[ad_1]

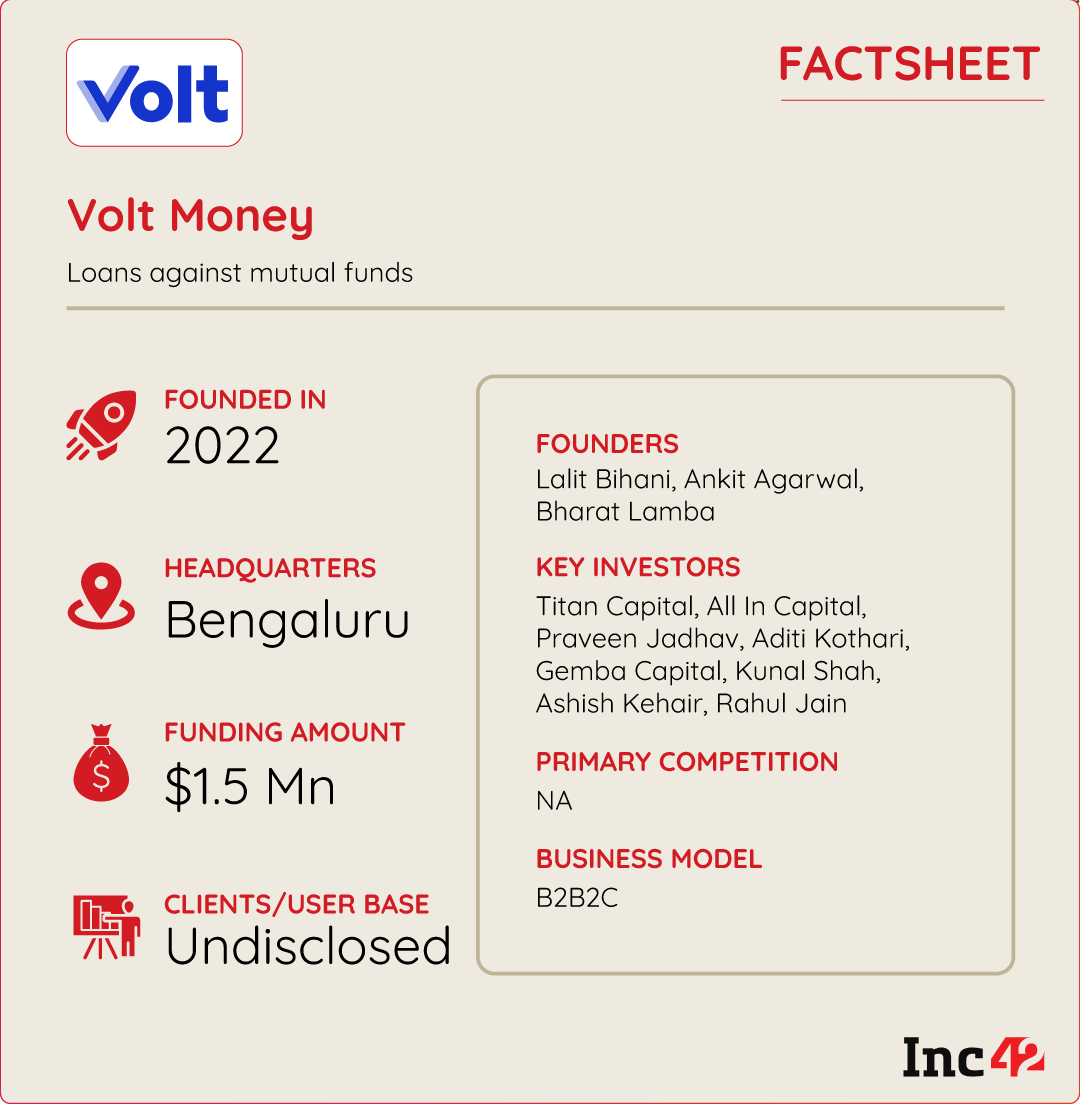

Founded in 2022 by Bharat Lamba, Lalit Bihani and Ankit Agrawal, Volt Money offers loans against mutual funds, a space where it enjoys something of a first-mover advantage

With nearly 150 Mn folios in India, mutual funds have become less of a long term savings scheme and more of an investment opportunity

Having recently secured $1.5 Mn in a pre-seed round, Volt looks set to disrupt the secured lending market with more asset classes in the near future

After more than a decade at Bank of America and HSBC, Bharat Lamba wanted to take the entrepreneurial plunge in 2022. It was the era of the great resignation. But for Lamba, it was about the opportunity to innovate in the fintech segment, particularly disrupting the lending space, which was booming in the post-pandemic era.

Lamba teamed with long-time friends Lalit Bihani and Ankit Agrawal to launch Volt Money in 2022, joining India’s colourful digital lending landscape. But the trio knew they needed to differentiate themselves from the host of personal loan apps.

So, unlike the unsecured loans being offered by these apps, Volt dove into the secured lending space. It was also in 2022 that the RBI was pushing for more innovation in the secured lending space, so Volt Money’s bet had the advantage of market timing.

But secured lending is not new as such – gold, real estate and fixed deposits (FDs) linked models already abounded. There was one asset class that the trio identified as being untapped, and that was mutual funds.

“We were the first ones to identify the opportunity in mutual funds,” Lamba told Inc42, adding that while the startup has leveraged this first-mover advantage, the larger vision is to venture into other asset classes.

Essentially, Volt Money ties up with network participants, including the National Securities Depository Limited (NSDL), DigiLocker, Computer Age Management Services (CAMS) and the Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI), alongside several folio management firms such as Edelweiss and ICICI to offer secured loans.

“From the lender’s angle, secure lending is what they love. On the depository side, the process was improving, and on the customer side, traction could be gained by spreading awareness. All of this, together, developed into a superb idea that we used to build this business,” Lamba explained.

Having recently secured $1.5 Mn in a pre-seed round from the likes of Titan Capital, All In Capital, Praveen Jadhav (Raise Ventures), Aditi Kothari (DSP Adiko Holdings), Gemba Capital, Kunal Shah (CRED), Ashish Kehair and Rahul Jain (Nuvama Wealth), Volt looks set to disrupt the secured lending market with a new asset class.

The Hidden Value In Mutual Funds

Indeed, today, many players are looking at mutual funds as a potential asset class for secured lending.

Per a report by the Association of Mutual Funds in India, the average assets under management for the Indian mutual fund industry for June 2023 stood at INR 44.82 Lakh Cr, growing more than 5X in 10 years. With nearly 150 Mn folios in India, mutual funds have become less of a long term savings scheme and more of an investment opportunity.

However, most of this value is locked away in long term investments, and redeeming mutual funds means closing the account and risking losing years of progress. To address the emergency demands of customers and their unwillingness to withdraw from mutual funds, startups such as Volt Money disburse secured loans against the user’s folio.

According to the startup, customers can avail loans from INR 25,000 to INR 2 Cr, depending on the size of their mutual funds. Per RBI’s guidelines on loan against securities (LAS), a lender can only lend up to 50% of the total value of the securities. Hence, a user has to hold at least INR 50,000 in mutual funds to avail of a loan from Volt Money.

As part of the loan agreement, the mutual funds’ holder has to add a lien in favour of the lender, though Volt reverses this as soon as the lender has repaid the borrowing.

The fintech startup’s interest rate for loans starts at 9.95%, much lower than a personal loan in today’s environment, and this is one of the advantages secured lenders are banking on.

The borrower only has to pay interest on the amount withdrawn from the total sanctioned amount, which makes this a credit line rather than a lump sum loan. This automatically makes for lower risk for the lenders partnering with Volt.

Volt even allows borrowers to pay just the interest for very-short term loans, significantly reducing the chance of a default on payment. Given these flexible lending terms compared to the rest of the industry, Lamba claimed Volt is yet to see a default. However, Inc42 could not verify these claims independently.

In case there is a default, Lamba explained that the lender retains the right to sell the mutual funds to recover the loan amount. The cofounder said lenders can only recover the amount borrowed, which in most cases means the borrowers still hold 50% of their mutual fund assets, in the scenario of a default.

To reach potential customers at every touch point, Volt has developed web and app software development kits (SDKs) to allow easy integration with any platform offering mutual funds.

The startup earns revenue by taking a commission from the interest paid by the borrower and through direct processing fees. Since Volt operates in the B2B2C business model, Lamba claimed it has nearly zero customer acquisition cost (CAC), enabling it to operate on razor-thin margins.

The company has not yet filed its financials for FY22 or FY23, and Lamba declined to comment on the revenue for the past two fiscals.

Is Secure Lending The Future?

But mutual funds are just the start. As India’s retail investors diversify their assets, the company will expand into other asset classes, including equity stocks and insurance policies. To be clear, some of these avenues are already available at most large lenders, such as banks, but Volt offers these lenders a distribution advantage due to its tech-driven acquisition funnel.

“The vision is to leverage all financial assets; it’s not just mutual funds,” Lamba said.

With the RBI pushing for secure lending to reduce non-performing assets (NPAs) in India’s banking system, there is a clear push by digital lending startups into secured asset-linked loans.

For instance, several startups are in the gold loan space, including Ruptok, Oropocket, Rupeek, Yellow Metal, and others. Even Paytm and other larger apps offer gold loans. Fintech startup 50Fin also offers loans against securities, though this is against actual stocks held by a potential borrower, not the mutual funds’ portfolio.

While some large lenders offer loans against life insurance policies, India’s low insurance penetration makes it a difficult market to address. Plus, the value of most life insurance policies in India is on the lower side, which makes it harder to scale this vertical.

Therefore, with a potential total addressable market of 150 Mn mutual fund folios and growing, Volt has the opportunity to scale rapidly. Here, the big challenge for Volt Money is to create a meaningful moat in the segment, even though Volt has the first-mover advantage.

Pairing up with mutual fund depositories and NBFCs to ensure smooth integrations proved to be time-consuming in Volt’s experience. Companies looking to enter the segment might also face the uphill battle of creating a robust credit risk assessment model specific to mutual funds.

There is also the problem of the lack of historical data and standardised valuation methods for existing mutual funds. This can hinder a company’s attempts to accurately assess borrower creditworthiness, severely limiting its moat in this field.

Volt Money got around these hurdles by developing algorithms to analyse fund performance, volatility and investor behaviour. It will be interesting to see if the competition enters this space in the near future given that unsecured lending has so much competition.

Volt’s Lamba believes that customer trust is the biggest challenge of them all. Mutual funds, although widely popular, are seen as investment vehicles, not collateral for loans. While the startup has achieved significant scale over the past year, scaling up the model and reaching a larger share of the 150 Mn folios will be its biggest challenge going ahead.

With inputs from Nikhil Subramaniam

[ad_2]

Source link