[ad_1]

MATIC Sees An Increase in Price

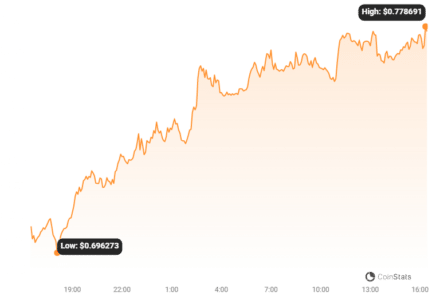

In what is considered to be a month of green (gains), October ended recently, and certain cryptocurrencies had quite strong performances. Over the previous month, a lot of altcoins saw price increases; MATIC is one prominent altcoin that profited from this.

The cryptocurrency asset has crossed the critical $0.75 threshold, gaining momentum and moving closer to the important $1 threshold. But by the end of 2023, if the token is lucky enough to maintain its present rate, it could hit $1.

If the token can rise beyond $0.85 in November, MATIC should achieve the much-desired $1 milestone. If buyers are unable to hold their lead at $0.60, a reverse below $0.75 will lower the MATIC price to $0.55.

The Exponential Moving Averages (EMAs) of MATIC have also seen a noteworthy breakout in recent weeks. Following the cryptocurrency’s 200-day EMA breakout, the price of MATIC exceeded the critical $0.75 barrier.

By overcoming a 200-day EMA, MATIC has advanced and may eventually hit $1 by year’s end. This is because when the 50-day and 200-day EMAs are crossed above in the Polygon chart, a golden crossover chance arises.

The rising trend of the 50-day EMA points to the possibility of a golden crossover, but the bull run that crosses the 200-day EMA can also point to a reversal movement. The cryptocurrency asset has, nevertheless, been able to maintain its upward trajectory ever since it crossed above the 200-day EMA.

Read Also: SUI Gains 12% While Chainlink and Polygon Keep Alt Rally Rolling

Importance Of The Cryptocurrency Market

The coin is currently trading at $0.77, representing an 8% daily price rise with $489,605,430 worth of trades over the course of a day. With a $7 billion market capitalization, the token market is strong and now ranks 13th among cryptocurrencies.

With 9.24 billion MATIC in circulation and a strong market presence, MATIC outperforms 48% of all cryptocurrencies now in use. Its long-term technical score is further supported by this fact.

MATIC’s price increase can be attributed, in part, to the token’s 33% year-to-date (YTD) decrease in September. As a result, the cryptocurrency bounced back from this within a month.

Furthermore, the token’s robust bullish candles and increasing volumes suggest that its upward trajectory will continue. Because of this, purchasers stand a high probability of holding onto their advantage at the current MATIC price.

After a 33% year-to-date fall in September, MATIC has seen a 50% increase in the last 20 days, placing it in a profitable position. The coin offers greater potential earnings in the future with its current bullish trajectory.

[ad_2]