[ad_1]

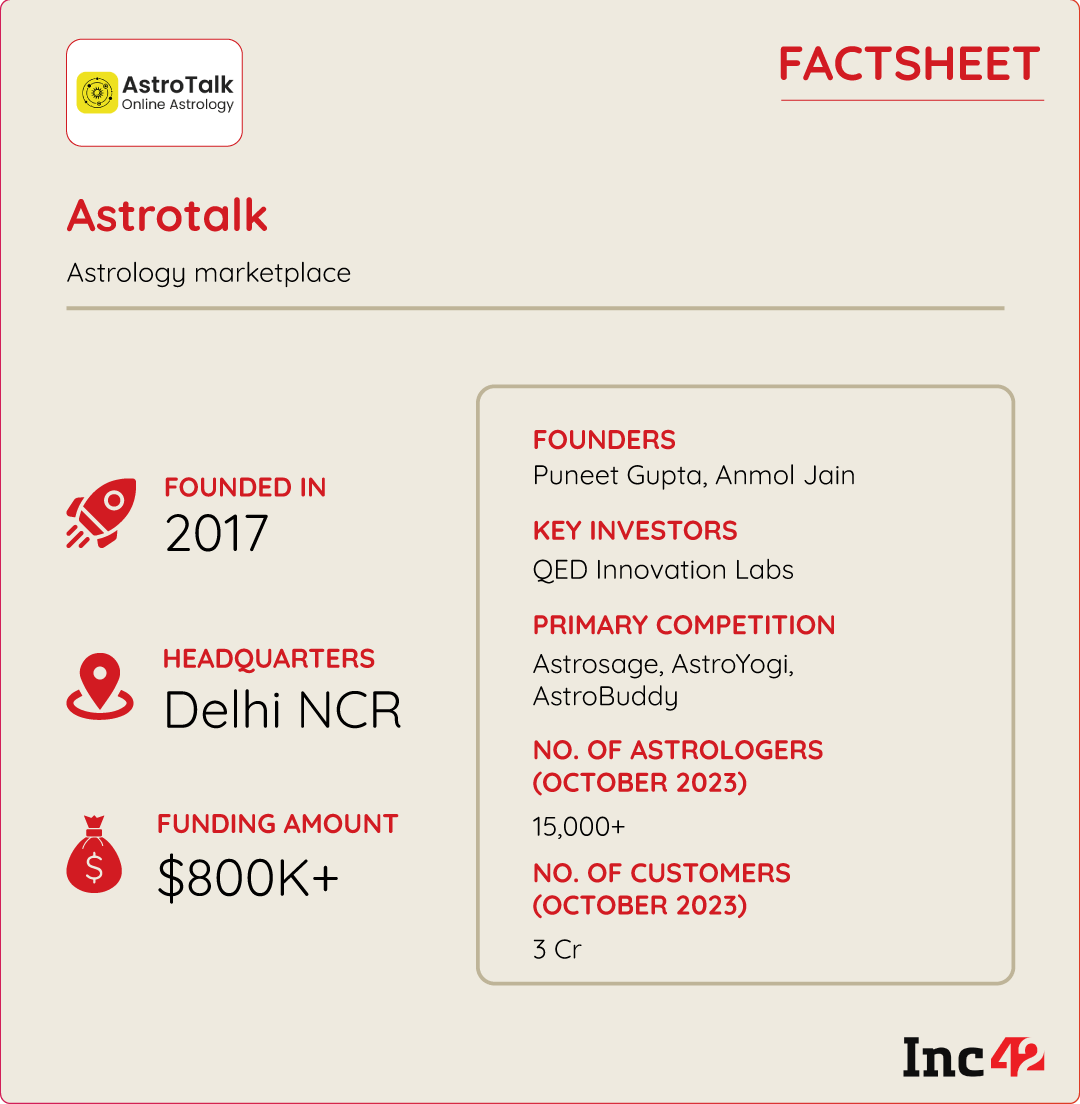

Astrotalk, which first achieved profitability in FY20, believes that it is poised to become the ‘Uber’ for astrology and is eyeing international expansion

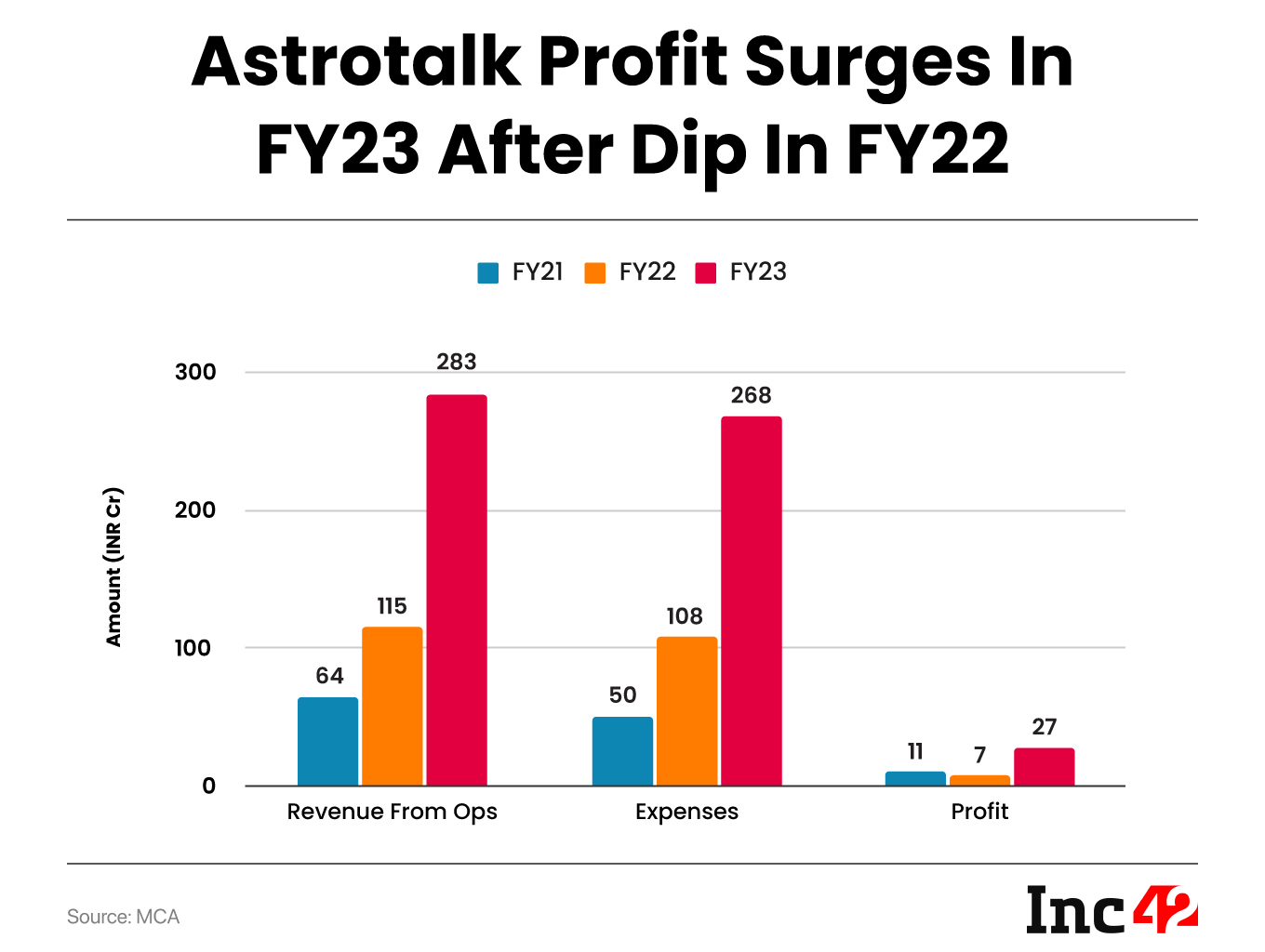

In FY23, Astrotalk reported revenue of INR 282 Cr with a profit of INR 27 Cr, nearly 4X higher than the previous year

Given the company’s target of reaching INR 2,000 Cr in revenue before an IPO in 2025-26, curbing marketing spends will be a significant challenge

No one can see the future, yet millions of Indians turn to fortune tellers, astrologers and seers to get a glimpse of their days to come. It’s no wonder then that astrology marketplace Astrotalk has emerged as an outlier in the sea of loss-making growth stage startups.

Of course, it would be folly to think of this as a business based around espousing superstitions. In many cases, this is akin to counselling or one-on-one guidance rather than completely relying on the stars, according to founder and CEO Puneet Gupta.

In the past, Gupta has been known to have said that he did not believe in astrology, till one such consultation in 2014 during a tough time in his career proved fortuitous.

It was this happenstance that led to Astrotalk, which first achieved profitability in FY20 and has scaled up exponentially in the past couple of years. Today the company believes that it is poised to be the ‘Uber’ for astrology.

Astrotalk’s Fortune Grows

As per Astrotalk’s audited FY23 financials, accessed by Inc42, the company has reported revenue of INR 282 Cr with a profit of INR 27 Cr in the last fiscal year. That’s 2X-plus growth on the revenue front, as well as a remarkable near 4X surge in profits. And even though the company’s net profit fell in FY22 in comparison to FY21, the FY23 profit is higher than FY21.

In many ways, FY21 was an anomaly, which explains the drop in profit in FY22. It was of course during the pandemic (2020-21) that the demand shot up for online consultations in astrology and related services.

During the first month of lockdown, AstroTalk saw a drop of about 10% in revenue but since then, it saw MoM growth rate of 10% throughout FY21. Daily revenue grew from INR 14 Lakh to INR 19 Lakh within six months. The startup latched onto this momentum by signing up astrologers in droves and connecting them to customers. It gave the company enough cash flow to continue adding more service providers.

And the way this segment is growing, Astrotalk expects to touch INR 600 Cr in revenue by the end of FY24, with a 16% EBITDA margin or INR 100 Cr projected.

Such EBITDA efficiency is not unprecedented but rare. Astrotalk cofounder and chief business officer Anmol Jain believes this is simply because the startup figured out that the quality of the service providers is paramount.

This is especially relevant in a sensitive field such as astrology, where often it’s a one-on-one service and not a company providing services to an end customer.

Seller-First Marketplace Approach

“We chose to go with a curated marketplace where the ‘inventory’ side of the marketplace grows slowly and steadily. There’s a vetting process before astrologers are on-boarded and we typically have a 70% selection rate for astrologers, with four to five rounds of interviews,” cofounder Jain told Inc42.

The model is dependent on verified professionals, since 90% of Astrotalk’s revenue comes from one-on-one consultations, where users pay per minute to talk to astrologers. About 5% of the revenue comes from live streaming fees where astrologers answer questions from multiple users and the rest comes from the ecommerce vertical including the ad revenue and sale of products for rituals and poojas.

Another distinct advantage for Astrotalk with its curated marketplace approach was that sellers or astrologers in this case do not pay to be a part of the marketplace. Instead, Astrotalk charges a commission for each transaction between customers and astrologers. Customers deposit funds, a portion of which is used for their one-on-one or group calls.

The company did not disclose details of how much commission it charges. Per-minute pricing for calls ranges from INR 10 to INR 200 per minute.

The evaluation criteria also involve setting the initial price of each astrologer. The pricing is then regulated based on quality parameters, review as well as demand for particular astrologers.

While some astrologers can pay to advertise and promote themselves to boost discovery, others choose to use YouTube and other affiliate links to bring customers on to Astrotalk.

“We took a conscious call to not charge the astrologers even from a point of view of training because it creates a lot of mistrust when we want to grow our brand and also asking for money to be part of the model. It’s like getting a job somewhere but you have to pay for it,” Jain added.

This allowed the startup to retain most of its astrologers and service providers even though competition has emerged in the space, as we will see.

Astrotalk’s Unit Economics

So far the startup has raised around $800K from CRED founder Kunal Shah’s QED Innovation Labs, but it is in talks with investors to raise between $30 Mn – $40 Mn in what is being reported as a pre-IPO round.

While Astrotalk cofounder Jain did not specify the size of the upcoming round, he did confirm that the startup is in talks to raise significant funding, which along with its cash flow will hold it in good stead for the expansion on the cards.

The biggest expense for the company is in the form of the astrologer payouts, followed by marketing, largely performance marketing with some degree of social media promotions thrown in.

Currently, Astrotalk sees about 2.2 Lakh to 2.3 Lakh customers coming through paid campaigns every month, which is a mix of Indian and international customers. The total base of monthly transacting users is currently around the 5 Lakh mark.

The blended customer acquisition cost for each customer is in the $6-$9 range. From a contribution margin perspective, this cost is recovered in six to eight months.

In this case, repeat usage becomes vital to unlock profitable growth, and Jain claims that the platform sees 80% of its revenue from repeat customers. “We see people who have been transacting with us for the last three, four years,” he added.

Building The ‘Uber’ For Astrology

While the CAC may seem to be on the higher side, that’s because the startup spends a lot on performance marketing in international geographies, where ad rates are higher. But the international market has been a major growth driver for Astrotalk, Jain added.

“Right now, about a sixth of our marketing spend is on the international markets, 1/6th of the revenue also comes from these geographies, primarily from non-resident Indians in the US, the UK, Canada, Australia and other English-speaking countries.”

To cut down on the acquisition costs within India, Astrotalk has partnered with a major nationwide publication, which would act as a distribution channel for the startup.

Given the company’s target of reaching INR 2,000 Cr in revenue before an IPO in 2025-26, curbing marketing spends will be a significant challenge, particularly as it looks to expand internationally, acquire non-Indian users and increase the revenue share from international customers.

But as the startup has shown, this particular model works and the competition is moving in this direction as well. Those astrologers who have not partnered with platforms also use WhatsApp and Telegram for digital services.

Plus despite digital platforms, astrology consultation in the offline space is also booming. An EMR study pegs the Indian religious and spiritual market at a value of $ 58.56 Bn in 2023. This is further expected to grow at a CAGR of 10% between 2024-2032 to reach around $150 Bn in less than a decade.

Astrotalk competes with the likes of Astrosage, AstroYogi, AstroBuddy, Ganeshaspeaks, AppsForBharat, and other unorganised players as well as independent astrology service providers.

But the international market remains the holy grail, and Astrotalk plans to add so-called non-Indian horoscopes and astrology-related practices such as tarot, psychic reading or shamanic counselling. Internationally, the startup competes with keen.com, as well Kasamba, both of which offer psychic readings.

Cofounder and CBO Jain believes that Astrotalk is poised to be the ‘Uber’ for astrology, as the core product has use cases and parallels worldwide, and the problem of trustworthiness is universal.

[ad_2]