is because the state (UP) lags in the number of total optical stores, Singh said. Recognising the untapped potential in the state, the founder has solidified ClearDekho’s presence across Ghaziabad and Noida, and smaller towns like Meerut, Hardoi, and Moradabad where larger brands are not present.

Currently, ClearDekho operates in 100 stores across India under the franchise-owned company company-operated (FOCO) model. Of these, a total of 50 stores are in UP and Delhi NCR region.

ClearDekho also has its presence in northern states, including Punjab, Haryana, Madhya Pradesh, and Rajasthan. It is now looking to establish its footprint in states like Bihar, Chhattisgarh, West Bengal, and Assam.

“This is again a market where you will not find many of the eyewear brands. We look at small pockets and small towns to deliver eyewear experience and leverage the first-mover advantage,” Singh said.

The key USP of ClearDekho lies in its affordable price range for eyeglasses and sunglasses, ranging from INR 200 to INR600. However, Singh emphasises that pricing is not the sole dimension, as the business model focusses on delivering high-quality products in the convenient vicinity of small towns.

Singh gave an example of the Saharanpur district, which has a dearth of eyewear brands. “In a district where over 5 Lakh people lacked access to optical stores, ClearDekho became the first to deliver eyewear services,” he added.

Balancing Margins, Quality & Profitability

Speaking with Inc42, Singh emphasised that ClearDekho never compromised on profit margins while offering budget-friendly glasses.

Despite the high cost typically associated with eyewear, ClearDekho aimed to provide a quality product priced at 500 rupees.

For Singh, the focus isn’t solely on maximising profit margins; the primary objective is to encourage widespread adoption of the product, thereby organically expanding the user base.

With a staggering 600 Mn Indians requiring eyeglasses, the fact that 50% of this demographic lacks access to affordable eyeglasses highlights the enormous opportunity for ClearDekho.

Additionally, there is a growing demand in the kids’ eyewear and protective eyewear segments. Currently, protective eyewear contributes 10% to the total eyewear business in India, Singh added.

In FY22, ClearDekho reported an operating revenue of INR 7.5 Cr, marking a 1.7X year-on-year increase from INR 4.4 Cr in FY21, according to Tofler. However, the company incurred a loss of INR 6.4 Cr in FY22, compared to INR 3.4 Cr in FY21. The financial results for FY23 are yet to be disclosed.

Meanwhile, Singh is confident that the company will achieve profitability in the next two years.

The eyewear market in India is projected to reach $5.58 Bn in 2023, with prescription glasses dominating at an expected $2.52 Bn. Notably, 94% of sales are anticipated in the non-luxury category, indicating the country’s increasing demand for affordable yet stylish eyewear, including frames and prescription lenses. This presents significant tailwinds for startups like ClearDekho going ahead.

[ad_2]