[ad_1]

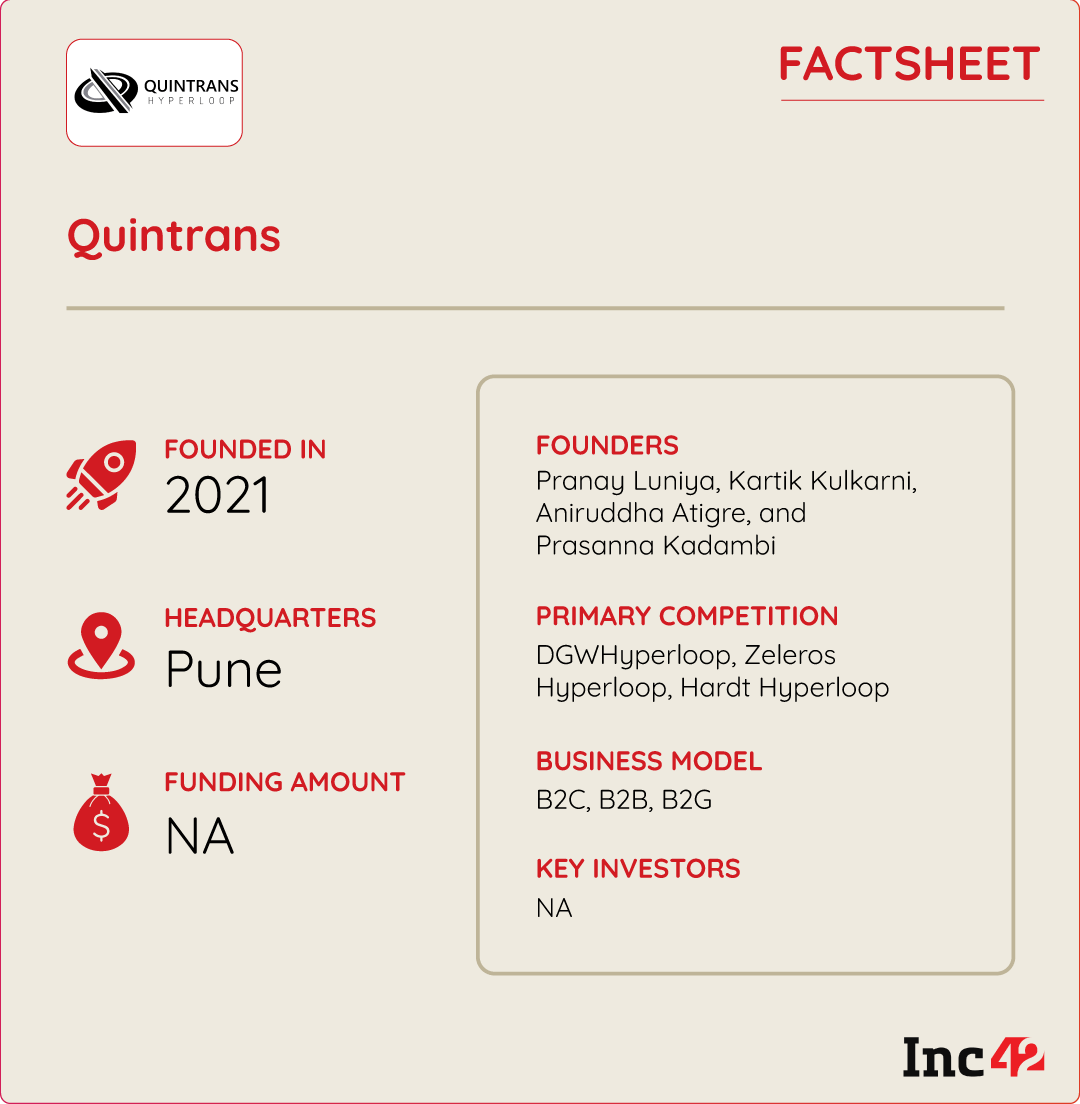

Founded in 2021 by Pranay Luniya, Kartik Kulkarni, Aniruddha Atigre, and Prasanna Kadambi, Quintrans is developing the country’s very own hyperloop technology, aiming to connect the Pune-Mumbai route

The startup has so far received around INR 80 Lakh-INR 85 Lakh as grant money while the agreement for another INR 60 Lakh-INR 80 Lakh government grant is under process

As per a research report, the global Hyperloop train market size is projected to achieve a market size of $57.5 Bn by 2032

From bullet trains to state-of-the-art maglev (magnetic levitation) systems, countries across the globe have long been obsessed with making their locomotives run at break-neck speeds, all while maintaining safety.

However, this fascination reached new heights in 2013 when Tesla CEO Elon Musk, in one of his research papers, introduced the concept of hyperloop.

This innovative technology envisions trains hurtling through low-pressure tubes at more than 1,200 km/h, paving the way for a new era of rapid transit. For context, the fastest train in the world is the Shanghai Transrapid Maglev Train in China, which is capable of reaching speeds of over 400 km/h.

Despite intriguing the interest of many nations across the globe, the technology, which today is being envisioned as the fifth mode of transportation, continues to be a distant dream even a decade later.

Meanwhile, something quite interesting is happening back home. Well, several entities, including state governments and private players, have been mulling the development and deployment of hyperloop technology in the country for a few years now. And at the forefront of this paradigm shift is a Pune-based startup, Quintrans.

Founded in 2021 by Pranay Luniya, Kartik Kulkarni, Aniruddha Atigre, and Prasanna Kadambi, Quintrans is developing the country’s very own hyperloop technology, aiming to connect the Pune-Mumbai route.

Notably, the startup is already in discussion with the Maharashtra government to deploy its tech on the route. The project, if sees the light of day, has the potential to reduce the 3-hour journey to just 30 minutes.

Amid this, the most interesting part of the Quintrans story is that it is working in a space that is yet to become fully tangible. Nevertheless, with several projects and research across the globe, the hyperloop technology is expected to soon cater to an increasing need for a faster and cheaper transportation system.

As per a research report, the global Hyperloop train market size is projected to achieve a market size of $57.5 Bn by 2032.

Quintrans: The Genesis

Before becoming a fully functional business, a startup if you will, Quintrans was initially a research unit, which the then engineering students of MIT Pune (now the cofounders of Quintrans) started in 2018.

Speaking with Inc42, the CEO of Quintrans, Luniya, said that the research unit got a startup makeover after the team realised the commercial viability of the project were working on.

Taking clues from Musk’s research, the cofounders developed their Hyperloop technology, which they showcased at several global competitions, including the SpaceX Hyperloop pod competition and European Hyperloop Week.

These competitions gave them a major push and they were able to attract the attention of companies like IBM India, Festo India, and Aeron Systems, which gave them financial backing.

Currently, Quintrans has reached a stage where it is developing a 30-metre full-scale pilot setup of its Hyperloop in Pune to showcase the technology and its potential to different authorities, including the Railway Ministry, NITI Aayog, the Maharashtra government, and others. The startup aims to develop the prototype by the end of 2024.

Quintrans has so far received around INR 80 Lakh-INR 85 Lakh as grant money. Luniya said that currently, an agreement for another INR 60 Lakh-INR 80 Lakh government grant is under process, which is expected to happen by December this year or January 2024.

Unlocking New Avenues In Cargo Movement

As per Luniya, the proposition for passenger hyperloops is going to take at least another decade. Hence, Quintrans is not limiting itself to only speeding up the Pune-Mumbai route railway movement with its technology.

The startup has already started exploring alternate ways of generating revenue from industries that require guided movement of vehicles for cargo, particularly in the logistics space.

The company is already in talks with a few port authorities in India where Quintrans’ technology can power the movement of shipping containers from ports to cargo hubs.

Besides, the startup is also in talks with some industrial corridors to help them fast-track the transportation of goods from one corridor to the other, built 30-40 km apart.

Quintrans has held discussions with the Maharashtra Industrial Development Corporation (MIDC) and the National Industrial Corridor Development Corporation (NICDC) for the same. It is also looking to collaborate with Bengaluru International Airport to help the authority in exploring ways to connect the airport with the centre of the city.

While most of these entities are interested in deploying the technology, they require a better understanding of Hyperloop, Luniyas said, adding that the startup’s 30-metre pilot track is a step in that direction.

Forging Ahead In The Hyperloop Frontier

While Quintrans aims to keep itself open to various other channels for generating revenue, its research to further develop the 30-metre track will continue. Also, the company is in talks with a few VCs to raise funds.

Establishing Hyperloops is cost-intensive, which has also been one of the barriers to deploying it at scale anywhere in the world.

Today, the 30-metre pilot set up by Quintrans in India costs around $1 Mn. “Going ahead, the per km cost of the hyperloop would be somewhere around INR 150 Cr,” Luniya said.

While regulatory challenges in the implementation and execution of Hyperloops, particularly due to safety concerns, also remain a major roadblock, Luniya believes that more tests carried out by tech players like Quintrans would help prove the merits of the technology.

In India, the startup competes with DGWHyperloop and research units like Avishkar Hyperloop. In the global market, some of the startups working on this tech include Europe’s Zeleros Hyperloop and Hardt Hyperloop.

While many, including Richard Branson’s Hyperloop One (Virgin Hyperloop), have failed to make the technology a reality even after millions of dollars of investment, it will be interesting to see how Quintrans pulls it off.

[Edited by Shishir Parasher]

[ad_2]