[ad_1]

Founded in 2022, SocialBoat is betting on AI to cater to problems related to menstrual health, PCOS, and thyroid, among others

Leveraging OpenAI’s GPT tool, SocialBoat has developed an AI chatbot named Sakhi, which the founders describe as the first generative AI for women’s health

Given that the women’s health space is highly competitive, SocialBoat will need to bring more features to stay relevant to its users in a market that is projected to reach $4 Bn by 2024

The rise of generative AI has brought forth new opportunities for innovation on a global scale, including its integration into our healthcare system. In addition to its applications in chatbots, personalised assistants, and ecommerce, AI’s positive impact can be seen in our daily lives.

At a time when so many market-disrupting innovations are happening, two visionary founders from Gurugram are utilising generative AI to improve the lives of women with PCOS and PCOD.

As per a Statista report, about 16% of women between the ages of 20 and 29 years suffered from polycystic ovary syndrome (PCOS) in 2020.

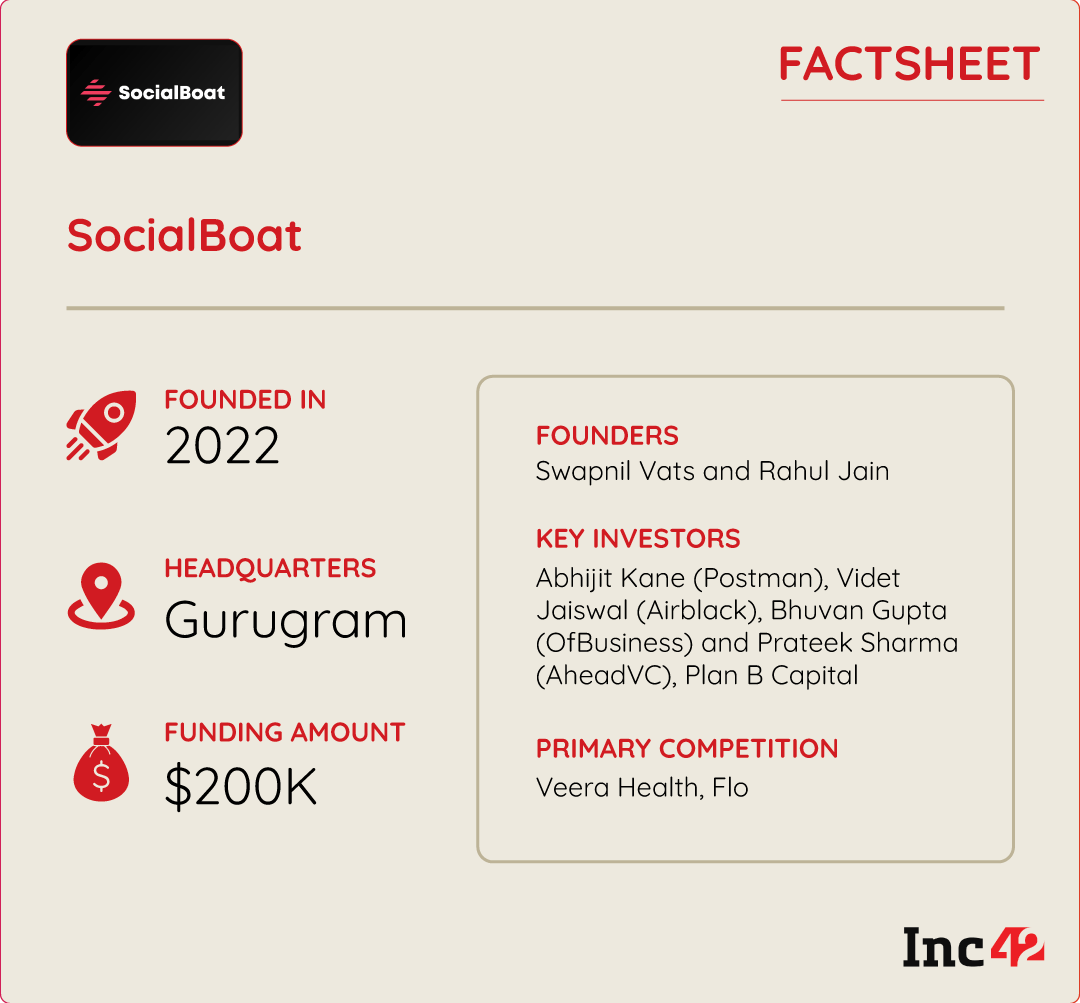

To provide effective solutions for women dealing with the hormonal imbalance of PCOS/PCOD, a Gurugram-based startup is developing an AI-led product. And at the helm of this mission are Swapnil Vats and Rahul Jain, both second-time entrepreneurs, who have created SocialBoat, a menstrual wellness startup to help women align their lifestyles with their menstrual cycles.

Founded in 2022, SocialBoat is betting on AI to cater to problems related to menstrual health, PCOS, and thyroid, among others. The founders are building this product leveraging the power of Open AI’s ChatGPT 3.5.

According to the founders, around 300 Mn women are in menstruation phases in India, and among them, close to 90-100 Mn show symptoms of PCOS.

“But what we are doing around it is not enough. Currently, health and fitness programmes also don’t cater to these problems. Moreover, women do not have access to the right kind of information and knowledge around this,” Vats said.

In January this year, the founders raised $200K in an angel funding round led by Plan B Capital. Abhijit Kane of Postman, Videt Jaiswal of Airblack, OfBusiness’ Bhuvan Gupta, and Prateek Sharma of AheadVC, among others, also participated in the round.

Femtech Gets A Generative AI Tweak

Leveraging OpenAI’s GPT tool, SocialBoat has developed an AI chatbot named Sakhi, which the founders proudly describe as the first generative AI for menstrual health. Sakhi is designed to provide immediate answers to queries concerning menstrual health and is accessible in 20 Indian languages.

While there are several platforms that offer information on such topics, Sakhi stands out by providing personalised recommendations based on user-provided information within the app.

When users sign up on SocialBoat, they are prompted to answer several questions regarding their body weight, height, period information (such as cycle date and duration), presence of PCOS symptoms, and workout habits. With this information, the chatbot delivers personalised answers tailored to the individual user’s lifestyle.

To build this solution, SocialBoat is incorporating a memory layer into the GPT tool. While the GPT tool itself provides access to historical data on menstruation and PCOS, the additional memory layer created by SocialBoat adds valuable context to enhance its functionality.

“All that information we get from users and we create a context based on that, and provide it to GPT. Context gets updated as users use the app more. Hence, our GPT gets more and more accurate,” Jain said.

What’s In SocialBoat’s Business Model

While the app provides AI-led free diet and fitness solutions to users, it also consists of premium subscription plans, which connect users with gynaecologists, dieticians, and yoga trainers.

SocialBoat has three subscription plans — monthly, quarterly and annual, which are priced at INR 3,000, INR 5,000, and INR 9,000, respectively. The startup, which targets users from Tier 1 cities, currently has a free to paid user conversion rate of 5% to 8%. The founders are looking to scale this rate to 20% by adding more human-led programmes.

As claimed by Vats, the startup is focussing on its unit economics from the beginning by targeting a lower customer acquisition cost (CAC) against lower average revenue per user. Currently, SocialBoat’s CAC per user is zero on the back of organic growth. However, this cost is expected to go up to INR 1,000 once the startup begins marketing its product. As the average revenue per user is at INR 4,600, the founders feel optimistic that the venture will remain profitable going forward as well.

In future, the startup may look at placing ads and brand partnerships on AI-led free models. Moreover, as it is training its model with more data, SocialBoat may also look at adding more services, such as predictive diagnosis, to diversify its revenue streams.

Operating In The Highly Competitive Femtech Space

The startup is trying to build an impact in a segment where several startups are proliferating. Recently, there has been a noticeable rise in women’s awareness of their health, leading to a growing trend of constant tracking and monitoring of their health, lifestyle, and exercise routines using technology.

Capitalising on this trend, numerous health-focussed startups have emerged, providing guidance and support to women in their pursuit of a healthy lifestyle.

Although the founders count startups such as Veera Health, Proactive For Her, and Ava, among others, as their competitors, which too are focussed on PCOD, menstrual health, and women’s health, SocialBoat is trying to cause disruption with its AI-based offering. According to Vats, unlike other apps in the market, SocialBoat plans are synced with the user’s menstrual cycle.

Given that the women’s health space is highly competitive, SocialBoat will need to bring more diverse features to stay relevant to its users. The more generative AI becomes mainstream, there are high chances for other startups to bring such AI-led recommendations in a market that is projected to reach $4 Bn by 2024.

[ad_2]

Source link