[ad_1]

Incorporated in 2022, Snap-E offers several unique value propositions – from no-cancellation policies to no-surge fees – to passengers, who otherwise have to rely on the duopoly of Ola and Uber to move from point A to point B in the city.

Snap-E achieved a gross merchandise value (GMV) of INR 2.45 Cr in September alone. Over the past six months, the total GMV has amounted to INR 11 Cr.

The startup, which today has a fleet of 600 cars, is in talks with several VC firms and angel investors to raise funds

From horse wagons to iconic black and yellow Fiat Padmini cruising through the bustling streets of Indian metropolises, the evolution of taxis in India is rich and quite elaborate. It’s a journey that has also seen transformative changes, from the emergence of Ola and Uber to the current era of hassle-free electric vehicle cabs.

The history of taxis in India also tells us that the highly unorganised sector underwent a major transition 10 years ago when Uber entered the country in August 2013 and Android smartphones were baptising Indian telecom users at a break-neck speed.

Up until the entry of Uber in India, autorickshaws (three-wheelers), too, remained the dominating force for passenger intracity transit. However, by the time 2013 ended, a majority of Indians were seen ditching traditional taxis, only to shift to the new ones – Ola and Uber. This is because Indians could now book cabs with a single tap on their smartphone and get discounts and free rides while using these services.

On the other hand, a wave of new drivers entered this segment and joined Ola and Uber, lapping up handsome monthly earnings. Finally, the market was disrupted, dominated and captured by these new players, outpacing traditional taxis.

A decade later, history seems to be repeating itself, as a new race of taxi service providers has now started disrupting the ride-hailing market, freeing customers from inconveniences such as ride cancellations, surges, and subpar quality of services in many cases.

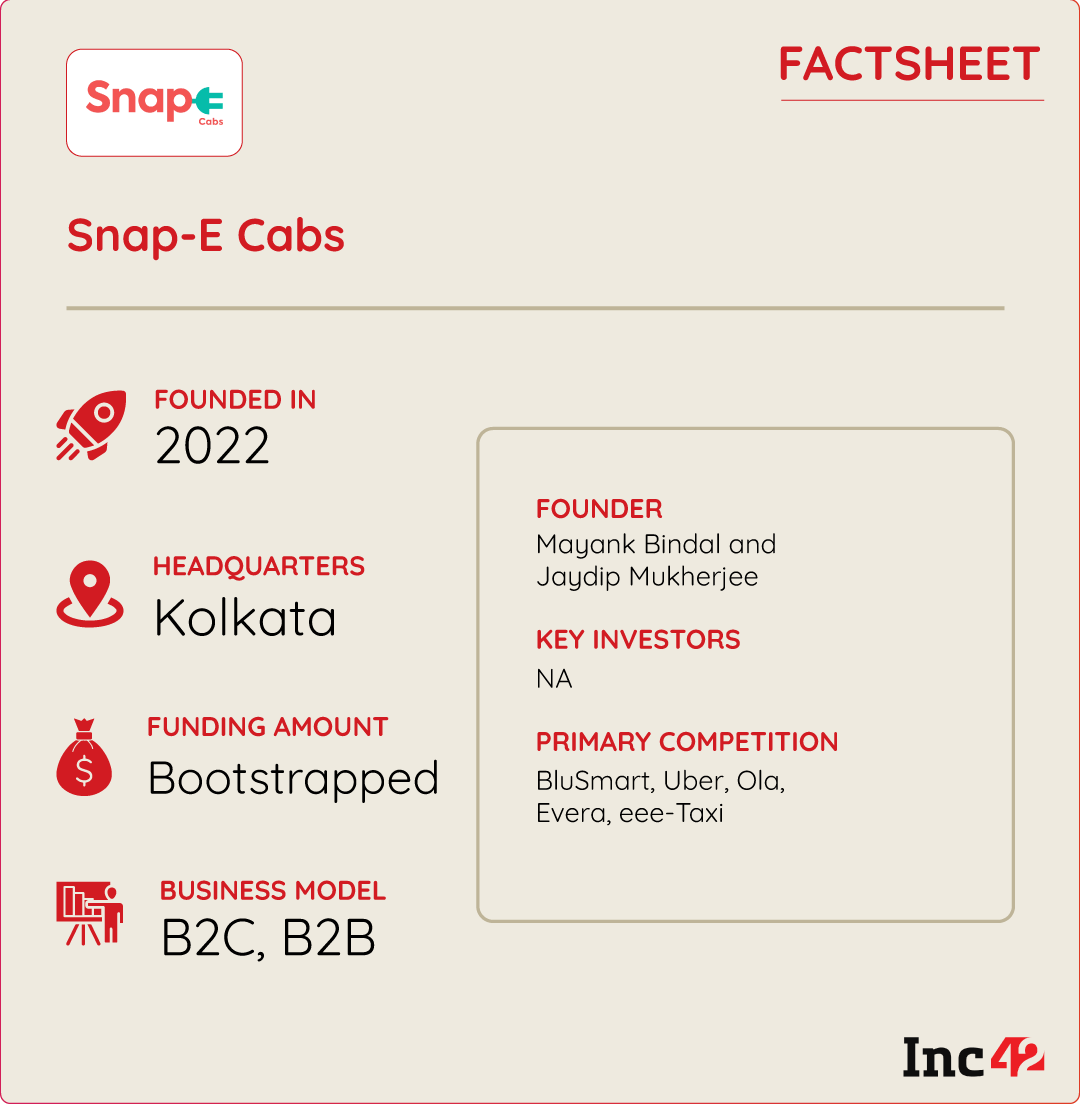

At the forefront of this seismic shift are Mayank Bindal and Jaydip Mukherjee, who want to address the existing pain points in urban transportation with their electric cab service, Snap-E Cabs.

Incorporated in 2022, the Kolkata-based startup offers several unique value propositions — from no-cancellation policies to no-surge fees — to passengers, who rely on the duopoly of Ola and Uber to move from point A to point B in the city.

Since its inception, the e-cabs provider has expanded its business significantly in Kolkata, with hardly any commitment to pipeline emissions.

With a push from the government to increase passenger and commercial EVs in the country, the sector is expected to witness unprecedented growth soon.

As per Vahan data, of the total 1.77 Lakh motor cabs registered till November 1 this year, more than 8K vehicles are electric. In 2022, the number stood at 1.14 Lakh versus 4.9K+ units.

Humble Beginnings Of The Bootstrapped Snap-E

When Snap-E initiated its operations in August 2022, the startup did not have an app and instead partnered with Uber to deploy its e-taxis on the streets of Kolkata.

Acquiring customers is one of the most challenging parts of app-based B2C businesses, cofounder and CEO Bindal told Inc42, reminiscing how the startup began its humble journey.

This very dilemma led Snap-E to opt for collaborating with Uber’s platform but with Snap-E’s branding on vehicles. This strategic decision helped the startup curtail the initial expenses associated with managing an app, customer relationships, and onboarding.

Much to everyone’s surprise, the startup witnessed a demand surge within two months of its operations. This also proved to be a huge learning curve for Bindal, who told Inc42 that they were able to disrupt the market and establish themselves just by streamlining the supply side of the sector.

“After seeing an unexpected demand surge, we realised that the real problem was in supply and not demand, following which we launched our app in October 2022, which received 30K downloads within weeks, giving us the window to emerge as a separate brand,” Bindal said.

The Snap-E app today has 4-5 Lakh downloads, and the startup receives close to 12K-15K ride requests daily in and around Kolkata.

“Unfortunately, with supply being a challenge, we are only able to do anywhere between 2,500-3,000 rides a day,” he added.

To resolve the demand side of the issue, the cofounder wants to take his current fleet of around 600 EVs to 1,000 by March next year.

An Uber challenger, Snap-E has procured about 160-170 cars from leasing firms like Mahindra and Muffin Green. For the remaining cars in its current fleet, the startup has taken bank loans.

According to Bindal, with about INR 20-22 Cr internal investment, Snap-E is bootstrapped so far.

Snap-E’s Always On Roads

In addition to its B2C taxi service model, Snap-E also operates a B2B business segment. The company has established partnerships with corporations such as TCS, Wipro, Cognizant, and several others to offer pick-and-drop services to their employees.

“Compared to cities like Delhi, Mumbai, and Bengaluru, Kolkata is still more of a day city and there is little traffic post 11 PM. That is predominantly the reason that we thought B2B was going to give us a steady stream of revenue with the maximum utilisation for our cars. And since the IT companies need cars for employee transportation, we decided to tie up with them,” Bindal said.

Snap-E effectively deploys all its vehicles during the day, with approximately 30-35% of them dedicated to providing employee pick-and-drop services during the nighttime hours.

Currently, around 75% of the company’s total revenue is derived from its B2C operations, while the remaining 25% originates from its B2B engagements.

In terms of its overall business performance, Snap-E achieved a gross merchandise value (GMV) of INR 2.45 Cr in September alone. Over the past six months, the total GMV has amounted to INR 11 Cr.

Snap-E follows a pricing structure that entails a flat fee of INR 150 for journeys up to 5 Km. Beyond this initial distance, the charge increases by INR 22.5 per km.

Building The Ecosystem

We cannot ignore the fact that building a robust charging infrastructure is the most important aspect when it comes to increasing the number of EVs and boosting the overall EV ecosystem.

Staying one step ahead in ensuring that its business runs seamlessly, Bindal said that Snap-E has established partnerships with various charge point operators (CPOs) such as Jio-bp, Tata Power, Chargezone, Evre, and others.

However, in the long run, the startup wants to do more than just depend on these CPOs. It wants to operate its own charging stations.

Snap-E has already signed an MoU with Kolkata Port Trust for building the charging stations, and the authority is ready to give them parcels of land on lease for 20-25 years.

Furthermore, the startup has commenced the process of entering into contracts with various potential parking aggregators to facilitate the operation of its vehicles in key locations, including airports and railway stations.

Meanwhile, Snap-E aims to deploy 2,000-3,000 more cars in Kolkata in the next 18-24 months. Moving forward, the startup aims to expand to other cities that have less access to ride-hailing platforms. Raipur in Chhattisgarh and Bhuvaneshwar in Odisha are the two Indian cities

Snap-E is currently planning to foray into, all while expanding its footprint in Kolkata.

Meanwhile, the startup is in talks with some VC firms and angel investors to raise funds. If the talks move through, Snap-E may announce the news in the next few months. The cofounder, however, has not disclosed the amount that he wishes to pick.

It’s worth noting Snap-E competes with players like BluSmart, Uber, Ola, and others, making significant strides in the EV ride-hailing space.

BluSmart, for instance, promotes customer-friendly features such as no surge fees and a no-cancellation policy, although its operations are currently limited to Bengaluru and Delhi-NCR.

Notable, Snap-E, too, is part of this rapidly evolving landscape and seems to be carving a niche for itself as one of the pioneering e-cab service providers.

However, going ahead, it will be fascinating to observe how the startup positions itself in the market in the years to come, especially when it comes to operating alongside established ride-hailing giants.

[ad_2]

Source link