[ad_1]

The hope for approval of a spot Bitcoin exchange-traded fund by the United States Securities and Exchange Commission has propelled Bitcoin’s price, registering a remarkable 27% surge in October. This boost in sentiment has attracted enthusiastic buying from cryptocurrency investors.

Notably, Bloomberg’s senior ETF analyst, Eric Balchunas, made a noteworthy observation on X (formerly Twitter). He highlighted that ProShares Bitcoin Strategy ETF (BITO), the first futures-based ETF to gain regulatory consent in the U.S. in 2021, recently experienced its second most significant trading week ever, with a total volume of $1.7 billion. Similarly, Grayscale Bitcoin Trust (GBTC) saw a substantial trading volume of $800 million. This surge in trading volume for existing instruments hints at the substantial potential for spot Bitcoin ETFs when they finally emerge.

As history has shown, when the leader in the crypto market begins to perform well, it tends to elevate the entire sector. This is evident in the impressive performance of altcoins, which have witnessed a significant upswing from their multi-year lows.

Nonetheless, it’s essential to note that after the initial rally, some altcoins may encounter challenges in maintaining their upward momentum, while a select few will lead the market to higher ground. In such cases, it’s often wiser to align with the leaders, as they are more likely to outperform during the upcoming crypto bull phase.

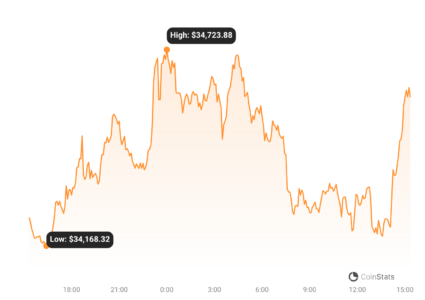

Bitcoin price analysis-

Bitcoin retraced from its peak at $35,280 on October 24, indicating that higher levels are attracting selling interest from traders. Notably, on October 27, there was an attempt by bears to trigger a more significant pullback, but a long tail on the candlestick illustrated robust buying interest at lower levels.

https://coinstats.app/coins/bitcoin/

While the rising moving averages indicate an advantage for buyers, the overbought conditions on the relative strength index (RSI) suggest that the BTC/USDT pair may enter a consolidation phase for some time. Crucially, it’s important to monitor the support levels at $32,400 and $31,000. Only if sellers manage to breach these levels can they gain control.

Conversely, if the price reverses its course and breaks through the $35,280 mark, it would signal that the bulls are back in control, potentially propelling the pair toward the next target at $40,000.

The 20-day exponential moving average (20-EMA) is gradually flattening out, indicating a diminishing bullish grip in the short term. This could confine the pair within a range between $35,280 and $33,200. If the bears successfully drive the price below $33,200, the pair might tumble down to $32,400.

On the contrary, if the price takes an upward trajectory and surpasses $35,280, it would imply that the consolidation was a continuation pattern, potentially setting the pair on a course to skyrocket to $40,000.

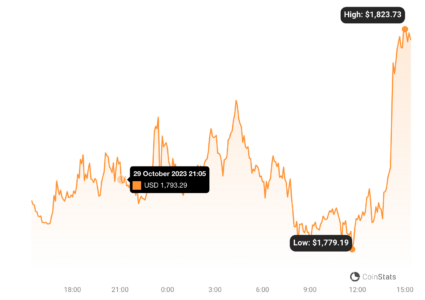

Ether price analysis-

Ether broke through the $1,746 resistance on October 23, reaching $1,865 on October 26. However, this level triggered profit-taking from short-term traders, causing the price to retreat toward the $1,746 breakout level.

https://coinstats.app/coins/ethereum/

Notably, the bulls successfully defended the retest of $1,746, indicating that this level may now serve as a new support floor. The rising 20-day EMA ($1,693) and the RSI, hovering near the overbought zone, affirm the bulls’ control. Buyers will likely strive to push the price above $1,865, with the potential to propel the ETH/USDT pair to $2,000.

If bears aim to thwart this upward trajectory, they must wrest control and sustain the price below $1,746, potentially opening the path for a decline to the 20-day EMA.

The 20-EMA on the 4-hour chart exhibits a flattening trend, and the RSI hovers near the midpoint, indicating potential range-bound movements in the near term. The pair might oscillate between $1,746 and $1,865 for some time.

Should the bulls successfully drive the price above $1,812, the likelihood of a rally toward the upper resistance at $1,865 would increase. Conversely, if the price remains below the 20-EMA, the bears could attempt to pull the pair below $1,746, potentially marking a bearish shift in the short-term trend.

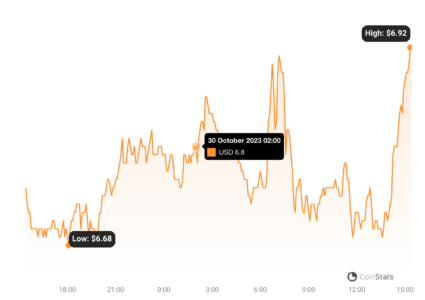

Aptos (APT) price analysis:

Aptos has experienced a sharp rally in recent days, signaling the bulls’ attempt to stage a comeback.

The APT/USDT pair encountered profit-booking near $7, but the silver lining is that the bulls retained much of their ground. This indicates that every minor dip is met with buying interest. The bulls are expected to make another push to conquer the $7 obstacle. If successful, this could mark the beginning of a journey toward $8.

https://coinstats.app/coins/aptos/

However, if the price reverses its course at $7, it suggests that the bears are still active at higher levels. In this scenario, the pair may find itself range-bound between $7 and $6.20, with a potential breakdown below this support heralding a deeper correction.

The 20-EMA has been providing consistent support to the pair, but the negative divergence on the RSI raises concerns about the weakening bullish momentum. A sustained break below the 20-EMA could signal the onset of a deeper correction toward the 50-SMA. This level is critical on the downside, as a breach might lead to a decline to $5.80. On the upside, the bulls must breach $7.02 to signify the beginning of the next phase of recovery.

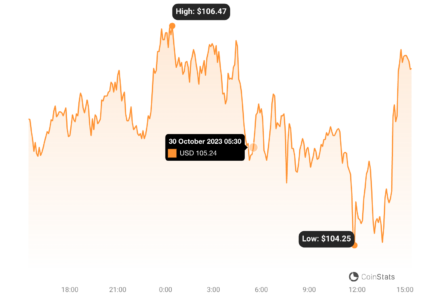

Quant price analysis-

Quant broke above the $95 breakdown level on October 23, signaling a rejection of lower price levels by the market. This buying momentum continued as the bulls pushed the price above the downtrend line on October 25, indicating a potential shift in the prevailing trend.

https://coinstats.app/coins/quant/

In the short term, it appears that some bulls are booking profits after the recent rally, which may lead to a retest of the downtrend line. This is a crucial level to monitor, as a breach below it could imply that the earlier move above the downtrend line was a bear trap.

Conversely, if the price rebounds from the downtrend line, it would signify that the bulls have

indeed turned this level into a robust support zone. In such a scenario, breaking through the $110 resistance would be the next logical step, signaling a resumption of the rally with potential targets at $120 and $128.

A closer look at the 4-hour chart reveals that the QNT/USDT pair is encountering selling pressure around the $108 mark. This indicates that short-term traders are locking in profits. Should the price drop below $103, the pair might experience a decline to $100.

However, if the bulls manage to maintain the price above the 20-EMA, it suggests that lower price levels continue to attract buyers. The bulls will likely make another attempt to breach the $110 mark, initiating the next phase of the upward movement.

THORChain price analysis-

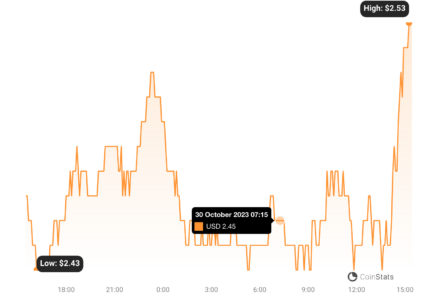

THORChain broke through and closed above the overhead resistance at $2 on October 23, completing a bullish inverse head and shoulders pattern.

https://coinstats.app/coins/thorchain/

Both the upward-sloping moving averages and the overbought RSI indicate that the bulls remain in control. Nonetheless, in the short term, the RUNE/USDT pair may enter a minor correction or consolidation phase.

If the pair holds its ground near the current level without a significant retracement, it suggests that the bulls are steadfast in their positions. This may increase the likelihood of a rally toward $3 and potentially even to the pattern’s target of $3.23. To disrupt this upward trend, the bears must pull the price below $2 and maintain that position.

It’s worth noting that the pair has been in a robust uptrend, with the bulls consistently buying on dips to the 20-EMA. Although the upward-sloping moving averages continue to favor buyers, the negative divergence on the RSI raises concerns about the fading bullish momentum. If the price slips below the 20-EMA, short-term traders may opt to secure profits, potentially leading to a retreat to the 50-SMA.

Conversely, if the price demonstrates resilience by bouncing off the 20-EMA with strength, it would signal the preservation of a positive sentiment. In this scenario, the bulls will strive to reassert their dominance by breaking through and closing above $2.57.

In summary, as we navigate the intricate world of cryptocurrency markets, these analyses provide valuable insights into the ongoing dynamics of Bitcoin, Ethereum, Aptos, Quant, and THORChain. It’s clear that the crypto space is ripe with both challenges and opportunities, and astute investors and traders must stay vigilant and adapt to the ever-changing landscape.

[ad_2]